Swiss new-car registrations rise as used prices plunge giving mixed 2024 outlook

23 January 2024

Hans-Peter Annen, head of valuations and insights at Eurotax Switzerland (part of Autovista Group), analyses how the Swiss new-car and used-car markets performed last year, and provides an outlook for 2024.

The new-car market in Switzerland and Liechtenstein was still a long way off pre-pandemic figures in 2023, despite consistent positive development. Registration grew 11.6% across the year, compared to a poor 2022.

Last year’s boost was aided by recovered supply chains and order backlogs clearing. However, ongoing conflicts in Ukraine and Gaza have left buyers reluctant to make a purchase, particularly private consumers. New-car registrations continue to sit behind 2019 data, down 19% on the pre-COVID-19 period.

Electrified vehicles recorded a 26.1% surge in registrations compared to the previous year, claiming a market share of 57.4% in 2023. Battery-electric vehicles (BEVs) posted the biggest growth of all powertrains over the 12 months, up 31.3% and representing 20.9% of the market. Plug-in hybrids (PHEVs) also made good progress with a 26.5% gain, alongside hybrids (including mild– and full hybrids), up by 22.7%.

Both internal-combustion engine (ICE) variants saw a decline in 2023, as diesel deliveries decreased by 10.6% in contrast to the previous year. Petrol had a much more subdued drop, down 1.1%.

The new-car market is expected to continue its recovery in 2024, although figures will still likely remain below pre-pandemic performances. Between 265,000 and 275,000 units can be expected. Reaching this number of deliveries will depend on the progress of electro–mobility, such as charging infrastructure growth, as well as developments in worldwide crises.

Recovering results

Switzerland’s used-car market has seen its supply volumes continue to recover across 2023, following a time of high demand and low supply, which helped the market prosper.

Now, available volumes exceed what was available before the COVID-19-impacted period across almost all age categories. The only exception is cars up to two years of age, with volumes down 20% on February 2020.

The number of ownership changes also recovered, after spiralling in 2022 and the first half of 2023, with a growth of 2.4% equating to 757,044 transactions. This rise is expected to continue in 2024, aided by a steady increase in new-car registrations and a larger range of used vehicles. Between 770,000 to 780,000 transactions is a rational target for the year ahead.

Asking prices plunge

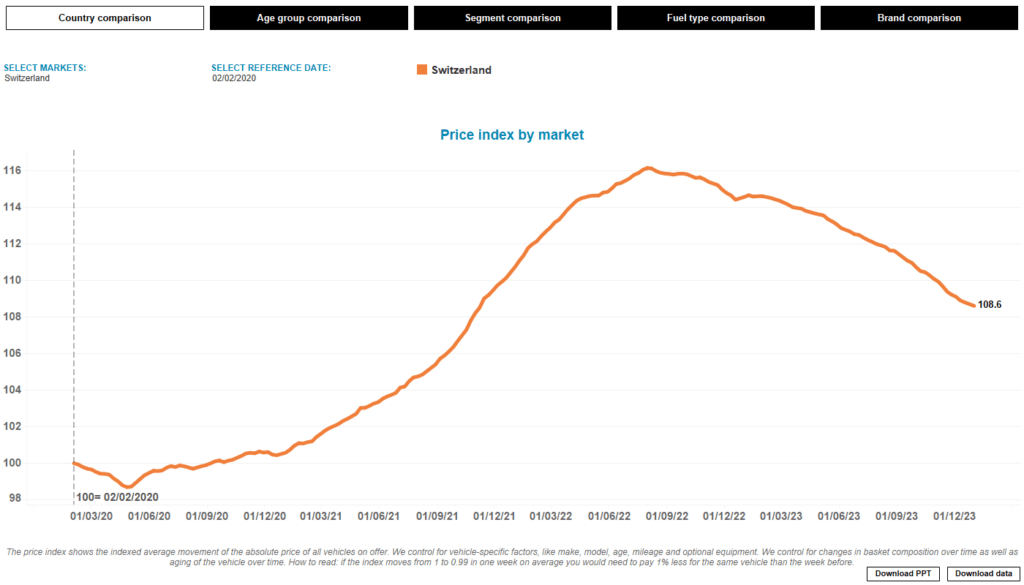

Previously high used-car asking prices have fallen significantly compared to the beginning of last year, as the market has come under pressure. This was the result of a greater supply situation and lower demand. However, offers remain above average pre-pandemic prices.

At the end of 2023, the Eurotax asking price index was still up 8% on levels recorded in February 2020, prior to COVID-19. Meanwhile, the index was around 15% higher at the end of 2022. Almost all supply prices fell significantly in contrast to 2022 when every powertrain and age category benefitted from an exceptional market situation.

One exception to this is full-hybrid vehicles, with a more muted drop in prices. For electrified vehicles overall, there was a clearer downward trend last year, especially for younger electric models, after a temporary increase in 2022 across all age groups in this market.

The new-car market and state of supply are decisive factors for the future development of the used-car market. With ongoing conflicts, greater inflation and rising energy costs, consumer demand has weakened. This is opposed by high availability of new cars that are in an escalating price war as well as a broad selection of used cars, likely leading to a further decline in residual values in 2024.

*Since the beginning of 2022, the Federal Roads Office, ASTRA, has provided figures for changes of ownership. Before that, up to and including June 2022, ASTRA supplied raw data with all changes in the Swiss vehicle stock. The analysis of changes of ownership was carried out by Eurotax, partly with assumptions. The figures calculated in this way were approximately 3% higher than the values according to ASTRA’s evaluations from 2022 onwards. Therefore, the figures for 2022 are based on ASTRA data. The values up to and including 2021 are shown according to the previous method. This must be taken into account when comparing the figures for 2022 with previous years. Comparisons are therefore only possible to a very limited extent, if at all.