Monthly Market Update: Residual values set to decline in 2024

10 January 2024

Experts from across Autovista Group unpack what happened in Europe’s used-car markets at the end of 2023 and what it means for residual values (RVs) this year.

The RVs of three-year-old cars at 60,000km, presented as a percentage of original list price (%RV), are expected to follow a falling trend into 2024. The used car markets of Austria, Germany, Italy, Spain, Switzerland and the UK can all expect to see values decline this year.

The largest drop is expected in the UK, with %RVs forecast to fall 7.5% year-on-year by December. This is followed by predicted declines of 4% in Switzerland and 3.5% in Austria. Italy is not far off, with an expected drop of 2.3%. Meanwhile, the declines forecast in Germany and Spain are more marginal, at 1% and 0.7% respectively.

These projections follow on from a negative trend established in 2023. The year got off to a good start, but higher living costs soon began to erode spending power across Europe. This meant used-car demand slowed across many markets.

Additionally, consumers who did venture onto forecourts were more likely to find older models in countries like Germany. This was due to a lack of supply from de-fleeting, as new-car purchases in 2020 and 2021 were heavily impacted by the COVID-19 pandemic.

Fears for BEV values

There was also a great deal of concern for the RVs of battery-electric vehicles (BEVs) in 2023. As the powertrain’s early adoption stage came to a close and competition from new brands increased, many carmakers began adjusting the prices of new models. This impacted the value of models already on the road.

Looking at December 2023, BEV %RVs fell in Austria (down 13.7%), Germany (down 15.7%), Switzerland (down 10.8%), and the UK (down 36.2%). Only Italy (up 0.5%) and Spain (up 2.8%) saw more stable all-electric car values.

Incentive schemes will be fundamental in deciding how BEV uptake, both in the new and used markets, will progress in 2024. This includes financial grants towards purchases, adjusted power costs, charging infrastructure implementation and tax schemes.

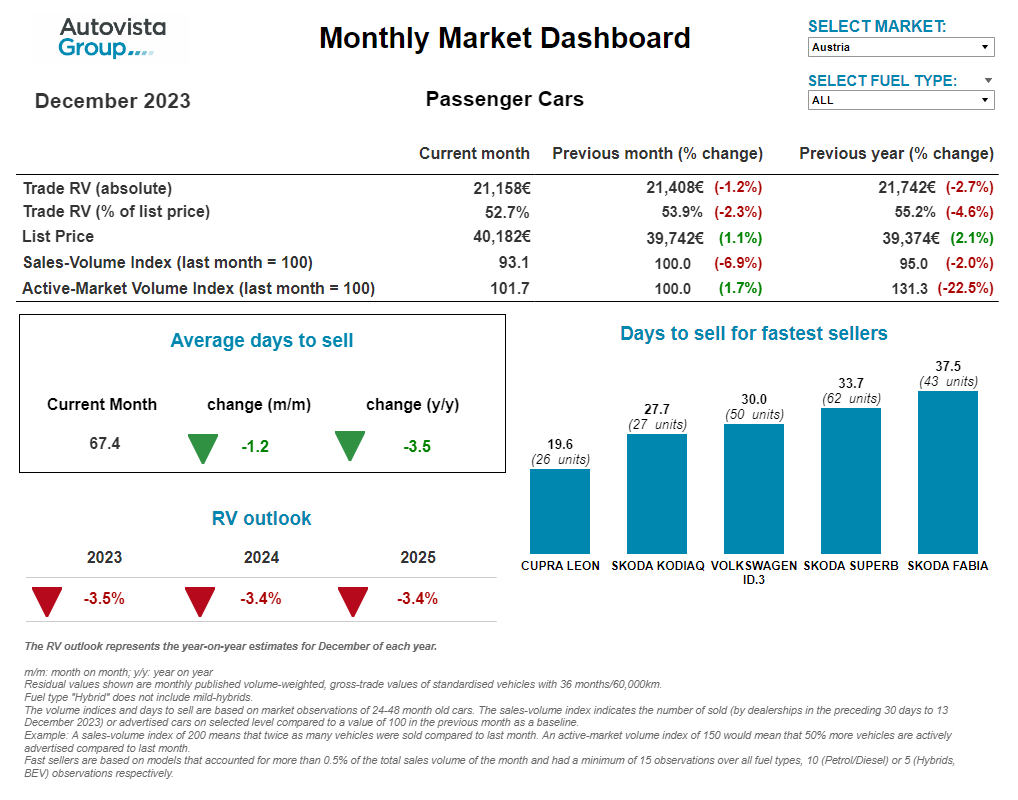

The interactive monthly market dashboard examines passenger-car data by fuel type, for Austria, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

Weakening demand in Austria

Austria saw lower levels of used-car transactions in December as living costs remained high. The sales-volume index (SVI) dropped by 6.9% compared with November, and 2% against December 2022. Meanwhile, the supply volume of two-to-four-year-old passenger cars was around 1.7% higher in December than a month earlier.

The average number of days needed to sell a used car fell to around 67 days in December. Diesel cars sold the fastest, averaging around 64 days, followed by petrol-powered vehicles at 67 days. BEVs took around 74 days to sell and plug-in hybrids (PHEVs) roughly 77 days. Full-hybrids (HEVs) sold more slowly at nearly 81 days.

‘As demand dropped, RVs of 36-month-old cars at 60,000km fell compared to November,’ explained Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

‘Average %RVs dropped to 52.7%. This marked a decline from 55.2% in December 2022 and shows that pressure on RVs is increasing as supply remains stable,’ he added.

HEVs led the way with a %RV trade value of 56.1% followed by petrol models (55.4%), diesel cars (51.4%) and then PHEVs (50.2%). Meanwhile, 36-month-old BEVs retained the lowest value at 46.7%. Continued pressure on RVs can be expected alongside falling demand.

‘In 2024, average %RVs are expected to decrease further by around 3.4% year on year, due to weakening demand and unwavering supply,’ Madas added.

Difficult year for RVs in Germany

‘A small amount of used-car-market growth can be expected in Germany in 2024, owing to recent new-car-market trends,’ said Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

Fleet registrations were weak in 2021, as the market was affected by the COVID-19 pandemic and the ensuing supply-chain crisis. Supplies of used cars up to four years old will therefore likely remain low overall this year. Similar to 2023, older models will appear more frequently on used-car portals.

An overall increase to around 6.4 million used-car transactions is realistic in 2024. This would still be down on the over seven million sales recorded in 2019, prior to the pandemic. This will mean a sales gap that retailers will need to address.

Therefore, 2024 will be a transitional year with price stability and undersupply expected in only a few segments of the new and used-car markets. This will primarily affect internal-combustion engine (ICE) models, while competition and oversupply will impact electrified powertrains, including HEVs.

‘Unfortunately, it will therefore be a difficult year for residual values,’ Geilenbruegge added. There will be cause for RV optimism after 2024, fuelled by improving macroeconomic factors, growing demand, and hopefully government support for the purchase of used electrified models.

This does not necessarily mean new incentives, but rather anything that will encourage the use of an electric vehicle (EV). This could mean subsidising electricity, expanding the charging network, easing the administration of constructing private EV infrastructure, or significantly increasing the vehicle tax advantage.

Volatile prices in Italy

Following a recently established trend, December saw %RVs decline in Italy by 0.8% month-on-month. However, these values grew by 1.9% year on year. %RVs can be expected to fall in 2024, following the downward trend observed in the second half of 2023.

‘Alongside falling values, the number of days it took to sell a used car increased,’ stated Marco Pasquetti, head of valuations, Autovista Group Italy. ‘In December, vehicles remained in stock for an average of almost 68 days before the sale was finalised, whereas it only took 56 days at the same point in 2022.’

The only powertrain to see %RVs decline was compressed-natural gas (CNG), from 42.6% in December 2022 to 41.5% in the same month last year. This was despite the cost of the fuel falling significantly compared to a year ago.

On the other hand, average prices have been extremely volatile recently. This has made cautious buyers who are concerned about consumption and budgeting, even more wary. Meanwhile, %RVs have grown most significantly for liquid-natural gas (LNG) models and HEVs, up 15.8% and 9.8% respectively. Growth was more moderate for PHEVs and especially BEVs.

‘It is not necessary to radically alter the outlook for these powertrains for the next few years,’ Pasquetti said. ‘However, much will depend on whether government promises made at the end of 2023 to revise the incentive scheme are upheld.’

Similar year expected in Spain

For yet another year, while still dealing with various challenges, the Spanish automotive sector came out ahead. The new-car market recorded a year-on-year registration increase of almost 17% across 2023, with nearly 950,000 units.

These figures are still insufficient to meet industry expectations of a stable market in 2024, once production and logistical problems have been resolved and interest rates see more encouraging developments.

‘The Spanish used-car market ended 2023 in positive territory,’ said Ana Azofra, Autovista Group head of valuations and insights, Spain.

Approaching two million used-car transactions, a growth of nearly 4% was recorded in the year. The market was still slightly weighed down by a large number of vehicles aged seven years and above. However, 2023 has seen some rejuvenation with the renewals from car-rental businesses and leasing companies.

Trade values finished the year almost 4% lower than in 2022. Specifically, the average price paid for a three-year-old vehicle at 60,000km was €19,445. These models spent 71 days in stock on average, 10 days more than in December 2022.

Overall outlooks remain roughly stable, with slight declines, especially for PHEVs and BEVs. The RVs of both technologies are forecast to develop negatively moving forward.

HEVs recorded a good year, with strong demand on new and used-car markets as well as healthy transaction price developments. This benefitted the likes of Toyota, Hyundai and Kia, all brands which have supplied HEVs to the used-car market.

‘The coming year can be expected to deliver a similar performance to 2023, which will be considered further in the coming months,’ Azofra added.

Slower sales in Switzerland

‘The supply of used cars in Switzerland recently stabilised on pre-COVID-19 levels,’ explained Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland. ‘Living costs in the country have climbed since the beginning of 2023, while transactions slowed.’

The active-market volume index for two-to-four-year-old passenger cars decreased by 1.6% from November to December. The supply level was only 1.3% lower than a year earlier. Constrained supply has only persisted for younger models.

The SVI declined by 1.6% month on month and 6.3% year on year. The recent steadiness of supply and deterioration of demand has resulted in the average %RV of a 36-month-old car falling again. The level went from 49.9% in November to 49.4% in December, while the average %RV was higher at the same point last year, at 52.1%.

HEVs achieved another year-on-year %RV gain, this time climbing to 52.6%. Petrol cars followed (50.4%), then diesel models (48.5%), followed by PHEVs (46.7%). Meanwhile, 36-month-old BEVs held 45.4% of their original list price.

Two-to-four-year-old passenger cars sold more slowly in December, remaining in stock for 80 days, up a day from November. HEVs sold the fastest on average after 73 days, followed by petrol cars after 76 days, then diesel models after 79 days. PHEVs took over 89 days to sell on average while BEVs needed nearly 106 days.

Used-car demand is expected to diminish while supply remains stable and unwavering. The values of three-year-old cars are forecast to stay relatively strong, set against a wider declining trend. The %RV level in Switzerland finished 2023 down 5% on December 2022. In 2024, levels are expected to fall by around 4% due to stable supply and lower demand.

RV fall expected in UK

In the fourth quarter of 2023, the UK used-car market saw large month-on-month declines in residual values (RVs), led by a lack of wholesale activity. This could have been the result of a drop in retail demand or a reluctance of dealers to speculatively stock forecourts.

‘Either way, the outcome was that the overall %RV fell by 9.9%, or 6.2 percentage points when compared with 2022,’ commented Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

The UK’s used-car market began 2023 in a reasonably healthy position. Retail activity throughout the first quarter was very good, and the average three-year-old model did not suffer any depreciation.

This was brought about by a very buoyant wholesale market. Auction conversion rates regularly approached 80%, something not seen regularly in 2022. Retail activity during this period was very good and gave dealers the confidence to speculatively stock forecourts which undoubtedly led to increased wholesale demand.

The second quarter began in a similar vein, with RVs growing stronger in April by almost one percentage point, although this eased in May and June. The summer months were typically subdued. This is frequently a period in which consumers switch their focus to other priorities, such as the holiday season. Consequently, RVs fell throughout the third quarter.

Used-car values were volatile throughout the last quarter of 2023. However, the average RV of a three-year-old car in December 2023 remained 9.2 percentage points higher than in December 2020, just before the significant hike in values observed throughout 2021.