Monthly Market Update: European used-car prices resilient in January amid challenges for BEVs

01 February 2023

The average residual value (RV) of a three-year-old used car increased across most European markets in January, except for modest corrections in France and Switzerland.

Used-car prices outpaced list-price developments in most markets. Accordingly, values of three-year-old used cars, represented as a retained percentage of their original list price (%RV), either held firm or gained last month, except in Austria and France. This aligns with double-digit year-on-year declines in the sales-volume index in the two markets.

Although there are grounds for cautious economic optimism, the cost-of-living crisis will invariably erode consumer demand for used cars, which would ordinarily put pressure on RVs. However, in addition to new-car supply challenges, the COVID-19 pandemic significantly derailed the European new-car market from March 2020 onwards. This will acutely reduce the volume of cars de-fleeting after three years.

So, undersupply into the used-car market is expected to persist, which will compensate for diminishing demand. Accordingly, Autovista Group forecasts that the %RV will not decline significantly across European markets in 2023 and 2024.

Battery-electric vehicles (BEVs) face unique challenges. On one hand, the surge in registrations in Germany at the end of 2022 does not bode well for RVs in the short term. Furthermore, Tesla has reduced list prices, which is having a ripple effect across the prices of its used models and BEVs in general. On the other hand, values stand to gain with lower incentives available in France and Germany and as countries introduce more low-emission zones.

Nevertheless, their low share in new-car markets such as Italy and Spain, and even weaker used-car presence, limits their potential, along with concerns over charging infrastructure.

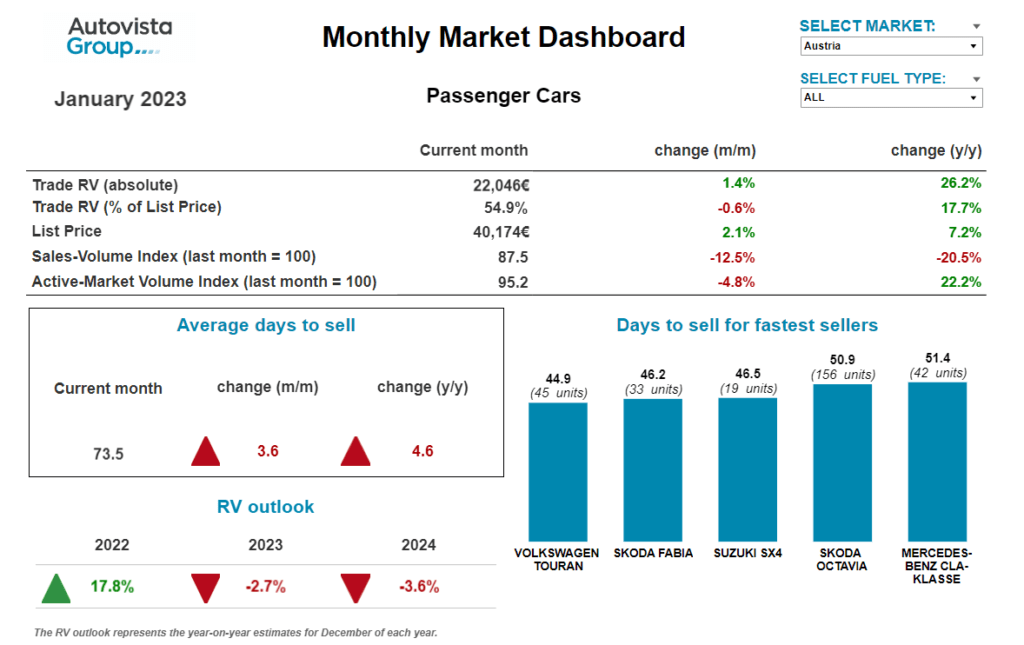

The interactive monthly market dashboard examines Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including RVs, new-car list prices, selling days, sales-volume and active market-volume indices.

Scenario analysis

There are upsides and downsides to this base-case scenario of undersupply and diminishing demand. Used-car prices will come under greater pressure if the economic situation deteriorates in Europe, with a greater negative impact on demand. This would be compounded if there are significant supply improvements.

For example, lower demand for consumer electronics could see a quicker resolution to the semiconductor shortages in the automotive industry. According to VNC Automotive, the ‘semiconductor drought could soon become a flood of chips.’

Conversely, there are risks of greater disruption to new-car supply, which would benefit used-car prices. Automotive suppliers could succumb to mounting costs and economic headwinds. The risk of the war in Ukraine escalating remains too, with potential consequences for Europe’s fragile supply chains. Any unforeseen improvement in used-car demand, either if fewer new models can be delivered or consumers defect to buying used instead of new, would also push RVs higher.

Modest pricing decline in Austria

Living costs are rising in Austria and used-car transactions are slowing down compared to 2022. The sales-volume index clearly shows weakening demand in January, with a year-on-year decline of 20.5%. Conversely, the supply volume of passenger cars aged two-to-four years was 22.2% higher year on year. Average days to sell have increased to 73.5 days.

Hybrid-electric vehicles (HEVs) are currently selling the fastest, averaging 50.6 days, followed by BEVs with 59.7 days, petrol cars with 73.2 days and diesel cars with 73.6 days. Plug-in hybrids (PHEVs) are selling the slowest, averaging around 104 days.

Despite weakening demand and improving supply, RVs of 36-month-old cars have remained relatively stable. The average %RV decreased by 0.6% month on month in January, with cars retaining 54.9% of their list price on average. This marks a solid 17.7% year-on-year gain.

HEVs are currently leading with a trade value of 58.4% of their original list price, followed by PHEVs (55.8%), then diesel cars and petrol cars (both 54.9%). 36-month-old BEVs retain the lowest value, at 53.6% of list price.

As demand is expected to weaken while supply recovers, pressure on RVs is anticipated. Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland, forecasts that the %RV will end 2023 approximately 3% down on December 2022. Nevertheless, prices of three-year-old used cars will remain relatively high. For 2024, Madas predicts that the %RV will decrease by a further 3.6% year on year due to weakening demand and increasing supply.

Buyers await lower prices in France

The French used-car market has seen drastic changes since 2021, with rising RVs amid list-price increases and limited availability of new and, in turn, used cars. The market stabilisation since the end of 2022 was confirmed in January 2023 with the %RV falling 1.5% month on month.

‘Higher list prices are no longer influencing used prices, which is reflected in the poor development of the sales-volume index as buyers are holding back, expecting lower sales prices. Private buyers are focused on older vehicles or lower segments than usual, mainly led by budget. Accordingly, values of used cars aged over 12 years are suffering the least,’ explained Ludovic Percier, residual value and market analyst, France, at Autovista Group.

The %RV of all fuel types is either stable or in decline, except for healthy price growth for BEVs. ‘Vehicles available on the used-car market now offer a higher range, which previously limited the usability of vehicles and the number of customers,’ Percier commented. Nevertheless, BEVs still have the lowest values in both absolute and value-retention terms.

RVs of petrol and diesel cars are subtly declining after ongoing increases in recent months due to new-car shortages, long delivery times, and higher list prices. Furthermore, as new-car buyers have been switching from internal-combustion engines (ICE) to other fuel types over the last two years, this reduced their availability on the used-car market and drove prices higher.

Even with the rollout of low-emission zones (ZFEs) and a tarnished image, RVs of diesel engine cars are falling slowly. ZFEs are only in towns and cities with at least 150,000 inhabitants and do not target high-mileage drivers, but will have a bigger impact on diesel from late 2024 and into 2025.

PHEV values should remain stable for the time being but they already decreased slightly at the end of last year and Percier anticipates further declines from mid-2023 onwards.

EVs under pressure in Germany

The high volume of new-car registrations in December ‘is a prime example of how extraordinarily the German new-car market has been distorted by external influences in recent years and how the implicit mechanisms of supply and demand are being undermined,’ explained Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

The prospect of a lower environmental bonus for BEVs and the end of incentives for PHEVs from 1 January meant every eligible car coming off the production line with registration papers, was taken to registration offices to receive the subsidy. January is therefore expected to be a well below-average month, due to the huge number of registrations that were brought forward.

‘For used electric vehicles, this means that the high price level will come under increasing pressure but experience a strong rebound in the coming months. However, residual values for most vehicles continue to stabilise at a high level and show only slight signs of fatigue due to the loss of purchasing power and reluctance to buy. Stock days are also still in a moderate to favourable range,’ Geilenbruegge noted.

Since January is not known for unusual activity from a used-car point of view, it will only become clear from the spring onwards how far values may decline. This will depend not least on the recovery of production and supply before prices presumably take another slight upturn later in the year.

ICE cars will continue to become increasingly rare and the absence of incentives for used electric vehicles (EVs) will maintain stable prices. The soaring prices of new cars will also keep used cars very attractive.

Meanwhile, Tesla has recently caused quite a stir in the industry with a move in the opposite direction. ‘Ultimately, this does a disservice to value retention and not only of the company’s own models,’ Geilenbruegge concluded.

‘Awareness of BEVs is growing’ in Italy

The new year started in the same way 2022 ended in Italy, with RVs increasing sharply, especially compared to a year ago. ‘Suffice to say that a 36-month-old used car with 60,000km on the clock has an average residual value of around €18,900, i.e. almost €2,000 more than in January 2022,’ commented Marco Pasquetti, head of valuations, Autovista Group Italy.

The volume of sales recorded through the main portals, represented by the sales-volume index, also indicates a growing used-car market (up 9.5% compared to December), even though vehicles remain in stock 24 days longer than a year ago.

Used BEVs enjoyed especially strong value growth in January, up 14.8% year-on-year, with the sales-volume index rising by a phenomenal 160.5% year on year. ‘Awareness of BEVs is certainly growing in Italy, but it is still advisable to remain cautious as their share remains very low in the new-car market, at 3.7% in 2022, and especially in the used-car market,’ said Pasquetti.

Pasquetti expects RVs to be higher at the end of 2023 than in December 2022 due to inflation and supply problems, albeit with significantly slower growth than last year.

Lack of stock ‘weighing down’ Spain

The Spanish new-car market closed 2022 with 813,396 registrations and a year-on-year decline of 5.4%. In addition to established supply issues, transport problems constrained the sector further. In 2023, registrations are expected to improve but this depends on what happens to inflation, interest rates, energy prices and, ultimately, how the war in Ukraine develops.

ICE vehicles account for 64% of new-car registrations in Spain. Of the remaining 36%, HEVs capture the largest share (25%). BEVs and PHEVs account for only 9% of the market, in line with Italy, which is clearly below the European average (19%) and neighbouring countries such as Portugal, where they already have a 21% share.

The used-car market also finished 2022 below forecasts, with a string of declines throughout the year. In total, 1,885,553 units were transacted according to the Spanish dealers’ association GANVAM, resulting in a ratio of 2.3 used cars for each new car registered.

‘The lack of stock is weighing down the possibilities of a market that tends to benefit in times of crisis. The limited availability of product mainly applies to younger vehicles, which tend to be in the hands of the dealer network, while the weight of vehicles over 10 years old continues to increase considerably,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain.

With regard to average RVs, after the usual adjustments at the end and beginning of each year, Azofra expects stability in the coming months. ‘There is a modest downward trend for petrol cars but HEVs are escaping this fate as they are in high demand, with quick turnaround times, as they will benefit from the implementation of zero-emission zones in almost 150 Spanish cities.’

‘It would be expected that BEVs could also benefit from this development but, for the time being, they do not even command a 1% share of the used-car market. As long as the charging infrastructure does not improve, the chances of developing a second-hand electric market are slim,’ Azofra concluded.

RVs stable in Switzerland despite demand

‘The Swiss used-car market has experienced increasing supply for several months, but it is still lower than before the pandemic, especially for younger used cars. Moreover, with rising costs of living, used-car transactions continue to slow down compared to the first half of 2022,’ noted Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

Across all two-to-four-year-old passenger cars, the active-market volume in January was 1.8% higher than a month earlier, and 39.2% higher than in January 2022. On the other hand, the sales-volume index has retreated further, with a 10.5% decrease compared to December, albeit with only a small 0.2% decline year on year.

Despite cooling demand, the average value retention of 36-month-old passenger cars grew slightly to 52.6% in January (up 1% month on month and up 13.5% year on year). BEVs posted particularly strong year-on-year %RV gains of 21.4%. Nevertheless, petrol cars are currently leading, retaining 53.4% of their original list price, followed by HEVs (52.0%), BEVs and diesel cars (both 51.2%). 36-month-old PHEVs retain the lowest value, at 49.8% of their original list price.

The average days to sell clearly increased in January, with a passenger car aged two to four years in stock for 73 days. Petrol cars are selling the quickest, after an average of 72 days, followed by diesel cars after 73 days, PHEVs after 79 days, BEVs after 81 days, and HEVs after 84 days.

As used-car demand is expected to weaken amid recovering supply, Annen foresees a slightly decreasing trend but values of three-year-old used cars will remain relatively high. He forecasts that the %RV will finish 2023 around 3% down on December 2022. For 2024, Annen expects RVs to fall by around 3.7% year on year due to weakening demand and increasing supply.

RVs strengthen in UK, except for BEVs

‘The UK’s used-car market returned to seasonal norms in January, with an uptick in demand. Although the month began slowly, wholesale activity ramped up as the month progressed. The Glass’s editorial team observed auction conversion rates approaching 80%, something not seen regularly throughout 2022,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

RVs for all fuel types strengthened in January, except for BEVs. There has been an especially sharp increase in available volumes of used BEVs according to the active-market volume index, which shows a rise of 41.7% compared to December. BEVs also performed poorly in the last quarter of 2022 and, as a result, values have fallen sharply in recent weeks. The average value of a three-year-old BEV now sits at 59% of the original list price, a fall of 6.6% compared to December.

‘As values have fallen sharply, there is a risk that dealers may become reluctant to buy BEVs speculatively, in fear that prices will continue falling and wipe out any profit margin. This will of course affect demand further. Tesla’s recent move to reduce new-car prices is also likely to affect used values and may lead to other brands suffering more depreciation as consumers evaluate what they can now get for their money,’ commented Whittington.

However, it is worth remembering that used BEV values were reasonably high throughout 2022, the result of a spike in interest from retail consumers and businesses looking to avoid waiting up to a year for a new one. At three years of age, used BEV prices are 4.9% higher than in January last year.

‘Although BEV values are potentially facing a correction, they are only narrowly behind other fuel types when expressed as a percentage of their original list price,’ Whittington concluded.

The January 2023 monthly market dashboard provides the latest pricing, volume and selling-days data.