Rising COVID-19 anxiety compounds November downturn in UK new-car market

06 December 2021

The UK new-car market stumbled again in November, amid rising COVID-19 cases and concerns about the new Omicron variant. Yet electrification continued apace. Autovista24 senior data journalist Neil King explores the latest figures and factors.

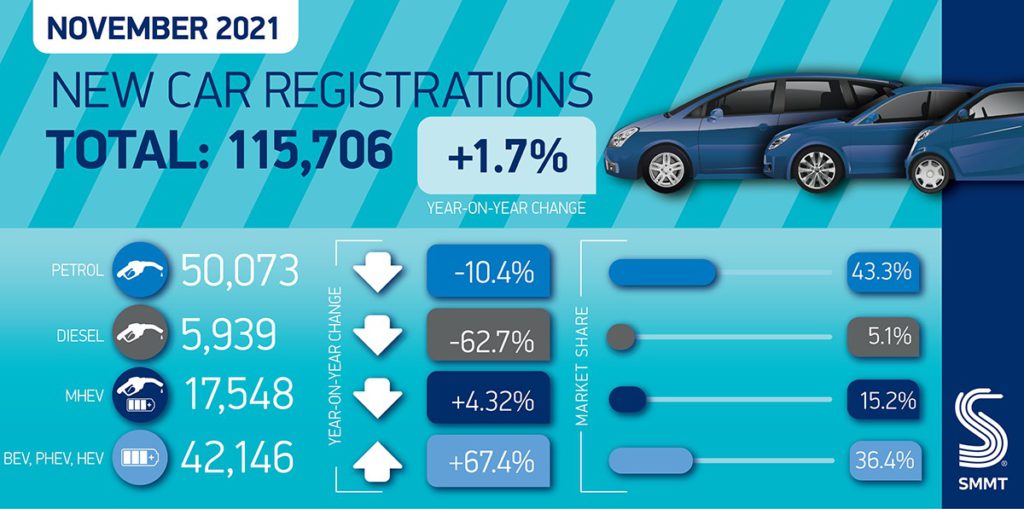

In total, 115,706 new cars were registered in the UK last month, according to data released by the Society of Motor Manufacturers and Traders (SMMT). This represents the first year-on-year growth since June, albeit of just 1.7%, but the UK was in lockdown for part of November 2020.

‘What looks like a positive performance belies the underlying weakness of the market. Demand is there, with a slew of new, increasingly electrified, models launched but the global shortage of semiconductors continues to bedevil production and therefore new-car registrations. The industry is working flat out to overcome these issues and fulfil orders, but disruption is likely to last into next year, compounding the need for customers to place orders early,’ said SMMT chief executive Mike Hawes.

As UK dealers endured lockdowns and subsequent releases of pent-up demand during 2020, year-on-year comparisons can be highly misleading. Therefore, comparisons against 2019 are a far better indicator of the market’s performance.

Compared to November 2019, registrations declined by 26.1%, in line with the downturn in October. However, there was an extra working day in November and, on an adjusted basis, Autovista24 calculates that the market fell by 29.5%, far more than the adjusted 18.8% fall in October. Moreover, the SMMT highlights that November was ‘31.3% below the pre-pandemic five-year average as semiconductor shortages constrain supply.’

Society anxiety

In the first 11 months of this year, the UK new-car market contracted by 28.8% compared to the same period in 2019. In addition to supply constraints, higher energy costs and fuel prices, the UK is battling a rise in COVID-19 cases, especially of the Omicron variant. A positive side effect, however, is that the additional economic uncertainty means the likelihood of an anticipated rise in interest rates is reduced, at least in December.

Nevertheless, the additional anxiety in UK society means Autovista24 has downgraded its 2021 forecast to 1.65 million new-car registrations, equating to 1% year-on-year growth and a fall of 28.8% against two years ago.

Similarly, in its latest quarterly forecast update, the SMMT predicted 1.66 million registrations in 2021 ‘in light of the ongoing supply issues and deteriorating economic outlook.’ This marks a significant downward revision to the association’s July forecast of 1.82 million and ‘would see 2021 finish 1.9% or some 30,000 units up on 2020, but some 650,000 units down on 2019’s pre-pandemic 2.3 million performance,’ the association emphasised.

One in three cars electrified

Despite the wider downturn, registrations of electrically-chargeable vehicles (EVs) are surging and gained a 28.1% market share in November. This is almost treble the 9.6% share of diesel cars, including mild-hybrid (MHEV) models. Including the 8.3% share of hybrid electric vehicles (HEVs), more than one in three cars registered in the UK last month features an electrified powertrain.

‘Plug-in vehicle demand continued to grow, with battery-electric vehicles (BEVs) equating to 18.8% of the market, with 21,726 units – more than double compared with November 2020 – while plug-in hybrid vehicles’ (PHEVs) share grew to 9.3% or 10,796 units’ the SMMT noted.

In the first 11 months of 2021, BEVs and PHEVs captured 10.6% and 6.9% market share respectively. The total 17.5% share of EVs exceeds the diesel share of 14.7% and means ‘one in six new cars is capable of being plugged in,’ the SMMT highlighted. 'When combined with HEVs (9% share), more than a quarter (26.5%) of the new-car market during 2021 has been electrified.’

Deterioration of charging-point ratio

Despite the accelerated uptake of EVs, SMMT analysis found that between 2019 and 2020, the ratio of charging points available in the UK fell by 31%, ‘with the number of plug-in cars potentially sharing a public on-street charger deteriorating from 11 to 16.’

The UK’s ratio of EVs to available public charge points is also one of the worst among the top 10 global markets. Between January and September 2021, just one new standard charge point was installed per 52 newly-registered plug-in vehicles.

The SMMT is calling on the government to avoid further deterioration of this ratio, ‘by boosting the provision of public charging points through the imposition of binding targets.’

‘The continued acceleration of electrified-vehicle registrations is good for the industry, the consumer and the environment but, with the pace of public charging infrastructure struggling to keep up, we need swift action and binding public charger targets so that everyone can be part of the EV revolution, irrespective of where they live,’ Hawes concluded.