Thriving used-car markets across Europe? Yes, but not for every powertrain

08 September 2021

COVID-19 has stimulated demand for the used car; the semiconductor shortage has restricted supply. No doubt, used-car markets across Europe are performing exquisitely. Dr Christof Engelskirchen, chief economist of Autovista Group, explores which powertrain types are the winners, which the losers, and why.

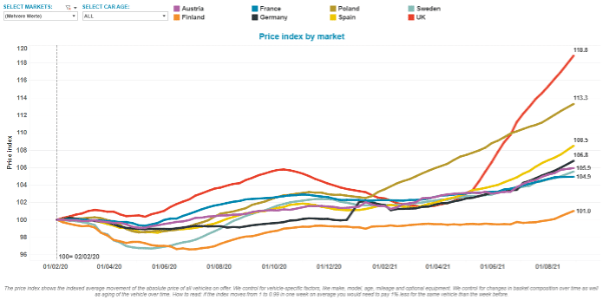

Europe’s used-car markets have come through the recent crises that have beset the automotive industry rather unscathed. After an initial dip in prices, which was more pronounced in Sweden and Finland (see chart below) that had no or a very limited lockdown of dealers due to COVID-19, all markets recovered swiftly and are performing above pre-pandemic levels. Trends are still pointing upwards. In the charts and tables below, we show the price index for used cars, controlling for changes in mix. They capture the evolution of prices for the same selection of vehicles from week to week. Rising curves show that retailers are able to command more money for the same car.

Price-index development from February 2020 to August 2021– weighted across powertrain types/age groups

The UK presents the most elastic used-car market, as Brexit and supply-chain challenges unique to this import market have added fuel to the fire. Used-car prices are up 19% in the UK vs. 18 months ago.

Prices in Poland have been rising steeply (+13%) due to a swift economic recovery and the continued supply shortage of used cars, which were available in abundance before 2020.

Not at the same magnitude, but still consistently across Europe, pent-up demand and an economic recovery are heating up used-car prices. All European markets have seen a substantial rise, but at levels around 5- 9%, typically. This correlates with the speed of economic recovery post lockdowns and with unmet pent-up demand.

Record prices for diesel and petrol cars

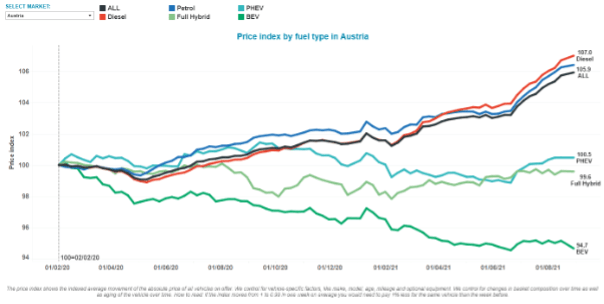

Diesel and petrol cars still account for roughly 95% of used-car transactions in Europe. While diesel market shares fall swiftly for new cars, their share on used-car markets is coming down at a much slower pace. Diesel models still make up nearly half of used-car transactions in many markets. If you look at how their prices have been developing over the past 18 months, you can see that they are the true winners of the pandemic (see chart below).

In Austria, prices for diesel cars are up 7% vs. pre-pandemic levels and petrol cars 6%. The direction Austria has been taking is representative of what we see happening in many markets. The magnitude of each of the trends varies across markets, though.

It also shows that used-car buyers have not yet adopted electrically-chargeable vehicles (EVs) as an alternative to the internal-combustion engine (ICE).

Price-index development from February 2020 to August 2021 in Austria – by fuel type across age groups

Going one level deeper, older used-cars (54-90 months) and budget cars (91 months and older) are still under particularly high demand and driving these curves up.

Difficult times for BEVs on Europe’s used-car markets

Dealers have faced challenges selling battery-electric vehicles (BEVs) over the past 18 months. With the exception of the UK (see table below), where BEV prices rose by 2.8%, prices have come under pressure. This is not surprising and occurs due to a combination of factors:

- BEVs are facing a higher lifecycle depreciation on used-car markets as new models enter the market. These offer higher suitability for daily use at similar list-price levels. We have recently explored these BEV remarketing challenges in more detail

- High incentives for BEVs in many markets compound the issue. Austria, France, Germany, Spain and many other markets offer substantial and direct purchase incentives, which brings transaction prices down. This price pressure washes through to used-car markets instantly

- Used-car markets have not (yet) adopted the BEV as an alternative to ICE vehicles. This will only be a matter of time, but it requires attention by governments and stakeholders as a rising number of BEVs will soon hit Europe’s used-car markets.

Price-index development 28 August 2021 vs. 2 February 2020 in % for selected countries – by fuel type across age groups

More incentives for BEV ownership

Europe’s green agenda is one of the strongest industrial policies we have seen in a while. Therefore, electrification is an automotive megatrend that is easier to forecast than other trends. In the coming years, we will continue to observe the phase-out of pure ICE vehicles as OEMs seek to comply with the toughening CO2-thresholds. We expect that this will manifest itself in stable, and possibly rising, residual values for ICE vehicles over the coming years – for both petrol and diesel variants. These are still in high demand across many European markets, in particular in those where economies are recovering swiftly and that have been reliant on used-car imports to meet their mobility demands.

Governments and cities should stimulate demand for used BEVs by incentivising not just the purchase but also their ownership. There are plenty of ideas and case studies out there – not just in Norway – which can serve as blueprints of how to drive used-car market adoption of BEVs.

We now have valuable evidence at what transaction-price levels the demand for EVs is stimulated. OEMs need to work hard to hit those transaction prices without relying much longer on government subsidies. They are bound to be phasing out as well over the next decade.

We will revisit this topic and the blueprints for stimulating EV used-car market adoption during our next Autovista24 webinar on ‘The EV-Subsidies Gamble – Impact on New- and Used-Car Markets’ on 22 September.