Monthly Market Update: Used-car pricing boom across Europe extends into 2022

31 January 2022

Sales of used cars in a number of European markets grew in January 2022 compared to a year ago. In the UK, activity was stable and Italy and Spain experienced downturns. However, the ongoing issues in the automotive supply chain dictate that residual values (RVs) of three-year-old models rose further in January 2022, compared to December, and remain firmly higher than a year ago.

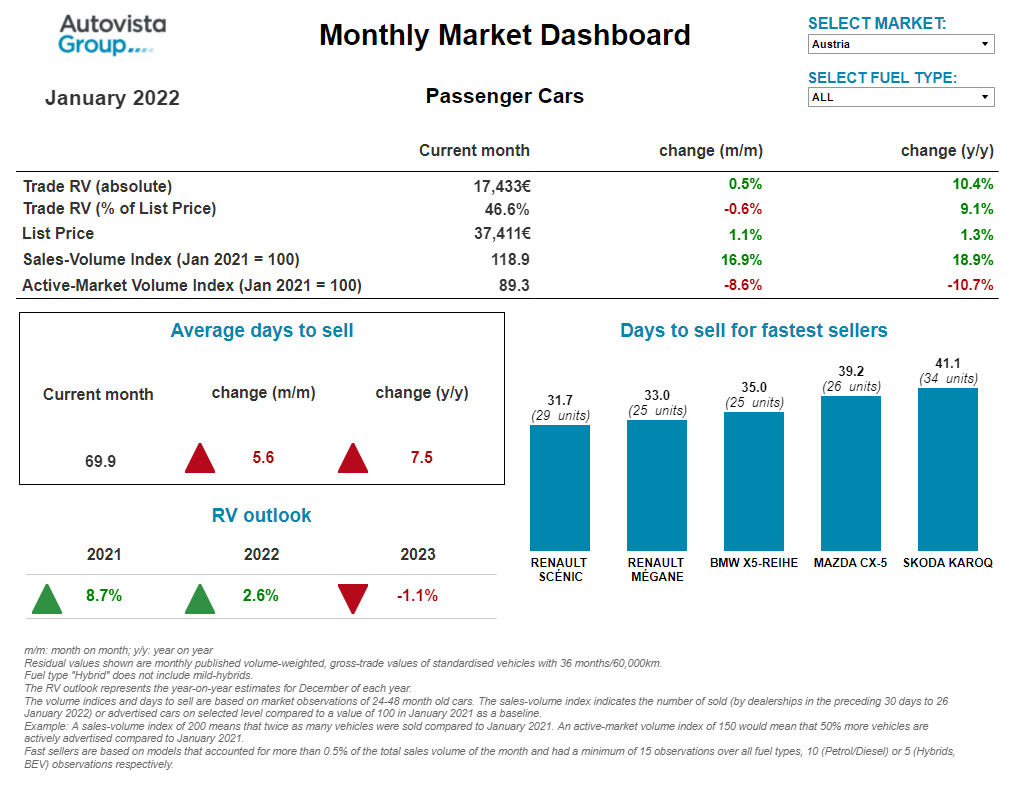

Autovista Group’s coverage of used-car markets in the monthly market dashboard features Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It also includes a breakdown of key performance indicators by fuel type, average new-car list prices, as well as sales-volume and active market-volume indices.

The upward trend in the prices of cars with internal-combustion engines (ICE) and hybrid-electric vehicles (HEVs) is forecast to continue in Europe in 2022, but not in the UK. The outlook also points to ongoing RV rises for plug-in hybrids (PHEVs), except in France and the UK, as they make up for the lack of ICE cars and HEVs. However, transaction prices of battery-electric vehicles (BEVs), especially those with a limited range, will continue to struggle as there is not enough demand from private used-car buyers to absorb the growing supply.

Austria supply down 10% year on year

The Austrian used-car market continues to be underpinned by stable demand and low supply. On average across all passenger cars aged two-to-four years, the supply volume in January was 10.7% lower than a year ago, highlights Robert Madas, Eurotax (part of Autovista Group) valuations and insights manager, Austria and Switzerland.

Diesel cars and BEVs are especially missing from the market, with drops of almost 20% compared to January 2021. The supply of petrol cars and PHEVs has increased year on year, but standard hybrids are slightly down.

In the ongoing context of used-car demand outstripping supply, average days to sell decreased by 5.6 days compared to December, to an average of 69.9 days. HEVs are selling the fastest, averaging 62.1 days, followed by petrol cars with 62.8 days. PHEVs are selling the slowest, averaging 88.6 days.

This market environment has led to a further increase in RVs of 36-month-old cars. They have risen by 10.4% year on year in value terms, with cars retaining 46.6% of their list price on average. Petrol cars are currently leading with a trade value of 47.5%, followed by HEVs (47.2%) and diesel cars (46.4%).

Madas assumes that the market parameters will not change in the medium term, because new-car registrations are still markedly lower than before the crisis (2021 was down 27% compared to 2019). Due to this undersupply, RVs for three-year-old passenger cars will probably continue to rise this year. Only when the new-car market picks up significantly, and thus volumes on the used-car market also increase, are values likely to come under pressure. This will probably not be the case before 2023.

New regulations inflate prices in France

January saw new regulations come into effect in France, with an increase in the malus (penalty) for registering cars with CO2 emissions of 128g/km or more, up to a maximum of €40,000 for cars with emissions higher than 224g/km. This means that list prices of many new cars have artificially increased.

This also comes at a time when there is lower supply than usual and consumers are postponing their purchase of new cars and young used cars due to the price increases and indecision as to which fuel type to opt for, explains Ludovic Percier, residual value and market analyst, Autovista Group France.

Furthermore, OEMs are offering new cars with a lack of options due to the semiconductor crisis, which is also deterring customers from buying, even when the car itself is available. The combination of price increases and the restricted availability on the new-car market has driven RVs higher, even for 24-month-old cars. However, customers that opt for a new car with a lack of required equipment will lead to a decrease in RVs in 36-48 months, Percier adds.

The increase in list prices also largely explains the 1% decrease in RVs, in value-retention terms (%RV) compared to December. Higher prices are raising buyers’ expectations and, in turn, the number of stock days, especially as there is an increasing number of vehicles with configurations that do not fit with demand.

Diverse fuel-type impact

Diesels RVs have risen further in value terms, compared to both January and December 2021, but petrol cars and PHEVs have seen greater gains. PHEVs are especially dynamic in terms of RVs as de-fleeting has been limited, although this will increase in 2023. Nevertheless, prices are high on the used-car market and stock days are much higher than last year too.

There is a broad decline in RVs of BEVs, although Percier notes that vehicles such as the Tesla Model 3, Mini Electric, and Korean contenders like the Hyundai Ioniq 5 are less impacted. BEVs offering a higher range are in greater demand and therefore perform far better than those with a low range. Too many incentives and discounts on the new-car market and weak demand on the used car-market is generating more advertisements in France. Furthermore, the lower new prices have contributed to the decrease in RVs, as well as a rise in stock days as demand on the used-car market is simply insufficient.

Unstoppable RV growth in Italy

The growth in RVs seems to be unstoppable in Italy. During January 2022, a 36-month-old used car with a mileage of approximately 60,000 km was purchased at an average of 49.7% of its list price, an increase of 13.5% compared to a year ago, notes Marco Pasquetti, forecast and data specialist, Autovista Group Italy.

This is the result of the balance of supply and demand, which has been radically changed by the impact of the COVID-19 pandemic on the automotive sector. Among other effects, this has also considerably speeded up the time it takes to sell a used car. In January, an average of just 51.5 days passed between a model being advertised online and its sale, two days faster than last year.

There are no signs of a change in the trend in the short term, although Pasquetti expects the growth curve to gradually stabilise over the course of 2022. By the end of the year, he foresees a slight increase in RVs of around 0.7% compared to 2021. A slight fall in RVs, of just 0.1%, is envisaged for 2023, which is expected to mark the start of a slow descent towards pre-crisis values from 2024 onwards.

There has been an especially sharp increase in the RVs of HEVs in January, which grew by 25% compared to December. Toyota is a key player in this segment, accounting for the three fastest-selling models in Italy. Premium brands, on the other hand, dominate when it comes to PHEVs, which, with an average list price of €62,000 (compared to €31,000 for HEVs), are more oriented towards wealthier consumers.

In absolute value terms, RVs of BEVs have fallen by 25.4% year on year, although the sales-volume index has increased by almost 150% and a BEV is now sold after 89 days. The sales process is 14 days faster than a year ago, but this is still high compared to ICE vehicles.

Used cars up 9% in Spain

Spain was marked in 2021 by a shortage of both new and used cars. Registration figures for new cars were at a similar level in 2021 as in 2020, but used-car transactions were 9% higher, although they did not exceed pre-pandemic levels, says Ana Azofra, Autovista Group head of valuations and insights, Spain.

The shortage of supply is especially pronounced in younger cars up to a year old. This is partly due to the lack of new cars because of production stoppages, which transferred some demand to young used cars. Furthermore, there was a shortage of cars coming from the rental channel (down 26% in 2021), which is one of the main entry channels for young used cars in the Spanish market.

A small part of used-car demand has been met by used imports, which increased by 30% in 2021, but the most direct impact of the supply shortage has been the growth in RVs. Although milder than the impact on young used cars, average transaction prices for cars aged three years increased significantly in 2021. Azofra expects the growth trend to slow during 2022 as the problems caused by the semiconductor crisis are resolved.

All this is reshaping the profile of the used-car market in Spain, mainly in terms of the age and weighting of each brand, with an impact on average prices. The strongest increases in RVs occurred in the oldest vehicles, i.e. those aged 10 years or more. Their effect on pricing is significant as they still account for 60% of used-vehicle transactions, Azofra emphasised.

EV demand exceeds supply in Switzerland

For more than a year now, demand has exceeded supply in the Swiss used-car market. On average across all two-to-four-year-old passenger cars, the supply volume in January was 9.3% below the level at the beginning of 2021.

Diesel cars are particularly lacking, with supply 29.2% down compared to a year ago. There are also fewer HEV offers on the market than in January 2021 (down 14.8%), and sales activity is particularly high in relation to stock availability. The supply of plug-in hybrids and especially BEVs has increased compared to the beginning of 2021, but even demand for used examples of the two EV powertrains is exceeding supply, notes Hans-Peter Annen, Autovista Group head of valuations and insights, Switzerland.

The average days to sell rose slightly for a short time but are now declining again: a passenger car aged two to four years is currently in stock for 58 days only. PHEVs are selling the quickest, with an average of 52 days, followed by HEVs with 53 days, petrol cars with 55 days, and diesel with 65 days.

Stubborn demand and supply shortages have led to a further increase in the average %RV of 36-month-old passenger cars, to 46.3% (up 12.3% compared to January 2021). Petrol cars posted strong year-on-year RV gains of 12.6%, to 47.4%, as too did diesel cars (up 10.8% to 44.3%).

Supply will be a key factor in the future development of RVs. As new-car registrations are markedly lower than before the crisis (2021 was down 23.4% compared to 2019), Annen assumes that market parameters will not change in the medium term. RVs for three-year-old used cars will continue to rise this year, before eventually stabilising and declining over the year 2023.

Lull in UK wholesale activity

Auction activity in the UK was subdued in December 2021, which is not uncommon in the run-up to the festive period. Auction hammer prices were in line with Glass’s trade values, confirming that dealers were still prepared to pay strong prices, but poor conversion rates, which rarely rose above 50%, suggest they did not need to buy in bulk to fill forecourts, surmises Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

Activity throughout January 2022 has been similar, and it took dealers on average 1.4 days fewer than last year to retail a used car, suggesting that dealer stock remains high. Despite the lull in wholesale activity, RVs remain eye-wateringly high, with the average RV of a three-year-old car over 40% higher than in January last year, Whittington notes. The average RV increased by 5.7% compared to December, based on the mix of three-year-old used cars sold to consumers.

Nevertheless, the UK’s used-car market does not appear to be firing on all cylinders. Although the sales-volume index shows that a similar number of 24-to-48-month-old cars were sold in the 30 days to 26 January, as last year, it is worth remembering that the UK was in lockdown last January. Supply constraints in the new-car market are disrupting the flow of used cars, so there is less choice for consumers, which may account for the comparatively low sales rate according to Whittington. The active-market volume index supports this view, showing that only 75% of last year’s volume is being advertised for sale.

The outlook is still healthy for RVs in the UK by historic standards, however, as used-car supply issues are expected throughout this year, giving vendors the confidence to hold out for strong reserve prices. Glass’s expects values to lose some of the impressive gains made in 2021, albeit only falling by around 4-5%.

View the January 2022 monthly market dashboard for the latest pricing, volume and stock-days data.