Hybrids offer an alternative path to carbon-neutrality for Toyota

10 September 2021

Toyota has unveiled its battery-development and carbon-neutrality strategy, citing 2030 as a milestone for delivering new technologies.

The carmaker wants to significantly increase the sale of electrified vehicles, including hybrids, plug-in hybrids (PHEVs), battery-electric vehicles (BEVs) and hydrogen fuel-cell vehicles (FCEVs). In addition, the company will invest around ¥1.5 trillion (€11.7 billion) in the development of a battery-supply system, and research and development of new battery technologies.

‘On the production and supply side [the investment] is about ¥ 1.0 trillion,’ commented Masamichi Okada, Toyota’s chief production officer. ‘This is largely for electrified vehicles and, by 2025, we will build 10 more new [production] lines. Between 2026 to 2030, we will build 10 lines per year, which will total 70 lines for BEVs. Therefore, this investment is mainly for production, including machines and facilities.’

Options open

Toyota has been steadfast in its plans to offer a technology option to all its customers as it looks to lower vehicle emissions. Its plan to target eight million sales of electrified vehicles globally by 2030 includes just two million BEVs and FCEVs. However, Masahiko Maeda, chief technology officer of Toyota’s battery development and supply, was unable to confirm the exact numbers in the mix.

‘We cannot be clear at this point,’ he told the media. ‘This number was mentioned in our financial reporting as guidance number. Please understand we do not have the details for the breakdown.’

This does mean that the majority of targeted sales will be hybrid and PHEV models. As a pioneer of hybrid technology, Toyota is unlikely to abandon the technology just yet. This is despite introducing a new BEV sub-brand, bZ, and committing to a hydrogen future by launching a second generation of its Mirai FCEV.

Hybrids over BEVs

‘At the moment, because we can provide hybrids at a comparatively affordable price, in places where the use of renewable energy is to become widespread going forward, electrification using these is among the effective ways of reducing CO2 emissions,’ commented Maeda.

‘On the other hand, Toyota believes that the increased use of zero-emissions vehicles, or ZEVs, such as BEVs, and fuel cell electric vehicles, or FCEVs, is important in regions where renewable energy is abundant.’

While other carmakers are turning to a future of selling just BEVs, Toyota must hope its plans will cater to everyone who wants a lower-emission vehicle and does not have access to a BEV-charging or hydrogen-refuelling infrastructure.

The carmaker is stating that, according to its data, the CO2 reduction of three hybrid models is equivalent to one BEV. Therefore, the 18.1 million hybrids sold to date offer the equivalent CO2 reduction of 5.5 million BEVs. Yet, the volume of batteries for hybrids produced so far is the same as that of batteries installed in about 260,000 BEVs.

‘In other words, we can say that the batteries needed for 260,000 BEVs have been used to achieve the CO2 emissions reduction effect of 5.5 million BEVs,’ stated Maeda.

It’s unclear, however, what Toyota will do for the European market from 2035 onwards, as its Fit for 55 plans aim to allow only zero-emission passenger cars on roads from this time. The carmaker is also investing in the R&D for new battery technologies that could help it develop more BEV models for Europe.

Battery technologies

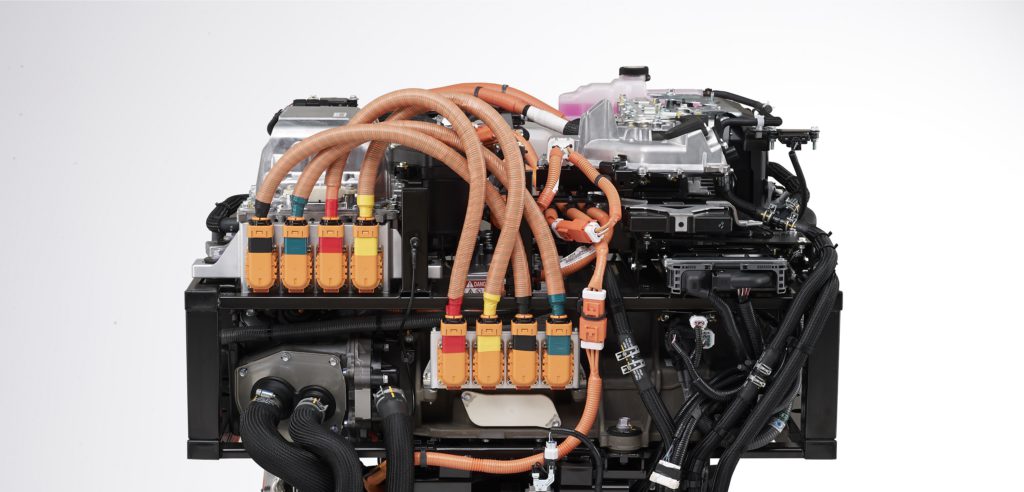

Toyota is looking to develop batteries that meet five key elements: safety, long service life, high level of quality, affordable and high-level performance. Its development and supply plans will see a cost reduction of up to 50% per vehicle, which would help to make its models more reasonably priced. It also aims to build a flexible supply network and production system based on small basic units. Toyota aims to respond flexibly to increasing battery demand from 180GWh to more than 200GWh.

This capacity will come from the company’s existing partner suppliers, including CATL, BYD, GS Yuasa, Panasonic, and Toshiba. However, Toyota will develop its battery technology itself.

‘When it comes to electrified vehicles, cars and batteries cannot be separated,’ added Maeda. ‘Toyota, which has been committed to producing batteries since 1997 and whose market-introduced hybrids, alone, number 18.1 million units, is an automaker that has been working on battery development as a corporate group.’

Toyota will also continue its development of solid-state batteries, seen by many as the next logical step in battery technology. These units offer longer ranges and shorter charging times. Yet when the technology is first introduced, it will be done so in the carmaker’s hybrid models.

‘We believe focusing on the application to hybrid is the fastest way to deliver the product to our customers,’ added Maeda. ‘However, there are still challenges remaining. For example, longer use will result in creating spaces in the solid electrolyte, which leads to deterioration. We need to continue developing the material for the solid-state, leveraging our experience over the years.’