Swiss new-car registrations inch up in February while used-car market takes a hit

14 March 2022

Hans-Peter Annen, head of valuations and insights Switzerland at Eurotax (part of Autovista Group), analyses how the Swiss automotive market is holding up.

The latest figures for February show that the new-car markets in Switzerland and Liechtenstein have not yet found their way out of the crisis. This comes at a time when the COVID-19 pandemic is fading into the background as the war in Ukraine overshadows market developments and adds to the strained delivery situation for new cars in Switzerland. The grim events in Eastern Europe are disrupting production and bringing orders to a halt due to a shortage of components such as cable harnesses.

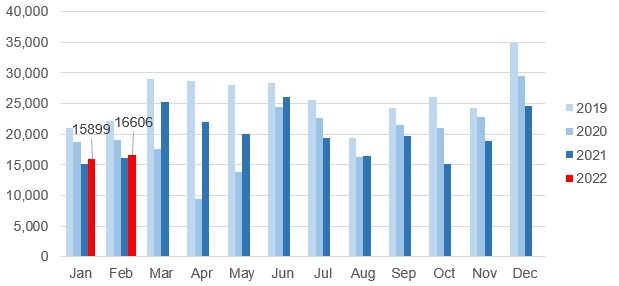

Last month, 16,606 cars were newly registered, up 2.9% year on year – but compared to 2019, new-car registrations were down 25.1%. For the first quarter, only a marginal improvement can be expected. Meanwhile, for the remainder of the year, new-vehicle registrations are unlikely to recover due to the war in Ukraine, with delivery times expected to increase even further.

New-car registrations by month: 2019-2022

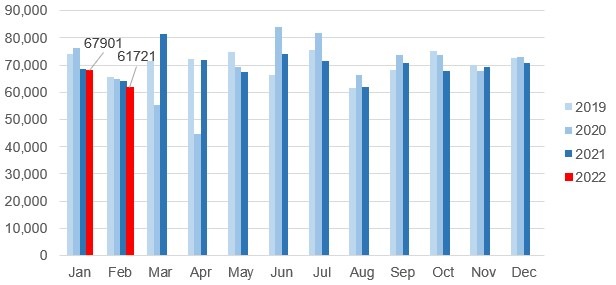

The used-car market, on the other hand, has been on a high since the summer months of 2020, and is underpinned by stable demand combined with low supply. In 2020 as a whole, used-car registrations amounted to 830,634, down slightly by 2.1% and sitting just below the previous year’s figure of 848,100. Additionally, in 2021, used-car registrations inched up by 1.1% to 840,044, almost reaching the same pre-pandemic level seen in 2019.

Used-car registrations by month: 2019-2022

Stability for used cars slipping

But now, this upward trend seems to have been broken. In February 2022, the number of cars changing owners was down to 61,721 vehicles from the previous year’s figure of 64,324, marking a decline of 4.5%. The coming, high-volume months will show whether this downward development will continue. Currently, the low registration figures for new cars do not bode well as only cars that are available on the market can be sold and exchanged.

The ongoing supply shortage has not worsened in recent weeks and has instead stagnated at a low level. However, the volume of active offers on the market is still down 29% when compared to the beginning of February 2020, just before COVID-19 took its toll. Prices for diesel and petrol vehicles have benefited from this deficit, whereas plug-in hybrids have profited to a lesser extent. Battery-electric vehicles (BEVs) across all age groups have not yet made up for the losses seen in recent months.

For the used-car market, further developments will depend on the supply chain situation. As long as new-car registrations sit significantly below pre-pandemic levels, the supply of used vehicles will remain scarce and prices will continue to rise. Residual values are likely to increase further in the coming months before stabilising again in 2023 – but only if the used-car supply improves significantly due to a notable rise in new-car registrations. Unfortunately, this will not likely be the case in the near future.