How will the agency model impact automotive residual values?

16 May 2023

The automotive industry has been going through massive upheavals, with the COVID-19 pandemic forcing carmakers to rethink their sales models. Instead of relying on traditional car dealerships, manufacturers are exploring opportunities to sell their new vehicles directly to consumers.

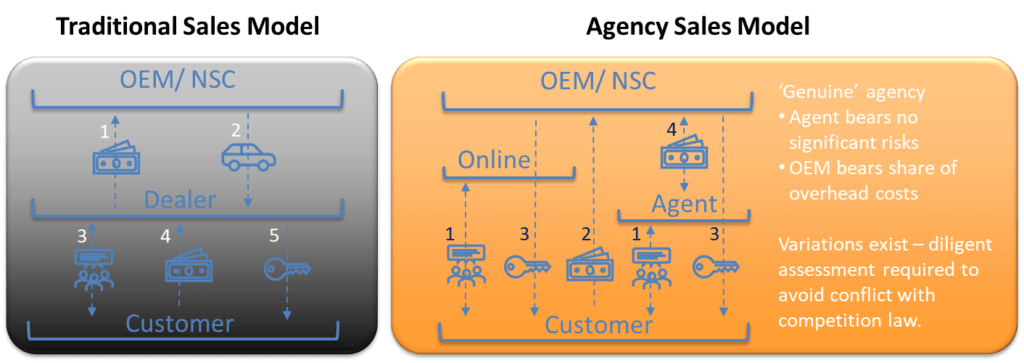

One potential path to gain greater control of the sales process is by introducing the agency model. This turns the car dealer into an agent between the OEM and the consumer, in effect giving the carmaker ownership of pricing. Meanwhile, dealers would act as intermediaries, responsible for the customer experience in the offline part of this omnichannel approach to car sales.

Eurotax Switzerland and Eurotax Austria, both part of Autovista Group, analysed the agency model in their latest webinars, The trend towards the agency model in the automotive trade. Guest speaker Dr Christof Engelskirchen, Autovista Group chief economist, was part of the debate, providing details on current developments.

‘The biggest difference between the traditional sales model and the agency model is that asset, credit and the majority of commercial risks lie with the manufacturer or importer,’ said Engelskirchen. ‘It is also important to note that many variants are possible with the agency model and they all have to be examined in detail under competition law.’

Traditional versus agency sales model

The agency model, dubbed the future of automotive retail, is something major car producers including BMW, Ford, Mercedes-Benz, Volkswagen Group, Volvo and Stellantis, aim to roll out across European markets. While this business model has a direct impact on new-car sales, it will also leave its mark on the used-car market and residual values (RVs).

Push for agency model since pandemic

Engelskirchen explained that the agency model is not a new concept but that the pandemic served as a catalyst for adoption, putting it in the limelight.

Compared to the traditional means of selling a vehicle – which focuses on maximising car volumes – the agency model is deemed more suitable for margin optimisation in combination with an improved customer-buying experience. In other words, selling fewer cars at higher transaction prices could compensate for the potential loss in the number of transactions under the agency model.

With this shift, manufacturers could take charge of whom they sell cars to. At the moment, dealers collect consumer data, but the agency model would somewhat turn the tables, allowing manufacturers to obtain and leverage these insights at scale.

From a customer’s point of view, buying a car directly from the manufacturer is a hassle-free and seamless process. It distributes the roles and responsibilities between the carmaker and the dealer, with the former in charge of pricing and the latter in offering advice, test drives, and the vehicle handover. This approach leaves very little room for up-front discounts and negotiations when it comes to single-vehicle purchases. It also means consumers do not find themselves having to bargain.

Engelskirchen explained that car manufacturers can still adjust their pricing strategy in light of competitor activity. This could include offering additional equipment, attractive leasing rates, loyalty programmes with kick-backs for returning customers, or special models and colours during vehicle ramp-up or run-out phases.

As such, the agency model offers a lot of flexibility for carmakers, as well as risks. With the traditional sales model, these risks are shared between the dealer, importer and manufacturer.

For example, the carmaker will have to bear a share of the agent’s overhead costs, as well as financing the cars displayed in the showroom and used for test drives. The agent might have to pay usage fees for test drives. The exact contractual arrangements will vary though and depend on the negotiations between stakeholders.

Pros and cons of the agency model

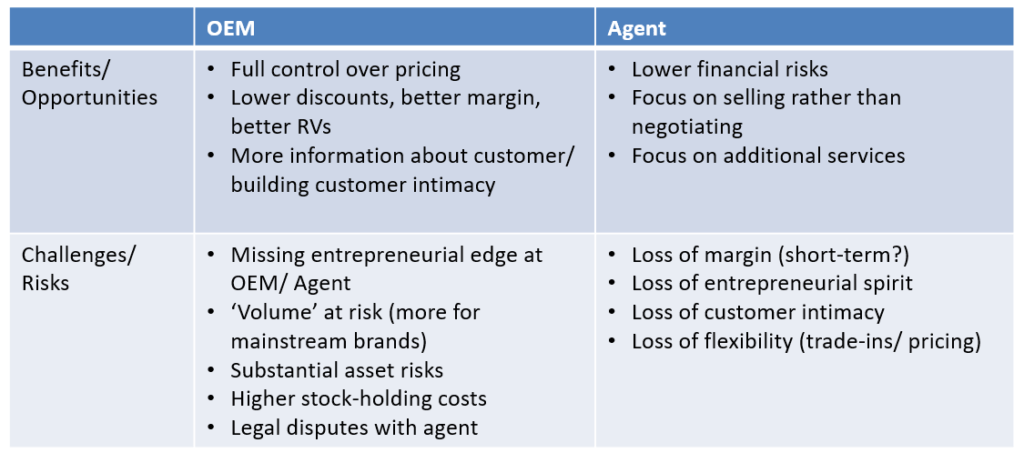

The agency model offers advantages and disadvantages for both manufacturers and dealers, some of which are not too happy about the prospect of becoming mere intermediaries in the future. For manufacturers, the benefits include price control, fewer discounts and higher residual values, as well as an easier way to build a direct relationship with consumers.

For dealerships, the agency model means fewer economic risks, a clear focus on facilitating the sales process and not having to negotiate the price. Attention can also be shifted to additional services, such as car-sharing or electric-vehicle (EV) charging.

Car dealers will still play a dominant role in buying and selling used cars. Engelskirchen recently explained that the list of disadvantages for car manufacturers is significant and could include a loss of business, on top of volume and asset risks. Carmakers will face higher costs for storage and setting up pricing intelligence centrally, while there could also be legal disputes with dealerships.

Dealers, on the other hand, will be severely impacted by the agency model as they face lower profit margins and a loss of customer contact and retention. They will also be less flexible when it comes to offering payment options and discounts.

Risks and benefits of the agency model

Impact on residual values

The agency model will have a largely positive effect on RVs. It will avoid battles over discounts, giving carmakers the option to lower list prices, as well as providing attractive configurations and leasing offers instead of having to present the customer with certain discounts.

‘We believe that the agency model will have a positive impact on the residual value level of brands. The biggest plus point is the avoidance of discount battles, which are negative for residual values. It is simpler to adjust the list prices,’ said Engelskirchen.

Higher leasing quotas and improved marketing for battery-electric vehicles (BEVs) are also likely as they gain ground in the used-car market. Overall, the agency model will allow carmakers to focus on margins and not so much on volumes, both of which will positively impact RVs.

Future of automotive retail

So, will the agency model truly dominate the future of automotive retail? ‘We have to emphasise that the agency model will coexist with other sales models,’ said Engelskirchen.

‘Some of the established European brands and several Chinese brands have already announced that they will concentrate on the traditional sales model. We will see whether the agency model can successfully operate in an environment where it competes with the traditional sales model that can push volume quite successfully,’ he added.

Rainer Hintermayer, market analyst at Eurotax, demonstrated the growing significance of the agency model in Austria, where many car manufacturers are experimenting with pilots. Tesla was one of the first carmakers to roll out the sales model in the country, followed by Mercedes-Benz. Polestar is also exploring this route, along with major brands such as BMW Group.

By the end of this decade, the agency model will be a lot more prevalent in Europe although there will still be manufacturers that will abstain from introducing it. These are likely to include Asian brands, such as Toyota, Hyundai, Nissan, Honda, Mazda, Suzuki, BYD, and MG.

To find out more about the topic, recordings of the webinars (in German) about the Austrian and Swiss automotive markets are available below.

Switzerland: https://register.gotowebinar.com/recording/2911414862270044847

Austria: https://attendee.gotowebinar.com/recording/6376720370896930987