Used-car market update: The UK starts to return to business as normal

22 July 2021

Robert Redman, forecast editor at Glass’s (part of Autovista Group), looks at developing trends in the UK’s used-car wholesale and retail markets in June 2021.

The volume of cars sold through the UK used-car auction market increased in June, but the first time conversion rate fell slightly, suggesting that wholesale demand may be calming. This is not unexpected, with some retailers having managed to return their stock to pre-lockdown levels and reverting to their usual practice of buying to match demand rather than to fill empty spaces.

Despite the fall in conversion rate, the values paid continued to increase, especially for fleet profile and late-and-low vehicles. Volumes remain lower than usual in these sectors, especially the latter. Their conversion rates are also notably better than for the general market, at 96% for fleet profile and 95% for late and low. Reduced new-car supply for 2020 and 2021 (and possibly 2022) means that these sectors, and in particular late and low, have moved from a traditional situation of oversupply to one of undersupply. This may continue for some time.

In terms of desirability, It was largely ‘business as usual’ – good condition SUVs and convertibles sold well, whilst cars that were poorly specified or required work were generally unpopular unless they were very cheap.

Used-car retail market

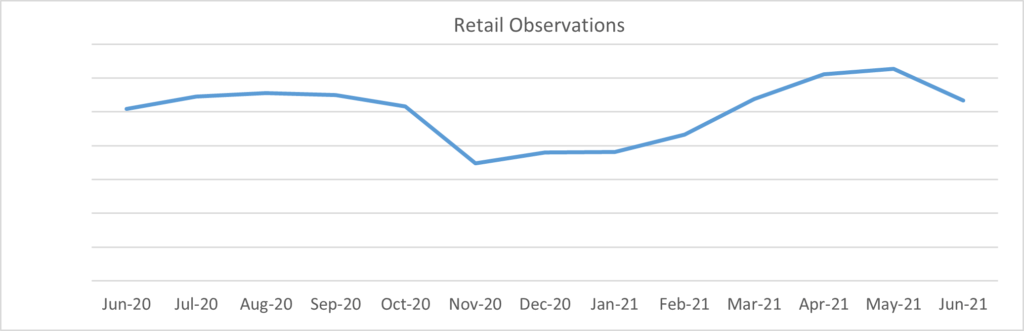

The number of observed used-car retail sales dropped a little in June, although their average sale price remained virtually unchanged from May. The average discount decreased markedly, from 1.4% in May to 0.5% in June.

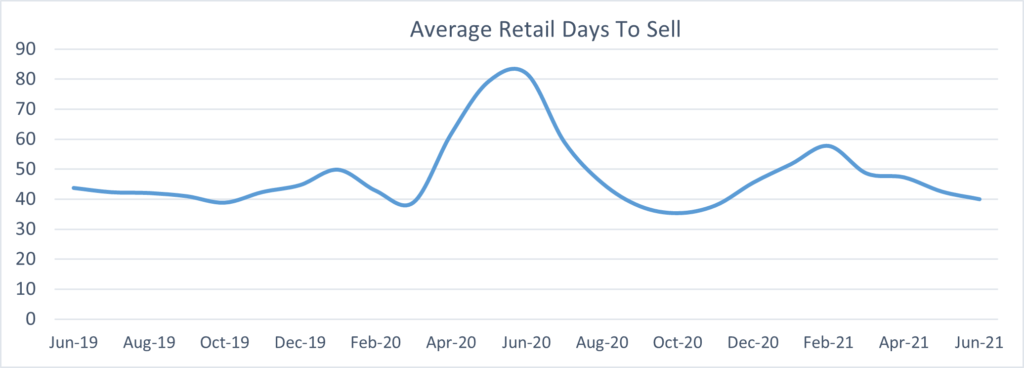

Ideally, a used car spends as little time as possible on the forecourt – obviously, the faster it sells, the quicker a profit (hopefully) is achieved. The average days to sell report records this for the observed sales and is a key metric when assessing the health of the used-car retail market. Unsurprisingly, COVID-19 lockdowns have played havoc with this figure over the last 18 months, but the good news is that since the easing of restrictions, the average has improved noticeably. June’s figure of 40 days is an improvement of 2.6 days from May and comfortably below the average for June 2019.

Outlook

The used-car market held up well through June, and we expect July to be similar. The rush to replenish stocks that were run down during lockdown has slowed, and buyers are largely back to buying to fulfil orders or keep up with demand. However, early indications are that retail demand for used cars remains good, and with the further loosening of restrictions, it is likely that demand will continue through July.