Monthly Market Update: Used-car demand bounced back in October following declines

02 November 2023

Demand for used cars in Europe appeared to bounce back in October, following recent month-on-month declines. Austria, France, Germany, Italy, Spain, Switzerland, and the UK, all achieved sales-volume index (SVI) growth, with the majority of these markets in the double digits.

Italy recorded the greatest increase in transactions, up 64.9% compared with September. France was close with growth of 52.2%, then Spain (26.2%), Austria (14%) and Germany (11.9%). The SVI upswing was less pronounced in the UK and Switzerland, with respective increases of 2.6% and 0.9%.

Demand also outshone supply across the seven markets, with the respective active-market volume indices (AMVI) all either posting single-digit growth or marginal declines. October, therefore, appeared to be a more positive month for many European used-car markets.

However, these results follow a far more negative results in September and August, when supply overshadowed demand, equating October’s positivity to seasonal balancing. Compared with the same month last year, demand only pulled ahead of supply in four markets. The SVI saw double-digit growth in just two countries, namely France (up 26.7%) and the UK (up 21.5%).

The average number of days it took to sell a used car also increased across most of these markets last month, growing slightly compared with September. France saw the greatest change with models in stock for an additional 5.8 days, reaching 71.3 days in total. The country also recorded the greatest year-on-year change in average time to sell, reaching 13.9 average stock days.

Absolute residual values (RVs) and RVs presented as a percentage of the original list price (%RV) were mostly stable in October when compared with September. The UK recorded the greatest drop in both (down 4.3%), while France saw the only increase in absolute RVs (up 0.5%). Set against October 2022, only Italy (15.4%), France (up 12%) and the UK (up 0.6%) saw absolute RVs increase.

The interactive monthly market dashboard examines passenger-car data by fuel type, for Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

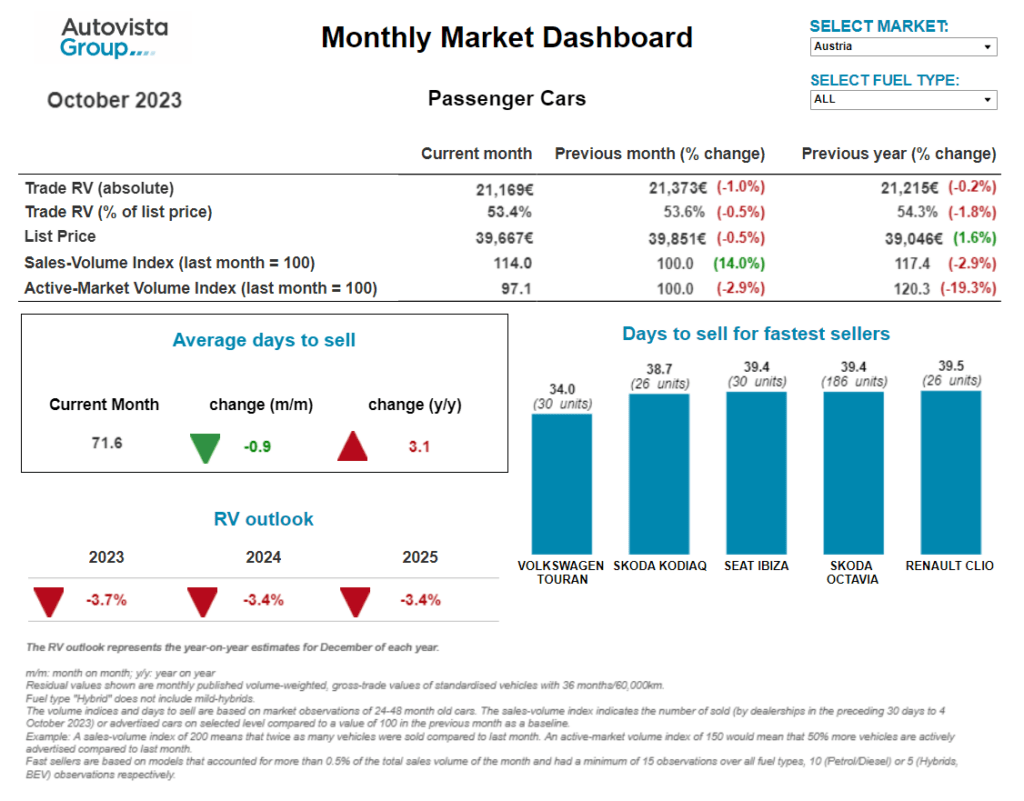

RV pressure builds in Austria

In October the SVI stayed at the same low level, with a year-on-year decrease of 2.9%. Meanwhile, the supply volume of two-to-four-year-old passenger cars shrank by 19.3% compared with October 2022.

Compared to September, the average number of days needed to sell a used car fell slightly to 71.6 days, but this is still 3.1 days more than a year ago, confirming weaker demand. Diesel vehicles sold the fastest, averaging around 65 days, followed by hybrid-electric vehicles (HEVs) at 66 days, petrol cars at 73 days and plug-in hybrids (PHEVs) at around 83 days. Battery-electric vehicles (BEVs) sold more slowly, at around 99 days.

‘As demand fell, %RVs of 36-month-old cars declined to 53.4% on average. This marked a 1.8% year-on-year decrease and shows that pressure on RVs is increasing,’ said Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

HEVs led the way with a %RV trade value of 55.5% followed by petrol (54.4%), diesel (53.9%) and then PHEVs (50.9%). Meanwhile, 36-month-old BEVs retained the lowest value, at 46.5%. With demand due to weaken as supply grows stronger, further pressure on RVs can be expected.

The market’s average %RV of a 36-month-old car at 60,000km is forecast to end the year approximately 3.7% down compared to December 2022. For 2024, %RVs are expected to decrease further, by around 3.4% year on year, because of waning demand and growing supply.

Pricing important in France

Used-car RVs in France were roughly stable in October. The year-on-year gap in values continues to shrink compared with previous months, confirming the overall RV decline. There were slightly more expensive vehicles in October’s sample of the French used-car market, leading to artificially inflated absolute RVs. This growth was smaller than the increase in list prices, resulting in slightly lower %RVs for all powertrains.

Residual values of petrol models grew marginally, essentially staying stable. Meanwhile, diesel values were stagnant, heading into a small decline. With more premium models on offer and higher list prices than in September, HEVs saw absolute and percentage RVs increase slightly month on month.

PHEVs continued their decline in October. The technology is not very appealing to private consumers in the used-car market and enjoys greater success in the new-car market, particularly for fleet buyers. Additionally, the used market is starting to become saturated by PHEVs returning from leasing contracts. Older plug-in hybrids are also seeing accelerated value depreciation as they compete with newer models that are capable of twice the electric-only range.

BEVs have seen %RVs increase marginally thanks to lower list prices. The used-BEV market is becoming more crowded as the Tesla Model 3 enters in greater numbers. These models come with lower prices than in September, as a refreshed version of the Model 3 is unleashed. This follows months of pricing adjustments, a trend that many other carmakers adhered to as well.

The SVI experienced growth as lower prices allowed sales to take place. The scale of the ‘waiting effect’ became apparent, as consumers paused expensive purchases, hoping for costs to fall. The fastest cars to sell were not exclusively the smallest models, although the top five ranking did see a heavy presence of A and B-segments, additionally, C-segment vehicles are now being seen in the top five.

‘While days to sell are higher on average, those modes on offer for the ‘right price’ are selling more rapidly. Vehicles with bigger price tags are still taking longer to sell. So, it appears the market is starting to return to normal, with sellers understanding that prices have to drop for sales to be made,’ explained Ludovic Percier, Autovista Group residual value and market analyst for France.

Market pressure in Germany

Signs continue to point to a new-car market recovery in Germany, especially in the fleet channel, where registrations have met and exceeded pre-COVID-19 crisis levels for a substantial amount of time. This channel is of high importance to the used-car market.

However, in the year to date, the wider new and used-car market results remain well behind the figures recorded in the first nine months of 2019. So far there have been approximately 600,000 new cars and roughly 900,000 fewer used cars.

‘This lack of vehicles continues to put enormous pressure on market participants, as they try to generate sufficient revenue and manage margins. This has produced different results across the powertrain types. Despite sharply declining consumer demand, internal-combustion engine (ICE) prices remain stubborn, either falling slowly or remaining stable,’ said Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

As high-priced segment representatives, models with electric drives have suffered more RV turbulence. However, two to three-year-old BEVs, and to a lesser extent PHEVs, are already showing the first signs of price stabilisation.

Volume growth and pricing reactions have been followed by uptake and decreasing stock days. For plug-in vehicles up to 18 months of age, the situation is worse. An enormous influx of BEVs stands out, with the level of supply nearly equal to all other alternative drives, including PHEVs.

The number of used Chinese models available is still extremely low, not even reaching four figures. However, their rapidly growing new-car registrations have recently managed to outshine established brands such as DS Automobiles, Subaru, Lexus, Jaguar, Alfa Romeo, and Honda. This uptake foreshadows far more competition in the used-car market. For example, models from MG will probably be available as often as those from Mitsubishi.

Italy faces downward slope

‘October saw a 1.5% month-on-month drop in %RVs, the largest fall so far this year. Following a trend which began in the second half of 2023, the Italian used-car market looks to have peaked and is now facing a downward slope,’ stated Marco Pasquetti, head of valuations, Autovista Group Italy.

The significant %RV drop from 54.7% in September to 53.9% in October has prompted an RV outlook adjustment. The market is now expected to achieve a smaller amount of year-on-year growth, reaching 4% by the end of 2023, while a decline of 2.4% is expected in 2024.

Declining sales trends confirmed the downward trajectory of the Italian used-car market. The SVI indicated that transactions were down 18.5% year-on-year, while the number of available cars increased by 7.5% according to the AMVI. The average number of days a used car spent in stock increased too, reaching over 73 days.

HEVs were the only exception to the general market trend, enjoying relative stability amid ongoing demand. Meanwhile, compressed natural gas (CNG) vehicles have been heavily penalised following rising fuel costs in previous months.

BEVs still struggled to inspire adoption, both on the new and used-car markets, where they continued to hold a share of approximately 4%. This means the powertrain has essentially been stable for two years.

Timid performance expected in Spain

While at a slower pace than in previous months, the Spanish new-car market once again posted positive results in September when compared with the previous year. In the first nine months of 2023, registrations grew by 18.5% year on year. Sales to companies grew slightly faster than other channels, boosted by a return to activity following the holiday period.

However, the new-car market’s performance over the coming months is expected to be timid, with demand contained by the continued rise in interest rates. September also saw a slowdown in demand for used vehicles, dropping 4%, although the year-to-date figures remained positive, up 2% year on year.

Already well below last year, used-car trade prices in October were down 3% compared with the same month in 2022. Specifically, the average price paid for a three-year-old used car at 60,000km was €19,266 in October, almost €600 less than in September 2023 and October 2022.

‘The average number of days in stock lengthened and the supply of used vehicles expanded, especially for PHEVs and BEVs. The latter has recently been finding it more difficult to be placed on the used-vehicle market,’ said Ana Azofra, Autovista Group head of valuations and insights, Spain.

ICE-powered models continued to follow a slightly negative trend, which is more pronounced for diesel vehicles. HEVs kept gaining momentum and despite increasing supply, saw the greatest number of positive market indicators.

In September, two Hyundai models, the Santa Fé and Tucson, took the top two positions from Toyota in the used-hybrid market, needing the least amount of time to sell. However, Toyota continues to lead the overall ranking with RAV-4, Corolla and Yaris.

Steady supply and deteriorating demand in Switzerland

Recent months have seen the supply of used cars in Switzerland stabilise on pre-COVID-19 pandemic levels. Living costs in the country have climbed since the start of 2023, while used-car transactions slowed.

The AMVI for two-to-four-year-old passenger cars fell by 1.8% from September to October. However, levels were 9.3% higher than a year earlier. Only younger used models saw constrained supply continue.

The SVI rose by 0.9% month on month and by 6% year on year. The recent steadiness of supply and deterioration of demand meant the average %RV of a 36-month-old car fell again. The level went from 50.3% in September to 50.1% in October, while the average %RV was clearly higher at the same point last year, at 51.4%.

HEVs achieved another year-on-year %RV gain, this time growing 6.1% to hit 53.7%. Petrol cars followed (51.1%), then diesel models (49%) and PHEVs (47.3%). 36-month-old BEVs held 46.8% of their original list price.

Two-to-four-year-old passenger cars sold more quickly in October, in stock for 81.1 days, a drop of 2.2 days from September. HEVs sold the fastest on average after 55.4 days, followed by petrol cars after 78.9 days, then diesel cars at 82.1 days, PHEVs at 88 days, and finally BEVs after 93.8 days.

‘Used-car demand is expected to diminish while supply remains high and unwavering. The values of three-year-old cars are forecast to stay relatively strong, set against a wider declining trend,’ commented Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland.

‘The %RV level in Switzerland is expected to finish 2023 down roughly 4.2% on December 2022. In 2024, levels are expected to fall again by around 3.8% due to constant supply and lower demand.’

Largest monthly %RV fall in UK

‘Three-year-old cars in the UK saw their average %RVs fall by 2.7 percentage points in October. That is the largest monthly depreciation so far this year, falling from 62.1% in September to 59.4% a month later,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

It is not uncommon for values to fall following September’s plate change activity in the country. This is due to increased volumes of part-exchanges and end-of-contract lease vehicles finding their way into wholesale channels in a relatively small window. Compared to October last year, the average value of a three-year-old car has fallen by 3.2 percentage points.

October’s SVI shows retail activity has been positive, with 2.6% more cars sold compared to September and 21.5% more than a year ago. Retail demand therefore remains healthy, but dealers appear reluctant to speculatively stock their forecourts, so wholesale demand has remained steady.

As a result of less competition between buyers, auction hammer prices have come under pressure with values falling as a consequence. That said, residual values have remained high since their growth in 2021. With the recent downturn in values, Glass’s expects the average RV to have fallen by approximately 5% at the end of 2023.

Compared to September, the average number of days it took a dealer to retail a used car increased by 1.5 days in October to almost 40 days. Petrol, diesel and hybrid models were all close to this average but PHEVs fared slightly worse, increasing 4.3 days to 42.3 days. BEVs were the fastest-selling models on average, at just 36.3 days.