Will current demand for new and used cars in Poland continue?

26 April 2022

Marcin Kardas, head of valuations and specifications at Autovista in Poland considers how the country is standing up to regional and international developments.

The Polish car market is slowly returning to normal and the war in Ukraine is a key problem only for the truck market. The next few months will show whether the current demand for new and used cars in Poland is sustainable and how the rising costs of living, including the purchase and financing of vehicles, will affect the country’s new and used cars markets.

There was an unexpected change in the Polish automotive market at the start of the year as interest in new and used passenger cars declined. But considering the rising inflation from the second half of 2021, the change in the tax system from the beginning of 2022, more expensive fuel, as well as new and used cars, the market reaction does seem more obvious.

In addition, the war in Ukraine began in February, which worsened public sentiment. The rapid rise in the cost of living in a relatively short period of time reduced demand for cars. Demand from private users, who are very price sensitive will certainly shrink, but it will be counterbalanced by fleet purchases and the continuing problems with new cars availability.

A temporary economic upheaval

As it turns out, this was not a permanent turning point for the Polish car market, but rather a temporary economic upheaval. It did not take long for higher vehicle purchasing and running costs to be accepted, and in April the market returned to its former position. Customers once again flocked to showrooms and consignment shops. This is particularly evident at the more expensive end of the Polish car market.

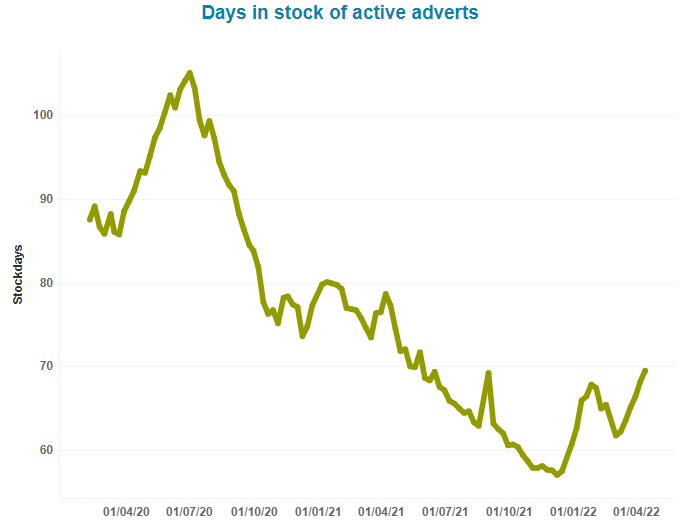

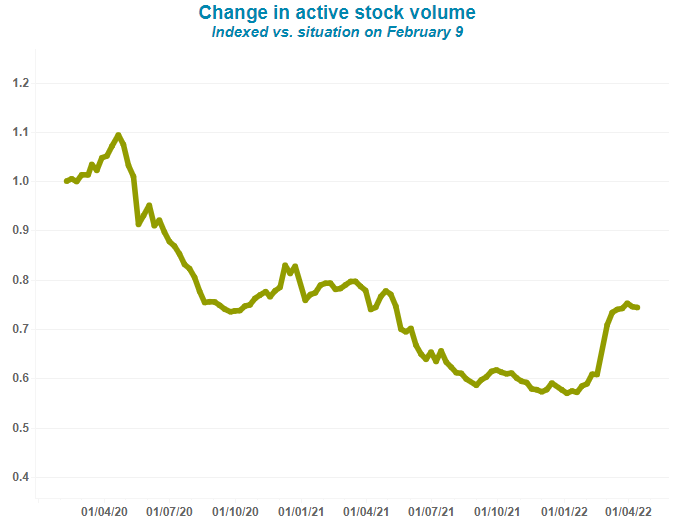

So far, the extended period of used-car sales has not slowed down the trend of increasing car values. This is due to minimal stock levels, although these have already started to rise slowly in response to declining demand. Since the beginning of the year, the number of active ads has moved from around 55% to nearly 75% of the pre-pandemic level (February 2020). As the chart below shows, this looks to be stabilising.

Demand has started to outstrip supply again, which could lead to further increases in used-car values. This will affect residual values, which will also increase. Percentage values should be relatively stable due to the massive increases in new-car prices.

The situation in the commercial vehicle market seems to be a little more stable, but a decline in purchase interest is also evident. It should be remembered that the deficit of used cars in Poland was much deeper, which also means a longer period of price stabilisation.

Importers are reporting a big drop in demand for new cars, but list prices are still rising rapidly. In this situation, residual values of light commercial vehicles should remain very high and relatively stable for the time being.

Suffering truck market

The biggest problem is currently in the truck market. Transport restrictions on the eastern border, the introduction of the EU mobility package and tax regulations, as well as huge increase in the cost of diesel, liquified natural gas, and new tractor units, are not as critical as the loss of drivers.

Many Polish fleets relied on drivers from Ukraine, who gave up their jobs and travelled home. As a result, since March this year transport companies have started to dispose of their unused fleets and are holding off on replacing them.

The downturn is not yet being felt in used-tractor unit values, as there has been a critical shortage of them on the market so far, but the situation could change quickly. Then a very rapid fall in value is possible.

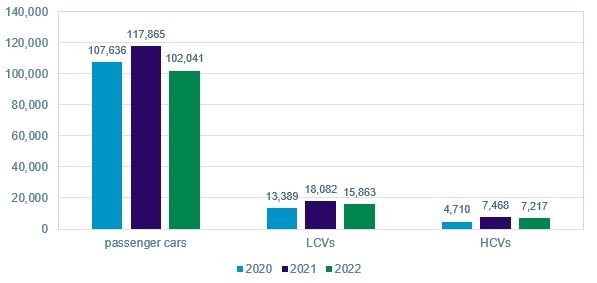

New-car registrations statistics show clear declines too. Up to and including March, 10.7% fewer passenger cars were registered year-on-year, along with 6.5% fewer vans and 3.4% fewer trucks.

New-car registrations in Poland to March 2022

The slight drop in truck registrations is the result of huge orders from last year, and delivered vehicles are being picked up due to very favourable prices. It should be remembered that all current registration results are realisations of orders placed many months ago, so they do not reflect the current market situation. This will only become apparent in the coming months. It is also important to bear in mind declining production capacity due to the war. For now, it is difficult to separate the fall in demand from the lacking supply of new cars.