Monthly Market Update: Stable used-car demand and undersupply drive RV improvements

26 July 2021

Europe’s used-car markets continue to suffer from insufficient supply to meet pent-up demand. This is translating into positive development of almost all key-performance indicators (KPIs).

The new sales-volume index is essentially stable except in Spain and the UK. In contrast, the active-market-volume index is in retreat as markets contend with undersupply. Consequently, residual-value (RV) retention, shown in percentage terms, has risen in all seven markets in July, and stock days continue to fall.

Whereas most fuel types are benefitting from rising RVs, battery-electric vehicles (BEVs) are in decline. Higher supply volumes and low demand on used-car markets, in conjunction with faster technology-ageing and enticing incentives, are conspiring to decrease RVs and increase stock days.

Autovista24 has extended its coverage of the used-car market to include Austria and Switzerland, in addition to France, Germany, Italy, Spain and the UK. It also includes a breakdown of KPIs by fuel type, average new-car list prices and sales volume and active-market volume indices.

Buoyant developments in Austria

Since the beginning of the year, Austria’s used-car market has been characterised by stable demand and continued low supply, says Robert Madas, Eurotax (part of Autovista Group) valuations and insights manager, Austria and Switzerland. On average across two-to-four-year-old passenger cars, the supply volume in July was around 7% lower than in 2020. Diesel vehicles are disappearing from the market, with a drop of almost 17% compared to the previous year. At the same time, used-car sales activity in July increased by 10.8% compared to the same period last year. Stock days have also fallen: on average, a car aged two-to-four years is currently on offer for 55 days, down from 69 days a year ago.

This market environment has led to a further increase in the residual-value percentage (%RV) of 36-month-old cars, which has risen by 2.9% year on year to 43.9%. Hybrid-electric vehicles (HEVs) in particular were able to make strong gains, up 4.3% year on year to 46.2%. In contrast, three-year-old BEVs have declined significantly and only retain 37% of their value, down 7.1% compared to the same period in 2020. Apart from the higher supply volumes, the reasons for this are the faster technology-ageing of older BEVs and the attractive subsidies in the new-car market.

Market parameters are unlikely to change in the medium term, so values for three-year-old passenger cars will probably continue to rise this year and next, Madas believes. Only when the new-car market picks up significantly and volumes rise on the used-car market are RVs likely to come under pressure. This will probably not be the case before 2023, he concludes.

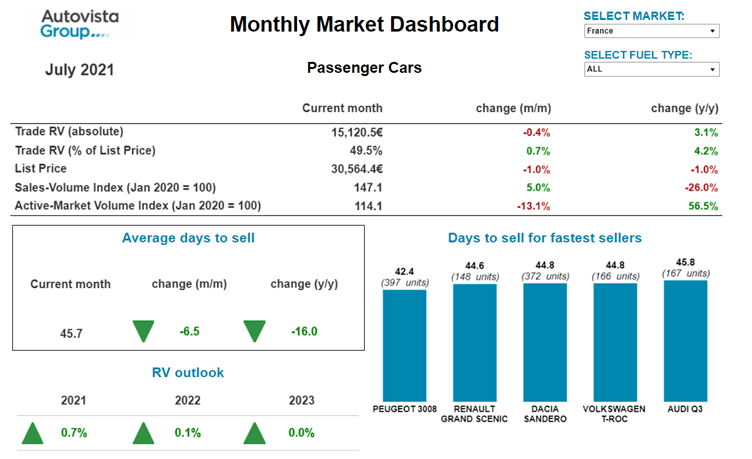

Supply and demand disconnect in France

Used-car demand is increasing month after month in France, whereas supply coming from the new-car market is steadily decreasing, says Yoann Taitz, Autovista Group’s regional head of valuations and insights, France & Benelux.

The semiconductor crisis is leading to reduced production of some models and longer delivery times. Customers are awaiting positive economic conditions, while taxation issues and the strong increase in supply at the end of 2020 have all led to a smaller new-car market in the first half of 2021. With supply struggling to match used-car demand, RVs rose in July, both compared to June and the same period in 2020. The strong demand has also led to a month-on month reduction in the number of stock days, and an even greater year-on-year fall, observes Taitz.

Diesel values are steadily increasing as used-car demand is stabilising at a high level, accounting for more than 50% of total transactions. Meanwhile, new-car demand is steadily decreasing, and even in the fleet channel, sales of plug-in hybrids (PHEVs) have been as high as diesel sales since January. Diesel RVs are growing quicker than new-car prices, despite scaremongering political speeches and acts by the French government and the EU.

Little appetite for BEVS as used cars

Conversely, the situation regarding BEVs remains worrying. The appetite for them on the used-car market remains very low, capturing just 0.5% of total used-car sales. This translates into an increase in stock days to over 80 days, double that of petrol models, averaging 40.8 days. New-car supply remains high, accounting for 7% of registrations, mainly due to emissions targets.

Furthermore, to compensate for the fall in private and fleet sales since early 2021, OEMs have mainly registered BEVs in tactical channels, which is especially damaging for 12-month values, he notes. However, as this phenomenon persists, it is also impacting 24 and 36-month RVs. The year-on-year increases in RVs are only explained by the arrival of three-year-old BEVs with higher list prices on the used-car market.

Taitz says that the reduction in the purchase incentives for BEVs as of July 2021, from €7,000 to €6,000 for private buyers, will not really change the situation. In the best case, it may help to slightly stabilise RVs but there has not been a significant change in sales on the new-car market in July compared to June.

In early 2021, Autovista Group was expecting RVs of PHEVs to remain stable at high levels until the end of the year. However, the trend is reversing earlier than expected, with RVs of some models already decreasing in the first half of 2021. This is due to a complete change of the fleet channel situation and the increased registrations of PHEVs in tactical channels, again due to emissions targets. This explains the month-on-month and year-on-year RV declines, although the rising interest of used-car buyers is visible from the high reduction in stock days. However, given the high volume of PHEVs that will reach the 36-month used-car market, Taitz expects RVs to lower in 2022, and especially in 2023. Moreover, the arrival of the latest PHEVs (with 50km range) on the used-car market negatively impacts RVs of the old-generation examples (with only 25-30km range) that are now reaching the 36-month used-car market.

Standard hybrid-electric vehicles are increasingly popular in France. These vehicles are a good alternative to internal-combustion engine (ICE) models, with the technology offered at a lower price premium than PHEVs. They are also less constraining in terms of use, Taitz points out, as the car does not need to be charged and can go into city centres, unlike ICE vehicles. With the arrival of other OEMs on the used-car market, including Hyundai and especially Renault, used models are attracting more and more buyers, and the sector is adapting. Taitz therefore expects a positive outlook for HEV RVs in the next two years.

“Remarkable” change in days to sell in Germany

On average, used-car buyers have paid 1.9% more in July than in June, and 0.7% more than a year ago. At the same time, the average days to sell continue to fall. Compared to last year, it takes about 16 days less to sell – now at a remarkable 60.7 days, on average, says Christof Engelskirchen, Autovista Group’s chief economist. Our sales-volume index is at 148.4, which means that there are 48.4% more used cars traded in July 2021 than in January 2020, which was a winter month but also pre-pandemic. Traded volumes are stable, but sellers are tapping into cars in stock: there are 10.4% less cars on offer than a year ago and about 17% fewer than in January 2020.

Diesel remarketing values have seen a strong rebound, up 3.4% month on month and 3.8% year on year in absolute terms, due particularly to the very restricted supply. Their share of new-car markets has been dropping for many known reasons. And the active-market used-car volume has contracted by almost 30% compared to January 2020 and by 23% versus July 2020. There is very little reason to look for alternatives in used-car markets if buyers seek low-consumption, long ranges, and the image of longevity, especially at higher mileages, says Engelskirchen. Diesel-import markets are also longing for these powertrain types. He expects a stable RV outlook for diesel cars – maintaining their rebound position well.

Petrol cars are still the driving force among German used cars. 68% more used petrol cars are selling in July 2021 than in January 2020, and 9.1% more compared to July 2020. The active used-car market-volume index is at 92.8, i.e. almost at pre-pandemic levels. And there is continued high demand for used petrol cars; average days to sell are down four days compared to last month, and about 18 days versus July 2020. RVs have risen over the course of the pandemic, in percentage terms, but appear to be hitting a ceiling. Engelskirchen expects the smallest correction in 2021, of -0.3%.

Exotic BEVs

BEVs are still perceived as exotic in used-car terms and their average days to sell (72.3 days) are higher than for ICE and hybrid vehicles. Considering their high list-price positioning and strong incentives, their RVs have come under pressure year on year, down about 8% in both absolute and percentage terms. Mix effects play a role in monthly deviations currently. BEVs exhibit stronger lifecycle depreciation, and values are expected to come under further pressure in 2022 and 2023, according to Engelskirchen.

PHEVs, on the other hand, have been faring fairly well, he notes. However, at 69 days, they also exhibit higher days to sell than standard hybrids and ICE vehicles. He expects the RV positioning of PHEVs, which is still strong, to come under more substantial pressure than any other powertrain type in Germany. This is largely due to the overstimulation of new-car demand, especially from company-car buyers, due to the extraordinarily high incentives in Germany.

Switzerland holding steady

For some time now, the Swiss used-car market has been characterised by stable demand and low supply. On average across all two-four-year-old passenger cars, the supply volume in July was 13% below the level at the beginning of 2020, explains Hans-Peter Annen, Eurotax (part of Autovista Group) chief editor, Switzerland. Like elsewhere diesel cars particularly are missing, with supply 28% down compared to the beginning of 2020. At the same time, the supply of hybrid and electrically-chargeable vehicles (EVs) has increased. The average days to sell have fallen: a passenger car aged two-to-four years is currently in stock for 62 days, compared to 78 days a year ago.

This market environment has led to a further increase in the average %RV of 36-month-old passenger cars, to 42.2% (+7.4% compared to July 2020). Petrol and diesel cars were able to post strong gains of around 7% each. HEVs, PHEVs and BEVs also increased, but less than petrol and diesel. The reason for the stronger increase for petrol and diesel cars is the lower supply, whereas the supply of hybrids and EVs corresponds with current demand, notes Annen.

Regarding the future development of values, supply will be decisive. As cumulative new registrations are markedly lower than before the crisis (down 21% compared to 2019), he assumes that market parameters will not change in the medium term. RVs for three-year-old used cars will continue to rise this year, and at the beginning of next year, before stabilising over the course of 2022. Only when new-car markets pick up significantly and volumes subsequently increase on the used-car market, are RVs likely to come under pressure. This will probably not be before 2023.

UK stock struggles to meet “exceptional” demand

COVID-related movement and handling challenges remain in the UK, which slows the flow of cars into wholesale channels, says Jayson Whittington, Glass’s chief editor, cars and leisure vehicles. Lease-contract extensions resulting from new-car delays is also a major factor, reducing the volume of cars de-fleeted into the market. However, the main reason for the stock shortage continues to be strong retail demand, with dealers needing to replenish forecourts more frequently.

This led to exceptional wholesale demand in June, with hammer prices getting stronger as the month went on, in turn pushing Glass’s average RV ever higher. Indications from trading in early July suggests that auction hammer prices continue to climb, and with stock in relatively short supply, there is no indication when RVs will begin levelling out.

Reflecting this strength in the UK used-car market, the UK average trade %RV has increased by 5.5% month on month in July to 51.2% of list price. Furthermore, it has increased 15.1% compared to this time last year, notes Whittington.

The sales-volume index indicates that used retail sales have fallen in July, compared to June, by 11.9%. This could be due to the initial rush after the end of the lockdown in the first quarter beginning to ease. However, this has not translated into a slowing of wholesale activity, however, as dealers continue their buying frenzy.

The average number of days it is taking dealers to sell a car is 38.3. This figure continues to fall month on month as the market returns to seasonal norms, following lockdown. This is also 35.2 days lower than last year, but dealers were only able to welcome customers back into showrooms from the beginning of June 2020, so they were sitting on many ageing cars, observes Whittington.

Diesel a strong used car

Although diesel has fallen out of favour with new-car buyers, they remain very popular in the used-car market. In July, the average diesel %RV in July is 51.5% of list price, which is just above Glass’s average %RV.

Petrol RV percentages are not far behind diesel, at 50.9%, although the average value is over £5,000 less, reflecting the model mix, which is weighted more towards smaller cars.

In 2017, petrol volumes spiked in the new-car market, which signalled the decline of diesel. There was a concern that supply would outstrip demand in 2021 and affect RVs, but this has not materialised.

It is perhaps unsurprising, says Whittington, that the five fastest-selling cars in July are all SUVs. The popularity of SUVs in the UK shows no sign of slowing. Over the past few months, their RV performance has been exceptional.

Click here or on the screenshot above to view the monthly market dashboard for July 2021.