Germany drives the electrification of Europe

19 January 2022

In this final instalment of a three-part series, José Pontes, data director at EV-volumes.com examines Europe’s biggest EV market, Germany.

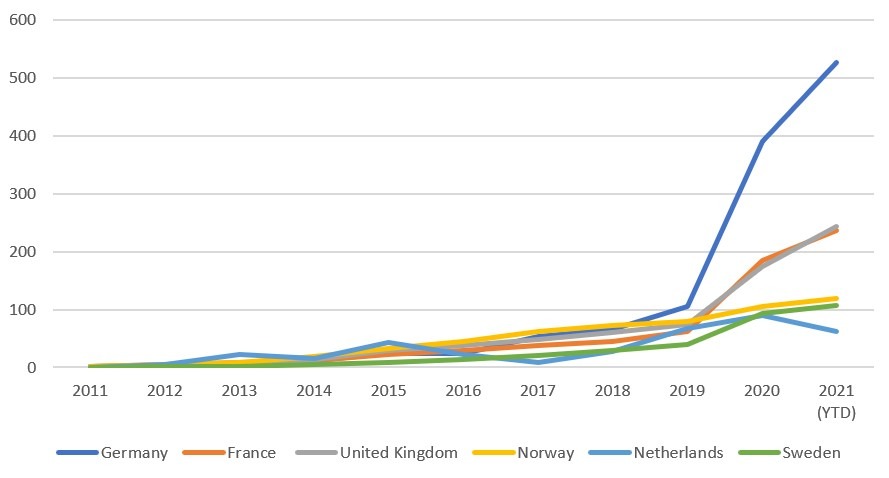

If Norway is the most electrified market in Europe, Germany is its biggest electrically-chargeable market. With at least one million electrically-chargeable vehicles (EVs) on the road, Germany is home to one in four EVs in Europe. There were more than 532,000 units registered in the country from January until October 2021, twice that seen in France in the same period.

But it has not always been like this. If we go back 10 years, Norway was the largest EV market in Europe, followed by France, while Germany, the largest automotive market in Europe, then ranked third.

EV sales in Europe (1k)

The German EV market experienced three different stages. It was practically non-existent up to 2016, then it saw steady growth for the next three years, followed by a more recent surge. The graph shows how Germany only took the lead for EVs in Europe in 2019, and then in 2020 sales really took off.

Market share

Targets not enough

Back in 2010, Chancellor Angela Merkel set a target to have one million electric vehicles in Germany by 2020.This was an ambitious goal that demanded a quick uptake, which the German government did not support with significant incentives. As a consequence, four years later, the EV market share was only 0.4%, and the total fleet was 24,150 units, a long way from the 2014 target of 100,000 units, let alone heading towards the one million units by 2020 pledge.

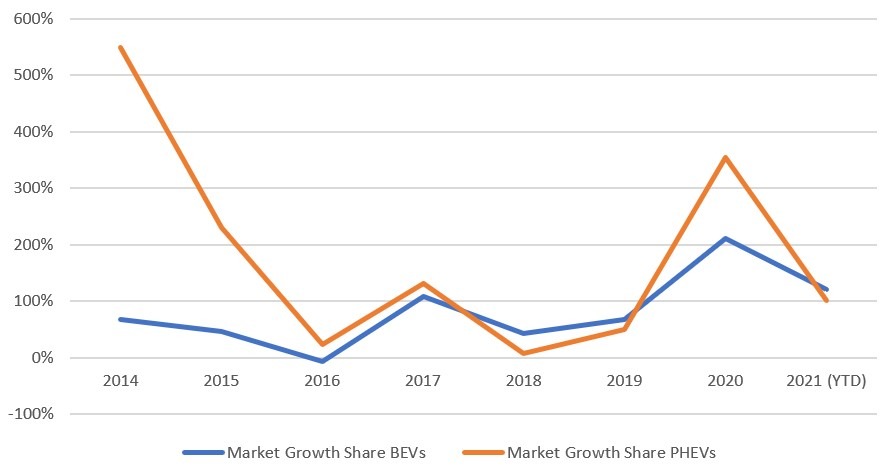

Growth rates

In 2015, a package of non-monetary incentives was introduced, along with the use of bus lanes in a few cities, free parking and reserved-parking places in locations with charging points, and special licence plates for EVs. However, these non-monetary measures failed to ignite demand that year, with growth rates continuing to fall year-on-year.

So, at the start of 2016, the German government finally decided to subsidise battery-electric vehicles (BEVs) with a federal subsidy of €2,000 (plus at least the same amount from the OEM) or €4,000 in total. Plug-in hybrid electric vehicles (PHEVs) had a €1,500 subsidy, €3,000 in total for PHEVs.

The funding guideline was published in the ‘Bundesanzeiger’ (Federal Gazette) at the end of June 2016 and was applied to vehicles first registered from 18 May 2016. The subsidies came into effect on 2 July.

By the following year, BEVs were on a steady growth path, which continued over the next couple of years. Sales of PHEVs slowed in 2018 because of more stringent eligibility rules.

The 50-60% growth rates that the German EV market was experiencing was not enough to meet the ambitious goals set by local governments. On the back of the economic recovery plan for COVID-19, Merkel’s government decided to introduce a new stimulus package to promote EV adoption and charging-infrastructure deployment.

New incentive plan

Under a new plan approved in June 2020, BEVs under €40,000 received a subsidy of up to €9,000, the highest EV incentive in any European country, with PHEVs and more expensive BEVs also receiving higher subsidy levels. In December 2021, the incentive was extended by the new federal government’s Green Minister for Economic Affairs, until the end of 2022. With a few tweaks, namely the size of incentives and eligibility, it is set to continue until the end of 2025. For example with an increase in the minimum electric range for PHEVs.

This created a spike in EV adoption, with both BEV and PHEV growth rates surging by at least 100%. This change bolstered EV market share, jumping from just under 3% in 2019 to over 12% by the end of 2020. In July 2021, the German EV market hit one million units, the goal that was set back in 2010, only six months after the original timeframe.

Germany can look with optimism at its EV market, with new and more competitive BEV models set to arrive in the coming years. BEVs are expected to grow to represent the majority of the overall automotive market by the end of this decade, but incentives need to be kept in place for the transition to happen smoothly.

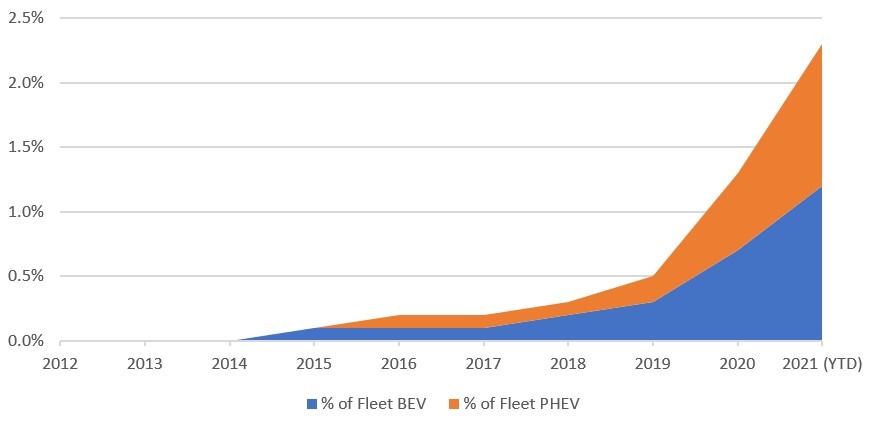

Fleet percentage

When it comes to fleet numbers, the trend broadly follows the market-share graph, with the needle only starting to move by the end of 2015, followed by slow but steady growth until the end of 2019. In 2020 and 2021, there was a significant rise in the vehicle replacement rate, with the EV share jumping by almost 2%.

Still, with the current EV fleet representing less than 2.5% of total numbers, and the EU’s 100% zero-emission mandate only set to be enforced by 2035, expect a complete phase-out of internal-combustion engine models by 2050, the earliest.

| Level of BEV Incentives | ||

| Type of incentive | Low (+) to High (+++) | |

| 1 | Purchase incentives | +++ |

| 2 | Ownership incentives | ++ |

| 3 | Company car incentives | ++ |

| 4 | Other incentives | +++ |

Notes:

1. Purchase tax exemption, purchase incentive, VAT exemption, import tax exemption, etc.

2. Ownership tax exemption, Bus Lane Use, toll exemption, free parking, free ferries, etc.

3. VAT exemption, BiK tax exemption, etc.

4. Charging cost deductibility, special license plates, EV charger subsidies, etc.

How big are the incentives?

Germany has established a purchase incentive of up to €9,000 for BEVs below €40,000, while above that threshold and up to €65,000, the EV subsidy can reach up to €7,500. The current terms are valid until the end of 2022. For PHEVs with a range of at least 60km and which are priced under €40,000, the subsidy is €6,750 (€5,625 for those priced above €40,000 and below €65,000).

There is a 10-year exemption on ownership tax for BEVs registered up until 2025, while PHEVs benefit from ownership-tax reductions.

Reduced benefit-in-kind taxes for company cars with a price list lower than €60,000 are in place, instead of the regular 1%. PHEVs with a minimum 60km electric range pay 0.5% and BEVs 0.25%, which can result in over €2,000 of annual savings for PHEVs and over €3,000 for BEVs.

Besides special licence plates, there is a €900 incentive per charging point, granted by the state-owned KFW Bank. For small-to-medium enterprises, there is a different incentive scheme that grants up to €16,000 for the installation of DC fast-chargers. Added to local and regional incentives for EV charging, this represents a complete range of charging incentives.

Finally, despite not having a national zero-emission mandate, Germany will have to comply with the European Union zero-emission regulations coming into effect in 2035, when all new vehicles registered must be based on zero emissions.

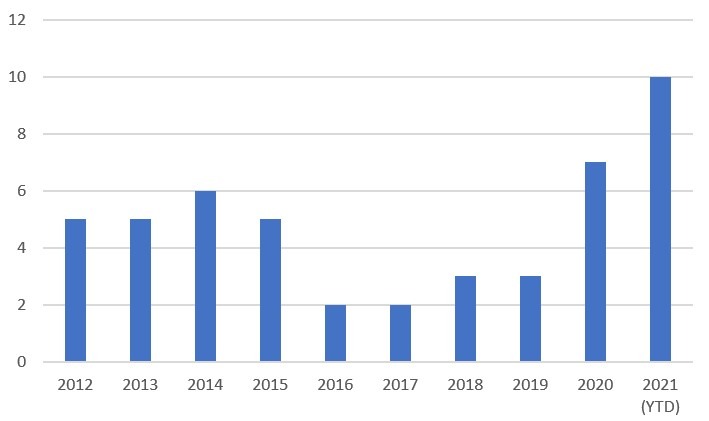

BEVs per charging point

The charging-anxiety ratio

The same issues for EV owners apply in Germany as in other markets. These include pricing, range and charging infrastructure (CI).

In terms of CI development, the ratio of BEVs per charging point was stable during most of the electrification process. The ratio was between six in 2014 and only two in 2016-17. The recent registration surge without a corresponding quick increase in CI, has led to a significant increase in the EVs to charging points ratio. While 10 BEVs per charging point in Germany is still far from the ratio of 17 in Norway, it is worlds apart from the two BEVs per charging point that the Netherlands has.

A major and decisive shortcoming of the German infrastructure is the fact that, according to the ‘Bundesnetzagentur’ (Federal Network Agency), there are on average only about 2.5 charging points per location. In addition, the locations are often decentralised on side streets, i.e. a user has to hope that there is a free space at one of the (mainly) two charging points, otherwise the user has to drive to find the next one.

In addition, drivers often have no place to wait, such as a café in the immediate vicinity. Germany shows that fiscal incentives and how they are implemented can be a significant factor in EV adoption. This market development is leading to Germany’s automotive market becoming the key force for adoption in Europe. Furthermore, adoption of used EVs are a key to long-term success because new vehicles need to find a place in the second-hand market. Their leasing and resale values are crucial to achieving the market transformation.

Part one (Norway) of the series is available on Autovista24 along with part 2 (the Netherlands).