Supply shortages continue to restrain UK new-car market in August

06 September 2021

The recovery of the UK new-car market was derailed again in August as supply shortages limited the volume of registrations. Autovista24 senior data journalist Neil King explores the latest developments.

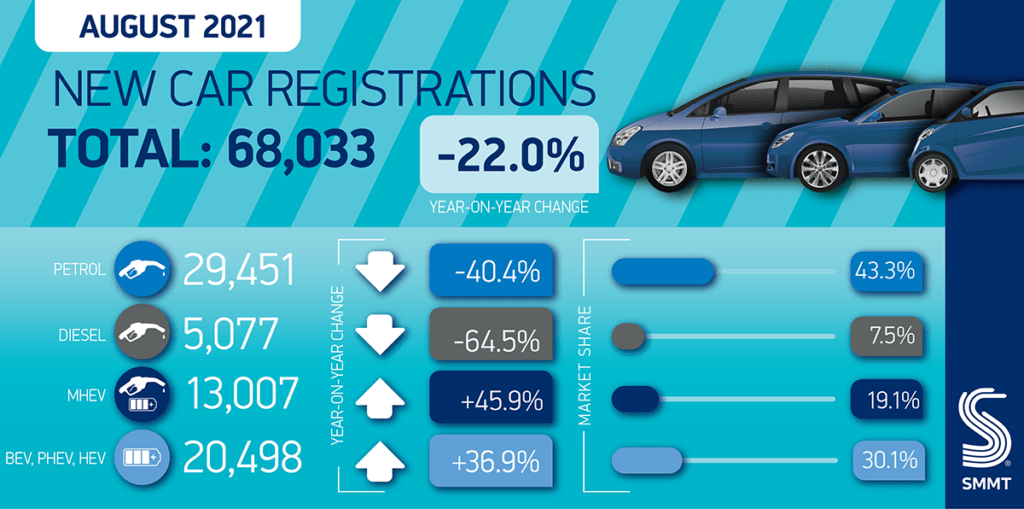

In total, 68,033 new cars were registered in the UK last month, according to data released by the Society of Motor Manufacturers and Traders (SMMT). This is 7.6% lower than the 10-year monthly average (between 2010 and 2019) of over 73,000 registrations, and the weakest performance for August since 2013. The SMMT attributes this ‘in part to constrained supply as the global shortage of semiconductors, an issue born of the pandemic, continues to undermine production volumes.’

As UK dealers emerged from lockdowns, year-on-year comparisons with 2020 are meaningless. Therefore, comparisons are made against 2019, which better represent the true performance of the country’s new-car market.

The 26.5% contraction last month is a clear deterioration from the 21.6% decline in July. Moreover, there was one less working day in July this year than in 2019 and, on an adjusted basis, Autovista24 calculates that the market ‘only’ declined by 18%.

Subtle forecast downgrade

Although the downturn in the UK was not as pronounced as in other major European markets in August, the supply constraints have further delayed the anticipated recovery. In the first eight months of this year, the market has contracted by 27.5% compared to the same period in 2019.

The August and year-to-date performance was only slightly weaker than Autovista24’s expectations. Nevertheless, as the shortage of semiconductors is expected to persist into next year, Autovista24 has subtly reduced its 2021 forecast to 1.85 million units, equating to 13.5% year-on-year growth and a fall of 19.9% compared to 2019.

‘While August is normally one of the quietest months for UK new-car registrations, these figures are still disappointing, albeit not wholly surprising. The global shortage of semiconductors has affected UK, and indeed global, car-production volumes so new-car registrations will inevitably be undermined. Government can help by continuing the supportive Covid measures in place currently, especially the furlough scheme, which has proven invaluable to so many businesses,’ said SMMT chief executive Mike Hawes.

In its latest quarterly forecast update, the SMMT predicted 1.82 million registrations in 2021. ‘This is still some 11.7% up on 2020, but down around 21.8% on the average new-car market recorded over the past decade,’ the association emphasised.

Electrifying growth

Although the UK market is contending with supply shortages, demand for electrically-chargeable vehicles (EVs) is surging. Battery-electric vehicles (BEVs) accounted for 10.9% of UK new-car registrations in August, and plug-in hybrids (PHEVs) captured a further 7.4% share. The combined 18.3% share of EVs far surpassed the diesel share, including mild-hybrid diesels, of 12.4%.

‘In fact, demand [growth] for PHEVs has outpaced BEVs in five of the last six months since changes to the Plug-in Car Grant, affecting BEVs, were introduced in March. There are now some 130 plug-in models on the market, with the range ever-increasing,’ the SMMT noted.

In the first eight months of 2021, BEVs and PHEVs captured 8.4% and 6.6% market share respectively. Hybrids (HEVs) still account for the highest number of electrified registrations, with a share of 8.7%, but are closely followed by BEVs. Combined, the 15% share of EVs is increasingly challenging the diesel share, which is at 16.4% in the year-to-date.

‘As we enter the important September plate-change month with an ever-increasing range of electrified models and attractive deals, buyers in the market for the new 71 plate can be reassured manufacturers are doing all they can to ensure prompt deliveries,’ commented Hawes.

The SMMT estimates that BEVs and PHEVs will account for 9.5% and 6.5% of registrations respectively in 2021, ‘collectively totalling around 290,000 units.’