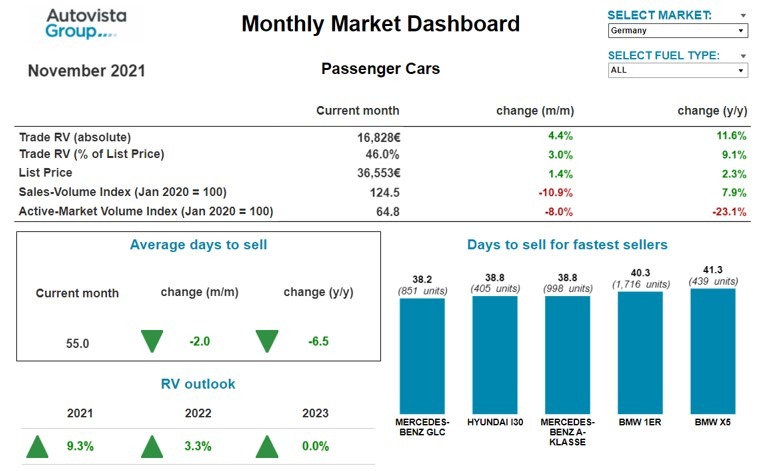

Monthly Market Update: Slowdown in used-car retail activity across Europe in November

02 December 2021

The sales-volume index retreated in Europe’s used-car markets in November. However, as demand continues to exceed supply, the usual seasonal downturn in residual values (RVs) of three-year-old models has not materialised. Consequently, Autovista Group has upgraded the RV outlook for European countries, except for a held forecast in France and a modest reduction in Austria.

Autovista Group has recently extended its coverage of used-car markets in the monthly market dashboard to include Austria and Switzerland. It also includes a breakdown of key performance indicators by fuel type, average new-car list prices and sales-volume and active market-volume indices.

The upward trend in the prices of cars with internal-combustion engines (ICE) and hybrid electric vehicles (HEVs) is forecast to continue in 2022, except in the UK. The outlook also points to ongoing RV rises for plug-in hybrid electric vehicles (PHEVs), except in France, Spain, and the UK as they substitute for the lack of ICE cars and HEVs. However, transaction prices of battery-electric vehicles (BEVs) will continue to struggle as the rise in supply, partly because of a high volume of tactical new-car registrations, is not matched by the low demand among private used-car buyers.

Austria supply down 15%, sales up 5%

On average, across all used cars aged two to four years, the supply volume in November was approximately 15% lower than at the beginning of 2020, but sales activity is up 23%, highlights Robert Madas, Eurotax (part of Autovista Group) valuations and insights manager, Austria and Switzerland.

Diesel vehicles are especially missing from the market, with a drop of 25% compared to the start of last year. At the same time, sales activity for diesel cars in September was 5% higher than in January 2020.

Average selling times have increased by 3.6 days compared to October. Petrol cars are selling the fastest, averaging 54.4 days. BEVs are selling the slowest, averaging 75.9 days, and the trend is clearly downward. In addition to the significantly higher supply volumes, the faster technology ageing of BEVs and the attractive subsidies on the new-car market are slowing their sales on the used market.

This market environment has led to a 5.7% year-on-year increase in RVs of 36-month-old cars, to retain 45.4% of their value. HEVs are currently leading with a trade value of 47.6%, followed by petrol cars (46.5%) and plug-in hybrids (46.3%).

Madas assumes that the market parameters will not change in the medium term, so that RVs for three-year-old passenger cars will probably continue to rise this year and next. Only when the new-car market picks up significantly, and thus volumes on the used-car market also increase, are values likely to come under pressure. This will probably not be the case before 2023.

Higher list prices ultimately detrimental to RVs in France

The list-price increases in France in recent months continue to translate into higher RVs in value terms, although value retention as a percentage of list price (%RV) stabilised in November. Because of the semiconductor crisis, OEMs have been regularly increasing list prices on the new-car market, reinforcing the consumer switch from new cars to used cars. Although this is positive from an RV point of view in the short term, it will ultimately be detrimental for RVs, explains Yoann Taitz, Autovista Group’s regional head of valuations and insights, France and Benelux.

The used-car buyer’s budget is not increasing, and because of transaction-price increases, consumers that do not absolutely need to change their car are postponing their purchase. Those that do need a car are looking for older vehicles. The decline in new-car registrations is drying up the used-car market, but when production properly resumes after the end of the semiconductor crisis, OEMs will have to increase discounts to compensate for the higher list prices.

This will have two impacts on RVs, according to Taitz. First, given that a used car cannot be more expensive than a new car, it will lower transaction prices. Second, too high and too frequent discounting is detrimental for RVs and will impact them over a longer period. This vicious circle, stemming from the OEMs’ short-term view of the crisis, is clearly not positive for RVs, and it will be difficult to transform it into a virtuous circle.

Mismatched configurations

There was a subtle increase in stock days in France in November, partly because many configurations offered on the used-car market do not correspond with demand. Some OEMs have stopped selling powerful diesel engines on the new-car market, but they remain sought after on the used market. For example, Peugeot and DS have stopped sales of the 180hp diesel engine and only offer the 130hp unit. This level of output is popular among fleet buyers but less so with private consumers of used cars, who prefer more powerful engines and higher trim lines. This is the premise of the disconnection between the new- and used-car markets, Taitz surmises.

Moreover, because of the semiconductor shortage, OEMs are, in some cases, producing configurations that do not meet with either new- or used-car demand. For example, engines with between 130hp and 160hp coupled with low trims.

High tactical registrations, low BEV demand

The low adoption of BEVs on the used-car market is clear in France, with a 6.3% month-on-month decline in trade RVs in November. Although a few models are bucking this trend, the used BEV market is affected as a whole. Furthermore, tactical registrations of demonstrator models and sales to car-rental companies have reached an average of 23% in 2021, with peaks of 30% in February, June and September. When the tactical share exceeds 10% to 12%, the used-car market is unable to absorb the extra volumes without affecting the RVs of cars aged 12, 18 and 24 months. The greater the impact on these younger cars, the more significant the effect at 36 and 48 months, as a three-year-old car cannot be priced over a two-year-old car.

No supply relief in Germany

More vehicles continue to leave the German used-car market than are replenished by returns. Consequently, the available supply keeps falling and there were 35% fewer used cars available in November than in January 2020. As 2018 was a weak fleet year and the volume of tactical registrations was low in 2020 due to production issues, no relief from increasing inflow is expected for the rest of 2021 and RVs will remain high, which is unusual for the end of a year. Accordingly, stock days are at a historic low, and the gap between the offer prices and sales prices of BEVs, and especially PHEVs, is widening and threatens to collapse in the first quarter of 2022, writes Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

A similar phenomenon can currently be observed for older vehicles. Here, too, the gap between wishful thinking (the offer price) and reality (the transaction price) is widening, but this applies almost exclusively to ICE vehicles. Apart from HEVs, the fastest-selling models in all powertrain types are predominantly from premium brands, presumably due to strong brand loyalty and reduced delivery capacity, Geilenbruegge notes. In fact, the average price increases are somewhat higher than in the market as a whole. The battle for supply will therefore continue, and the trade will be desperately looking for additional sources of used cars in order to participate in the currently highly profitable market.

Renewed positive momentum in Italy

After a slight slowdown in Italy in October, RVs grew by 3.4% month on month in November and are 8.2% higher than a year ago. This is a sign that the positive momentum in the used-car market has not yet died down, says Marco Pasquetti, forecast and data specialist, Autovista Group Italy.

With an active-market volume index of 105.9 and a sales-volume index of 182.5, compared to January 2020, supply is essentially in line, but demand has almost doubled. It has also increased by 43.6% compared to November 2020. Stock days are also continuing to fall. In November, the average used car sold in less than 52 days, almost five days fewer than last month. The fastest-selling model is the Dacia Sandero, with only three weeks passing between it going on sale and being purchased.

Compared to last month, the average residual value of BEVs is up 5.7%, driven by a sharp increase in sales and reduced supply. The volumes are a long way behind those of traditional ICE models, but this suggests that the second-hand market is starting to follow the growth trend witnessed in the new-car market. However, it still takes 102 days to sell a BEV, about twice as long as a petrol or diesel car. Diesel continues to be the most popular fuel type, with an average RV close to €18,000 for vehicles registered 36 months ago and with 60,000km. PHEVs are essentially stable, with average RV retention of 43.5%. They are moving on from dealerships after about 60 days and are currently the Italian market’s preferred compromise for the transition to BEVs, Pasquetti notes.

Spain running out of steam

The fall in registrations of new cars continues to worsen due to the semiconductor crisis, and it seems unlikely that they will recover until mid-2022. The used-car market, which had been absorbing part of the unfulfilled demand for new cars, is beginning to run out of steam. It has already experienced four months of decline, with increasingly reduced supply, and is very weighted towards old cars (35% are over 15 years old).The level of supply is not forecast to recover until 2023, says Ana Azofra, Autovista Group head of valuations and insights, Spain.

Logically, the lack of supply has led to an upward trend in RVs, which has accelerated in recent months. This has had a very positive impact on ICE cars and, to a lesser extent, on HEVs. This positive impact is clear when analysing the evolution of a model, but the general average of the market is not rising at the same speed or with the same intensity. The quality of the cars being transacted is reducing as there are fewer young used cars, with less vehicles coming from companies.

It is foreseeable that the upward trend in the prices of ICE and hybrid vehicles will continue over the next year. On the other hand, the situation and outlook remain negative for electrically-chargeable vehicles (EVs). List prices remain excessively high in relation to purchasing power and, despite promises, the charging infrastructure has not been able to catch up. This is increasing the gap with other European countries and making it impossible to create a used EV market. Moreover, the volume of used stock has continued to increase, and is about double the pre-pandemic level.

Swiss supply volume down 25%

The Swiss used-car market continues to be defined by stable demand and low supply. On average, across all passenger cars aged two to four years, the supply volume in November was 25% below the level at the beginning of 2020, notes Patrick Schneider, Autovista Group market and model analyst, Switzerland.

Diesel cars are particularly missing on the market, with supply approximately 40% down compared to January 2020. For petrol cars, where there are also significantly fewer offers on the market than at the beginning of 2020 (-18%), and hybrids of all types, market activity is particularly high in relation to available supply. The supply of PHEVS, and especially BEVs, has increased significantly since the beginning of 2020, with PHEV demand exceeding supply. For BEVs, on the other hand, supply and demand are more balanced.

This market environment has led to a further increase in the average %RV of 36-month-old passenger cars, to 44.6% (up 11% compared to November 2020). Petrol cars have posted strong year-on-year gains of 11.5%, to 45.8%, and so too have diesel cars (up 10% to 42.8%).

After a decline in recent months, the average days to sell rose slightly for a short time but are now declining again: a passenger car aged two to four years is currently in stock for 64 days. Petrol cars are selling especially quickly, after an average of 62 days, followed by diesel with 66 days. PHEVs are changing hands five days faster than last month, at around 69 days.

Supply will be decisive in the future development of RVs. As cumulative new-car registrations are markedly lower than before the crisis (down 22.7% compared to 2019), Schneider assumes that market parameters will not change in the medium term. RVs for three-year-old used cars are forecast to continue to rise this year and at the beginning of next, before stabilising over the course of 2022.

UK retail activity slowing

The used-car market in the UK performed staggeringly well from the second quarter of 2021 onwards, with Glass’s values rising for eight consecutive months. However, the market began to change in late October, with auction conversion rates falling sharply as dealers became more selective, which points towards a slowing of retail activity. The average number of days it took a dealer to retail a car in November reflected this change, at 34.8 days, which is 1.4 days longer than in October but still 1.3 fewer than last year, highlights Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

Glass’s expects retail activity to continue slowing in December as the attention of the buying public switches to the festive season. This will result in dealers needing to replenish stock from auction less frequently, and Glass’s values will ease back a little. However, with the average trade value growing 3.8% month on month in November and sitting 35.3% up on a year ago, residual values will still end the year on a high.

The outlook for the first quarter of 2022 remains optimistic, with retail demand returning and continued used-car supply issues. It would be surprising to see used-car values rising next year, as the likelihood is they have already reached their peak. However, Glass’s expects cars to suffer less depreciation than in a typical year, Whittington concludes.

View the November 2021 monthly market dashboard for the latest pricing, volume and stock-days data.