Hydrogen vehicles in Europe – is there growing support?

27 September 2022

While electromobility is in full swing, some European manufacturers are also working to bring hydrogen vehicles to the roads, writes Autovista24 journalist Rebeka Shaid.

With the EU planning to ban the sale of new petrol and diesel cars from 2035, European carmakers have shifted their focus to electromobility. But some manufacturers are exploring alternative powertrains, with hydrogen vehicles pitched as another ‘clean’ mode of transport.

Political backing came this month from the European Parliament, which has set minimum quotas for the use of hydrogen and synthetic fuels. By 2030, the share of so-called ‘renewable fuels of non-biological origin’ should make up at least 5.7% in the transport sector.

Two of the main hydrogen cars that are commercially available now are produced by Asian brands. Toyota’s Mirai and Hyundai’s Nexo are among the best-known hydrogen-based vehicles, but European car manufacturers are also diving into fuel-cell technology – both for passenger and commercial vehicles.

‘If we look at Europe, what we hear is the need for hydrogen is increasing dramatically,’ David Holderbach, CEO of Hyvia – a joint venture between Renault Group and hydrogen fuel-cell maker Plug Power – told Autovista24.

Hydrogen vehicles are ‘the closest to diesel,’ according to Holderbach. ‘European OEMs are monitoring fuel-cell technology and have been working on it,’ he added, citing Renault’s endeavours to build hydrogen-powered cars.

The French brand introduced its concept car, the Scenic Vision, earlier this year – a prototype hydrogen fuel cell-powered SUV, which has a 75% smaller carbon footprint than a conventional battery-electric vehicle (BEV). But the car will not be available until the next decade, when electromobility will be the norm across Europe.

Hyvia, on the other hand, will start dispatching its first hydrogen vans later this year, coming with a range of up to 500km. ’10 years ago, it was clearly too early for Europe to be in the hydrogen business. Today, with what is happening in Europe – whether it is France, Germany, the Netherlands, Spain – there is a big change. Infrastructure is coming and production is coming,’ Holderbach added.

Going against the flow

While European car manufacturers are investing in hydrogen, camps remain divided on its use. BMW recently confirmed it has started producing fuel-cell systems for its hydrogen-powered iX5, describing it as a climate-friendly alternative. Hydrogen cars only emit water and warm air. They can be made from renewable energy resources, and BMW considers them to be a sustainable addition to BEVs.

But the Munich-based business is going against the flow as its German rivals do not generally view hydrogen technology as a viable solution for passenger cars. In 2018, Mercedes-Benz rolled out a hydrogen SUV, the GLC F-Cell, which has since disappeared from the market.

The GLC F-Cell was primarily delivered to customers in Germany and Japan, with the carmaker being selective from the outset by limiting the availability of the SUV. Mercedes-Benz is now clearly going down the electric path and is moving away from hydrogen technology.

‘The potential of fuel-cell technology and hydrogen as an energy-storage medium is beyond question. Nevertheless, the EV battery is currently superior to the fuel cell in terms of a large-volume market launch, especially for passenger cars, not least in view of the still small number of hydrogen fuel stations worldwide and the relatively high technology costs,’ Mercedes-Benz told Autovista24.

As another German luxury brand, Audi has similarly moved its attention away from hydrogen to concentrate on electrifying its fleet. It did consider developing a hydrogen car, dubbed the h-tron, but scrapped the concept a while ago.

While Audi, which is part of Volkswagen (VW) Group, told Autovista24 that it is responsible for the development and industrialisation of fuel-cell technology within the group, it said: ‘Under the current conditions, we do not see any significant field of application for fuel-cell propulsion in the passenger-car sector.’

Low-volume production

Like Mercedes-Benz, Audi cited challenges such as building an appropriate infrastructure. It added that high energy losses during the production of hydrogen are also problematic, as well as converting the fuel to green hydrogen, which is the most sustainable way of developing the fuel.

None of this is deterring BMW, which is also taking a vested interest in e-fuels. The manufacturer is following through with its hydrogen plans, believing in the future potential of fuel-cell technology for passenger vehicles. The company sees an advantage in the technology as it could lower reliance on rare-earth materials. That is because hydrogen-powered systems mainly rely on recyclable metals such as aluminium, steel, and platinum.

Another benefit for BMW is the battery in a fuel-cell electric vehicle, which is smaller than those used in a BEV as it is not the main source of power for the car. The iX5 features an electric motor and a high-performance battery. Cold temperatures are also not an issue for hydrogen-powered cars, which have a comparable range to electric vehicles and can be filled up in a few minutes.

‘We think hydrogen-powered vehicles are ideally placed technologically to fit alongside battery-electric vehicles and complete the electric-mobility picture,’ said BMW CEO, Oliver Zipse, at an event last month.

BMW will start low-volume production before the end of the year, with hydrogen enthusiast Toyota supplying individual fuel cells. The two car brands have been collaborating on fuel-cell drive systems since 2013, and BMW will initially test the hydrogen-powered vehicles on a small scale. But the company does not exclude large-scale production in the next five years – if the automotive market is ready by then.

Commercial vehicles

According to H2Stations.org, there were 685 hydrogen fuel stations worldwide last year, most of which can be found in Asia. In Europe, Germany leads the way, with around 100 refuelling stations. The German government is heavily funding hydrogen projects, but with infrastructure lagging behind worldwide and the variety of hydrogen models still limited, analysts believe that the fuel is unlikely to offer a breakthrough for passenger cars any time soon.

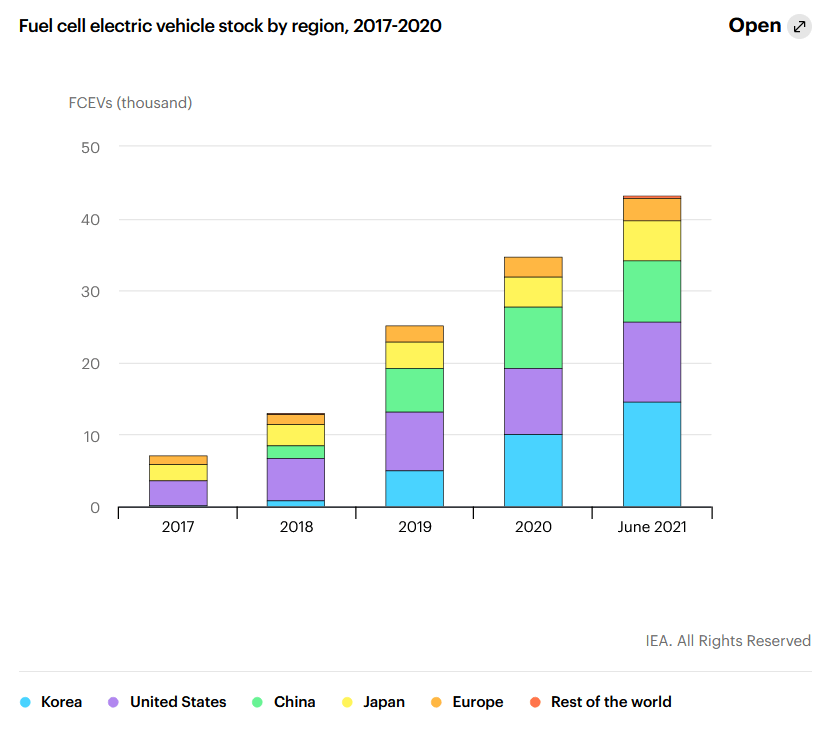

However, the number of fuel-cell electric vehicles is on the rise, with the International Energy Agency (IEA) recording more than 40,000 vehicles in use globally by the end of June 2021. It noted that deployment is concentrated on passenger light-duty vehicles, which accounted for three quarters of the stock at the end of 2020.

For commercial vehicles then, such as trucks, busses and vans, hydrogen could play a bigger role. France-based Hyvia wants to offer an ecosystem that includes light-commercial vehicles (LCVs) with fuel cells, hydrogen refuelling stations, as well as the supply of carbon-free hydrogen and services for financing fleets.

The company aims to achieve a 30% market share in the hydrogen light-commercial vehicle market by 2030, and it wants to get there in a more sustainable way. Holderbach told Autovista24 that Hyvia aims to ‘lead green-hydrogen mobility.’ He believes that hydrogen-powered vans will quickly become available in Europe, within the next couple of years or so, with the brand presenting its vehicles at the IAA Mobility show in September.

‘It will start with hubs,’ Holderbach said, especially in places such as France, Germany, and the Netherlands. ‘When you create hubs, you have massive production of hydrogen for heavy-duty industries and light-commercial usage.’

Audi told Autovista24 that its competence centre for fuel-cell technology in Neckarsulm is continuing its research activities in the area. ‘The results of our development activities could become relevant for the Volkswagen Group in the medium term, particularly for light-commercial vehicles and trucks,’ the carmaker said.

German automotive supplier Bosch projects that one in eight newly-registered commercial vehicles worldwide will be powered by a fuel cell by the end of the decade. The company told Autovista24 that it initially sees the automotive use of hydrogen in the commercial-vehicle sector.

Various European carmakers have at one point or another announced hydrogen-powered commercial vehicles. Stellantis-owned Citroën is currently testing the ë-Jumpy Hydrogen, which can be filled up in three minutes and has a range of 400km. The automotive group has other hydrogen-based vehicles in the works, modelled on their BEV counterparts, including the Opel Vivaro-e and the Peugeot e-Expert.

LCVs are an obvious choice for hydrogen, Holderbach noted. So, what about the passenger-car market? ‘I think there will be a point where hydrogen can become more meaningful for passenger cars, but we first need to make the breakthroughs,’ he said.