Monthly Market Update: Faster used-car sales in November not enough to buck slowing trend

04 December 2023

The average number of days needed to sell a used car fell across four major European markets in November. Austria, Italy, Switzerland, and the UK all saw stock days decline when compared with October. Meanwhile, France saw no change, Germany recorded a minor upswing of 0.5 days, and Spain posted an increase of just two days.

However, this was not enough to contest the wider trend of slower used-car sales across 2023. Even with the positive month-on-month results recorded in June and August, this year has so far seen stock days creep upwards. Demand has suffered thanks to harsher economic conditions, limiting spending power.

When compared with November 2022, slower sales were also observed. Average stock days increased year on year in France (14.6 additional days), Spain (10.7 additional days), Switzerland (8.6 additional days), Italy (8.2 additional days), and Germany (1.6 additional days). Only the UK and Austria saw faster sales compared with November 2022, down 4.1 and 3.4 days respectively.

The sales-volume index (SVI) also recorded negative year-on-year changes in Italy (down 10.9%), Spain (down 2.5%), Austria (down 1%), and Switzerland (down 0.2%) as demand fell. Meanwhile, France (up 24.4%), the UK (up 18.7%) and Germany (up 8.3%) saw more positive developments compared with November 2022.

When compared with October, just France (up 9.9%) and Spain (up 0.2%) recorded improved SVI results. As indicated by the active-market volume index (AMVI), Austria, Germany, Italy, Switzerland, and the UK saw supply outpace demand in November when compared with the previous month.

Absolute residual values (RVs) stayed broadly stable between October and November, with a positive inflection across many markets. Only the UK (down 2.7%) and Switzerland (down 2.2%) posted declines. The trend was reversed for RVs presented as a percentage of retained list price (%RV), with just France, Austria and Spain able to achieve month-on-month growth.

The interactive monthly market dashboard examines passenger-car data by fuel type, for Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

Austria sees supply slip

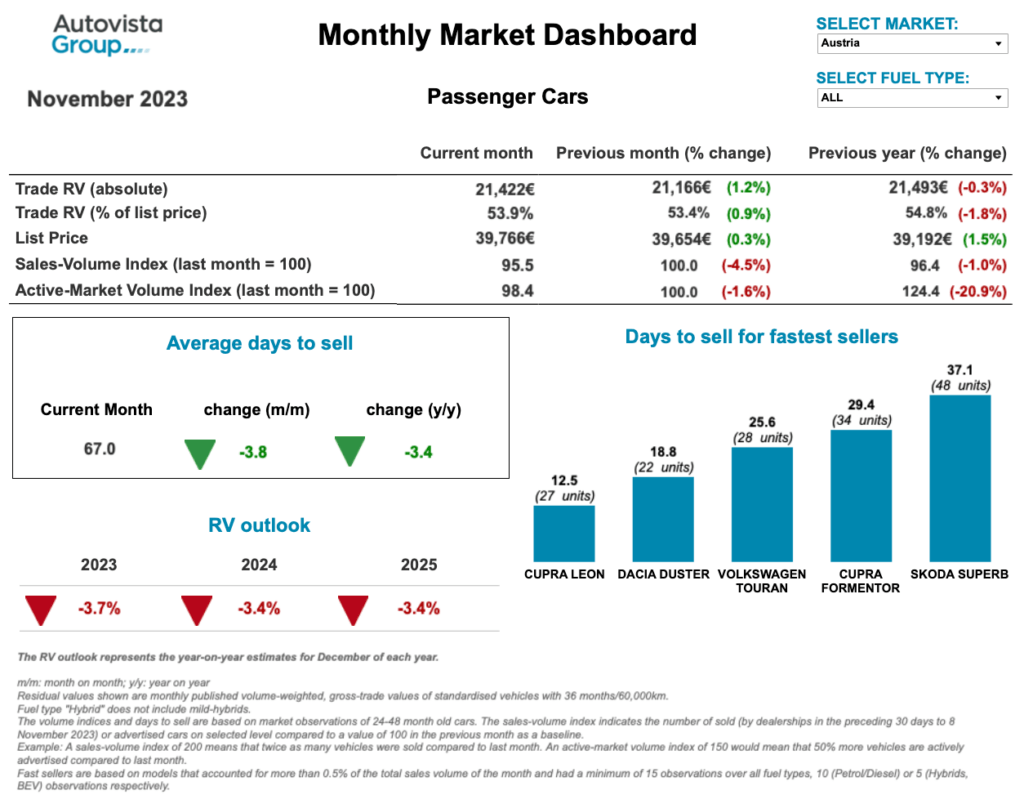

In November, the SVI dropped by 4.5% compared with October and 1% year on year. At the same time, the supply volume of two-to-four-year-old passenger cars was around 1.6% lower in November than a month earlier.

The average number of days needed to sell a used car fell to 67 days in November. Hybrid-electric vehicles (HEVs) sold the fastest, averaging around 55 days, followed by diesel vehicles at 61 days, petrol cars at 66 days and plug-in hybrids (PHEVs) at around 83 days. Battery-electric vehicles (BEVs) sold more slowly at around 99 days.

‘Despite weakening demand, RVs of 36-month-old cars expressed as a percentage of retained list price increased slightly compared to October, up to 53.9% on average,’ said Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

This marked a decrease from 54.8% in November 2022 and shows that pressure on RVs is increasing. A sharper drop in values has been prevented primarily by falling used-car supply.

HEVs led the way with a %RV trade value of 57.1% followed by petrol (56.6%), diesel cars (52.7%) and then PHEVs (51.3%). Meanwhile, 36-month-old BEVs retained the lowest value, at 47.9%. As demand is expected to weaken, further pressure on RVs can be expected.

The market’s average %RV of a 36-month-old car at 60,000km is forecast to end 2023 approximately 3.5% down on December 2022. In 2024, %RVs are expected to decrease further by around 3.4% year on year, due to weakening demand and increasing supply.

RV gap keeps closing in France

‘Used-car RVs in France remained roughly stable in November. Diesel, petrol and HEVs were up slightly, while BEVs and PHEVs continued to fall,’ commented Ludovic Percier, Autovista Group residual value and market analyst for France.

Overall, the RV gap with 2022 kept closing compared with previous months. The sample still contains higher list prices due to the presence of more expensive vehicles in some segments. This has artificially increased absolute RVs.

The value of petrol-powered vehicles remained roughly stable, increasing slightly in November. This was due to list prices shrinking compared with the previous month. Stock days were also steady when set against October, however, this was still some way off the levels seen in 2022.

‘Diesel stock days were consistent month on month and year on year, as fewer new cars featuring the powertrain were sold. This explains why diesel models had slightly healthier RVs than petrol-powered cars,’ Percier explained.

HEVs recorded a positive November overall, even if list prices increased by 5% and %RVs by 1%. Even with more vehicles available, demand kept increasing as stock days stayed stable. In the past, Toyota led this market with its healthy hybrid RVs, but new HEVs are still welcome given the small size of the market.

PHEVs had a more negative November, with days needed to sell still rising, as was the case in previous months. The technology is more orientated towards fleets than private customers, which explains the powertrain’s used-car struggles. PHEVs are starting to saturate the used-car market as they return from leasing contracts. Older models are also depreciating more quickly as they compete with newer PHEVs capable of twice the electric range.

BEVs dropped across the board in November, from absolute values to %RVs. List prices continued to fall and sales were more difficult and longer compared with 2022. There is now much more competition in the used-car market, which means hesitation and negotiation. The Tesla Model 3 is still penalising other brands with its lower new-car list prices.

The fastest vehicles to sell were not exclusively small cars. However, the top five ranking did support a large number of A and B-segment models, alongside C-SUVs. While days to sell were stable in November, they have yet to return to 2022 levels. Vehicles with larger price tags are taking longer to sell, leading to price drops.

Used-car prices drop in Germany

‘The end of the year is usually a period in which used-car prices move downwards to optimise the annual accounts by clearing stock,’ said Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group). ‘So far, 2023 is no exception.’

Last winter signalled a return to normality after two years of atypically rising prices, particularly for electrified powertrains. The end of 2023 has continued this trend, even affecting the stable prices of cars powered by internal-combustion engines.

While there is little promise of a recovery in the coming year, there is room for some optimism. Provided no new economic crisis shakes the world, there is the possibility that inflation will continue to fall as purchasing power stabilises.

Weakening demand in both the new and used-car markets is currently causing considerable problems for market participants. An increasing amount of stock is also being pushed into tactical channels, towards dealer, manufacturer, and rental registrations. However, this is at a considerably lower level than before the COVID-19 pandemic.

‘Hopefully, when this knot loosens over the coming year, relatively low volumes can come together with growing buyer interest and climbing new-car prices,’ Geilenbruegge said. ‘Increasing prices of attractive used cars are the exception to this rule. With some luck, stabilisation and growth could be next year’s motto.’

Slowing demand in Spain

After a more reserved September, the Spanish new-car market picked up the pace again in October with an 18% year-on-year increase in registrations. The results also remained moderately positive across 2023 on a cumulative basis.

The supply of vehicles into the used market was maintained in November. Sales recovered slightly and the average price did not fall. The average amount paid for a three-year-old used car at 60,000km was €19,415, €533 less than in November 2022.

‘While sales have recovered slightly and the average price has not fallen month on month, there are still signs of slowing demand,’ highlighted Ana Azofra, Autovista Group head of valuations and insights, Spain.

Average stock days kept growing, especially for BEVs, which took over three months to sell. The supply of all-electric models also increased, alongside greater volumes of PHEVs. These two powertrains are still finding it difficult on the used-vehicle market, a persistent trend in recent months.

On the other hand, the best-performing models in November were the BMW X1, the Toyota CH-R and the Ford EcoSport,’ Azofra added.

Switzerland to see %RVs down

‘The AMVI for two-to-four-year-old passenger cars increased by 1.2% from October to November. However, supply levels were 5.9% higher than a year earlier. Constrained supply has only continued for younger used models,’ said Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland.

The SVI declined by 8.7% month on month but only 0.2% year on year. The recent steadiness of supply and deterioration of demand has resulted in the average %RV of a 36-month-old car falling again. The level went from 50.1% in October to 49.9% in November, while the average %RV was higher at the same point last year, at 51.7%.

‘HEVs achieved another year-on-year %RV gain, this time climbing to 52.9%. Petrol cars followed (50.8%), then diesel models (49%), followed by PHEVs (47%). 36-month-old BEVs held 46% of their original list price,’ Annen added.

Two-to-four-year-old passenger cars sold more quickly in November, in stock for nearly 79 days, down a day from October. Diesel cars sold the fastest on average after some 74 days, followed by petrol cars after 75 days, then HEVs after 90 days, PHEVs after 91 days and finally BEVs after nearly 106 days.

Used-car demand is expected to diminish while supply remains high and unwavering. The values of three-year-old cars are forecast to stay relatively strong, set against a wider declining trend. The %RV level in Switzerland is expected to finish 2023 down roughly 4.5% on December 2022. In 2024, levels are expected to fall again by 3.8% due to constant supply and lower demand.

Lower asking prices and profits in UK

‘So far, the second half of 2023 has seen RVs change at a very different rate compared with the same time last year,’ commented Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

The average %RV of a three-year-old car in the UK sat at 57.3% in November. This was a fall of 2.1 percentage points compared to October (59.4%). Between July and November 2022, the average RV increased by 2.2 percentage points, yet this year they have fallen by 5.3 points.

The second half of 2023 has seen weaker auction conversion rates and hammer prices. Retail demand may have played a part as consumers continue to deal with rising living costs. However, some dealers may have become more cautious with the volume of cars in stock, as well as the price they are prepared to pay.

As RVs have fallen month-on-month, dealers face the prospect of unsold and ageing stock which owes them significantly more than what a competitor can now pay at auction. To remain competitive, dealers with older stock have had to lower asking prices and profit margins.

‘The alternative is risking prolonged stock days, potentially leading to even more depreciation. Many appear to be cherry-picking the most desirable stock in wholesale channels instead of speculatively filling forecourts, to avoid the risk associated with falling prices,’ Whittington said.

According to the SVI, the retail sales rate fell by 3.4% compared with last month’s report. Although activity appears to have eased, the time it took a dealer to sell a car dropped by 1.9 days to 37.3, four days faster than in November 2022 and the lowest number of days so far in 2023.