Total cost of ownership impact: German EV subsidies likely to decrease in 2023

09 May 2022

In Germany, government EV subsidies for battery-electric vehicles (BEV) are expected to gradually reduce between 2023 and 2025, with incentives for plug-in hybrids (PHEVs) likely to end on 31 December 2022. Given the long waiting periods for new-car deliveries, it is unclear whether recently ordered vehicles will be registered in time to still benefit from the popular incentives.

The impact on total cost of ownership (TCO) depends on the mileage-age scenario, the model itself and energy costs, but the effect on depreciation and leasing rates can be significant.

In mid-April, a letter was circulated by Michael Kellner, the parliamentary state secretary of the federal ministry for economic affairs and climate action, which suggests ending the subsidies for PHEVs in December 2022 and cutting back benefits for BEVs step by step until 2025. However, this has yet to be agreed on within the governing coalition, made up of the centre-left Social Democrats (SPD), the Greens, and the liberal Free Democrats (FDP). It suggests cutting the government share of the innovation premium from €6,000 to €4,000 as of 2023, and to €3,000 in 2024 and 2025.

Robert Habeck, federal minister for economic affairs and climate action, commented to the Funke Mediengruppe that these EV subsidies ‘are still significant and attractive, in particular as carmakers add another 50% to them.’

2022 BEV and PHEV incentive scheme in Germany

| Innovation premium | |

| BEVs up to €40,000 net list price | €9,000 (net, €6,000 government + €3,000 car maker) |

| BEVs up to €65,000 net list price | €7,500 (net, €5,000 government + €2,500 car maker) |

| PHEVs up to €40,000 net list price | €6,750 (net, €4,500 government + €2,250 car maker) |

| PHEVs up to €65,000 net list price | €5,625 (net, €3,750 government + €1,875 car maker) |

Source: German federal ministry for economic affairs and climate action

The registration date of a vehicle determines its eligibility for the EV subsidies, and this is where the current supply-chain disruptions and semiconductor shortages come into play. Delivery times for new vehicles have increased and a waiting period of a year has become the norm rather than the exception. The Austrian-based car subscription provider Instadrive reports delivery times of up to 106 weeks for a Skoda Enyaq. Therefore, it is likely that cars ordered under the assumption of receiving PHEV or BEV subsidies will be delivered after these have run out or have been reduced.

The total cost of car ownership will see a major impact from reduced or cut EV subsidies. A crucial question when it comes to electric vehicles (EVs) might be whether they actually pay off, especially when considering how their TCO changes when the models no longer benefit from the subsidies and how they fare in comparison to petrol or diesel variants.

To answer these questions, it is necessary to have a closer look at the main drivers for a vehicle’s TCO. The TCO is calculated as the sum of acquisition costs and utilisation costs. Government incentives like the EV subsidies directly influence the acquisition costs as they reduce the depreciation of a car by lowering the initial list price. The effects differ by brand, model, and mileage-age scenario. The following analysis can only provide an indication.

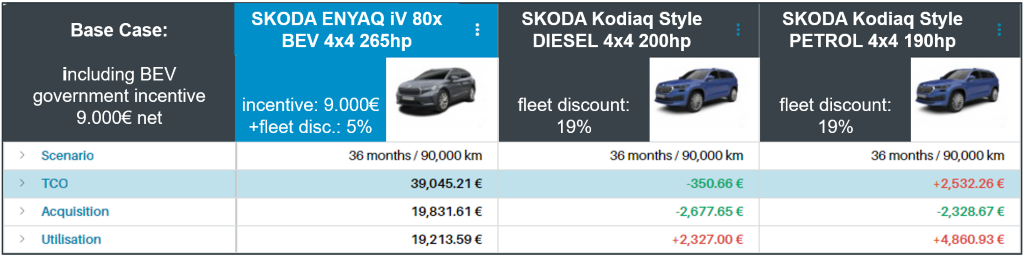

A comparison of the Skoda Enyaq’s TCO with and without the BEV grant to that of the all-wheel drive petrol and diesel variants of the closely related Skoda Kodiaq illustrates the financial impact. Assumptions defined for the comparison include a market-typical discount of 19% for small and medium fleets, which reduces to 5% for the Enyaq when benefitting from the full €9,000 government incentive.

Also, an equipment adjustment ensures that must-have features are fitted and models can be compared on a like-for-like basis. For the Enyaq iV 80x, equipment features worth €10,500 had to be added for a realistic and residual-value (RV) supporting specification, while the Kodiaq Style benefits from a more comprehensive standard equipment and only adds options worth €6,500. The mileage-age combination is 36 months with a total of 90,000km, a common fleet scenario in Germany.

TCO comparison: Skoda Enyaq iV 80x versus Skoda Kodiaq petrol and diesel variants (base case, including BEV incentive)

Notes: List prices include additional equipment, Enyaq + €10,512, Kodiaq + €6,470.

Discounts assumed to be at 5% and 19% respectively.

Fuel prices: electricity at €0.5/kWh; diesel and petrol at €1.90/l

Consumption values have been adjusted to real-world values: Enyaq 22.3kWh/100km (versus 17.3kWh/100km, WLTP), Kodiaq diesel 7.8l/100km (versus 6.3l/100km, WLTP), Kodiaq petrol 9.5l/100km (versus 7.8l/100km, WLTP)

Both scenarios, the base case with the EV subsidy applied as well as the Scenario 2 without any BEV grant taken into account, see the Skoda Kodiaq diesel variant with the lowest TCO over three years and €90,000km. However, considering the government incentive for the Enyaq, it comes in as a close second with a disadvantage of only €350 to its diesel sibling.

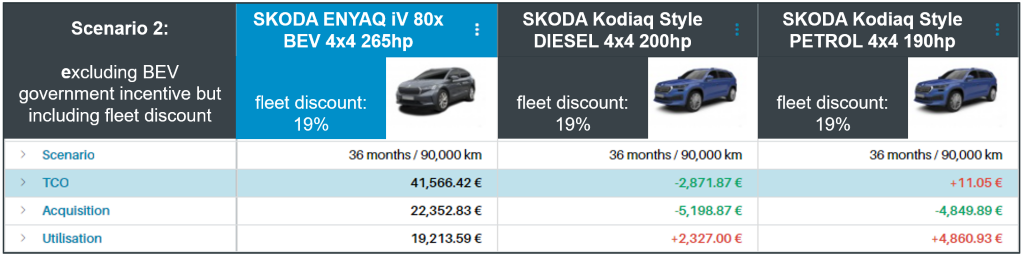

Thanks to the full €9,000 BEV grant, the Enyaq sees eye to eye with a diesel Kodiaq in terms of TCO, but considerably falls behind without the EV subsidy. The Enyaq’s TCO grows by €2,500 when omitting the BEV incentive, increasing the gap to the Kodiaq diesel variant to €2,870 and draws level to the petrol version’s TCO. The expected reduction of the incentive until 2025 will result in smaller effects.

TCO comparison: Skoda Enyaq iV 80x versus Skoda Kodiaq petrol and diesel variants (scenario 2, excluding BEV incentive)

Utilisation costs are increasingly becoming a focal point for TCO due to rising fuel and energy costs. Fuel prices underlying this analysis are at €1.90/l for diesel and petrol and electricity is calculated at €0.50/kWh with a mix of home-charging (€0.30/kWh), public AC charging (€0.40/kWh), and DC charging (€0.75/kWh). Another wave of rapidly rising fuel prices, as seen in March 2022, or a stagnation at a comparably high level have the potential to negatively impact the internal-combustion engine models’ TCO.

Furthermore, a lot can be proactively done to decrease energy costs for charging a BEV. Contracts with energy providers or networks can bring down tariffs for DC charging, which is especially relevant for fleet vehicles with a drive profile focussed on longer distances. As an example, the DC charging costs at Ionity charge-points in Germany drops from €0.79/kWh to €0.35/kWh with an Ionity passport tariff at an additional €17.99 per month. Many brands already include comparable solutions with the purchase of the vehicle.

When a more consequent and long-term investment in sustainability and renewable energies is an option, energy costs for charging electrified car fleets can be reduced even further. The price for one kWh charged via a photovoltaic system is as low as €0.05 to €0.10, depending on how high the benefit is from feeding energy back into the grid.

Photovoltaic systems could be installed at a company’s car park while company car drivers could also be incentivised to have one at their homes. Amortisation costs will need to be considered, but pure utilisation costs of BEVs could be brought down considerably and subsequently make TCO more attractive.

Whether BEVs pay off from a TCO-perspective depends on numerous internal and external factors, which need to be considered when deciding on a company car policy or vehicle purchase. Government EV subsidies and their pending reduction play a major role as to acquisition costs. Ultimately, rising fuel costs and potential savings on electricity costs can tip the scale in the favour of BEVs.