UK new-car market recovery strengthens in November

07 December 2022

The UK’s new-car market recorded its fourth consecutive month of year-on-year growth in November. Moreover, the recovery strengthened following the market’s rebound in October and exceeded Autovista24’s expectations for the month.

‘The growth delivered the best total for November since 2019, with manufacturers continuing efforts to fulfil orders amid erratic global components supply,’ the Society of Motor Manufacturers and Traders (SMMT) commented.

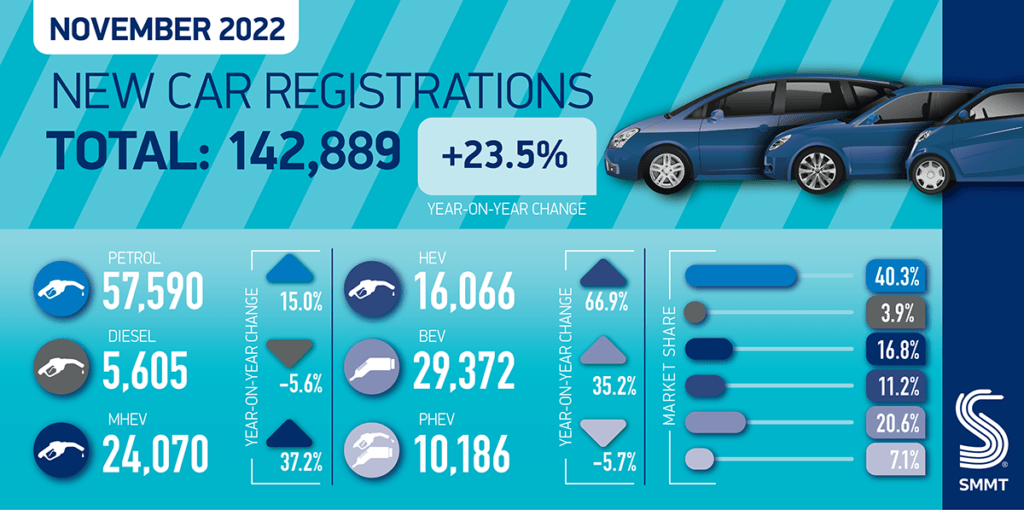

The SMMT reports that new-car registrations increased 23.5% year on year last month, to 142,889 units. This is slightly weaker than the 26.4% growth in October but is against a higher base of comparison. Autovista24 calculates that the seasonally-adjusted annualised rate (SAAR) improved to 2.08 million units after falling just short of the two-million mark in October.

However, the SMMT emphasises that ‘registrations in the month were still 8.8% below 2019 levels.’ With fewer than 1.45 million new cars registered, the market has contracted by 3.4% in the year-to-date and is more than 30% smaller than in pre-COVID 2019.

Forecast upgraded despite economic challenges

Although supply shortages persist, the improvement last month suggests that the UK could end 2022 with a ‘final spurt’ like Germany. Autovista24 expects the growth rate in December to be lower than in November, largely because there is one less working day than in December 2021. Nevertheless, the 2022 forecast has been revised upwards to 1.61 million new-car registrations, down 2.1% on 2021.

On one hand, the cost-of-living crisis shows no sign of abating and the outlook for the country’s automotive sector remains particularly uncertain. On the other hand, supply improvements mean Autovista24 has maintained its 13.3% growth outlook for 2023. Given the higher assumed 2022 base, however, the volume forecast has been upgraded to 1.83 million units, from 1.79 million.

‘While further recovery is anticipated in 2023, global and domestic economic challenges mean that the market will remain below pre-pandemic levels,’ the SMMT cautions.

The downside of recovering supply is that the market will be less bolstered by fulfilling a backlog of orders. Furthermore, new-car demand will continue to suffer from weak consumer confidence, rising interest rates and high inflation.

The consumer prices index (CPI) rose further to 11.1% in the 12 months to October 2022 and the Bank of England increased interest rates by 0.75% to 3% on 3 November. Finally, the average energy price cap will increase from £2,500 (€2,900) to £4,500 (€5,220) from April 2023, and unemployment is expected to rise too.

Against this backdrop, Autovista24 has cut its growth forecast for 2024 to 4.8%, taking the market to 1.91 million units.

BEVs gain, PHEVs fall

Despite the UK government’s termination of the plug-in car grant (PiCG) on 14 June, registrations of new battery-electric vehicles (BEVs) gained 35.2% year on year in November, accounting for ‘more than one in five new cars (20.6%) – the largest monthly share of BEVs this year,’ according to the SMMT.

Conversely, plug-in hybrids (PHEVs) declined 5.7% year on year with their share falling to 7.1%, replicating the downward trend across Europe. Nevertheless, electric vehicles (EVs) represented more than one in four new cars (27.7%) registered in November.

‘Hybrid-electric vehicles (HEVs), meanwhile, rose by 66.9% to [capture] 11.2% of the market, driven particularly by fleet operators looking for flexibility and emissions reductions,’ the SMMT notes.

‘Recovery for Britain’s new-car market is back within our grasp, energised by electrified vehicles and the sector’s resilience in the face of supply and economic challenges. As the sector looks to ensure that growth is sustainable for the long term, urgent measures are required – not least a fair approach to driving EV adoption that recognises these vehicles remain more expensive, and measures to compel investment in a charging network that is built ahead of need. By doing so we can encourage consumer appetite across the country and accelerate the UK’s journey to net zero,’ surmised SMMT chief executive Mike Hawes.

End to EV tax exemptions

In the 2022 autumn statement, the UK government announced that EVs will no longer be exempt from vehicle excise duty (VED) from 1 April 2025. ‘This will ensure that all road users begin to pay a fair tax contribution as the take up of electric vehicles continues to accelerate.’

The statement outlines the proposed changes, which the government will legislate for in the autumn finance bill, as follows:

• New zero-emission cars registered on or after 1 April 2025 will be liable to pay the lowest first year rate of VED (which applies to vehicles with CO2 emissions 1 to 50g/km) currently £10 a year. From the second year of registration onwards, they will move to the standardrate, currently £165 a year

• Zero-emission cars first registered between 1 April 2017 and 31 March 2025 will also pay the standard rate

• the Expensive Car Supplement exemption for electric vehicles is due to end in 2025. New zero emission cars registered on or after 1 April 2025 will therefore be liable for the expensive car supplement. The Expensive Car Supplement currently applies to cars with a list price exceeding £40,000 for 5 years

• Zero and low-emission cars first registered between 1 March 2001 and 30 March 2017 currently in Band A will move to the Band B rate, currently £20 a year

Company car tax rates for EVs will also change, increasing by one percentage point in the tax years 2025-26, 2026-2027 and 2027-2028 - up to a maximum of 5% for electric cars and 21% for ultra-low emission cars emitting less than 75g CO2/km.

‘We recognise that all vehicle owners should pay their fair share of tax, however, the measures announced today mean electric car and van buyers – and current owners – will face a significant uplift in VED. The sting in the tail is the VED supplement, which will unduly penalise these new, more expensive vehicle technologies. The introduction of taxes should support road transport decarbonisation, and the delivery of net zero, rather than threaten both the new and second-hand EV markets,’ said Hawes in the SMMT’s reaction to the statement.

Ford also issued a response, in which Tim Slatter, Ford UK chairman, said: ‘Unfortunately, today’s announcement by the government to impose VED for electric vehicles from 2025 is a short-sighted move. We are still many years from the ‘tipping point’ when electric vehicles will reach cost parity with petrol and diesel vehicles. Until then, we should be incentivising customers to make the greener choice.’

As the share of new cars powered by internal-combustion engines (ICE) is in sharp decline, governments need to address the shortfall in their finances by not only reducing incentives for EVs but also taxing them. In July, Switzerland announced plans to tax EVs to plug the funding gap and other countries beyond the UK will inevitably follow their lead.