What are the implications of Nissan’s potential UK gigafactory?

29 June 2021

Nissan and the UK government are reported to have agreed terms for a gigafactory to be built near its plant in Sunderland. The move could have major implications for both the carmaker and the country, if confirmed.

While some early reporting can consist of questionable information and conjecture, stories surrounding Sunderland appear well fleshed out with detailed information. Sky’s city editor, Mark Kleinman, tweeted that as he understands it, Nissan will confirm its plans as soon as this week.

When asked by Autovista24 about the speculation, Nissan said: ‘having established EV and battery production in the UK in 2013 for the Nissan Leaf, our Sunderland plant has played a pioneering role in developing the electric-vehicle market. As previously announced, we will continue to electrify our line-up as part of our global journey towards carbon neutrality, however, we have no further plans to announce at this time.’

Safety for Sunderland?

A battery plant in Sunderland could mean the creation of hundreds of new jobs. It would also generate stability for a facility that was often been cast under a shadow during the Brexit process. Bosses have previously been quick to point out that keeping production in the country would ′not be viable,’ if import and export tariffs were introduced given that it exports around 70% of its capacity to Europe.

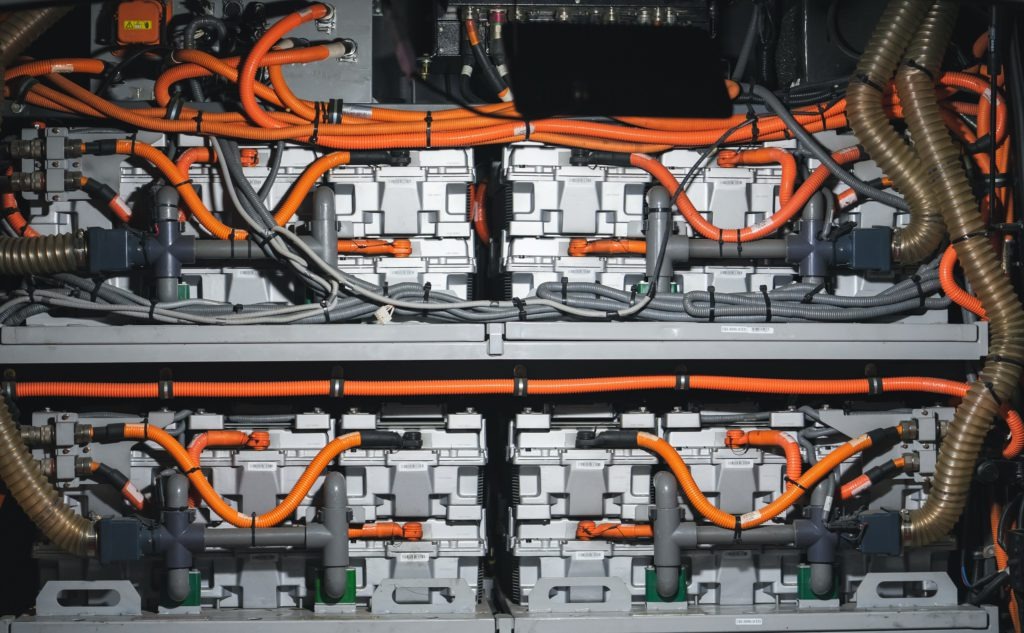

Therefore, Nissan was one of many carmakers pointing to the need for a free-trade agreement (FTA) between the UK and the EU during talks. At present, Nissan builds its batteries in Japan, which are then shipped to the UK for use in the Leaf. Had it continued with this supply chain, each unit would have faced a 10% tariff on export to the EU. So when news broke in January this year that the company had committed to its UK manufacturing site following the end of trade talks, there was cause for celebration with 6,000 plant jobs secured.

Moving battery production to the UK meant Nissan complied with thresholds for locally-sourced components included in the FTA. These imply that no more than 60% of an EV can comprise of non-EU or UK components until 2023.This drops to a stricter 50% until 2026. If these thresholds are breached, tariffs will be applied to exported vehicles.

Localised production

If Nissan does commit further to a gigafactory in the UK, it will fall within a wider trend of localising European battery supply chains. Currently, the automotive industry relies heavily on battery shipments from Asia. So, to boost the efficiency and reliability of this supply chain, a more local network of gigafactories is under construction.

COVID-19 highlighted the fragility of globalised manufacturing networks, as component sites froze under localised lockdowns. The automotive industry traditionally works within a ‘just-in-time delivery system,’ meaning the pandemic continues to cause disruption, particularly within the world of electronics as semiconductors run short.

But this did give carmakers pause for thought, as they realised the need to move production sites closer to each other, with the important inclusion of gigafactories. Recently, Renault revealed a major partnership for EV batteries and power-electronics systems. The carmaker signed a memorandum of understanding (MoU) with French startup Verkor to develop and manufacture high-performance battery cells in France.

Electric foot forward

Should Nissan come through with a UK gigafactory announcement, it will also signal an increased commitment to electrification. The Leaf currently currently exists within the relatively under-populated segment of small BEVs and has proved massively popular.

But Nissan’s rollout of EVs within other segments appears somewhat sluggish. For example, the latest instalment of the company’s Qashqai model is only offered with mild-hybrid (MHEV) petrol engines at launch, foregoing plug-in hybrid (PHEV) or battery-electric (BEV) drivetrains until the introduction of a hybrid ‘e-Power’ version in 2022.

At the start of this year, Nissan announced it wants its operations, and the life cycle of its products, to be carbon-neutral by 2050. ‘By the early 2030s, every all-new Nissan vehicle offering in key markets will be electrified,’ the carmaker said. If this truly is the case, with the continued presence of the Sunderland plant, a local gigafactory can be considered not only useful but essential.