Cautious optimism for Swiss automotive market in 2023

24 January 2023

Hans-Peter Annen, head of valuations and insights at Eurotax Switzerland (part of Autovista Group), analyses the Swiss automotive market and ventures an outlook for 2023.

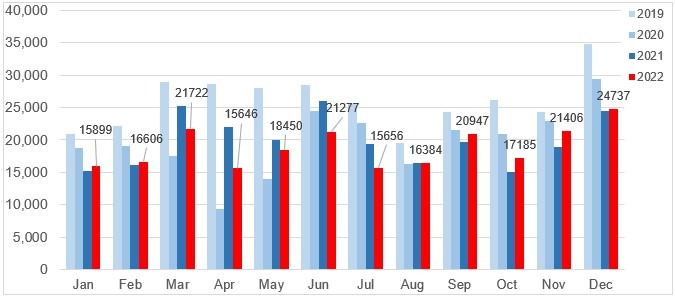

While 2022 ended with more positive market developments in recent months, Switzerland and Liechtenstein are still far from their pre-COVID new-car registration figures. The war in Ukraine interrupted supply chains due to missing components, with temporary plant closures and delivery delays preventing a significant recovery, despite good demand.

A total of 225,934 new passenger cars were registered in 2022, 5.3% behind the already poor previous year, and 27.5% behind 2019. Only electrified vehicles experienced a renewed boom, accounting for more than half of all new registrations last year. 114,833 passenger cars with an electrified or pure-electric drive were registered, 8.2% more than in 2021.

Battery-electric vehicle (BEV) registrations increased from 31,823 units in 2021 to 40,173 in 2022 (up 26.2%), taking a 17.8% market share. They were followed by hybrid-electric vehicles (HEVs) with an increase of 7.8% to 56,107 units and a market share of 24.8%. Plug-in hybrids (PHEVs) on the other hand, declined by 15.8% to 18,355 units and an 8.1% market share.

In 2023, a slight new-car market recovery can be expected, shadowing the last months of 2022. However, from today’s perspective, the result will still be clearly below the pre-COVID results. This translates to a realistic registration forecast of 240,000 to 250,000 new passenger cars. The result will heavily depend on the availability of components and the course of the war in Ukraine. Essentially, whether the new cars ordered can actually be produced and delivered.

New-car registrations by month, 2019 to 2022

Used-car transactions

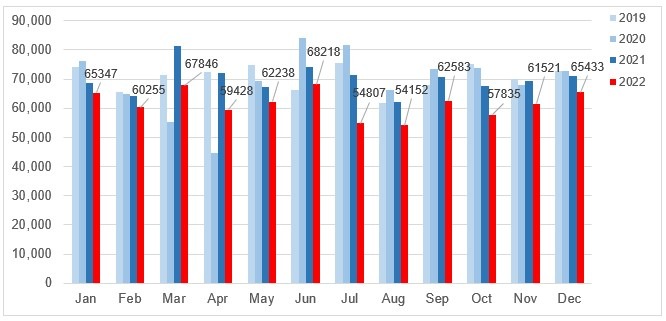

The market for used cars has been at a high since the summer of 2020 and sees constantly high demand. For a long time, this was offset by very low supply, which has since increased significantly. In 2021, there were 840,044 changes of ownership (up 1.1%), almost at the same level as in 2019.

However, in the first half of 2022 the number of changes of ownership (according to the previous counting method*) was 8.5% below the previous year. According to the new counting method, the values are clearly below the previous year but are not directly comparable.

So, the upward trend was broken in 2022. Since July, changes of ownership have remained below pre-COVID figures. The trend of declining used-car transactions is likely to continue while new-car registrations also remain low. Additionally, the new cars not sold in 2020, 2021 and 2022 will be permanently missing from the used-car market.

For 2023, a slight increase in the number of changes of ownership is expected due to ongoing low supply, especially of young used cars. According to the new ASTRA counting method*, 750,000 to 760,000 transactions seems realistic.

Used-car transactions by month, 2019 to 2022

Prices and supply

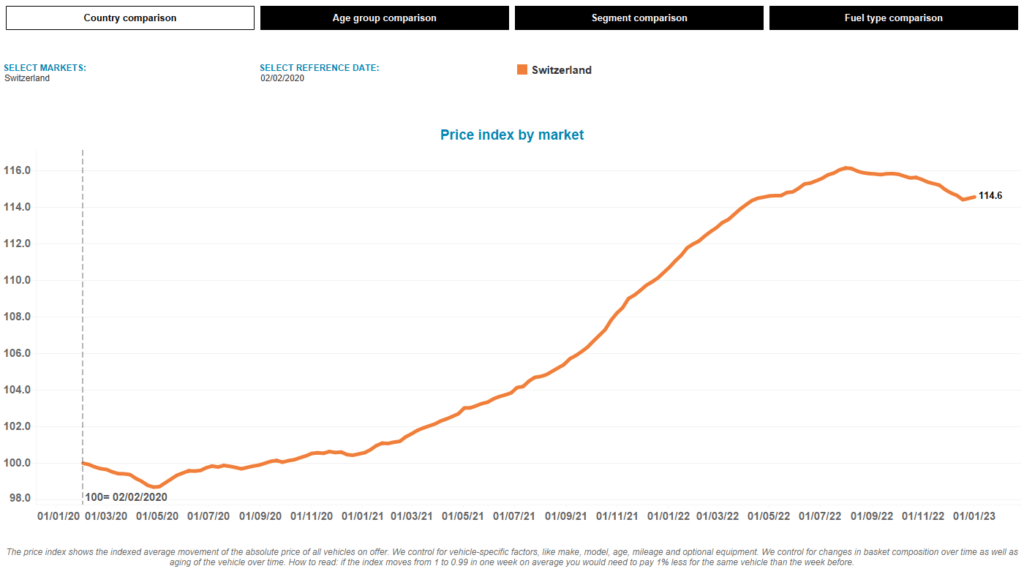

While the volume of active offers on the used-car market was 29% lower at the end of 2021 than at the beginning of February 2020, the situation improved significantly in the second half of 2022. At the end of last year, the number of active used-car offers was only around 4% lower than in February 2020. However, the recovery of supply varied greatly depending on age group. In the case of used cars up to two years old, supply was still 20% lower than in February 2020.

Due to high demand and tight supply, offer prices on the used-car market continued to rise last year. Compared to the beginning of February 2020, the Eurotax price index was almost 15% higher at the end of 2022. It is mainly young used cars that are affected given the lack of new cars registered in 2020 and 2021. As long as new-car sales are lower than before the crisis years, the price level will only move slowly downwards.

The asking prices of all vehicles have benefited from this supply shortage since 2020, particularly diesel and petrol vehicles. However, diesel has lost ground again since autumn 2022. BEVs saw a particularly rapid increase in residual values (RVs) in 2022. Younger electric models in particular have benefited. Among 12-month-old cars, BEVs even take joint first place with hybrids in the RV analysis, with an average sales value of 83.5% of original list price.

Overheated prices to cool

The state of the new-car market, the supply situation, as well as consumer sentiment, are decisive for the future development of the used-car market. After the Ukraine war led to rising inflation and high energy costs, supply chains are only slowly returning to normal. The same is true for new-car sales. This continues to affect the supply situation and prices of used cars. Although the rise in used-car prices seems to have stopped, now trending slightly downwards again, RVs are still at a high level.

RVs can only be expected to drop rapidly if the gloomy economic outlook results in a very negative impact on used-car demand. Otherwise, residual values are likely to move slowly downwards away from their overheated level.

* Note on the figures for 2022

Since the beginning of 2022, the Federal Roads Office, ASTRA, has provided figures for changes of ownership. Before that, up to and including June 2022, ASTRA supplied raw data with all changes in the Swiss vehicle stock. The analysis of changes of ownership was carried out by Eurotax, partly with assumptions. The figures calculated in this way were approximately 3% higher than the values according to ASTRA’s own evaluation from 2022 onwards. For this reason, the figures for 2022 are based on the ASTRA data. The values up to and including 2021 are shown according to the previous method. This must be taken into account when comparing the figures for 2022 with previous years. Comparisons are therefore only possible to a very limited extent, if at all.