Will affordable electric cars lead to mass-market EV adoption?

23 March 2023

A number of carmakers have unveiled plans to build cheaper electric vehicles (EVs). Autovista24 editor Tom Geggus asks what this means for mass-market adoption of the technology.

Electrifying the mass market means overcoming a range of obstacles. Besides vehicle range and charging infrastructure availability, affordability is a primary concern. ‘High list prices put pressure on leasing rates and issues are compounded by rising interest rates and reduced government incentives in many countries,’ said Dr Christof Engelskirchen, chief economist at Autovista Group.

Mass-market model

When automotive electrification first got underway, many carmakers prioritised high-end, plug-in SUVs targeting affluent early adopters. Now, a flurry of announcements indicates more affordable electric cars are on the way.

Volkswagen (VW) recently unveiled the ID.2all concept, with a target retail price of €25,000 for the battery-electric vehicle (BEV). Production will take place at the manufacturer’s Martorell site in Spain, using the brand’s new Modular Electric Platform (MEB) Entry platform. The production version is currently expected in Europe by 2025.

‘The ID.2all shows where we want to take the brand,’ said VW Passenger Cars CEO, Thomas Schäfer. ‘We are implementing the transformation at pace to bring electric mobility to the masses.’

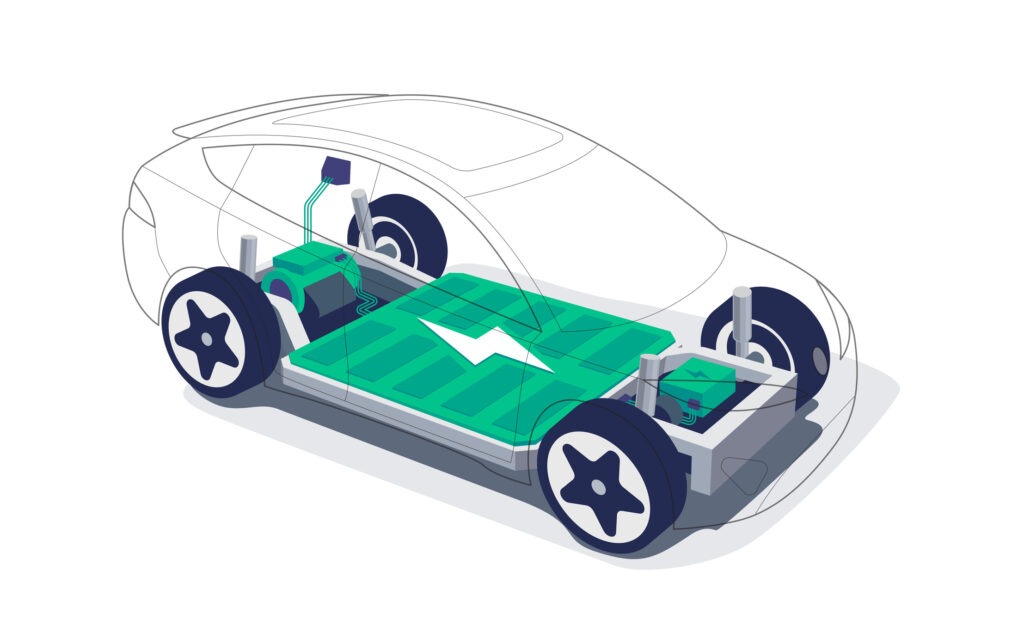

The VW.2all’s front wheel drive configuration alongside a new type of battery makes for a more affordable high voltage system. As the battery can account for up to 40% of the vehicle cost, reducing the cost of this main BEV component can drastically alter the overall vehicle price. Additionally, the carmaker can draw from existing technologies from within its MEB modular system.

Design opportunities

Designing a mass-market model is no simple task. Sam Livingstone, director of Car Design Research, highlighted how the concept’s muscularity and resolution indicated design talent. The engineering enables an incredibly large boot while the interior is equipped with a large infotainment and dial screen. VW also seems to have removed the much-maligned capacitive switches seen in its other models.

But despite all of this the ID.2all also ‘tells a story of huge missed opportunity,’ Livingstone wrote on LinkedIn. He pointed out that the design consensus appears to have been to ‘least offend the most people.’ But this is not the case with earlier models. Looking back to 1974, the Golf did not only stand out but was able to reform the market design language, he explained to Autovista24.

‘Clearly, the ID.2 will sell like hotcakes, and much because of its great engineering package and fine design resolution. How much more it could have added to the brand’s commercial success through a more distinct design theme will forever be impossible to know,’ Livingstone said.

Widespread affordability?

Another VW Group brand, Audi, is also bringing back lower-priced models, Reuters reports. Off the back of easing semiconductor shortages, the carmaker is expected to normalise its product mix. Among the 20 new models it has planned for launch by 2025, 10 will be BEVs. ‘From 2026 on we will only launch battery electric vehicles for the world market,’ the carmaker told Autovista24. ‘By 2027, we aim to offer an all-electric vehicle in the portfolio in all core segments.’

Elsewhere, Citroën’s head of design, Pierre Leclercq, told Autocar that the carmaker will aggressively price its upcoming smaller electric cars, each with a unique design language. But not every manufacturer is following the smaller and cheaper car trend. Ford has unveiled the Explorer, an all-electric SUV. Engineered and built in Germany on top of VW’s MEB platform, the BEV is anticipated to cost under €45,000.

Small in price and size

Despite the obvious cost advantages, sales of small electric vehicles – consisting of BEVs and plug-in hybrids (PHEVs) – appear to be declining. In 2020, registrations of small EVs rose some 186% year-on-year with 366,832 units. In 2021, this climb slowed to a near 43% year-on-year increase (523,102 units), before falling roughly 8% in 2022 (482,944 units).

Neil King, senior forecasting analyst at EV-volumes.com confirmed with Autovista24 that sales volumes of EVs in the A and B segments (including small MPVs and SUVs) declined 8% year-on-year in 2022, but total EV volumes increased 14%.

‘A core problem with small EVs is the affordability as the incremental cost (as a % of list price) versus internal-combustion engine (ICE) models is far higher than for larger vehicles and consumers are of course much more price-sensitive at this end of the market,’ he said. This makes it particularly challenging to make a profit in the segment.

‘The [ICE-powered] Citroen C1 and Peugeot 108 have disappeared, for example, leaving Stellantis with the Fiat 500 (and 500e). The Toyota Aygo has transformed into the Aygo X small SUV but this may yet accommodate an electric powertrain,’ King added.

Beyond affordable cars

To believe that the automotive mass market will become electrified as soon as cheaper models become available is unrealistic. While EV ranges have grown significantly, some consumers are still plagued by range anxiety, even though lack of charger availability is a far greater threat.

The European Automobile Manufacturers’ Association (ACEA) analysed the EU’s EV infrastructure. It found that in 2022 nearly 42% of all electric car charging points are concentrated between the Netherlands (111,821) and Germany (87,674). However, these two countries only make up 10% of the EU’s entire surface area. The Netherlands has nearly 70 times more points than Romania, which is roughly seven times larger.

To help tackle this issue, carmakers have been working to establish deals with infrastructure companies and provide charging solutions of their own. But encouraging the widespread uptake of EVs means fighting a battle on many fronts.

This includes lowering the prices of existing EVs, trying to build batteries locally, as well as sourcing infrastructure solutions and making mass-market models. Strategies like these look to reduce the cost to the driver while retaining a profit margin that allows the continued development of BEVs.