Period of decline impacts used-car residual values in Poland

01 February 2024

Both the used-car and used-commercial vehicle sector in Poland faced various challenges at the end of last year, impacting residual values (RVs). Marcin Kardas, head of valuations at Eurotax Poland (part of Autovista Group), examines the markets.

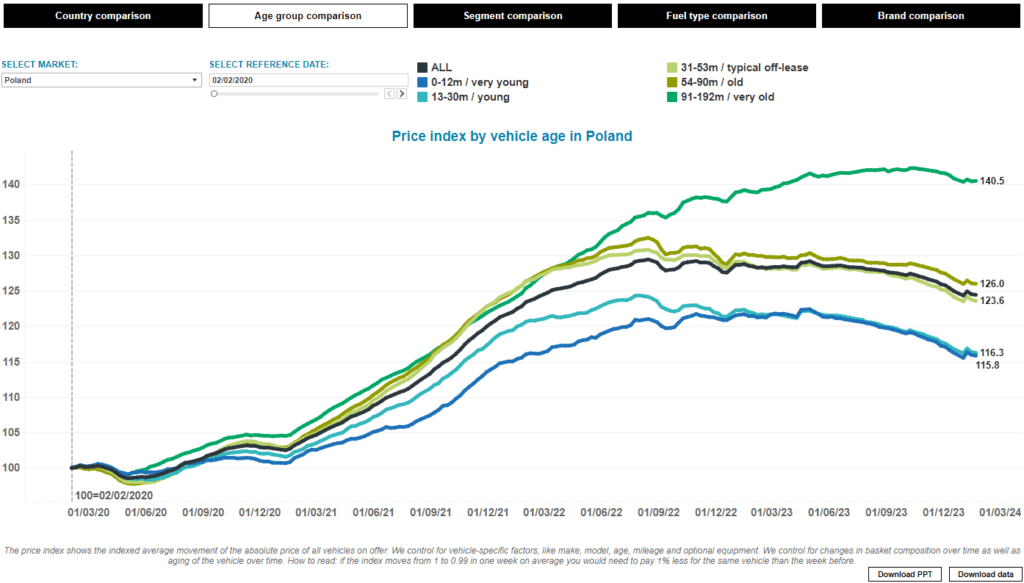

The end of 2023 saw a period of marked decline in the value of used cars in Poland. The availability of new cars increased significantly, and dealers entered a price battle to attract customers. Large discounts appeared, which directly affected the valuation of the youngest used-vehicles.

As fleets replaced their stock, this led to the appearance of many used cars, especially those registered before the COVID-19 pandemic. Cars one to two-years, and five to six-years-old, are currently on sale for the longest time. Stock of these models is increasing rapidly, and demand is gradually falling, despite a market stimulated by price reductions.

Older cars are still showing some stabilisation, although the push for price reductions is likely to appear soon there too.

Percentage increase in asking prices by segment in Poland

Mixed conclusions from used-car market

The used-car market in Poland currently has mixed outlook. In some dealership chains, despite the difficult situation, there is no clear stagnation and sales are at a relatively high level. Post-lease forecourts, on the other hand, are having major problems remarketing larger fleets.

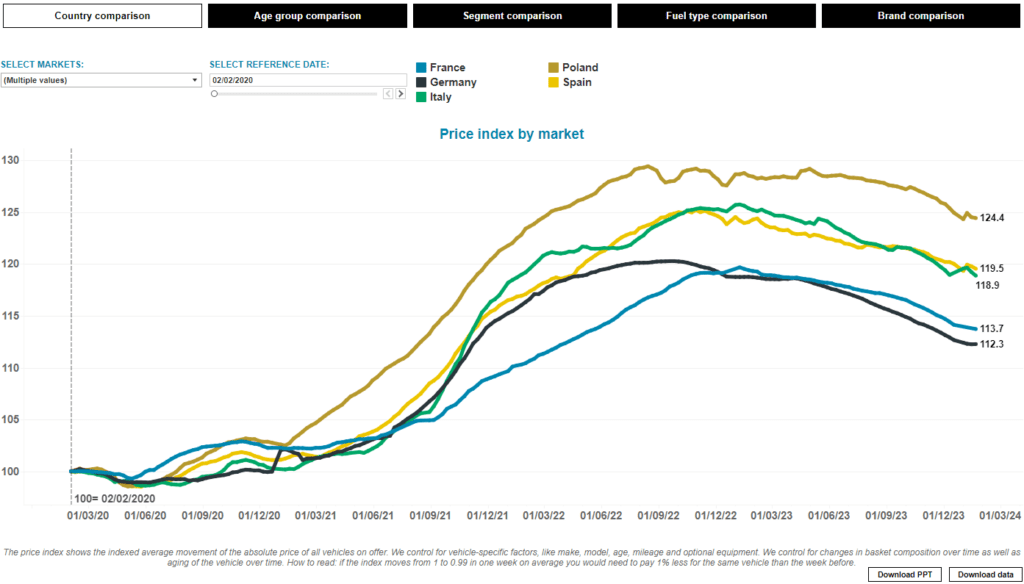

However, the macroeconomic data (decline in Gross Domestic Product (GDP) and purchasing power) indicates that a greater decline in demand and value of used vehicles is to be expected soon. This effect is already noticeable not only in Poland, but also throughout Europe.

Percentage increase in asking prices in individual markets in Europe

Importers and dealers are in a difficult situation. On the one hand, interest in new cars is gradually slowing. On the other hand, competition from Chinese brands has emerged in Poland. At the end of the year MG and BAIC made their European entrance, and several private importers now offer other brands.

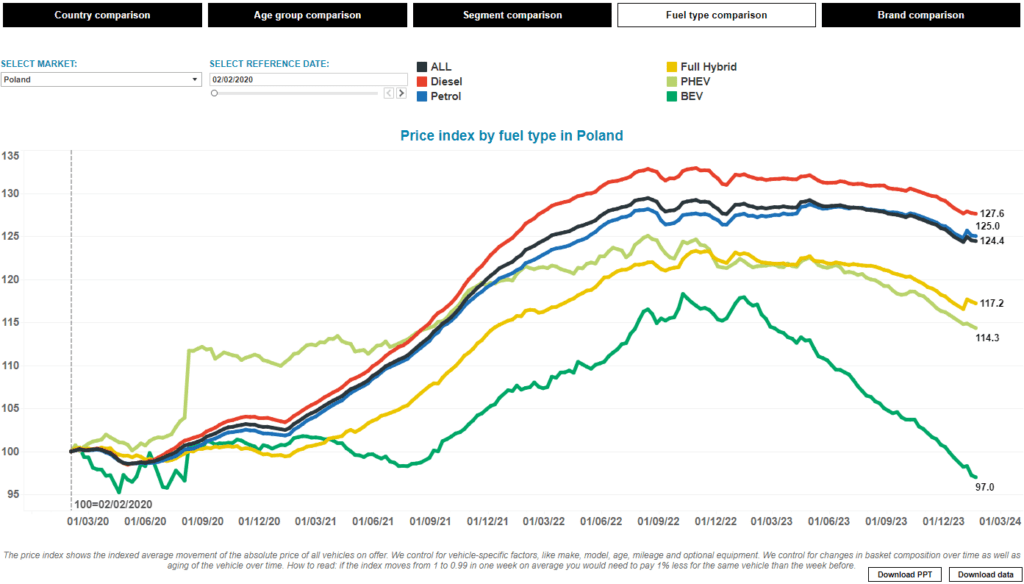

Differences in powertrain types

Prices of internal-combustion engine (ICE) versions which are much lower and provide competitive warranty conditions are attracting customers. The offers in the budget sector appear to be positive and should already be of concern to European manufacturers. This situation is likely to kick-start a decline in new car prices in 2024.

The electric vehicle (EV) segment is also unstable. Tesla’s policy of severe price cuts is forcing other competitors to make similar moves, and debuting Chinese models with very attractive offers will surely only aggravate the price battle for customers.

In this situation, it is hardly surprising that the values of used EVs are quickly falling. This is being driven by the pressure from the price of new cars and the lack of clear demand for used cars. This is dangerous because low total cost of ownership (TCO), of which the drop in value is the biggest element, should be the main purchase argument for EVs. In the current situation, they are no longer competitive with ICE cars.

Percentage increase in asking prices of individual powertrain types in Poland

Falling used-car listings will be followed by dropping residual values (RVs). They are slowly starting to return to pre-pandemic levels, and in a now highly competitive market this is happening at an accelerated pace.

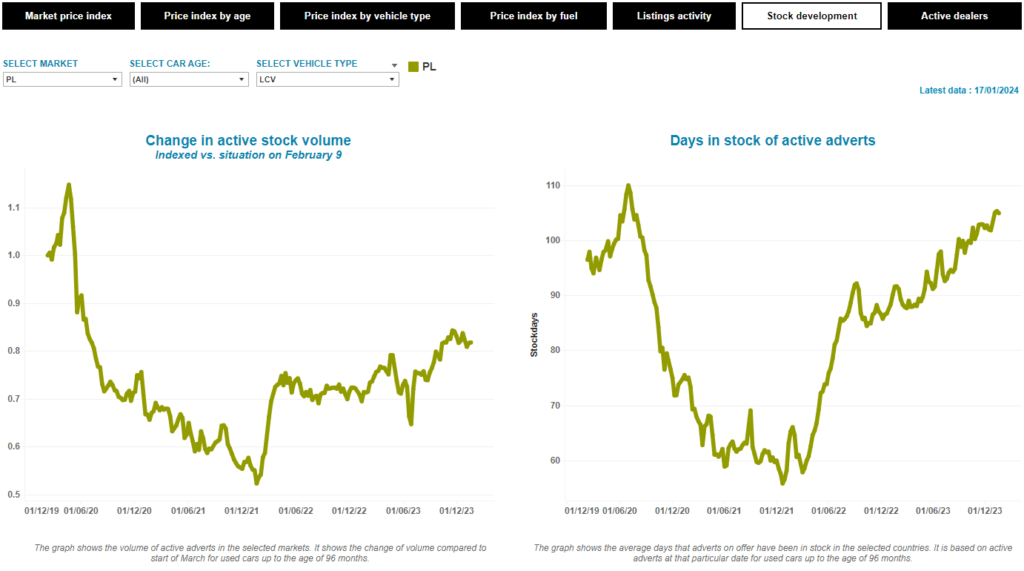

Crisis for commercials

The situation in the commercial vehicle (CV) market looks much more serious. The decline in values accelerated towards the end of 2023 and reached very high levels in the medium and heavy segment, independent of each body type.

This signifies a widespread crisis in the entire area of logistics, from courier deliveries to long-distance, and specialised deliveries. The biggest discounts affected vehicles up to five years old and reached 10-15% per quarter.

As demand fell, large discounts on new vehicles emerged, bringing van prices down to just over zł100,000 (€22,994). This meant stiffer competition from manufacturers, but also rapidly increasing stock levels that currently sit over 80% of pre-pandemic levels. Sales times and availability of new vehicles has increased because of soaring supply.

Change between fourth quarter and fist quarter of the following year

Electric vans have also been heavily losing value for some time. The first generations of vehicles just returning to the market are unpopular and extremely low-performance. It is difficult to make any firm judgements about their future on this basis, but at present their decline in value is much greater than ICE vehicles. This is also influenced by high discounts on new vehicles.

The overvaluation of the market value clearly affects forecasts. The RVs of commercial vehicles are expected to continue to fall in the coming months, and only an improved economic climate can stop this process.

Trucks in trouble

The largest and steepest discounts can be seen in the heavy truck market. Traditionally, truck tractors, which make up the largest part of the market, are most affected by the downturn in Europe. The huge declines in value since the third quarter of 2023 are continuing.

The lack of demand for new and used vehicles is obvious and even large price reductions are not stimulating it. The transport market has plunged into a deep crisis and fleets are unsurprisingly reducing their parc. In addition to the lack of work, more concerns have emerged for transport companies.

From 1 December 2023, a new toll system, based on CO2 emissions, was introduced in Germany. It discriminates against ICE vehicles, particularly diesel, but for the time being there is no good alternative for these models. Due to Germany’s transit role, this will certainly have an impact on Polish transport costs.

The weak domestic demand for new and used trucks cannot be compensated by foreign purchases. Buyers from Eastern Europe and Asia, who have been sourcing mainly older vehicles from Poland, are also limiting their purchases, and the situation is not helped by the blockade of the border with Ukraine.

Currently, tractors aimed at international transport are losing the most value. The difficult market situation is also starting to have an impact on distribution vehicles up to 18-tonnes gross vehicle weight, which have started to suddenly fall. Construction vehicles, mainly dumpers, are still holding their value, but their supply on the secondary market is already starting to increase. Off-road vehicles with 6×6 and 8×8 drivetrains depreciated the fastest in mid-2023, but their declines have now levelled out with the other configurations.

The year ahead

Statistically, new car sales in Poland in 2023 looked very good. Passenger car registrations reached 475,032 (up 13.2% year on year), alongside 64,522 vans (up 3.7% year on year) and 35,302 trucks (up 1.7% year on year) that were delivered.

Commercial vehicle figures are just above last year’s level, while trucks are more stable, but do not reflect the declining registration dynamics towards the end of last year. A similar trend should soon emerge with passenger cars too, and it will be very difficult to repeat these strong results in 2024. A robust performance heavily depends on the economic situation in Poland and Europe, which is particularly important for commercial vehicles.