Cupra a promising fleet choice – rebel with a good remarketing cause

04 July 2022

The Cupra brand recently celebrated its fourth anniversary. SEAT launched it back in 2018 as a ‘special brand for enthusiasts’ and presented the Cupra Ateca as its first model.

Cupra has now invited its ‘tribe’ back to Terramar, where it was first introduced. In June it announced target to sell 500,000 cars a year and gave a glimpse into its future model line-up, strongly supported by the instant success the brand has received. And Cupra does not only appeal to private customers, it also boasts in strong residual values (RVs), making it a promising fleet choice.

Early scepticism from critics has now been replaced by facts and figures. Since its launch, Cupra has sold close to 200,000 cars and grew its revenue to almost €2.2 billion in 2021, exceeding all expectations. This year, Cupra intends to double its sales, an ambitious goal in a new-car market facing major challenges. However, between 2020 and 2021 it did just that, more than doubled its production volumes from 34,285 to 81,839 units. The lion’s share of this was down to the Cupra Formentor with 58,863 units.

Only exceeded in volume by the SEAT Arona, Ibiza and Leon, the Formentor was the fourth best-selling model of the SEAT company.

In Terramar, Wayne Griffiths, CEO of Cupra, said: ‘in the midterm, our aim is to deliver 500,000 cars per year and push forward with our international expansion into new markets as well as entering new segments.’ This aim is even more impressive in the context of the SEAT company’s total volumes. SEAT and Cupra together sold 494,000 cars in 2021 and 667,000 units in 2019 before the pandemic hit.

The trajectory of growing Cupra to 500,000 units a year hints at a major shift of focus between the brands. This move fits with an overall re-positioning of the Volkswagen Group brands announced in 2019 by Herbert Diess, chairman of the automotive giant’s board. With SEAT only being strong in Spain, Germany, and the UK, the Cupra brand is supposed to introduce models that are more attractive for global markets.

Electrifying model line-up

Cupra has a compelling model line-up backing its ambition. It’s first model, the Ateca, launched in 2018, followed by the Leon. Both of these vehicles are based on SEAT models. The carmaker’s first standalone launch was the Formentor in 2020, and it has also added the all-electric Born to its ranks; a very diversified line-up.

Cupra aims to become fully electric. On the path to this goal, the carmaker will start sales of the Terramar in 2023, which will be available as a fleet-relevant, plug-in hybrid vehicle (PHEV) with around 100km of electric range. And in 2024 and 2025 the Cupra Tavascan and UrbanRebel will join the Born as fully-electric models.

Source: Cupra

Attractive fleet vehicles

For fleet and leasing businesses the attractiveness of a model is often determined by its RV forecasts, which guide leasing rates and risk assessment. But how is Cupra faring compared to its equivalent SEAT models?

The Ateca and Leon are the only models available under both SEAT and Cupra. Bhaven Shah, senior market analyst Car To Market at Autovista Group, had a closer look at both cars and said that ‘the Cupra generally has a higher list price than its closest comparable SEAT model. However, the relative RV forecast for SEAT and Cupra models in Spain, Germany, and Italy is very close between the two brands.’

The list-price premium washes through to the RV, while more expensive and better-equipped models typically have a lower residual-value percentage (%RV). ‘This suggests that as an asset, Cupra models are just as good, if not better, than the respective SEAT models,’ according to Shah.

The Ateca’s %RV only recently start to diverge slightly in Germany and Spain, giving the SEAT model an advantage. This is most likely linked to new-car price increases, inflation, and a general impact on consumer confidence and willingness to pay.

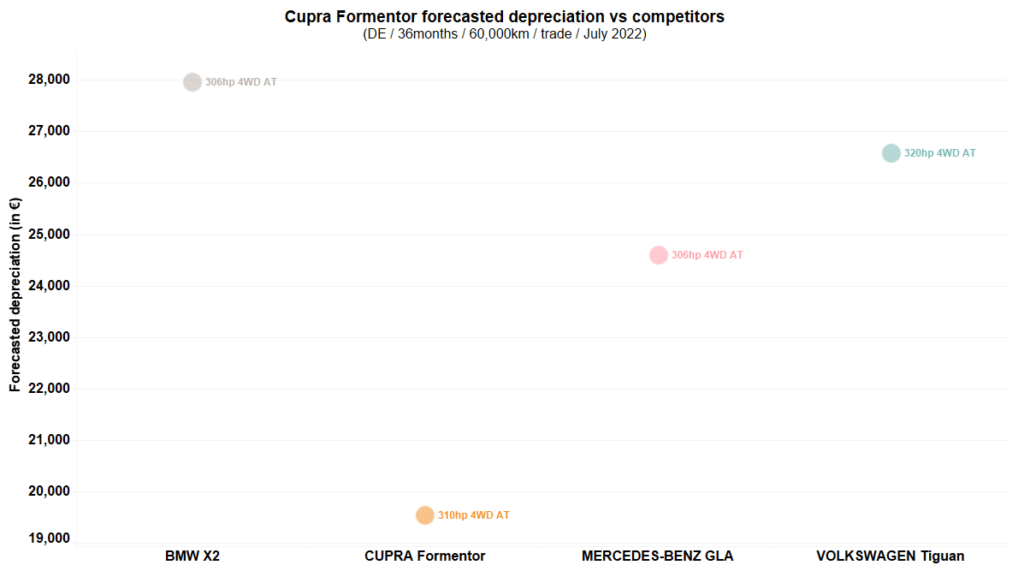

The Formentor VZ 2.0 TSI, with an engine output of 310hp has a list price of €48,090 in Germany, which is €10,000 less than a Mercedes-Benz AMG GLA 35 or a BMW X2 M35i, and almost €14,000 less than a Volkswagen Tiguan R. These list prices do not reflect an equipment adjustment.

Thanks to the highest %RV of these models, the Formentor also has lower depreciation, which makes it a very attractive near-premium alternative for user-chooser customers searching for a sporty model in this segment. After three years and 60,000km, the depreciation hits €19,590. This represents an advantage of €7,430 compared to the Tiguan R (€5,406 vs the GLA and €8,660 vs the X2).

Source: Autovista Group

For those eyeing total cost of ownership (TCO) and fuel consumption, there is a PHEV version available with either 204hp or 245hp. When charged regularly, and with a suitable driving pattern, this can bring down fuel costs significantly. Four years after the launch of the first Cupra model, the brand can look back at its rapidly growing volumes, despite a very challenging economic climate. The model line-up now represents a clear strategy towards full electrification of its vehicles, and residual values back its attractiveness to customers. The Cupra brand is here to stay, but it remains to be seen if its presence on the market will come at the expense of its parent brand, SEAT