Monthly Market Update: Residual values slump to lowest level of 2024

04 July 2024

Residual values (RVs) fell further across major European used-car markets in June, as battery-electric vehicles (BEVs) endured a particularly poor performance. Experts from Autovista Group (part of J.D. Power) analyse the data with Autovista24 journalist Tom Hooker.

In June, the average value of a three-year-old car at 60,000km, presented as a percentage of retained list price (%RVs), fell to its lowest point so far in 2024. Year-on-year %RV declines ranged between 3.1 percentage points (pp) and 12.4pp across Austria, Germany, Italy, Spain, Switzerland and the UK.

A drop in demand compared to May hindered sales, as highlighted by the sales-volume index (SVI). This overall slump was compounded by a poor BEV performance across major European used-car markets.

BEVs in decline

All seven markets recorded their worst BEV %RV performance of 2024. Many countries also saw BEV values decline year-on-year, with Spain a notable exception. Italy returned the lowest BEV %RV level in June at just 34.3%. This was 18pp behind the overall market average of 52.3%, and 3.5pp below the technology’s January result.

Another country struggling was the UK. All-electric models retained only 37.3% of their original list price, significantly behind the 51.5% market average. Meanwhile, BEVs in Germany kept a %RV level of 39.3%, down 2.4pp from the start of the year.

In France, the technology held a higher %RV level than in Germany and the UK, reaching 41.1%. Despite this, all-electric models were further away from the overall market average than both countries, behind 14.9pp.

Then came Switzerland, where on average, BEVs retained 43.2% of their original list price for BEVs. This was followed by Austria with 44.2%, while Spain recorded the highest %RV value for BEVs at 49.5%.

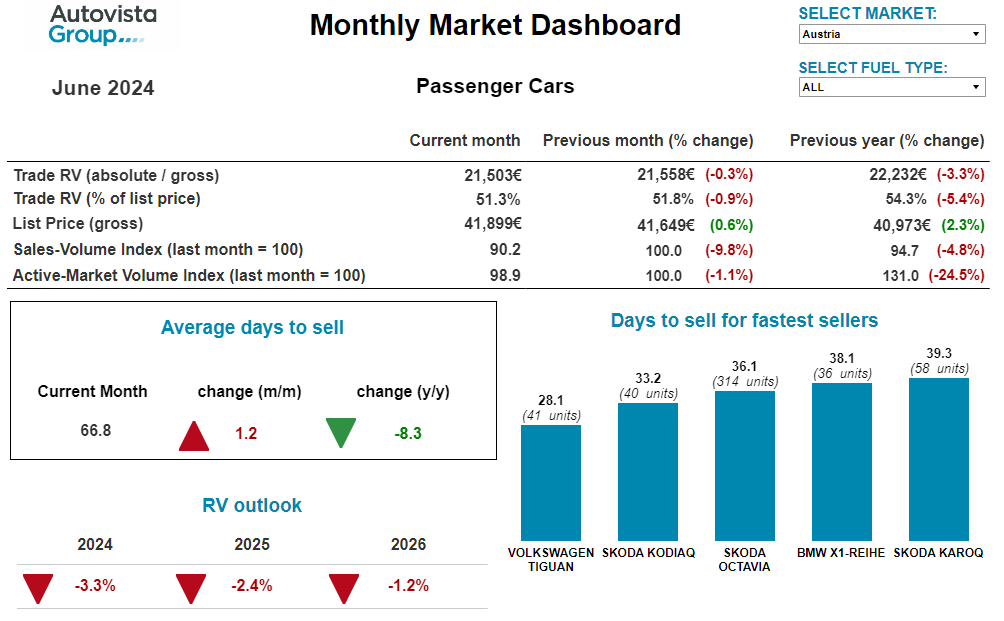

The interactive monthly market dashboard examines passenger-car data by fuel type, for Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

Supply and demand drop in Austria

Following a decrease in May, the SVI showed another sharp decrease of 9.8% in June compared to the previous month, and a 4.8% decrease year-on-year. Furthermore, the supply volume of two-to-four-year-old models declined by 1.1% compared to May and dropped by 24.5% in contrast to 12 months ago.

The average number of days needed to sell a used car increased slightly, to 66.8 days in June. Diesel models sold the fastest, at 57.4 days. This was followed by full hybrid vehicles (HEVs) at 69.1 days and petrol cars at 70.9 days. BEVs and plug-in hybrids (PHEVs) sold more slowly, at 81.2 and 84.4 days respectively.

‘In June %RVs of 36-month-old cars sat at 51.3% on average, a marginal decrease of 0.5pp compared to the previous month. This marked a decline of 3pp year-on-year and shows that pressure on RVs is growing,’ said Robert Madas, Eurotax (part of J.D. Power) regional head of valuations, Austria, Switzerland, and Poland.

HEVs held the highest %RV trade value of 55.9% in June. This was followed by petrol (53.8%), diesel (50.4%) and PHEVs (49.1%). Meanwhile, 36-month-old BEVs retained the lowest value, at 44.2%.

The %RV outlook for 2024 remained the same as May, with an expected 3.3% drop year on year. Further pressure on RVs is expected, fuelled by an unchanged supply and lower demand. The current forecast is for %RVs to decline at a more gradual pace in 2025 and 2026.

France falters

France saw RVs drop further in June, in both absolute and percentage terms. The latter dropped 3pp month-on-month. All powertrains were affected, and each one recorded a decline. Electric vehicles (EVs), consisting of BEVs and PHEVs, were the most impacted technology, following the trend of previous months.

BEV demand decreased by 7.2% compared to May. Incentives for some all-electric models have not been available since the middle of December 2023. Furthermore, models on the used car market are too expensive. Oversupply on the used and new-car markets, combined with a clear lack of demand, has resulted in a strong RV drop.

The progress of used PHEVs is also concerning. Despite the powertrain’s RVs falling in June, this decline is becoming less visible every month.

‘The powertrain does not fit into the demand of the used car market and is more suited to the new-car market due to fleet-based benefits,’ explained Ludovic Percier, Autovista Group residual value and market analyst for France.

‘New vehicles that have been recently launched are also offering more advanced technology and better ranges with lower list prices for some models. This has a direct impact on the used-car market.’

For the first time in a while, petrol and diesel passenger car demand both decreased, recording a month-on-month drop of 10.2% and 11.2% respectively. Yet, this decline is less worrying than it is for EVs.

This trend is confirmed by the SVI falling drastically this month, as consumers wait for prices to drop further. This has meant that stock days have increased.

Figures for full and mild-hybrids also fell in June. Despite being the healthiest powertrain over the past few months, customers cannot support such high prices. It seems buyers are not ready to purchase hybrid vehicles at the moment.

Germany on road to recovery

The German used-car market, including private and commercial sales of all age groups, was almost 300,000 transactions behind pre-COVID-19 levels in May. However, it is still on the road to recovery.

Although BEV sales have doubled compared to the same period in 2023, the segment is responding to weaker demand, dropping by 28.8% compared to May. All-electric models also recorded longer stock days and greater price reductions compared to the overall market average.

The used EV market continued to see its share slump across the first five months of the year, reaching just over 12%. Despite this, pressures are expected to ease on future supply, at least from 2024.

The increasing number of EVs on German roads poses unique challenges for dealers. In terms of days in stock, PHEVs are performing at almost the same level as internal-combustion engine (ICE) models. Meanwhile, BEVs often remain in stock for far more than a month longer.

Therefore, it is understandable that dealers are becoming cautious, even though on average just one in seven of all used vehicles up to four years old is an EV. There are now more than 2.3 million EVs on Germany’s roads. Although this is quite small compared to the country’s total fleet of 49 million cars, they have reached a significant number that is generating new and used-car demand.

‘Of course, some EV buyers want to return to ICE models due to a lack of practicality for their everyday lives. However, the vast majority still want to continue using the technology,’ stated Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of J.D. Power).

‘We must not forget that it is not just about personal preferences when it comes to the powertrain type selected for one’s mobility, but also about the overarching goal of achieving CO2 neutrality in the transport sector,’ he commented.

Italy RVs fall further

RVs continued a negative trend in Italy that is generally linked to seasonality, although they fell slightly further than expected. A 36-month used car on average retained 52.3% of its original list price during June, compared to 55.9% from the same period one year ago.

‘This is the effect of a gradual return to a stable market that existed before the crises that the automotive sector has faced in recent years. It is very interesting to observe that list prices have risen by almost €2,000 compared to last year. This trend will continue to affect the performance of the second-hand market,’ explained Marco Pasquetti, head of valuations, Autovista Group Italy (part of J.D. Power).

The only segments with an improved %RV compared to last year were liquefied-petroleum gas (LPG) models and compressed natural gas vehicles. Both technologies still have relatively significant market shares when considering transfers of ownership. This is also true for LPG models in the new car market.

On the other hand, PHEVs suffered a %RV drop to 48.9%, while BEVs shrank to 34.3%. The two technologies are still in sharp decline, and the introduction of new-car incentives on 3 June could provide more uncertainty.

For other powertrains, these subsidies are still available. Yet, for BEVs, the entire subsidy budget expired on the very first day. If the bonus is not refinanced, no BEVs will be sold in Italy with the incentives.

Spain soars

Once again, the rental-car channel drove new-car sales from April to June, as it did in the first quarter. Currently, year-on-year deliveries in this sector have grown by 45%. Meanwhile, private registrations increased by 8% and business deliveries dropped by 12%.

Because of this, mainly young cars between one-to-two years old are returning to the used-car market. This increased supply of young cars is intensifying pricing pressure. RVs in this segment are declining, while in the other age groups, there is more price stability.

‘Most powertrains saw RVs trend negatively in June, especially electrified engines. It is difficult to find an outlet for electric used vehicles, as sales of new EVs are decreasing. In May, the EV market share fell by 2pp, falling into single digits (9.6%),’ outlined Ana Azofra, Autovista Group head of valuations and insights, Spain.

In an attempt to boost the market, the government has confirmed the renewal of the EV incentive scheme, MOVES III, until the end of the year. Although these subsidies could increase the pricing pressure on used EVs, the reduced supply will help the market.

Stability in Switzerland

‘Used-car supply in Switzerland was back to pre-COVID-19 levels in 2023 before falling slightly again in 2024. Since last year, living costs in Switzerland have increased while new-car transactions still have not fully recovered,’ said Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland.

The active-market volume index (AMVI) for two-to-four-year-old passenger cars decreased by 1.2% from May to June 2024. Year-on-year, this indicator slumped by 12.2%. This means the supply of younger used models has become more limited. Meanwhile, the SVI decreased significantly by 9.4% compared to the previous month and by 11.9% on the same period last year.

The RVs of 36-month-old cars remained almost stable, thanks to steady supply and moderate demand. %RV levels marginally declined from 47.5% in May to 47.4% in June. However, the year-on-year drop was more severe, as the %RV level sat at 50.5% in June 2023.

Looking at the different powertrains, HEVs retained the greatest amount of value, with a %RV of 50.3%. Petrol cars came next (48.5%), then diesel models (46.6%), followed by PHEVs with 45.3%. The worst-performing technology was BEVs, which retained only 43.2% of their original list price.

Two-to-four-year-old passenger cars sold more slowly in June, remaining in stock for 82.5 days, up by 2.5 days. Petrol cars sold fastest on average at 78.4 days, followed by diesel cars after 80.2 days, and HEVs after 80.6 days. PHEVs took 91.5 days to sell and BEVs needed 103.1 days on average.

The average value of three-year-old cars is forecast to drop further from a relatively high point, set against a wider declining trend. The %RV level in Switzerland finished 2023 down 5% on the previous year. Levels are expected to fall by roughly 5.3% in 2024 due to a lower used-car demand, despite stable supply.

Hybrid leads UK used-car market

The average three-year-old car in the UK retained 51.5% of its original list price in June. Although this was a relatively small drop from May’s 51.9%, compared to 12 months ago, it has fallen 12.4pp.

The SVI shows that retail activity fell 4.1% compared to last month. This is the second consecutive monthly decline, after falling 6.2% in May.

The AMVI also dropped by 3.7% month-on-month, indicating that dealers are beginning to stock according to reduced demand. This is not uncommon during the summer months in the UK, where retail activity typically slows.

In terms of %RV performance, hybrid models led the way in June, retaining 55.7% of their list price. Petrol and diesel models followed at an %RV level of 53% and 52% respectively. PHEVs held 49.5% of their original value, with BEVs recording a significantly lower level at 37.3%. This is 31.9pp lower than their peak in September 2022.

‘Although BEV RVs continue to decline, they are now developing similarly to other fuel types, which suggests they have found a new level in the UK market,’ stated Jayson Whittington, Glass’s (part of J.D. Power) chief editor, cars and leisure vehicles.

‘Feedback from dealers indicates that retail activity for BEVs is currently buoyant, particularly for those that benefit from a larger battery. The average days to sell metric backs this up, with BEVs taking on average 32 days for dealers to sell, the lowest of all fuel types,’ he explained.