UK new-car market approaches pre-pandemic levels in February

09 March 2023

Confidence is growing in the UK new-car market as February marked the seventh consecutive month of year-on-year growth, explains senior data journalist Neil King.

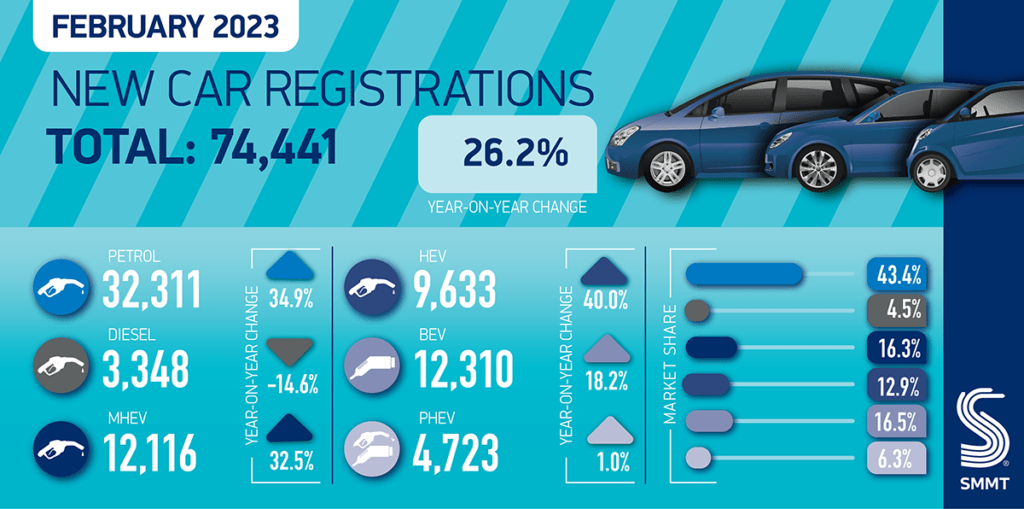

The Society of Motor Manufacturers and Traders (SMMT) reports that new-car registrations in the UK increased 26.2% year on year last month, to 74,441 units. This exceeded Autovista24’s expectations and represents the strongest growth rate since October 2022.

The seasonally-adjusted annualised rate (SAAR) surged to 2.35 million units ‘as easing supply chain shortages steered the market closer to pre-pandemic levels, down just 6.5% on the same month in 2020,’ the association noted.

‘After seven months of growth, it is no surprise that the UK automotive sector is facing the future with growing confidence. It is vital, however, that government takes every opportunity to back the market, which plays a significant role in Britain’s economy and net-zero ambition. As we move into “new plate month” in March, with more of the latest high-tech cars available, the upcoming budget must deliver measures that drive this transition, increasing affordability and ease of charging for all,’ commented SMMT chief executive Mike Hawes.

Lower de-fleeting ahead

The cost-of-living crisis shows no sign of abating in the short term. Although the consumer prices index (CPI) receded slightly to 10.1% in the 12 months to January, inflation remains a persistent issue in the UK. Furthermore, the Bank of England increased interest rates by a further 0.5% to 4% on 1 February, only weeks after hiking them by 0.5% on 14 December. The financial institution foresees the bank rate rising to around 4.5% in mid-2023 and falling back to just over 3.25% in three years’ time.

Alongside this, while supply bottlenecks continue to ease, the semiconductor shortage is unlikely to disappear in 2023. Additionally, COVID-19 lockdowns decimated the UK new-car market between March and June 2020, which will significantly reduce the volume of cars de-fleeting after three years in the coming months.

Nevertheless, the strength of the market in recent months, buoyed by supply improvements, means Autovista24 has increased its 2023 forecast by 62,000 units to 1.88 million. This equates to 16.3% year-on-year growth but a contraction of 18.8% compared to pre-pandemic 2019.

The downside of recovering supply is that new-car registrations will be less bolstered by fulfilling a backlog of orders. New-car demand will also continue to suffer from weak consumer confidence, high interest rates and inflation. Accordingly, Autovista24 has also reduced its growth-rate forecast for 2024 to 2.3%, down from 4.8% last month.

Every sixth car is a BEV

The SMMT highlighted that ‘hybrid-electric vehicles (HEVs) recorded the most significant growth of all fuel types, up 40%, followed by petrol [including mild hybrids], up 35.8% with a 56.9% market share, while diesel registrations [including mild hybrids] fell by 7%.’

Meanwhile, registrations of new battery-electric vehicles (BEVs) increased 18.2% year on year and gained a market share of 16.5%, accounting for every sixth car registered new in the UK last month.

Plug-in hybrids (PHEVs) only gained 1%, with their share falling to 6.3%, replicating the downward trend across Europe. Nevertheless, the gap in share between PHEVs and diesel cars (including mild-hybrid diesels) has narrowed to just one percentage point.

‘Combined, plug-ins accounted for almost a quarter (22.8%) of all deliveries in the month, with further growth anticipated. Indeed, nearly half a million (488,000) PHEVs and BEVs are expected to join Britain’s roads in 2023, as manufacturers bring more than 40 new plug-in electric models to the market,’ the association noted.

‘As the new UK car market looks towards a year of double-digit growth, the Spring budget is an important opportunity to shape Britain’s net-zero progress and deliver an equitable transition for all. This should include a long-term plan for charge-point investment, aligning VAT on public charging with domestic energy use, and reviewing the vehicle excise duty premium that will unfairly penalise EV buyers switching to this inevitably more expensive technology in the future,’ the SMMT concluded.