Poland sees negative used-car trend in first quarter of 2023

29 March 2023

The first few months of 2023 have seen demand for new and used cars continue to fall in Poland. While this is heavily influenced by age and value, it constitutes an ongoing trend. Marcin Kardas, head of valuations at Eurotax Poland (part of Autovista Group) explains.

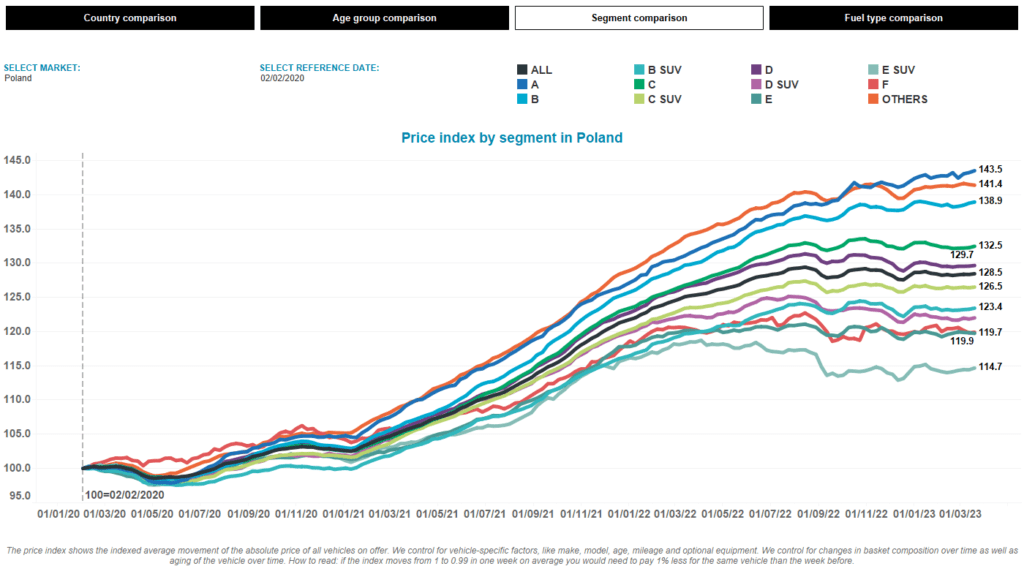

During the COVID-19 pandemic, cars in the more expensive segments reacted fastest to an economic upturn. Now, these models have been affected earliest by the financial downturn and the sharp rise in interest rates, with their sales slowing significantly since the middle of 2022. This is mainly linked to much higher financing costs.

In contrast, cheaper cars, especially in the B-segment, are still in demand with stable values. This is thanks to the huge price increase of new and used vehicles during the pandemic. Buyers with fixed budgets had to look for more affordable, older and smaller vehicles. Additionally, manufacturers have mainly offered more expensive, high-margin vehicles in the last two years, so the shortage of urban vehicles is clearly being felt.

In terms of age, cars up to 2019 are mainly cheaper, coming from fleets that have finally started to replace vehicles as availability increases. In contrast, younger cars, offered primarily by dealer networks, are still holding their value as there are very few of them on the market.

Temporary stabilisation

In early 2023, prices temporarily stabilised which may be due to a slight improvement in demand and greater interest in used cars. This is likely because of the falling value of used cars and improved availability. Considering the market situation objectively, this could temporarily halt the downward trend.

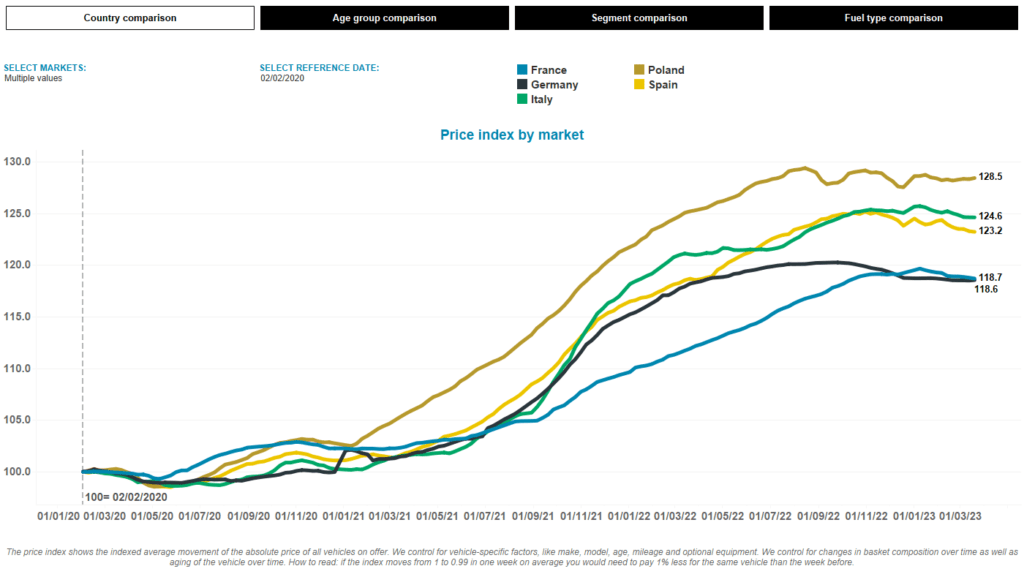

Analysing asking price volatility in Europe, similar developments can be observed regardless of market. The economic situation in the EU is similar as falling demand is a common reaction.

In Poland, fluctuations are the norm as falling used-car demand clashes with limited supply. Nevertheless, the market is returning to more regular declines in value over time. Still, values are being held back by the increase in new-vehicle prices and general scarcity on the used-car market.

As long as these slopes do not rise, Poland is unlikely to see sharp discounting and the market will remain relatively slow. It is important to remember that current used-car values are extremely high compared to levels from years ago.

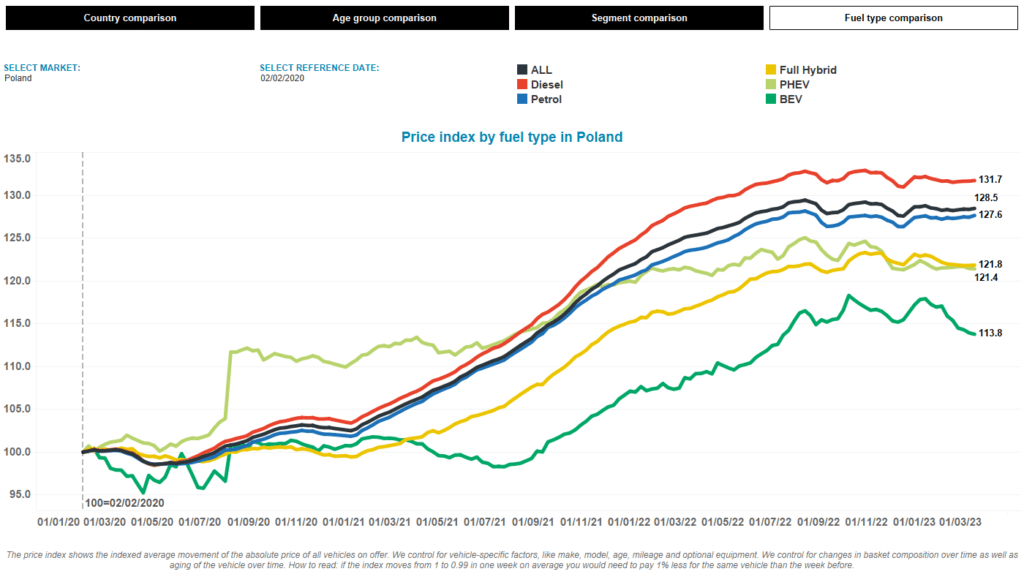

Prices by propulsion type

Analysing asking prices of different propulsion types, increases in the value of internal-combustion engine (ICE) vehicles clearly dominate. In contrast, electric vehicles (EVs) have seen limited growth. For now, their values remain relatively high, sustained by low demand and low supply.

However, information is emerging about the sale of used vehicles from the first wave of subsidised electric cars in Western Europe. At present, these are below expectations. This signifies a major problem as the aftermarket is not accepting these models enthusiastically. Subsidies focused on new vehicles while completely ignoring the used-car market, demonstrating the wrong approach to popularising electric drivetrains. Given the production cut-off dates set for ICE cars, it would be worth rethinking this strategy.

The absence of aftermarket demand also means a lack of replacement for the fleet of older ICE vehicles, something governments should care about as much as selling new cars. This problem with selling used EVs will increase their import to Poland, which will probably negatively impact their starting prices.

In terms of new-car sales, the market has not seen such a sharp collapse yet. Vehicles ordered many months ago are still being issued, and a lack of orders will take a few months to appear in official figures. Manufacturers have taken note, leading to big discounts in the more expensive segments. This means a drop in residual values (RVs) in the near term and a return to market competition.

Sales figures do not yet indicate the serious problems that are already visible in the aftermarket. By February 2023 (inclusive), 73,571 passenger cars were registered in Poland (up 17.7% year-on-year). For light-commercial vehicles (LCVs), registrations are already down 8.4% year-on-year (9,957 units) and heavy trucks are up 9.4% (5,183 units). However, it is important to note that the benchmark beginning of 2022, was a period of great variability in the production capacities of individual manufacturers. So it is difficult to measure current market trends with it.

Commercial demand

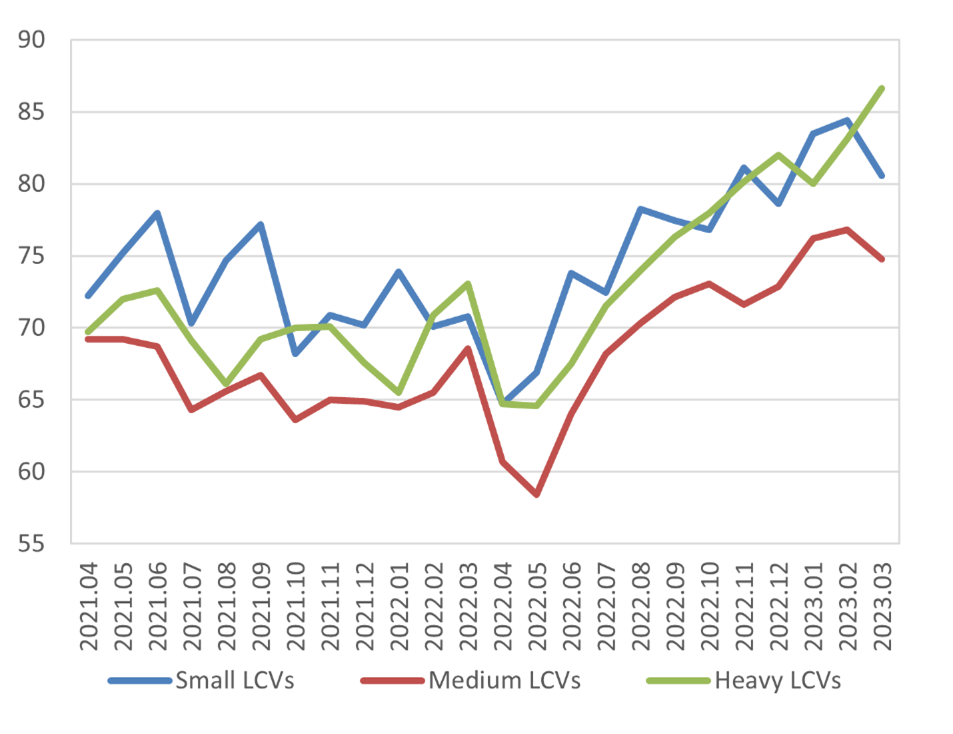

The commercial-vehicle market is experiencing more serious demand problems. Orders of new vehicles have declined sharply and used vehicles are selling more slowly. Used panel-van demand is declining sharply, reflecting issues in the courier industry that date back to the pandemic.

Economic problems and declining purchasing power are already starting to translate into the close distribution of goods. Stocks of used cars are rising and prices are falling, especially in the three to 10-year age range. Regardless of the segment, the timing of van sales also continues to increase.

Days to sell, 2021 to 2023

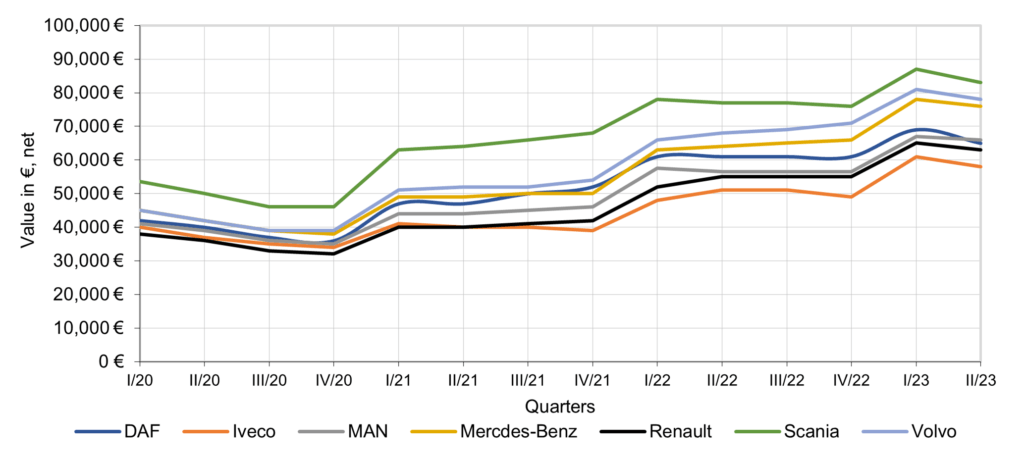

Severe impacts can be seen in the heavy-goods vehicle (HGV) segment. Declining consumption in Europe has affected freight volumes and reduced interest in used trucks. Tractor trailers have been losing value for several months, with greater discounts held back by a lack of supply.

New vehicle orders appear to be at a very high level, but many were placed almost a year ago. Additionally, production capacity outside MAN and Scania has improved and take-up times for new trucks are starting to get noticeably shorter. This indicates an increase in fleet replacement and the return of used tractors to the market.

Three-year-old long haulage tractor value, 2020 to 2023

There is currently a particular decline in demand for low-deck tractors used in international transport, which is linked to falling haulage to Western Europe. Multi-unit tippers are also suffering, marking a downturn in the construction industry. The reduction in fleets is already noticeable as the market has seen the emergence of drivers looking for work, a shortage of which has blocked the growth of the transport industry in previous years.