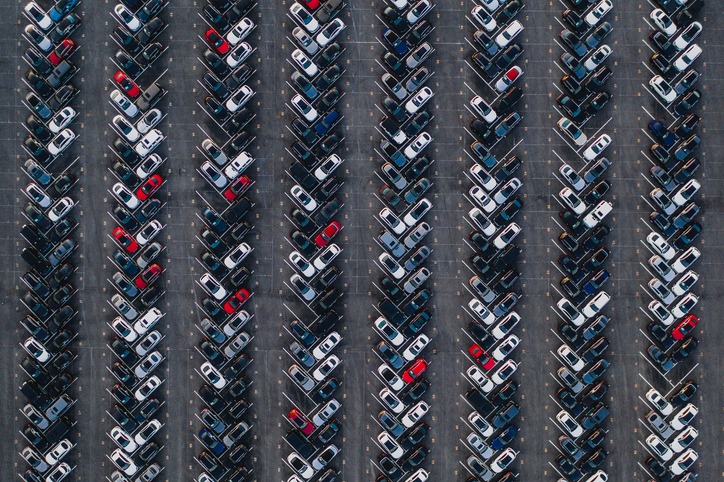

Recovery of European new-car markets lost momentum in July

03 August 2022

The Italian new-car market crept forward, Spain was stuck in neutral, and France engaged reverse in July, explains Autovista24 senior data journalist Neil King.

The slow recovery of European new-car markets lost momentum in July, the latest new-car registration figures from France, Italy, and Spain reveal. Autovista24 assumes the gradual improvement in supply has not been derailed, but that there was merely a hiatus last month because of mitigating circumstances, including the heatwave that scorched Europe.

Spain suffered a double-digit year-on-year decline in July but maintained the rhythm found in June. The decline in Italy was negligible, at only 0.8%, but July 2021 was a weak month for the country and the apparent improvement in the market’s fortunes was more modest than it appears.

In France, the 7.1% year-on-year downturn was the first single-digit fall since November 2021, but this was also against a low base of comparison in July 2021, as in Spain. Incentives for electric vehicles (EVs) were due to be lowered from 1 July, which helped to boost the French market in June but resulted in payback in July. The incentives have now been extended until 31 December, but this announcement came too late to stop buyers rushing to register new EVs before the original 30 June deadline.

The new-car market downturns were less pronounced when adjusted for the extra working day in July 2021. Italy even grew 3.9% year on year and the seasonally-adjusted annualised rate (SAAR) gathered pace too. However, even with the positive working-day effect, the SAAR fell in France and Spain. Moreover, all three markets performed below Autovista24’s expectations for the month, which had factored in an improvement in the supply situation.

Forecasts cut for all three markets

The heatwave across Europe invariably subdued new-car market activity last month, along with the originally planned reduction of EV incentives in France. Given this, Autovista24 still assumes supply improvements will continue throughout this year. However, the 2022 outlooks for all three new-car markets are weaker than expected last month.

The volume forecast for France has been downgraded by 43,000 registrations, to 1.57 million units, 5.2% lower than in 2021. Similarly, next year’s outlook for France has been reduced by 37,000 units, albeit with 22.7% growth and 1.93 million new-car registrations forecast. Nevertheless, this remains about 13% lower than the 2.2 million new cars registered in 2019, prior to the COVID-19 pandemic.

Although Italy performed better in July than June, the performance was slightly below expectations and Autovista24 has lowered its outlooks for 2022 and 2023 by 17,000 units and 29,000 units, respectively. The Italian new-car market is forecast to contract by 5.8%, to 1.37 million units, before rebounding by 24.5% in 2023, to 1.71 million units. However, this would still be 10.8% lower than in 2019.

As Spain did not improve as expected in July, the outlooks for 2022 and 2023 have also been reduced - by 18,000 and 27,000 units, respectively. This leads to a forecast of 813,000 new-car registrations this year, marking a year-on-year decline of 5.4%. Looking ahead more positively to 2023, Autovista24 forecasts that the Spanish new-car market will exceed the one-million mark, with year-on-year growth of 25.5%.

Significant risks to this challenging forecast remain, depending on the duration and severity of the conflict in Ukraine and whether it extends further west, and beyond the country’s borders. Unlike previous crises, such as the global financial crash of 2008-2009, the new-car registrations outlook for western European markets hinges more on new-car supply than any economic impact on sales, at least in the short term.

However, underlying demand is also challenged as inflation continues to rise across Europe, curtailing purchasing power for big-ticket items such as cars. Furthermore, reduced – or even disconnected – gas supplies from Russia to continental Europe still pose a major economic threat.

Year-on-year comparisons conceal weakness in France

According to data released by the CCFA, the French carmakers’ association, 107,547 new cars were registered in the country last month. The 7.1% year-on-year decline was a notable improvement on the 14.2% downturn in June. Moreover, there was one less working day in France last month than a year ago and Autovista24 calculates that the adjusted year-on-year contraction, of just 2.4%, was far better than June’s adjusted 10.2% loss. However, the low base of July 2021 skews the year-on-year comparison and the SAAR fell significantly to 1.48 million units, from 1.65 million units the previous month.

The French new-car market has been heavily affected by new regulations from the start of the year. The malus (penalty) for registering new cars extended to those with CO2 emissions of 128g/km or more. A weight-based tax was also introduced, which applies to all new cars weighing over 1.8 tonnes. The war in Ukraine derailed the market correction that began in February, but the cumulative decline in the first seven months of the year has improved to 15.3%.

The recent extension of the existing EV incentives will support demand in the coming months, but supply will ultimately dictate the French new-car market’s fortunes.

Incentives limited in Italy

Industry association ANFIA reports that 109,580 new cars were registered in Italy last month, just 0.8% fewer than a year earlier. Adjusted for the extra working day in July 2021, the market even expanded by 3.9% year on year, although this is against a low base of comparison.

‘The recovery in July 2022 stems from the comparison with the low volumes of July 2021, the first month of last year to record a collapse in registrations not only compared to the same period in 2019, but also in 2020,’ commented Paolo Scudieri, president of ANFIA.

Nevertheless, the SAAR improved slightly from 1.38 million units in June to 1.44 million in July and the year-to-date contraction reduced to 20.3% in the first seven months of 2022.

Aside from supply challenges and inflationary pressure in Italy, new-car registrations have been restrained as consumers awaited the reintroduction of purchase incentives announced in April. As these were reinstated on 25 May, the recovery of demand, especially for electric vehicles, is materialising, albeit slower than Autovista24 had factored into its forecasts for June and July.

‘To stimulate the recovery of demand, after the exhaustion of resources in the 61-135 g/km CO2 range, it would be appropriate to extend the range of beneficiaries also to the business and leasing sectors, which are currently excluded. These sales channels would allow an important contribution to the spread of electric mobility,’ Scudieri added.

As it stands, however, incentives are only available to private buyers and so the positive impact on the new-car market is limited.

Recovery ‘weighed down’ in Spain

A total of 73,378 new cars were registered in Spain during July, according to ANFAC, the Spanish vehicle manufacturers’ association. The 12.5% year-on-year decline follows a 7.8% downturn in June. However, adjusted for working days, Autovista24 estimates that the fall was 8.4% last month, in line with June. Similarly, the SAAR was only slightly lower, at 809,000 units compared to 833,000 units in the previous month.

‘Although July was traditionally one of the best months of the year in sales because the buyer took the opportunity to drive the car on holiday, we now find that purchases by individuals deepen their fall due to the lack of vehicles at points of sale due to the chip crisis. Added to this is unbridled inflation that increasingly reduces the purchasing power of families and that will weigh down the pace of market recovery in the coming months,’ commented Tania Puche, communications director of the Spanish dealers’ association GANVAM.

Spain had a poor start to 2022, with vehicle-tax increases introduced on 1 January. The year-to-date contraction receded slightly in July for the first time since April and the recovery is clearly fragile.