The new Citroën C5 X: a successful D-segment comeback?

13 May 2022

Autovista24 principal analyst Sonja Nehls and market analyst Dennis Borscheid review the remarketing potential of the new Citroën C5 X.

After a five-year absence, Citroën has launched its comeback to the D-segment with the new C5 X. Attractive price positioning and brand-typical commitment to ride comfort give the C5 X a head start. But the extravagant design forms a stark contrast and might not match the taste of D-segment customers. The lack of a diesel variant in this competitive and fleet-driven segment limits the C5 X’s volume potential, typically a plus for residual values (RVs).

Citroën C5 X remarketing potential

| Remarketing upsides | Remarketing downsides |

| Premium-like comfort and roominess | Extravagant exterior design |

| High-quality material | Lack of credibility in D-segment after a five-year absence |

| Attractive price positioning | No diesel engine available |

| Comprehensive standard equipment | Decreasing demand in the D-segment, no organic growth and strong competitors |

A market of one

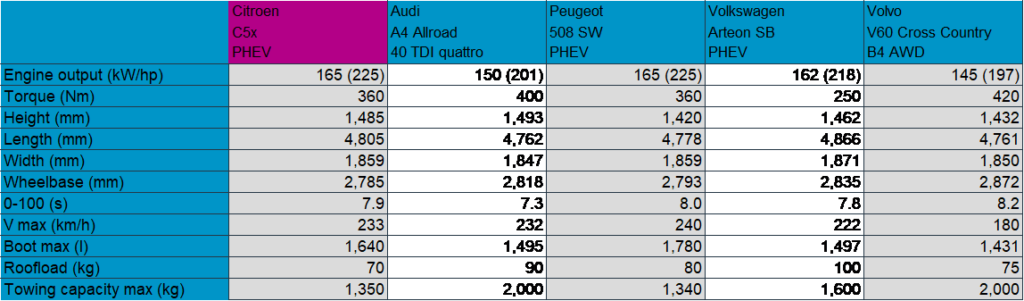

Re-entering the D-segment will be a challenge as the C5 X faces strong competitors such as the Audi A4 Allroad, Volkswagen Arteon Shooting Brake, Volvo V60 Cross Country, or its stablemate – the Peugeot 508 SW. The segment is undergoing a period of consolidation, which manifests itself in the line-up and availability of models. As an example, the Skoda Superb Scout is no longer on sale in France and the UK.

Other non-premium models like the Renault Talisman or Ford Mondeo recently left the market altogether. Identifying a set of comparable models, therefore, proves complicated. The C5 X combines features from a sedan, an estate and an SUV, which theoretically opens up a wide target audience. However, the body style also makes it so unique that it sits in a market of one.

Specifications and dimensions versus main rivals

Source: Autovista Group specification data

Premium-like comfort

The C5 X is staying true to its DNA by providing the smooth ride that has been a signature feature of Citroën models since the beginning. This is especially true for the plug-in hybrid (PHEV) version of the C5 X as it is equipped with the brand-new active suspension, advanced comfort system.

Another comfort-focussed feature is the acoustic glass which wraps around the cabin and keeps noise where it belongs – outside. Adding to this are advanced comfort seats, which provide comfort and support.

Unconventional design

The grown-up and refined attitude to comfort contrasts the C5 X’s extravagant exterior design. This is especially noticeable in its profile with a raised chassis, long front bonnet, and sloping roof line. The front features a considerable number of chrome elements, which hints at a design preference for the Chinese market. The rear sports two spoilers, which are supposed to add sportiness to the design, but feel out of place for a comfort-oriented car. Put together, these cues as well as the overall shape create a design unlike any other in this segment. A love-it or hate-it approach typically goes hand in hand with rapid ageing, posing a risk to the model’s remarketing potential.

The discrepancy of features is also found inside. The spacious rear cabin, high-quality materials and comfortable seats create a premium-like atmosphere, which stands in contrast to quirky design cues such as the three-coloured seats and their logo stitching. The cockpit features an elevated dashboard and centre console, which fully encompass the driver, but is not in line with current trends of more airy and spacious cockpits. The comparatively small seven-inch digital instrument cluster does not match the level of main rivals, which offer digital clusters with an average size of twelve inches. This is partly compensated for by a standard head-up display in the higher trim lines.

Combining and mixing body types has become a preferred tactic of many carmakers, hoping to appeal to a broader customer base. With the C5 X, Citroën has potentially gone a step too far, creating an extravagantly niche product. The model will appeal to comfort-oriented individuals, but will struggle to win over more conservative customers in this traditionally fleet-focussed segment.

Attractive pricing is an asset

The C5 X offers plenty of value for money and features a price significantly below its rivals, before and after equipment adjustment. Segment-typical must-have features, such as a head-up display, privacy glass and traffic sign recognition are standard on C5 X’s Shine trim but are only optionally available with rivals. In France, its domestic market, this led to the price of the C5 X PHEV Shine sitting around €10,000 below that of the Volkswagen Arteon Shooting Brake PHEV. To put this into perspective, The C5 X sports a price comparable to the C-SUV rival Kia Sportage PHEV.

The comprehensive equipment of the C5 X in all trims supports the model’s remarketing potential, as there is a limited risk of vehicles lacking important equipment once they enter the used-car market. A good level of standard equipment in combination with an attractive price also contains depreciation, which results in a more attractive total cost of ownership (TCO) and leasing rates.

Lack of diesel engine

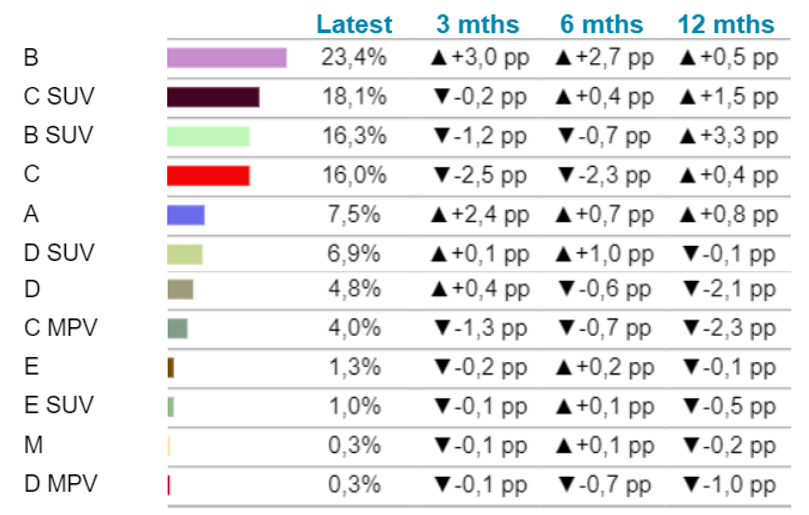

Gaining a foothold in the D-segment again, after the C5 was discontinued in 2017, will not be an easy task for Citroën. The brand previously lost customers and segment credibility, with the segment itself continuously losing volumes and market share. In April 2022, the D-segment only accounted for 4.8% of the French used-car market (36mths/60kkm) and lost 2pp since April 2021. There is no organic growth creating sales opportunities for the C5 X.

French used-car market by segment, 36mth/60kkm, April 2022

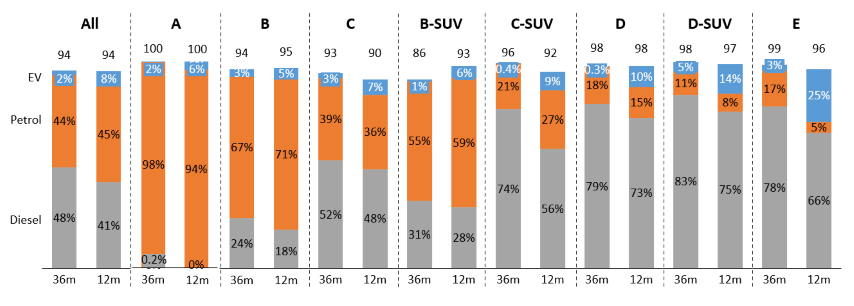

This is further compounded by the lack of a diesel engine, which remains an important powertrain in this fleet-driven segment. Diesel variants account for 79% of all three-year-old used-cars in the French D-segment, and the share only decreases slightly to 73% when looking at one-year-old used-cars.

Share of fuel types in the French used-car market

Note: 36m- and 12m-old cars, France, November 2021

Other segments are already moving more quickly and in larger numbers towards petrol and electrified models. The D-segment lags behind the development, which might now gain more momentum due to increasing fuel costs.

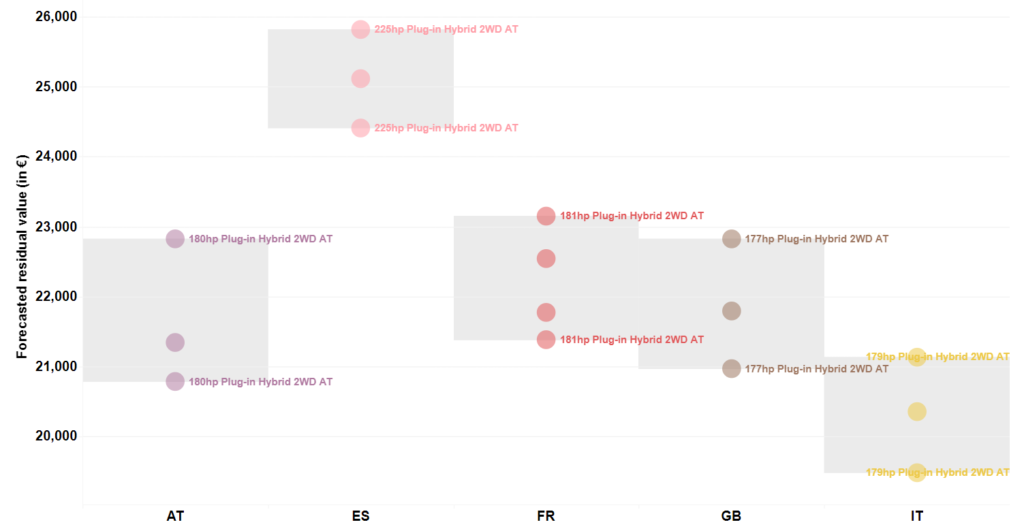

RVs below Peugeot 508 SW

Residual value forecasts for a three-year-old Citroën C5 X PHEV Shine with 60,000km range between €21,300 and €22,500 in Austria, France and the UK. In line with the overall market level, RVs are highest in Spain (€25,100) and lowest in Italy (€20,353). It sits €2,400 to €3,000 below a comparable Peugeot 508 SW in most countries covered except for Austria, where the difference is only €1,000. The interactive dashboard gives a more detailed cross-country overview and benchmarks the C5 X’s residual value and depreciation against comparable models in the markets.

Citroën C5 X RV forecast, 36mth/60kkm, May 2022

Will the C5 X mark a successful comeback to the D-segment after years of absence by Citroën? While it has potential with its premium-like comfort, advantageous price positioning and well-equipped trim lines, the expressive design is a challenge in the conservative fleet-oriented segment.

By designing a car that offers the elegance of a sedan, the practicality of an estate, and the elevated seating position of an SUV, Citroën created a model with niche potential. The lack of a diesel engine and the missing segment credibility pose a challenge to winning over fleet customers.

Nevertheless, there will be those that love the C5 X for its quirky and different design, its awesome comfort, and comprehensive equipment. Without the risk of major volumes from off-lease vehicles coming to the used-car markets, residual values and remarketing potential will not come under pressure.