Semiconductors and ‘pingdemic’ suppress UK new-car market in July

05 August 2021

The recovery of the UK new-car market was again on hold in July as shortages of both staff and semiconductors limited the volume of registrations. Autovista24 senior data journalist Neil King explores the figures and factors.

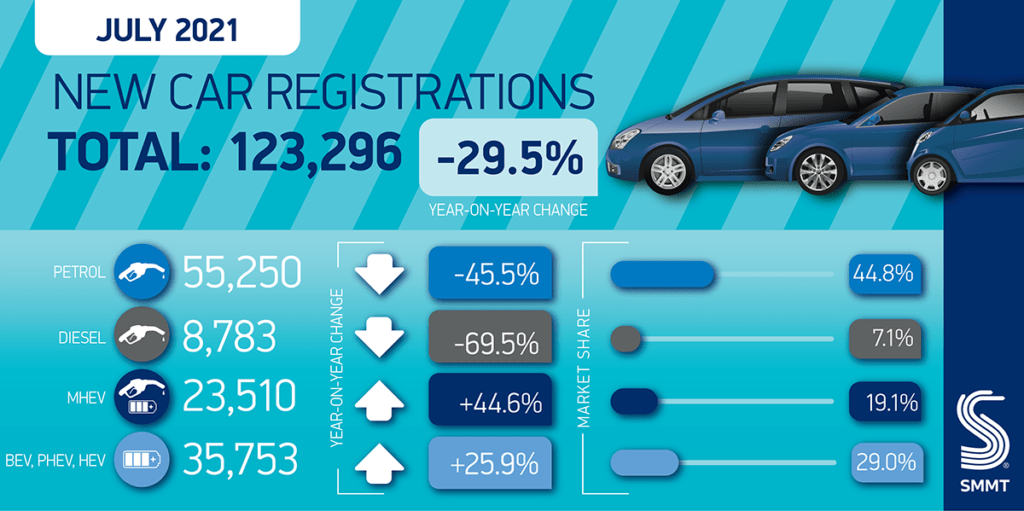

In total, 123,296 new cars were registered in the UK in July, according to data released by the Society of Motor Manufacturers and Traders (SMMT). This is 22.3% lower than the 10-year monthly average, between 2010 and 2019, of 158,000 registrations.

The ongoing semiconductor shortage that is afflicting the automotive industry has been compounded by a ‘pingdemic’ in the UK. If people are ‘pinged’, i.e. receive notification via a mobile-phone app that they have been in contact with someone infected with COVID-19, they should self-isolate for 10 days. Although this is not a legal requirement, it is taking many potential car-buying consumers out of the equation and is also causing staff shortages for businesses.

‘As a result, this was the weakest July for new-car registrations since 1998, prior to the introduction of the two-plate system,’ stated the SMMT.

As UK dealers emerged from lockdowns, year-on-year comparisons with 2020 are meaningless Therefore, comparisons are made against 2019, which better represent the true performance of the country’s new-car market. Initially, the 21.6% contraction last month suggests the market has deteriorated since the 16.7% decline in June. However, there were two more working days this year than in June 2019, and one less in July. On an adjusted basis, Autovista24 calculates that the market declined by 18% in July, representing an improvement on the adjusted 24% fall in June. Similarly, the seasonally-adjusted annualised rate (SAAR) improved to 1.86 million units in July, from 1.8 million in June, when working days are factored in.

Forecast downgrade

Although the UK was not as disrupted as some European markets in July, the suppression of registrations activity is delaying the anticipated recovery. In the first seven months of this year, the market has contracted by 27.6% compared to the same period in 2019. Whereas the ‘pingdemic’ should subside as COVID-19 cases reduce and the UK government relaxes the self-isolation rules, the shortage of semiconductors is expected to persist into next year.

‘The automotive sector continues to battle against shortages of semiconductors and staff, which is throttling our ability to translate a strengthening economic outlook into a full recovery. The next few weeks will see changes to self-isolation policies which will hopefully help those companies across the industry dealing with staff absences, but the semiconductor shortage is likely to remain an issue until at least the rest of the year,’ said SMMT chief executive Mike Hawes.

Accordingly, Autovista24 has reduced its 2021 forecast to 1.86 million units, equating to 14% year-on-year growth and a fall of 19.6% compared to 2019.

Similarly, the SMMT has revised its outlook downward and forecasts 1.82 million registrations in 2021. ‘This is still some 11.7% up on 2020, but down around 21.8% on the average new-car market recorded over the past decade,’ the association emphasised.

Plug-in positivity

Although the UK automotive sector continues to grapple with COVID-19 and supply constraints, there is positive development of electrically-chargeable vehicles (EVs). Battery-electric vehicles (BEVs) accounted for 9% of UK new-car registrations in July, and plug-in hybrids (PHEVs) captured a further 8% share.

‘The bright spot remains the increasing demand for electrified vehicles as consumers respond in ever greater numbers to these new technologies, driven by increased product choice, fiscal and financial incentives and an enjoyable driving experience,’ commented Hawes.

The SMMT estimates that BEVs and PHEVs will account for 9.5% and 6.5% of registrations respectively in 2021, ‘collectively totalling around 290,000 units.’

In the first seven months of the year, the petrol share of the market, including mild hybrids (MHEVs), was just above 60%, and diesels accounted for less than 17% of all registrations.

The combined share of hybrids and EVs, 23.2%, already exceeds the diesel share. HEVs still account for the highest number of electrified registrations, with a share of 8.4%, but are closely followed by BEVs, with 8.2%.