Monthly Market Update: Hybrid residual values outperform wider market in May

04 June 2024

Full hybrids (HEVs) continued to record market-leading residual values (RVs) in May. Experts from Autovista Group (part of J.D. Power) consider the powertrain’s performance with Autovista24 editor Tom Geggus.

Average values of three-year-old cars at 60,000km continued to suffer pressure across many European used-car markets in May. RVs presented as a percentage of retained list price (%RVs) declined year on year in Austria, Germany, Italy, Spain, Switzerland and the UK.

Demand drags

This poor performance across all powertrains came as many countries saw demand drag behind supply. However, HEVs retained the most value of the major powertrains, pulling the wider market’s %RV level upwards.

In Spain, HEVs held on to 64.7% of their new-list price value after three years and 60,00km. This was ahead of the country’s market average of 59.3%. The %RV of HEVs hit 60.6% in France compared with the wider market’s 56.1%. At 56.2%, full-hybrid values surpassed the wider Austrian used-car market at 51.8%.

In Germany, HEVs retained 54.1% of their list price, ahead of the powertrain average of 50%. With a %RV of 55.1% in the UK, HEVs were just beyond the 51.9% average. The powertrain retained just over half of their new-car list price in Switzerland, while the wider market sat at 47.5%. Italy was the only major market to see diesel (56.6%) exceed both HEVs (55.1%) and the powertrain average (52.7%).

Full hybrids benefit from concerns about battery-electric vehicles (BEVs). By offering an electrified powertrain, drivers can benefit from lower emissions and a trusted internal-combustion engine (ICE). Demand in Europe’s used-car markets has therefore accelerated, with sales-volume indices across seven markets reaching at least double-digit growth.

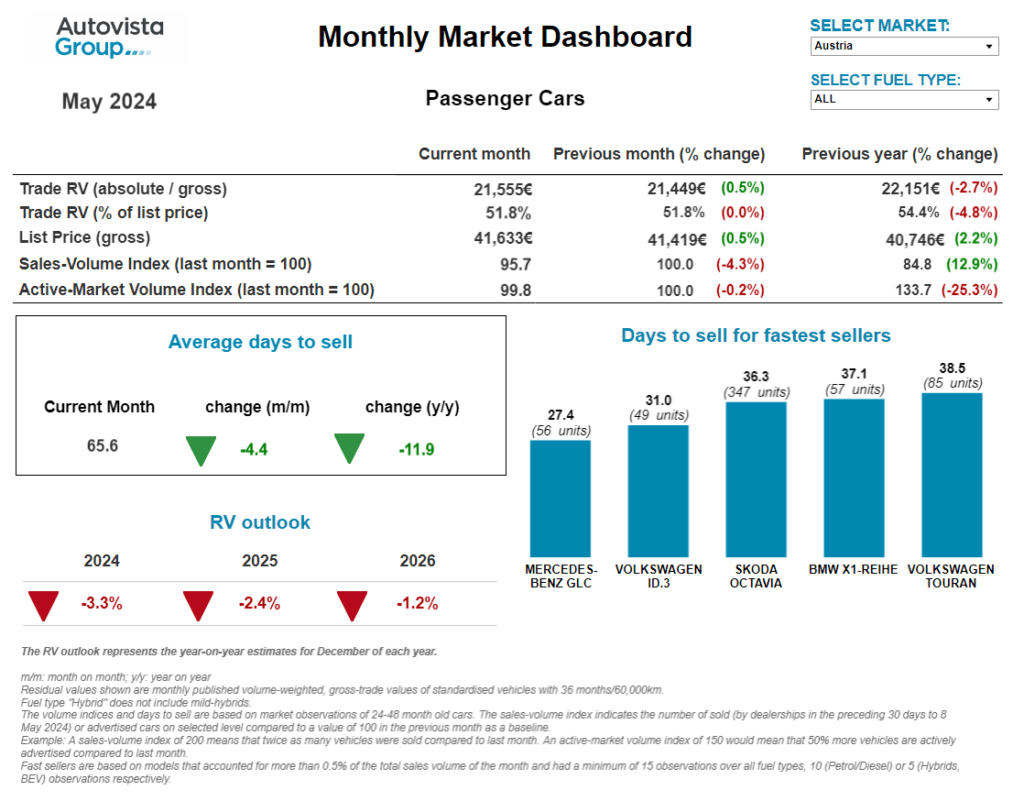

The interactive monthly market dashboard examines passenger-car data by fuel type, for Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

Residual values to fall in Austria

After a marginal increase in March and April, Austria’s sales-volume index (SVI) fell by 4.3% in May compared with the previous month. Year on year, it increased by a healthy 12.9%.

Meanwhile, the supply of two-to-four-year-old passenger cars remained stable on April’s levels, down 0.2%. Compared to the previous year, however, the supply volume dropped sharply by 25.3%.

On average, it took 65.6 days to sell a car in May. Diesel vehicles once again sold the quickest, averaging 58.3 days. Petrol vehicles followed at 71.6 days and HEVs at 72.1 days. Plug-in hybrids (PHEVs) and BEVs sold more slowly, at 74 and 75.3 days respectively.

‘On average, %RVs remained unchanged from April, at 51.8%,’ explained Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland. ‘This marked a decrease from 54.4% in May 2023 and shows that pressure on RVs is increasing.’

HEVs recorded the leading %RV trade value at 56.2%, followed by petrol (54.3%), diesel (50.5%) and then PHEVs (49.6%). Three-year-old BEVs retained the lowest value, at 45.8%. As demand is expected to weaken, further pressure on RVs can be expected.

In 2024, %RVs are expected to keep decreasing, by around 3.3% year on year, due to weakening demand and unwavering supply. In 2025 and 2026, %RVs are expected to decrease but at a slower pace.

Values fall in France

‘France saw RVs and %RVs fall in May,’ commented Ludovic Percier, Autovista Group residual value and market analyst for France. ‘This was even with list prices sitting higher in the month than in April. The values of all powertrains continue to experience increasing pressure.’

Used PHEVs and BEVs have been the most heavily impacted by weak demand. Due to fleet-based benefits in the new-car market, the used-car market is suffering from an oversupply of these electric vehicles (EVs).

As a result, these powertrains are also being discounted to compete with new models launched with more advanced technology, such as larger and more durable batteries, and even lower list prices. Many vehicles are sitting in stock waiting to be sold too. This has a direct impact on the used-car market. Meanwhile, diesel, petrol and HEVs are not subject to the same conditions.

Stock days rise

Stock days in France have risen since the beginning of 2024. This trend is persistent, even with a marginal month-on-month decline in May. Accordingly, the SVI fell as consumers waited for prices to drop further.

The sample of vehicles in May contained slightly more expensive models compared with April. This led to artificially inflated absolute RVs and a marginal %RV increase. All powertrains saw slightly lower values on average.

Petrol and diesel RVs came under some pressure, even if absolute values appeared high. This was because the market sample contained more premium models than it did in April. Of the two ICE technologies, diesel recorded a more significant decline in value.

HEVs saw absolute RVs fall marginally month on month. Meanwhile, their %RVs benefitted from the availability of more premium models with higher list prices. The absolute RVs of BEVs increased slightly, as %RVs grew from 41.8% in April to 42% in May. Meanwhile, list prices climbed by 1.7% month on month, putting values under greater pressure.

German market picks up speed

The German used-car market continues to pick up speed as volumes increase. In April, transactions increased by 27.5% month on month and 12% year on year. This confirms that more vehicles are being put back into circulation.

‘ICE models are showing astonishing price resilience. A major contributor to this phenomenon is that new cars registered in 2021 are beginning to enter the used-car market as three-year-old models,’ explained Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of J.D. Power).

In 2021, the automotive market was hit by semiconductor shortages, while it emerged from the impact of COVID-19, which impacted new-car deliveries. Three years later, the usual peak of models reaching the end of their leasing contract and moving to the used-car market has not materialised. Instead, supply is constrained, which is helping maintain list prices.

PHEVs continue to hold up well in terms of price. Conversely, BEVs are experiencing a negative price trend, as stock days and supply levels increase. However, transaction volumes are increasing, providing hope that demand will keep rising at a relatively high rate.

The soaring price of petrol, driven by 2024’s higher CO2 price per tonne, is making ICE models with higher fuel consumption less attractive. Meanwhile, older electrified vehicles are drawing more interest.

Around 111,000 BEVs and 60,000 PHEVs were newly registered between January and April this year. Many of these models will land on the used-car market in a few years. This is a challenge, especially for dealers and used-car traders. It is a specialised field and many of these businesses are underprepared and do not receive enough support.

Italy sees values fall further

RVs keep falling at a faster-than-expected rate in Italy,’ commented Marco Pasquetti, head of valuations, Autovista Group Italy (part of J.D. Power). ‘This has been reflected in the 2024 outlook which has been adjusted further downwards. By the end of this year, %RVs are expected to decline by 4.7% compared with 2023.’

May saw diesel-powered cars maintain the highest %RV in Italy at 56.6%. However, this was down from 57.1% in April. Fears over new driving restrictions in big cities could be starting to discourage some buyers. For the time being, these values are not expected to drop dramatically.

EVs saw above-average %RV declines from April to May. BEV values fell from 35.8% to 35.1% while PHEVs dropped from 50.8% to 50.2%. Both powertrains are failing to inspire buyers in Italy, with new-car market shares down year on year in April.

However, this trend can be expected to go into reverse soon. Sales are likely to jump at the start of June when it will finally be possible to apply for Italy’s new and improved incentive scheme. A proportion of the funds available in the scheme, €20 million, has been allocated to boosting used-car purchases. Used Euro 6 models will also be eligible for incentives when a polluting vehicle is scrapped.

Significant RV adjustments expected in Spain

April was a good month for new car registrations in Spain, with year-on-year growth of 23.1%. The rental-car sector continued to support this development in the first quarter. Private registrations also supported growth with deliveries up by 32% compared to April 2023.

This will help rebalance the used-car market and take pressure off younger used models. These vehicles are still under pressure, with RVs continuing to change. In fact, sales of vehicles between one and three years of age soared by more than 85% in April. For the time being, there looks to be greater RV stability across the other age groups.

‘However, in the coming months, RVs of three-to-four-year-old vehicles can be expected to undergo more significant adjustments,’ said Ana Azofra, Autovista Group head of valuations and insights, Spain. ‘This is because demand has shifted towards younger, more attractive models.’

As interest in three-to-four-year-old vehicles drops, this stock will continue to accumulate in dealerships as the models sell more slowly. In the short-term price adjustments will be required to make these models more attractive.

Strikingly, the supply of PHEVs tripled in May, which is likely due to an increase in imports. The Spanish market seems to be digesting this technology better than other European countries, where RVs continue to fall drastically.

Subdued demand in Switzerland

Two-to-four-year-old passenger cars saw their active-market volume index increase by 2% month on month in Switzerland. Compared with May 2023, this indicator fell by 9%. The supply of younger used models has only become more constrained. The SVI increased by 7.4% month on month but decreased by 4.4% year on year.

A roughly stable supply and conservative demand have resulted in RVs of 36-month-old cars falling slightly. Their %RVs dropped from 47.7% in April to 47.5% in May. However, the year-on-year drop was more severe, as the %RV level sat at 50.9% in May 2023.

HEVs once again retained the greatest amount of value, with a %RV of 50.5%. Petrol cars came next (48.5%), then diesel models (46.6%), followed by PHEVs with 45.6%. 36-month-old BEVs retained 44% of their original list price.

The amount of time needed to sell a two-to-four-year-old passenger car increased in May, up 0.2 days to reach 80 days. HEVs sold the fastest on average after 65.6 days, followed by petrol cars after 77.5 days, and diesel cars after 79.3 days. PHEVs took 87.7 days to sell while BEVs needed 91.7 days.

Used-car demand is expected to remain conservative while supply stays stable overall. The average value of three-year-old cars is forecast to decline further from a relatively high point, set against a wider declining trend.

‘The end of 2023 saw %RVs down 5% year on year on average,’ outlined Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland. ‘In 2024, levels are expected to fall by roughly 5.6% due to stable supply and lower demand.’

Market correction in UK?

The SVI shows that 6.2% fewer cars were sold by dealers compared to April’s report. As retail activity slowed, the active-market volume index rose by 7.4% month on month, as units kept entering the market.

Recent feedback from the auction market suggests that wholesale activity remains consistent. So, although the sales rate appears to have dropped, dealers do not seem concerned and have carried on buying regardless. As a result, RVs have remained relatively consistent.

May’s dashboard shows that the average three-year-old car retained 51.9% of its original cost-new price. This is up 0.2 percentage points (pp) on April but down 14pp year on year. Some commentators have suggested that this is effectively a market correction, after the extreme RV growth which began in the second half of 2021.

For context, of the seven markets reviewed in May’s dashboard, the UK’s average %RV was the fourth highest. Spain led the way at 59.3%, France came second at 56.1%, followed by Italy at 52.7. After the UK was Austria at 51.8%, then Germany at 50%, and finally Switzerland at 47.5%.

‘So, while the average %RV in the UK has fallen significantly in twelve months, it is now on a comparable level with other European markets,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles. ‘It does remain 4.6pp higher than in May 2021, just prior to the market rising.’