Ukraine war set to increase used-car prices in Eastern Europe

01 April 2022

The war in Ukraine is exacerbating inflationary pressure and the constrained supply of new cars in Eastern Europe. This is expected to translate into moderately higher residual values, explains Autovista24 senior data journalist Neil King.

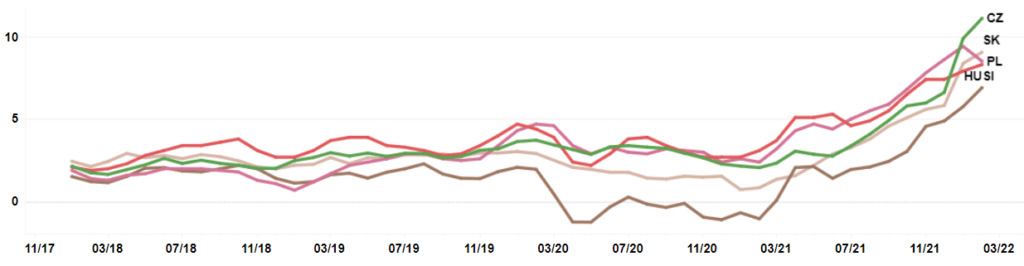

Inflation was already running at a higher rate in key Eastern European markets than across Western Europe in February, ranging from 6.9% annual growth in Slovenia to 11.1% in the Czech Republic.

Inflation rate in selected markets, January 2018 to February 2022

The war in Ukraine is expected to have a more dramatic impact on inflation, as well as economic growth, in the eastern region than further west. This will be compounded by exchange-rate effects in non-Eurozone countries, such as the Czech Republic, Hungary, Poland, and, to a lesser extent, Romania. However, Eastern European banks have introduced new measures in an attempt to bolster their weakening currencies.

‘The exchange-rate issue seems to have been managed by the intervention of the local national banks,’ Zsolt Horvath, regional head of valuations at Autovista Group, commented positively.

Demand for new cars across Eastern Europe will invariably be affected by weaker purchasing power and potentially higher list prices. Furthermore, the conflict-induced disruption to automotive supply chains – ranging from wiring harnesses, to neon gas (critical in the production of semiconductors), to palladium for catalytic converters, and nickel for electric-vehicle batteries – is adding to the pre-existing shortage of semiconductors.

‘Inflation has a negative influence on everything. The demand for new cars is still higher than supply and the new supply issues due to the war in Ukraine will not remedy this in the short term,’ Horvath emphasised.

The further uncoupling of new-car demand and supply may divert even more consumer interest to used cars. However, used-car demand will not escape unscathed, with inflation extending to higher vehicle-running costs too. The impact on residual values (RVs) is, therefore, expected to be relatively modest.

‘The problem is living costs, which have risen since the beginning of this year. Higher inflation is influencing people’s moods and we can observe a drop in demand for both new and used cars,’ commented Marcin Kardas, head of editorial at Eurotax in Poland (part of Autovista Group).

‘The War in Ukraine is an additional factor that is influencing the current market situation. People’s attention is currently redirected from car purchasing. I think the situation will stabilise in the coming months and the risk of further used-car price increases is lower,’ Kardas added.

Rate-setters intervene in Czech Republic and Hungary

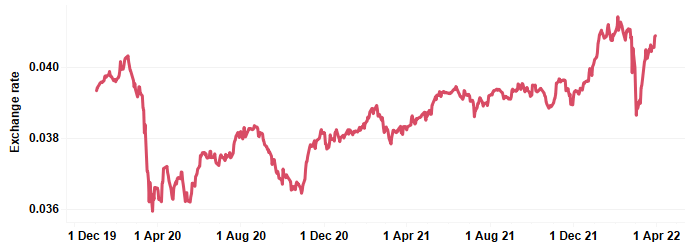

Inflation in the Czech Republic is running at the highest level of the markets under review, reaching 11.1% in February. The pressure on banks to support currencies such as the Czech koruna, which plummeted sharply in early March, is ‘forcing Czech rate-setters into market interventions,’ Horvath noted.

Exchange rate, Czech koruna to €, January 2020 to March 2022

This may ease inflationary pressure to a certain extent, but Horvath believes the effect on the local economy and new-car sales will be like other markets. Accordingly, used-car prices are expected to rise, especially for low-consumption vehicles as petrol prices are comparatively high in the Czech Republic and have risen sharply in March.

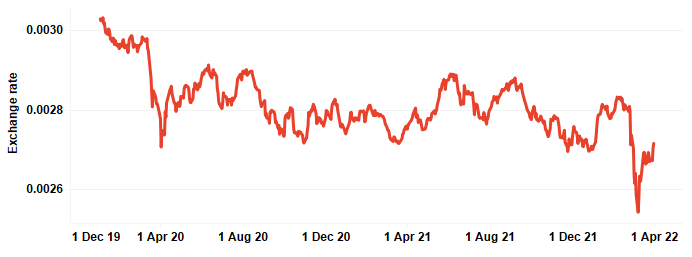

The exchange-rate issue is strongly affecting Hungary too, where the inflation rate reached 8.3% in February and has caused prolonged rate hikes. ‘While the crisis is likely to have a dampening effect on growth, the combination of higher commodity prices and currency devaluation is significantly inflationary,’ said Horvath.

However, he added that energy and fuel prices are fixed in the country and living costs are not rising as sharply. ‘The RV-decreasing effects are less in Hungary and the expected uplift in prices relates especially to the high inflation rate. This is why values have been increased much more than in other Eastern European markets.’

Exchange rate, Hungarian forint to €, January 2020 to March 2022

Polish potential, Romanian resilience

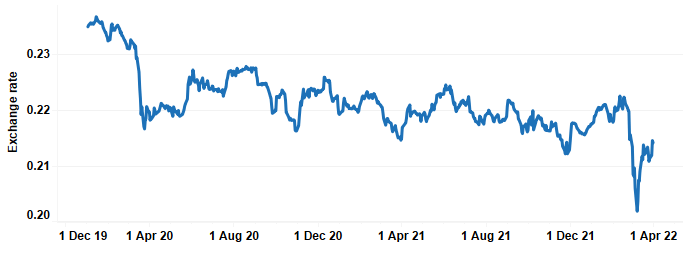

Manufacturing, including the production of some car parts, may be moved to Poland from Ukraine, which could even benefit the local economy. Currently, there is almost no unemployment in Poland, but ‘problems with the significantly higher inflation rate means that we expect lower consumer purchasing power’ explained Kardas. The devaluation of the Polish zloty also plays a pivotal role in this development, as in the Czech Republic and Hungary.

‘The increase of fuel prices and the weaker zloty also means much higher costs of car usage. Due to lower used-car demand, we can already see stock increases and longer sales times,’ Kardas added.

Exchange rate, Polish zloty to €, January 2020 to March 2022

The expected impact on residual values in Poland is less pronounced than in some markets. ‘RVs will slightly increase, but only up to 1%, because on the one hand asking prices are high but also demand begins to be worse than before the war’ Kardas concluded.

’Currently, in several cases, a three-year-old car has a higher used value than its new price three years ago,’ Horvath added.

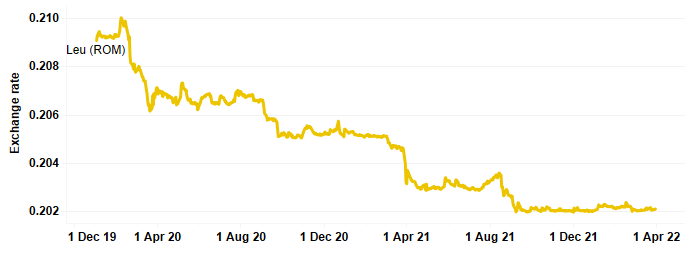

Romania is also outside the Eurozone, with its own currency, the Leu (RON), but the ‘national bank seems very determined to maintain the EUR/RON rate close to 4.95,’ Horvath explained. ‘There was no such up-and-down fluctuation as in the Czech Republic, Hungary or Poland,’ he added.

There is less pricing pressure going forward too but inflation is still very high, running at 8.5% in February, and this has slightly affected the development of RVs.

Exchange rate, Romanian leu to €, January 2020 to March 2022

Slovakia and Slovenia shielded

Slovenia and Slovakia are shielded from currency devaluations as both countries trade in Euros, but inflation rose to 9% and 6.9% respectively in February. Furthermore, business confidence in Slovakia is at the lowest level within the EU.

Business confidence in selected markets, January 2018 to February 2022

Nevertheless, demand for new cars still exceeds supply in both markets and the additional problems emanating from the war in Ukraine means ‘used cars will still be preferred and slight RV increases are expected,’ Horvath concluded.

The upcoming Autovista24 webinar: How is the Ukraine conflict impacting Europe’s automotive markets?, looks at the disruption caused to the industry across the continent, and its effects on supplies, prices and residual values. Register now for the free online presentation, taking place at 3pm CET on 7 April 2022