Volkswagen shaping up to become electric-vehicle leader

23 August 2022

José Pontes, data director at EV-volumes.com, considers the fortunes of one of Germany’s most recognised automotive manufacturers, Volkswagen Group.

September 2015 will go on record in Volkswagen Group (VW) history for two apparently unrelated events. These events signalled a significant change of direction that allows VW to become one of the most promising legacy car manufacturers when it comes to electric vehicles.

These events were, firstly the Frankfurt Motor Show (IAA) presentation of the Audi e-Tron and Porsche Taycan concept cars, and secondly, the Dieselgate scandal.

When faced with the perfect storm of negative press and falling sales that followed Dieselgate, VW made a rare change of direction. All of a sudden, the Audi e-Tron and Porsche Taycan (“Mission E” at the time) were no longer just concept cars for a distant future, but instead the first representatives of its new-found faith in electric vehicles.

Looking back, that momentary fall into the abyss ended up being a blessing in disguise for the German firm. Thanks to its early (and forced) bet on electromobility, VW is now the legacy automotive manufacturer with the most developed and ambitious electric vehicle (EV) plans, and the best prepared to face the EV revolution.

A slow warm up to EVs

Having been the best-selling automotive group in Europe for over two decades, it was important for the overall electrification process of the European market that VW adapt quickly to electrification, but that is not what happened.

The first production series EV from VW was the VW e-Up!, which was delivered in October 2013, a time when some competitors had already been making their mark with electric vehicles. The Renault Zoe had been on sale for over a year, and the Nissan Leaf had been on the market for almost three years.

Still, with the introduction of the Porsche Panamera plug-in hybrid (PHEV) in late 2013, and the addition of the VW e-Golf battery-electric vehicle (BEV), the VW Golf GTE and Audi A3 e-Tron plug-in hybrids in the second half of 2014, VW started to gain some traction. It ended 2014 in second place in Europe, with an 11% share, below Renault-Nissan Alliance, which dominated the European EV market, with 47%.

Globally, the picture was less rosy, as VW ended 2014 with only 4% of global sales, being only eighth among manufacturers, behind BMW Group in seventh place (6% share) and the still unknown BYD (also 6%) from China in sixth.

But then again, top management did not seem too concerned about this, as they expected the transition to be slow and diesel to still reign for many years.

The good, the bad and the Frankfurt Motor Show

Until August, 2015 was actually going well for VW EVs. In that month the VW Golf GTE won the best-selling plug-in model title in Europe for the first time, and its market share had jumped to 28%, thanks to the success of its compact EV offerings (VW e-Golf, VW Golf GTE and Audi A3 e-Tron). VW shortened the distance to the leader Renault-Nissan Alliance to just 8%. Globally, VW had doubled its share to 8%, jumping to the fourth position, just behind the Renault-Nissan Alliance, BYD and Tesla.

But then on 18 September, the US Environmental Protection Agency said it had found that VW had installed a ’defeat device’ software code in the diesel models sold in the US. Four days later, VW admitted it had installed the emission-defeat device in 11 million cars sold worldwide, which sent shockwaves throughout the industry.

This admission led to Martin Winterkorn resigning as the Group CEO the next day. A nightmare of bad press, penalties and lawsuits ensued, estimated to have cost the company some $30 billion (€29 billion).

The effects impacted VW’s EV business. A year later, it had lost 9% of market share in Europe, down to 19%, and globally it fell one position in the ranking, overtaken by BMW, having seen its global share drop from 8%, to 6%.

But buried in the storm of bad news were the first seeds for a turnaround. At the Frankfurt Motor Show, VW presented two concept cars, the Audi e-Tron Quattro and the Porsche Mission E, that would later become the Audi e-Tron and Porsche Taycan. In normal times they would be just two more concept cars that might make it into production, but instead they became two highlights in the company’s new business focus – “Strategy 2025”, based on electric mobility.

A new life begins

In 2016 under the orders of CEO Matthias Müller, VW established its new “Strategy 2025” focussing on a new, dedicated BEV (battery-electric vehicle) platform, called MEB, to be used in several new models across different brands. A first preview of the new strategy was launched at the 2016 Paris Motor Show, in the form of the Volkswagen ID, a compact hatchback that would later become the VW ID.3.

The biggest problem with the new strategy was that it would take three years for these new EVs to become a reality, including the previously presented Audi and Porsche concepts.

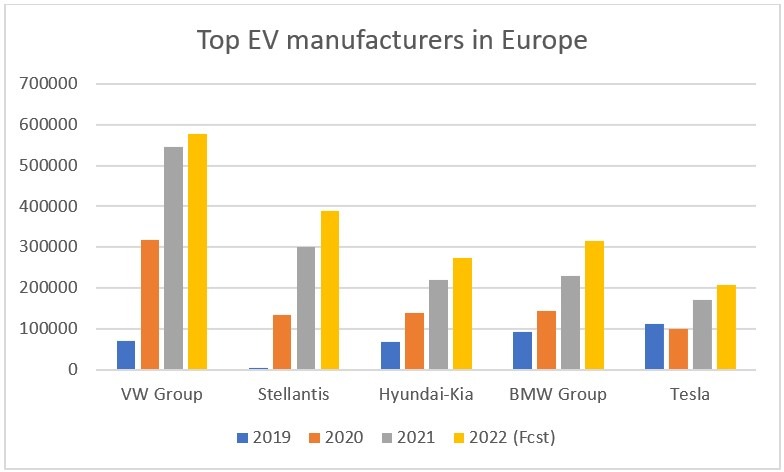

Despite an absence of dedicated BEVs, by 2019 VW ended in third position in Europe, with a 10% market share, mostly thanks to the consistent performances of the VW e-Golf, and the addition that year of the Audi e-Tron. However, globally the German business was lagging, ending the year in eighth, with just 5% market share, behind Hyundai-Kia and ahead of Geely-Volvo.

The MEB era

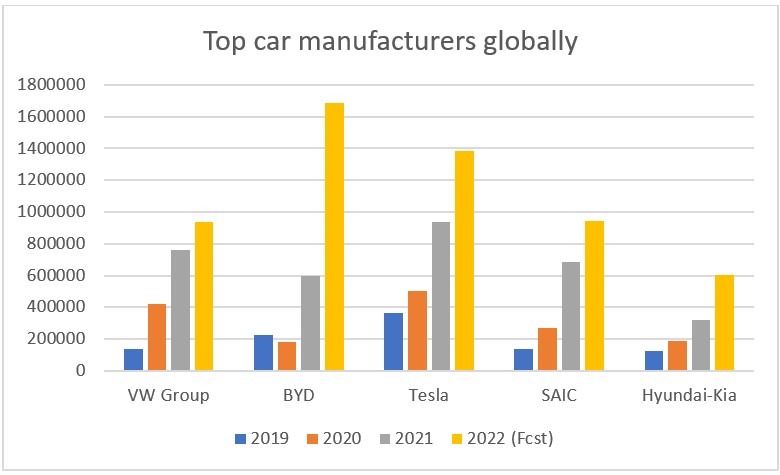

Meanwhile, if VW was celebrating first producing more than 100,000 electric units in a year in 2019, Tesla delivered close to 370,000 units in the same timeframe.

With the EU new passenger-car fleet-emission standards set at 95g/km of CO2, phasing in for 95% of vehicles in 2020 with 100% compliance in 2021, VW needed to make a massive effort to comply.

Good thing then that mass production of the first models from the MEB platform came online in the second half of that year, motivating significant last-minute pre-registrations in December 2020, with 28,000 VW ID.3 units registered that month, and 4,700 examples for the VW ID.4. VW averaged 92g/km in 2020 and won its first best-selling EV trophy in Europe that year. Globally, it tripled its sales and jumped from sixth to the runner-up spot, only behind the leader Tesla.

After the sales rush of late 2020, 2021 saw the launch of the popular Skoda Enyaq and Audi Q4 e-Tron, as well as the start of the Chinese operations for the VW ID family. The VW ID.4 was launched, along with the larger VW ID.6, which allowed VW to keep its leadership in Europe and remain the second best-selling EV manufacturer, again behind Tesla.

Currently, the deployment of new models continues, with volume production of the sporty Cupra Born hatchback and the VW ID.5 crossover, and continued success of the VW ID.4, Skoda Enyaq and Audi e-Tron, allowing VW to remain EV leader in Europe.

But there are dark clouds on the horizon, as Stellantis is closing in in Europe and VW has dropped to fourth on the global stage in the first half of 2022, behind a surging BYD, that has surpassed Tesla in the second quarter of the year. VW has also lost a position to Shanghai Auto (SAIC), with the Chinese company benefitting from the success of the tiny Wuling Mini EV, as well as the popularity of MG’s EV models in export markets, namely in Europe, leaving VW in fourth place at the end of the first half of 2022.

These recent sales woes add to the delays experienced in the rollout of new models on the PPE premium platform, due to an underperforming software division, along with internal struggles, namely with unions, and conditions for changes at the top emerged.

With the current CEO, Herbert Diess stepping down at the start of September, and the current head of Porsche, Oliver Blume, succeeding him, this could become another turning point for VW. It is, therefore, important to look at the near future perspectives, the options for the new CEO, as well as the business’s strong and weak points in the EV industry.

Blume’s to-do list

First up Blume’s seven most urgent topics should be:

- Recover ground in China. VW is by far the biggest car manufacturer in the Chinese overall market, but it is only in seventh position in the EV market;

- VW gaining some ground in North America, and local production of the VW ID.4 starting just in time for the new US incentive rules, prioritising local production. A swift ID.4 production ramp up in the Chattanooga plant has become even more important;

- Defend VW’s leading position in Europe in the EV market, from Stellantis and Tesla, namely by increasing production output;

- Solve the Cariad software business issues that have delayed a number of new Audi and Porsche EVs;

- Make over-the-air (OTA) updates a regular and seamless feature;

- Successfully secure Porsche’s IPO. With the current economic weakness, this could be at risk; and

- Prepare for a possible energy crisis related to Russian gas supply that could disrupt production in Germany and other countries.

Challenges

VW faces a number of challenges when it comes to establishing itself as the highest-ranking EV manufacturer. These include, but are not limited to:

- China’s Volkswagen-loving days might be coming to an end. For decades, Volkswagen has been the sales leader in the world’s largest automotive market, with their profits rising at the same pace as the expansion of the Chinese market. The same could be said about many foreign firms that had China as their main market, but with the rise of EVs, this has changed. Chinese manufacturers are surfing the wave of EVs to win back their domestic market. In the overall market, Chinese brands have a 47% share of their domestic market, and for EVs, they hold around 85% of the market. VW has just 4% of Chinese EV sales, against more than double that in the overall market. VW risks losing one million units in yearly sales, in China alone, which will be one of the most challenging topics in Oliver Blume’s agenda for the future;

- The threat from Tesla, and Chinese manufacturers. Tesla is already disrupting the overall midsize category. Its Model Y is Europe’s best-selling midsize model, all powertrains included, and the Chinese manufacturers are preparing themselves to make important inroads in overseas markets. Established brands, like VW, now see themselves having to share the market with a significantly larger number of players, which will invariably lead to an even more fragmented market and less sales per participant;

- Transitioning from a traditional car company culture to a leaner, and software-focused business – The Cariad division is an example of how the business is trying to adapt to a new reality where software is as important as engineering. The challenges surrounding it come from not realising that software is a key feature of the new EV era and has led to delays in model launches. This demonstrates the immense challenge VW has before it, in developing new, proprietary software, and competing with EV startups, and established manufacturers, that work with a specialised third party to achieve the best software the market has to offer (e.g., Huawei in China, or Google); and

- Ramping up EV production without losing overall profitability – VW’s current EV strategy has a conundrum shared by many established manufacturers. How will firms respond to the incumbents (e.g. Tesla and Chinese manufacturers) encroaching on their share of the market, without losing profitability. If VW goes too fast on EVs, it risks losing the still profitable internal-combustion engine (ICE) business, but if it takes too long to respond, like in China, it might miss the window of opportunity to remain among the top players. At least, the VW management seems to have a plan for this, while others are still expecting (hoping?) that ICE powertrains will remain for a few more decades.

Volkswagen’s future EV plans are ambitious, and the Dieselgate scandal might have forced them towards electrification before others, but having the right ideas is not enough. They need to be executed efficiently and in due time.

Optimising opportunities

VW is no stranger to electrification and can be considered one of the best-prepared established car manufacturers to respond to the challenge. Ironically, it was the 2015 Dieselgate scandal that really ignited their EV plans. Here are its main strengths for the new EV era:

- Its early start on mass EV production is now bearing fruit. By developing its dedicated mass EV platform relatively early, VW is reaping benefits earlier than the competition. It has MEB-based mass-produced models across four brands (VW, Skoda, Cupra and Audi), and in the three main markets (Europe, US and China), while most of the competition still have their first mass produced, dedicated EVs in development;

- Leading position in China. Despite losing share in China whatever market share it manages to hold in the future, VW will still be the best among foreign manufacturers. This is not only because it is a familiar name in the country that many consumers will feel comfortable with, but also because it is taking mass local production of EVs seriously, with only Tesla rivalling it in terms of locally-made EVs;

- Large synergies without losing diversification. This is part of the VW DNA and drove a significant portion of its success in the ICE era, as it can offer models with distinct personalities, while using the same basic components. The same strategy is being used for the MEB platform. While a Cupra Born and a Skoda Enyaq appeal to different types of people, they are using the same platform and components, even when their place in the market seems entirely different, as is the case for the VW ID.3 or the Audi Q4 e-Tron. It even allows them to create something completely original, such as the upcoming VW ID.BUZZ; and

- Wide-ranging portfolio. From the most rarefied high end of the market (Bentley, Porsche), to the micro-mobility solutions of SEAT Mo, passing by the heavy-duty market (Traton), VW is involved in every segment of the market, allowing massive scale opportunities.

VW’s expertise in managing scale and synergies will no doubt help it develop top-notch EVs, with significant profit margins.

With Europe’s EV market leadership apparently secured, this will be a good foundation for VW to win share in North America and recover ground in China. There unrivalled recognition and large-scale production capabilities might help it not lose too much ground to local brands, in a future BEV-based market.

In order to recover its leading status globally, Volkswagen needs to focus on swiftly ramping up the production of BEVs, and become a more forward-thinking company, all the while not impacting its profitable ICE business too much. It will need to invest in scaling up the EV business.