Poland’s new and used-car markets see slight stability in third quarter

18 October 2023

Recent months have brought a slight sense of stability to Poland’s new and used-car markets, but commercial vehicles have suffered a severe upset. Marcin Kardas, head of valuations at Eurotax Poland (part of Autovista Group) reviews the figures from the third quarter of 2023.

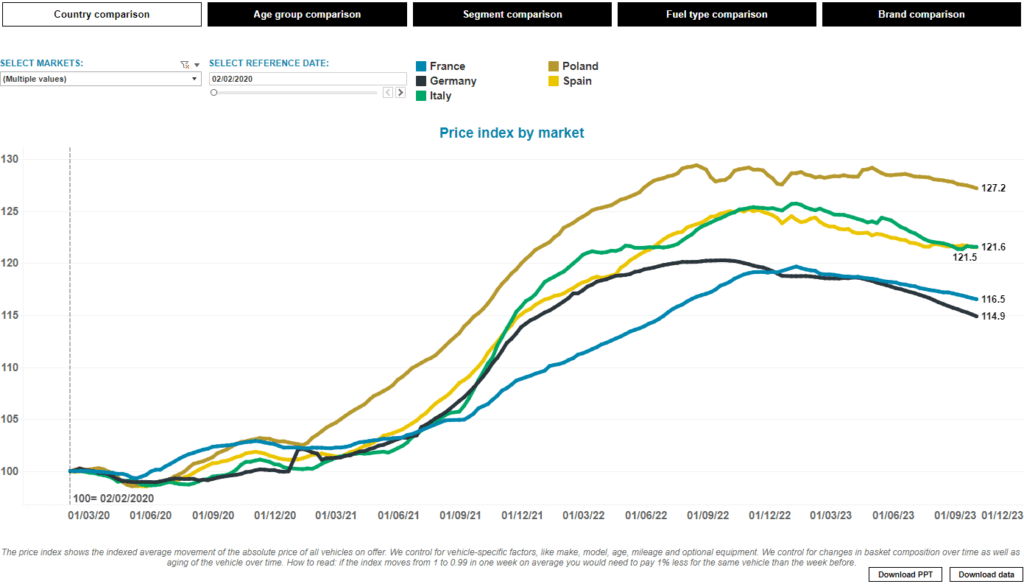

Following the holiday period, many western European countries have seen pronounced declines in both new and used-car demand. Poland has been able to avoid this trend, however, and has yet to see any marked change. Furthermore, with high inflation and used-car stock volumes well below pre-COVID-19 pandemic levels, residual values (RVs) remain relatively high.

Asking price volatility

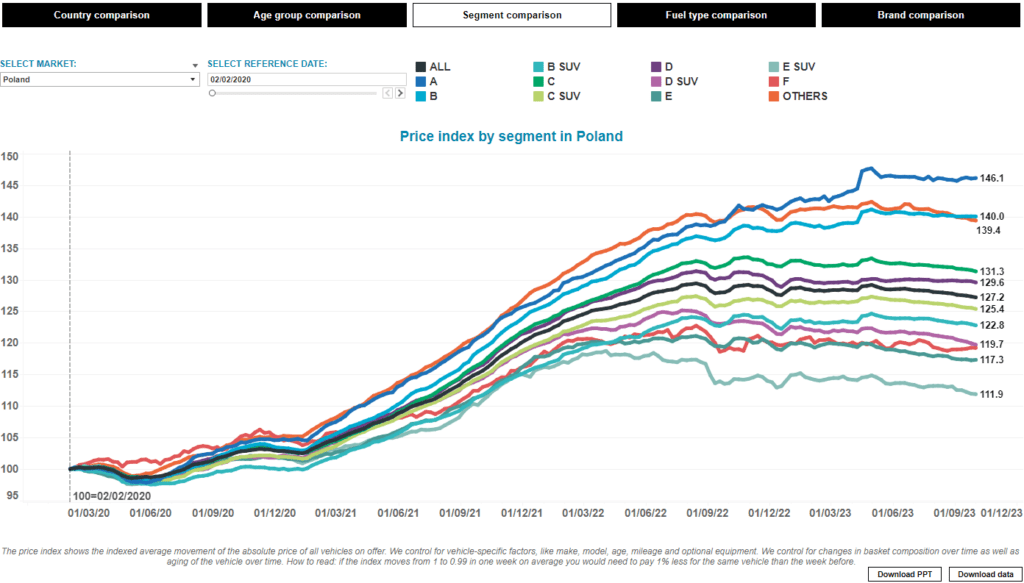

The premium segment has seen a return to aggressive new-car discounting, which directly affects the pricing of the youngest used vehicles. This strategy also puts increasing pressure on the values of more mass-market models belonging to mainstream brands.

Meanwhile, older vehicles have seen a slight downward trend, except for models over 90 months of age, which belong to the smallest and cheapest segments. These vehicles have seen values continue to rise, and are highly sought after on the used-car market.

Recent quarterly periods have seen a great deal of asking-price volatility. However this ‘sine wave’ is slowly beginning to stabilise, which indicates that the used-car market is becoming gradually saturated with models.

Following the end of the summer holidays, the rising Euro exchange rate has once again increased the attractiveness of domestic used cars for importers from western Europe. Expectations are also noticeably higher on the Polish used-car market, and price is increasingly determined by quality. Models that are worn out, or equipped below market standard, are falling out of favour.

Ambiguous electric signals

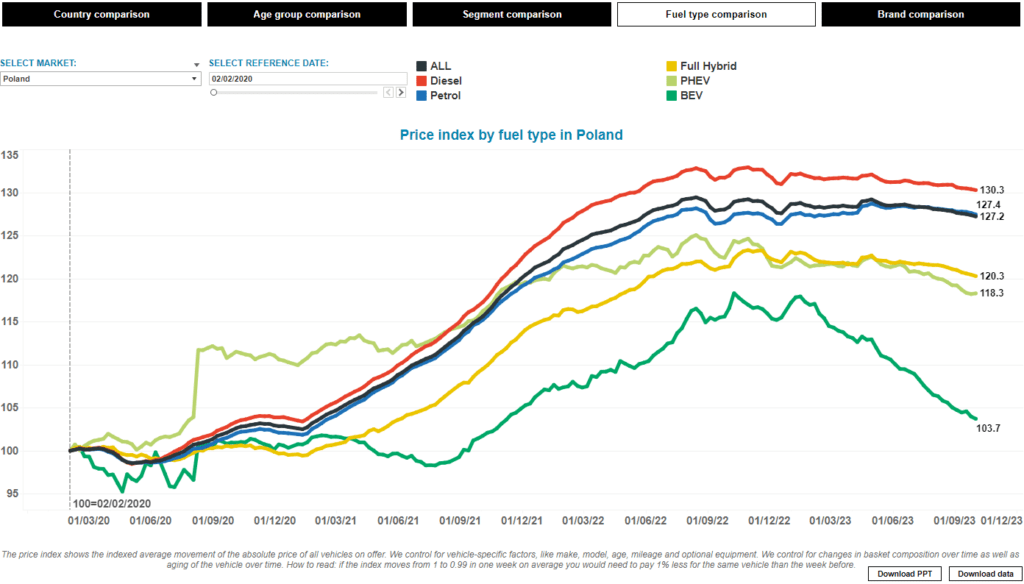

The market for electric vehicles (EVs) has been giving off ambiguous signals. There is still a balance between low demand and low supply, but given time, RV declines should start to increase.

There will be growing pressure as models are imported from western Europe. These vehicles are now beginning to flow into Poland’s used-car market in larger quantities. However, Tesla’s strategy of cutting prices is encouraging fierce competition on the new-car market, something which will soon affect used-car prices.

This situation has implications for RVs, which are beginning to fall gradually. However, values were very high during the pandemic, and so are now seeing revisions. Increased competition on the used-car market will certainly support this process. This decline could be particularly significant for EVs as the risk of greater and faster discounting grows.

Used vehicles are getting more affordable and this is unlikely to change in the coming months, but electric cars pose the biggest challenge. These models have been slowly appearing on the used market since the beginning of the year. Although, first-generation EVs with relatively poor performance can experience a large drop in value.

Van demand falling

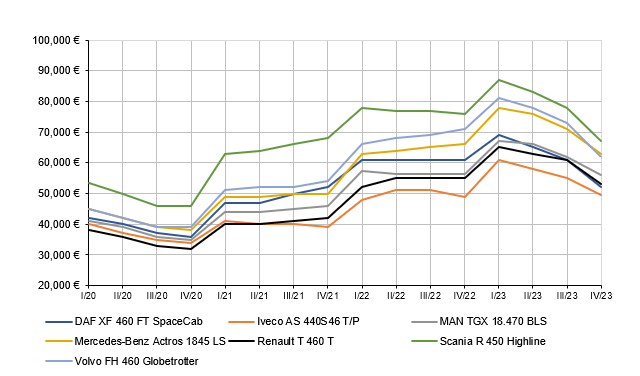

Both new and used vans have also come under intense pressure from falling demand in recent months. Increased availability and falling sales are forcing more new-vehicle discounting, mitigating the effects of higher list prices. The most difficult situation is in the truck market. The number of new tractor orders has been severely impacted, meaning much lower transaction prices.

Interest in used vehicles has hit a low point and market values are falling exponentially, by up to 20% quarter-on-quarter. Construction vehicles (mainly dump trucks) and distribution vehicles are also experiencing large declines. This is a crisis point for the transportation businesses and illustrates the poor condition of the Polish economy. There is no indication this situation will improve any time soon.

Additionally, Germany will introduce new toll rates based on CO2 emissions (rather than Euro standards) in December. This will cause confusion in the market and, in the long term, increase costs for transportation companies, only worsening their current situation.

Average value of a three-year-old tractor unit on the Polish market

A changing picture

New-vehicle registrations continue to show little decline. By September 2023, a total of 350,317 passenger cars (up 10.6% year on year), 45,176 vans (up 3.6% year on year) and 26,596 trucks (up 10.9% year on year) were registered in Poland, according to the PZPM.

However, when examining September’s data in isolation, the picture changes. Passenger cars were up 9.1% year on year, commercial vehicles rose 8.7%, while trucks fell 34.3%. Apart from vans, the market’s growth is slowing, which is particularly visible for trucks. It should also be remembered that these comparisons are set against a problematic 2022, which suffered issues with new-vehicle supply.