UK new-car market outlook weakens despite July improvement

04 August 2022

The UK new-car market suffered its fifth consecutive month of year-on-year declines in July, although the downturn was less pronounced than in the preceding four months. With one less working day than in July 2021, the contraction was comparatively benign on an adjusted basis.

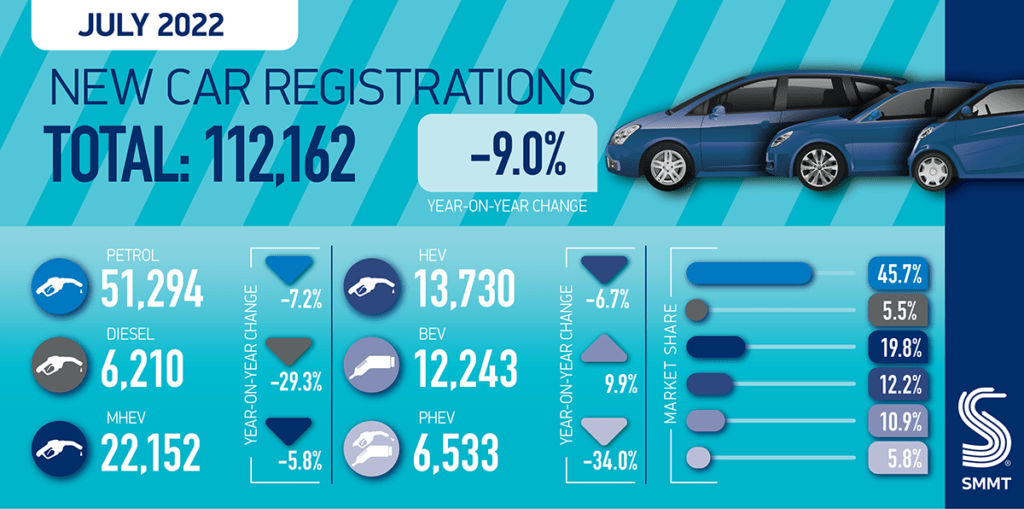

The latest figures from the Society of Motor Manufacturers and Traders (SMMT) show that 112,162 new cars were registered in the UK last month, equating to a 9% fall year on year following the dramatic decline of 24.3% in June, partly because of the Queen’s Platinum Jubilee.

‘Ongoing global supply-chain issues, predominantly the lack of semiconductors, continued to frustrate order fulfilment, exacerbated by COVID-19 lockdowns in key manufacturing and logistics centres in China, plus disruption from the war in Ukraine, all of which restricted production output and thus supply into the UK new-car market,’ the association explained.

Adjusted for working days, Autovista24 estimates that the year-on-year fall was 4.7% last month, marking a major improvement on the adjusted 16.7% downturn in June. Similarly, the seasonally-adjusted annualised rate (SAAR) increased from 1.62 million units to 1.72 million.

The ongoing recovery of the UK’s automotive sector is in contrast to the loss of momentum in France, Italy, and Spain, as well as Germany, which is ‘in reverse gear.’

The volume of new-car registrations last month also aligned perfectly with Autovsita24’s July forecast. This suggests that the heatwave experienced in July was less debilitating for the UK’s new-car trading environment than across continental Europe.

However, the outlook for the UK new-car market is also weaker as inflation and interest rates continue to rise, and the country is expected to enter recession in the fourth quarter of 2022.

Recession projected, inflation and interest rates rise

UK new-car registrations declined by 11.5% year on year in the first seven months of 2022, to 914,241 units. ‘The first half of the year has proved more challenging than anticipated, due to the enduring severity and impact of the semiconductor shortage and global conflict,’ the SMMT commented.

Although the UK new-car market performed in line with Autovista24’s expectations for July, and supply is expected to improve throughout the remainder of 2022, the economic fallout from global events will inevitably suppress underlying demand.

The consumer prices index (CPI) rose by 9.4% in the 12 months to June 2022, up from 9.1% in May. The Bank of England (BoE) expects CPI inflation to ‘rise to just over 13% in 2022 Q4, and to remain at very elevated levels throughout much of 2023, before falling to the 2% target two years ahead.’

In an attempt to meet the inflationary target, the BoE increased interest rates by 0.5 percentage points on 4 August, to 1.75%. This is the biggest single rise in 27 years and interest rates are now at their highest level since December 2008. ‘The United Kingdom is now projected to enter recession from the fourth quarter of this year. Real household post-tax income is projected to fall sharply in 2022 and 2023, while consumption growth turns negative,’ the BoE stated.

This stark warning also comes after the UK government terminated the plug-in car grant (PiCG) in June, which offered up to £1,500 (€1,740) off the cost of a new electric car.

In this context, Autovista24 has revised its 2022 forecast for UK new-car registrations downward, to 1.64 million units. This equates to a year-on-year decline of 0.3%, and a 28.9% contraction compared to the pre-pandemic level of 2019. The SMMT has also reduced its outlook for 2022, to 1.6 million new-car registrations, ‘with the industry facing its most challenging year for three decades.’

‘Around two million registrations have been lost since COVID-19, effectively representing a loss of a year’s registrations,’ the association added.

Countless new-car orders will not be fulfilled this year, but the weaker demand assumption means the Autovista24 registrations outlook for 2023 has also been reduced, to below two million units.

'Although the 2023 outlook has also been revised downwards since the April estimate, it is likely to be an improvement on 2022, with overall registrations anticipated to reach 1.89 million (rather than 2.02 million),’ the SMMT noted.

BEV uplift ‘weakest since the pandemic’

Despite the overall market decline and the withdrawal of the PiCG on 14 June, registrations of new battery-electric vehicles (BEVs) grew 9.9% year on year in July. With 12,243 units registered, BEVs gained a 10.9% market share, up from 9% a year earlier.

‘Although this is the weakest monthly uplift recorded by BEVs since the pandemic, overall growth in the year has reached 49.9% to deliver a 13.9% market share, illustrating the volatility in the supply chain. July was a weaker month for hybrid-electric vehicle (HEV) uptake, with registrations falling 6.7% to take 12.2% of the market. Plug-in hybrids (PHEVs) fell 34%, which cut their market share to 5.8%,’ the SMMT highlighted.

Electric vehicles (EVs), comprising BEVs and PHEVs, accounted for one in five new-car registrations in the first seven months of 2022. Although the termination of the PiCG, along with rising interest rates and inflation, will have a detrimental impact on EV uptake, their 2022 share ‘will continue to grow, to reach 22.6% as manufacturers prioritise investment in zero-emission vehicle production,’ according to the SMMT. The association predicts that their share will rise further in 2023, to 27.8%.

‘While order books are strong, we need a healthy market to ensure the sector delivers the carbon savings government ambitions demand. The next Prime Minister must create the conditions for economic growth, restore consumer confidence and support the transition to zero-emission mobility,’ concluded SMMT chief executive Mike Hawes.