Monthly Market Update: Residual values down across European used-car markets in March

02 April 2024

European used-car markets saw residual values (RVs) fall in March. Autovista Group (part of J.D. Power) experts analyse the influences and trends with Autovista24 editor, Tom Geggus.

The average RV of a three-year-old car at 60,000km shrank in many of Europe’s major used-car markets during March. Presented as a percentage of the original list price (%RV), values declined both month on month, and year on year in each region.

The drops were relatively marginal month on month. Italy experienced the largest fall, with %RVs down 0.6 percentage points (pp) to 53.6%. Switzerland witnessed a drop of 0.5pp to 47.6%, while values fell by 0.4pp in Austria (51.8%). In the UK, %RVs shrank by 0.3pp to 52.5%, while Spain and Germany saw declines of 0.2pp to 59.9% and 50.6% respectively.

These drops were more pronounced when comparing values recorded last month with those reached in March 2023. The UK suffered the largest fall of 12.8pp, followed by Germany’s decline of 6.7pp. Switzerland endured a slump of 3.7pp and Austria’s values declined by 3.6pp. Then came Spain and Italy, down 2.7pp and 2pp respectively.

Four of these markets did see demand decline year on year, as indicated by the sales-volume index (SVI). In Italy, cars between two and four years of age saw the SVI decline by 14.7%. Then came the UK, down 14.6%, and Switzerland, down 13.9%. Germany’s SVI decline was more marginal, down 2.7%. Should demand continue to drop and supply remain stable, RVs will come under increasing pressure.

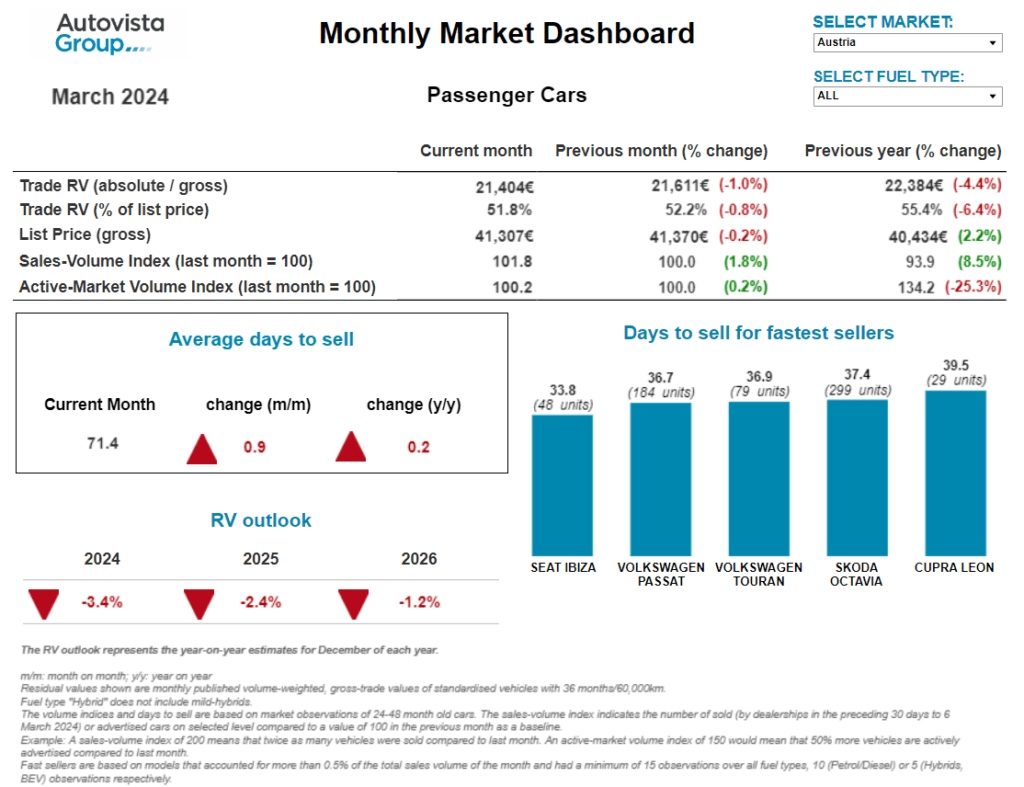

The interactive monthly market dashboard examines passenger-car data by fuel type, for Austria, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

Days to sell increase in Austria

‘After a healthy increase in February, the sales-volume index showed a slight increase in March,’ explained Robert Madas, Eurotax (part of J.D. Power) regional head of valuations, Austria, Switzerland, and Poland. ‘Month on month, the SVI increased by 1.8% and by 8.5% year on year.’

Meanwhile, the supply volume of two-to-four-year-old passenger cars remained at roughly the same level as in February. However, this meant that the active-market volume index (AMVI) dropped sharply, by 25.3% compared to March 2023.

The average number of days needed to sell a used car increased to 71.4 days in February. Diesel vehicles sold the fastest, averaging 64.5 days, followed by full hybrids (HEVs) at 66.2 days. Battery-electric vehicles (BEVs) came next at 75.4 days. Petrol vehicles sold after 76.9 days, while plug-in hybrids (PHEVs) sold more slowly at 88.4 days.

As demand weakened, the %RVs of 36-month-old cars fell compared to February, to 51.8% on average. This marked a decrease from 55.4% in March 2023 and shows that pressure on RVs is increasing as used-car supply remains stable.

HEVs led the way with a %RV trade value of 55.5% followed by petrol (54.4%), diesel cars (50.6%) and then PHEVs (49.3%). Meanwhile, 36-month-old BEVs retained the lowest value, at 45.6%. As demand is expected to weaken, further pressure on RVs can be expected.

‘In 2024, %RVs are expected to decrease further by around 3.4% year on year, due to weakening demand and unwavering supply,’ Madas added. ‘In 2025 and 2026, %RVs are expected to keep decreasing but at a slower pace.’

Values keep falling in Italy

In March, %RVs fell again in Italy, down to 53.6%. This was down from 54.2% in February and 55.6% in the previous year. A downward trend was widely expected across 2024, but this fall in values is more significant than expected.

‘For this reason, the local outlook has been reduced,’ stated Marco Pasquetti, head of valuations, Autovista Group Italy (part of J.D. Power). ‘By December 2024, the %RV level is now expected to drop 3.3% year on year, a steeper decline than the 2.3% fall that was previously forecast.’

Compared with February’s data, %RVs clearly trended downwards for all powertrains. The only exception was compressed natural gas (CNG), with values improving slightly, up 0.5% month on month. However, the fuel currently holds a negligible market share of 0.2% in the country.

‘It is worth remembering that this technology has been abandoned by almost all manufacturers, so buying a new CNG vehicle is currently complicated,’ Pasquetti noted.

Elsewhere, there is no reversal in trend for PHEVs and BEVs. These powertrains suffered the most significant year-on-year drops in %RVs. PHEVs saw values fall by 3.8% while BEVs dropped by 3.7%.

This reflects Italy’s reluctance to adopt electric-vehicle technologies, with both powertrains holding just over 3% of the new-car market in February. This is without a doubt one of the worst results in Europe. The figure has also been compounded by delays to the country’s 2024 incentive scheme, which was announced at the end of last year, but has yet to be activated.

Rental channel charge in Spain

‘In line with previous months, the rental channel boosted Spain’s new-car market ahead of Easter,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain (part of J.D. Power). ‘Registrations reached near double-digit year-on-year growth in February.’

Looking at powertrains in the new-car market, only diesel experienced a more difficult month, resuming a familiar trend after a small respite at the beginning of 2024. PHEVs experienced growth of 15.6% in February, while LPG deliveries increased by 39% and hybrids were up 26.5%.

Used-car transactions grew by 5% in February, with positive figures also expected at the end of March. Fleet renewals in the rental channel mean a greater supply of young used cars, which in turn puts pressure on RVs in this age segment. This effect was already noticeable in March and will only be accentuated in April.

‘The values of three-year-old cars also fluctuated, although not consistently across all powertrains. The absolute RVs of diesel models fell by 1.2% compared with February and 7.3% compared with March 2023,’ said Azofra.

The change was slightly milder for PHEVs, which suffered drops of 0.7% month on month and 6.1% year on year. Petrol RVs also fell by 0.8% from February to March, and by 4.9% compared to the same point in 2023.

Meanwhile, HEVs continued to see absolute RVs rise. The technology saw month-on-month growth of 0.3% and was up 5.9% year on year. BEVs also recorded increasing values, up 2.5% month on month and 8.4% year on year.

However, this was because of a slight product improvement in the three-year-old-car supply mix, as vehicles of higher quality, better finishes and extended ranges became available. In reality, it is still difficult to sell used BEVs in Spain, with RVs following a negative market trend.

HEVs lead value retention in Switzerland

The number of active adverts for two-to-four-year-old passenger cars fell in Switzerland last month. The AMVI declined by 0.7% from February to March 2024. Compared with March 2023, this indicator decreased by 11.8%.

‘Younger models have continued to see lower levels of supply,’ said Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland (part of J.D. Power). ‘The sales-volume index fell by 1.2% month on month and 13.9% year on year.’

Consistent supply and dropping demand resulted in the average %RV of a 36-month-old car falling yet again. This value retention hit 47.6% in March compared with 48.1% in February 2024. The decline was more severe year on year, descending from 51.3% in March 2023.

Examining powertrain performance, HEVs held onto the greatest amount of value, with a %RV of 51.4%. Petrol cars came next (48.6%), then diesel models (46.7%), followed by PHEVs with 45.2%. Three-year-old BEVs retained 43.8% of their original list price.

Stock days of two-to-four year-old cars increased in March to 84 days, up 0.7 days from February. At 72.9 days on average, HEVs sold the fastest, followed by diesel cars after 79.6 days, then petrol models at 80.4 days. PHEVs took 95.3 days to sell and BEVs needed 103.7 days.

Used-car demand is expected to fall while supply remains level. Set against a wider declining trend, the values of three-year-old cars are forecast to deteriorate from a relatively high level.

The %RV level in Switzerland finished 2023 down 5% on December 2022. In 2024, levels are expected to fall by roughly 5% due to stable supply and lower demand.

Lacklustre retail activity in UK

Used cars took an average of 39.7 days to sell in the UK according to March’s report, eight days fewer than recorded in February.

At first glance, this indicates that retail activity is moving in the right direction. However, the sales-volume index appears to contradict this. It indicates that 11% fewer used cars were sold in the 30 days leading up to 6 March.

‘Is retail activity really so lacklustre or is there a lack of the right stock available on forecourts?,’ asked Jayson Whittington, Glass’s (part of J.D. Power) chief editor, cars and leisure vehicles.

According to the AMVI, which measures the number of available used units on dealer forecourts, 10% fewer cars were advertised. Therefore, dealers may be struggling to get fresh stock ready for sale fast enough to satisfy demand.

The wholesale market remains consistently active, with decent conversion rates now the norm. Auction hammer prices have been reasonable, yet dealers remain fairly cautious. This means RVs have continued to fall, albeit at a slower rate than at the end of 2023.

In March, a three-year-old car retained 52.5% of its original list price, down from 52.8% in February. However, RVs are usually expected to increase in March as a result of the country’s new-plate uplift. Compared to March 2023, the average %RV fell by 12.8pp.

‘There will be considerable interest in observing the market’s reaction to the expected volume uplift following March’s plate change,’ explained Whittington. ‘Looking at the latest indices, it could be that additional stock is just what dealers need. Therefore, RVs may not see a significantly negative impact.’