Portfolio effect stabilises residual values of BEVs

10 May 2021

The availability of newer BEVs as used cars is relieving the pressure from oversupply, helping RVs to stabilise or even improve. ′In the 36 month/60,000km scenario in Germany, there is a portfolio effect. This is mainly driven by the A, C and E-SUV segments. In the C segment, the second-generation Nissan Leaf was launched in 2017 and the Volkswagen e-Golf was facelifted, with a new battery pack. In the A segment, there is the facelift of the Volkswagen e-up! and in the E-SUV segment, the Tesla Model X had some unusual list-price development that pushed the %RV up,’ commented Andreas GeilenbrÜgge, head of valuations and insights at Schwacke.

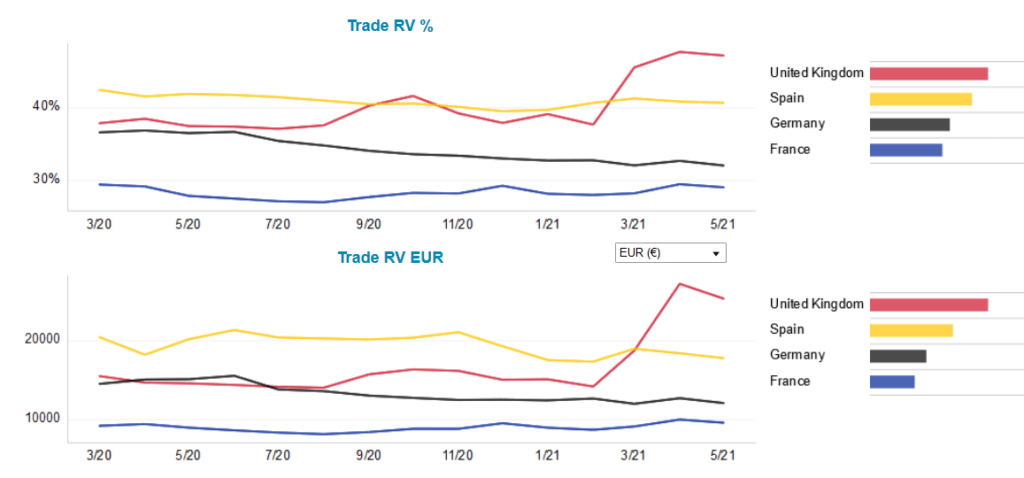

According to the European Automobile Manufacturers’ Association (ACEA), registrations of BEVs in the European new-car market (comprising the EU, EFTA and the UK) rose by 54.6% year on year in the first quarter of 2021, to over 200,000 units. To put this into context, the total passenger-car market grew by just 0.9% in Q1. This propelled the BEV share to 6.6%, up from 4.3% a year earlier. However, the ongoing surge in demand for BEVs in the new-car market is not mirrored in Europe’s used-car markets. Consequently, their RVs after 36 months and 60,000 kilometres are weaker in May 2021 than at the onset of the COVID-19 pandemic in March 2020. The exception being growth in the UK market (see chart below).

Residual-value development of BEVs, March 2020 to May 2021

Whereas the portfolio effect has stabilised RVs of BEVs in France, Germany and Spain, the impact has been significantly more pronounced in the UK. The average value retention of BEVs after 36 months and 60,000 kilometres has risen considerably since February 2021, climbing by about 10 percentage points (pp) to 47%. Further investigation reveals that this phenomenon has been driven by %RV growth in the C-segment, where the %RV of BEVs stands at 46.4% in May, compared to 35.3% in February. Similarly, the %RV of BEVs offered by brands such as Jaguar, Renault, Tesla and Volkswagen, has remained broadly stable but Nissan BEVs climbed from 37.6% in March to 46.2% in May.

Nissan Leaf drives the UK

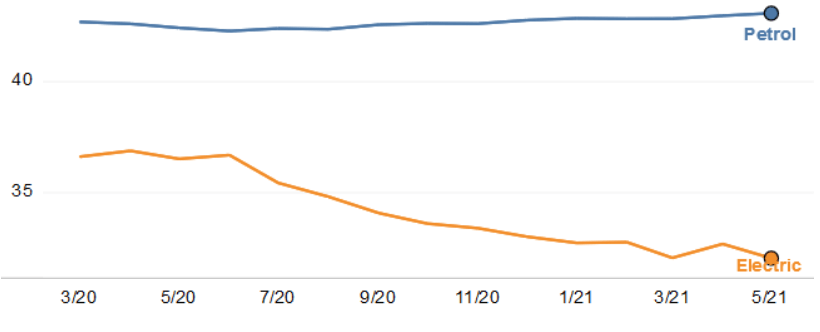

These significant improvements are a direct result of the arrival of the second-generation Nissan Leaf as a three-year-old used car in the UK market. Furthermore, the Leaf has driven the average %RV of BEVs above that of petrol cars in the UK. This is in stark contrast to other European markets, where BEVs remain at least 10 percentage points adrift of their petrol counterparts.

%RV development of petrol cars and BEVs, UK, March 2020 to May 2021

Stability not positivity

These developments should not be taken as overtly positive, however. ′The BEVs that are now coming into the used-car market are better in terms of product performance, but the share is still low and unstable in Spain,’ commented Ana Azofra, Autovista Group head of valuations and insights, Spain.

GeilenbrÜgge cautioned that ′due to the low total numbers of BEVs in the used-car market, a few newcomers are having a stabilising effect and, as their figures rise, more and more of a lifting effect. However, values of all vehicles are dropping continuously over their lifecycle and considering the upcoming volumes, this does not bode well.’

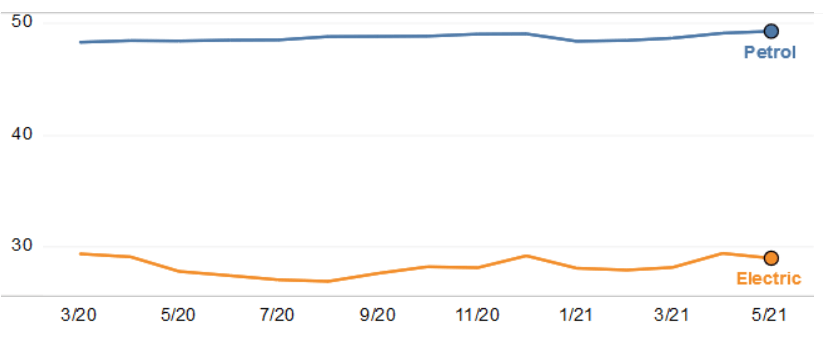

The %RV gap between BEVs and petrol cars has remained stable in France and Spain, but has even widened in Germany. The divergence has accelerated since the introduction of enhanced incentives on 1 July 2020. The federally-backed buyer incentive scheme doubled to €6,000 for BEVs costing less than €40,000, such as the Volkswagen ID.3. When paired with the manufacturer bonus of €3,000, customers are able to save €9,000. BEVs with a net price between €40,000 and €65,000, like the Audi e-Tron Sportback, are eligible for €5,000 in government subsidies, alongside a €2,500 OEM bonus.

′COVID-19 forced the German government to support the ′suffering’ automotive industry. And as it wasn’t popular to drive internal-combustion engine (ICE) sales, they decided to make a push on BEVs and plug-in hybrids (PHEVs), but not standard hybrids (HEVs), by doubling the incentives. But the lack of used-EV support puts double pressure on RVs by lowering transaction prices of new EVs with the incentive, while not incentivising used examples,’ GeilenbrÜgge emphasised.

%RV development of petrol cars and BEVs, Germany, March 2020 to May 2021

However, the biggest gap in RVs between BEVs and petrol cars remains in France. The difference in May 2021 stood at 20.3pp, slightly wider than the 19pp gap in March 2020.

′Despite the introduction of the bonus on the used-car market, sales of used BEVs remain low. France is still lacking charging points, and 25% of them are out of order, which is not supporting the development of the used-car market.’ commented Yoann Taitz, Autovista Group head of valuations and insights, France and Benelux.

%RV development of petrol cars and BEVs, France, March 2020 to May 2021

The remarketing challenge

The question, therefore, still remains – Who will buy Europe’s used-electric cars? Through a combination of government incentives, improved infrastructure, extended ranges, more choice, and the fear of CO2-emissions fines, forecasts point to electrically-chargeable vehicles (EVs) gaining a market share of around 40% in Europe by 2030, 80% of them being BEVs. For BEVs alone, that creates a €92 billion remarketing challenge, which needs to be addressed.

Unless demand for BEVs gathers pace in Europe’s used-car markets, RVs will continue to suffer, and there is a risk of oversupply to import markets too. As yet, there are no signs of saturation in these markets. In Norway, for example, registrations of new BEVs rose by 17.2% year on year in the first quarter of 2021, gaining a 52.8% market share. Moreover, demand is expected to grow by 13% annually over the next five years, according to Rodboka (part of Autovista Group) in Norway. However, this may no longer be sufficient to resolve the RV conundrum created by the government incentives for BEVs across Europe.

′The entire Norwegian new-car market is about 150,000 vehicles a year, so let’s assume they take 100,000 used cars up to four years of age per annum. Germany alone ′produced’ 230,000 used EVs in 2020, with different future ages, depending on whether they were fleet or tactical registrations. Thinking optimistically of 60% being absorbed locally, how many of the remaining 90,000 used cars should Norway import to solve our volume problem? And registrations of new EVs are still growing,’ questioned GeilenbrÜgge.

Used BEVs also face another challenge, from potentially more affordable new entries. For example, Chinese manufacturer NIO has announced Norway as its entry point into the European market. The Asian powerhouse’s carmakers are sizing up the electrifying European market and will certainly look to increase their footprint beyond Norway.

All governments should look into providing incentives to encourage used-BEV ownership, but these do not need to be straightforward purchase incentives. Lower energy costs for charging BEVs and visible expansion of the charging network would also be powerful signals.