A land of ice, fire and EVs – Iceland lights path to electrification

04 July 2022

José Pontes, data director at EV-volumes.com, examines Iceland’s electric-vehicle (EV) market, known for having the second-highest market share in the world.

Iceland’s EV market sits behind Norway and ahead of places like Sweden or the Netherlands when it comes to EV market share. This makes it a great case study for those countries that are less advanced in their electric transitions.

Iceland’s example demonstrates the power of three EV-adoption enhancers – high fossil-fuel prices, cheap electricity, and welcoming public policies. When these are brought together, EV adoption is fast, even in places with sparse populations, harsh climates, and rugged terrain.

Interestingly, the two countries with the highest EV market shares in the world, Norway and Iceland, are both known for their cold climates and rugged terrains. This helps put an end to the theories that EVs cannot handle extreme conditions.

Rule of thumb

One rule of thumb is that EV adoption on islands is relatively easy because fossil fuels must be imported and therefore, are usually more expensive due to higher transport costs. In the case of Iceland, this is complemented by cheap electricity, due to the country’s abundant renewable (hydro and geothermal) energy production, as well as a small population, which is another common element between both nations.

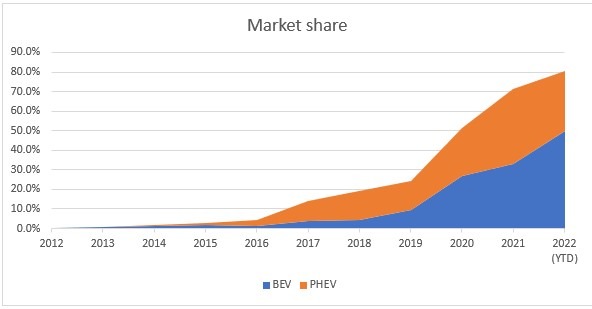

Add these factors to public policies encouraging EV adoption, like VAT exemptions that have been applied since 2012, and significant results start to appear. By 2016, the market share of electric and plugin-hybrid (PHEV) passenger cars reached 4.6%, the second-highest in the world, only behind Norway (29%).

By that time, one of the main obstacles to battery-electric vehicle (BEV) adoption was the lack of charging infrastructure (CI), namely a nationwide charging network. The distance between the eastern part of the island and the western part is around 700km. This forced many prospective BEV buyers into buying something else and thus increasing the market share of PHEVs.

A solution provided by local utility company ON Power increased the density of CI and created a network of 50kW DC chargers along the ring road that circles the entire country. Other companies will soon follow suit.

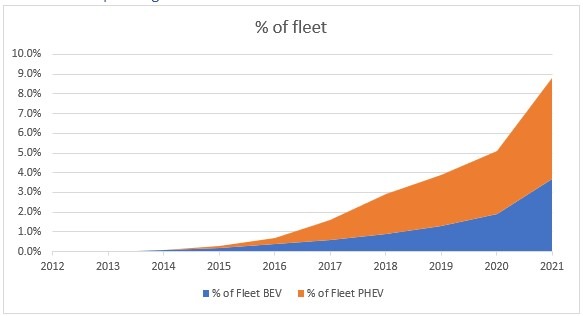

In 2020, the country celebrated a milestone, when BEVs and PHEVs took up most passenger-car sales for the first time ever. EVs by that time already represented 5% of the total fleet of passenger cars. With electric vehicles as a key component of the country’s environmental policy and CO2 targets, Iceland is at the forefront of transport electrification.

Market evolution – new registrations

The Icelandic EV market share has experienced three stages. The first was marked by a slow rising niche up to the beginning of 2016, to a steady growth until 2019. This was mainly due to plug-in hybrids, and especially the popularity of the Mitsubishi Outlander PHEV, a family-friendly SUV, with AWD availability, an important plus when tackling snow. These have been followed by a recent surge with the take-up of long-range BEVs, which have seen a wider choice of models.

With EVs now representing over 80% of the private passenger-car market, the EV transition is mostly done. By 2025, uptake is likely to be close to 100%, with BEVs representing over 95% two years later, completing the transformation.

Having said that, from April to June the EV share dropped due to registrations of car rentals – which are focused on small petrol or diesel cars, as tourists often look for the most economical options. This segment of the market could be a challenge to electrify because there are no cheap BEVs with the long range needed for rental cars.

In terms of growth rates, BEVs followed a common pattern until 2020, slowly decreasing the growth rate in the same proportion as volumes increased. Plug-in hybrids had a period of intense growth between 2015 and 2017, thanks to wider availability and choice of models, but then dropped afterwards.

2021 saw both technologies increase their growth rates, and the BEV market is expected to continue growing, although at a slower pace. This is because only 20% of the market is left to electrify. Meanwhile, PHEVs are projected to lose sales to BEVs, confirming their stepping-stone role.

Effects on the passenger-car fleet

When it comes to fleet numbers, the needle only really started to move by the end of 2015, followed by slow but steady growth until the end of 2019.

In 2020 and 2021, there was a significant rise in the vehicle-replacement rate, with the EV share jumping five percentage points in just two years, to 9% by the end of 2021.

With EVs representing over 80% of the passenger-car market in 2022, expect a rapid electrification of the automotive fleet, with a complete phase-out of petrol and diesel models by 2040.

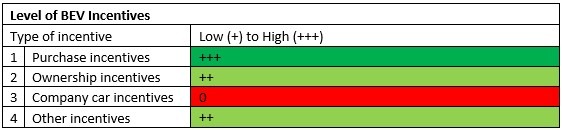

How big are the incentives?

With an incentives plan inspired by that of Norway, EVs have several significant incentives, not only at the point of purchase. For example, the VAT exemption, registration or import taxes, but also during the life of the car. These perks include a minimal ownership tax rate, or free charging and parking, in selected places.

Iceland and Norway appear exemplary of how to grow an EV market organically, by focusing on private customers and ownership incentives over the lifecycle. This contrasts with other countries, such as France or Germany, which over-proportionally incentivise BEV company cars and PHEVs (at least so far). This also leads to high numbers of PHEVs being driven like fossil-fuel vehicles only and not leveraging their CO2 reduction potential.

On top of this, there are also some indirect incentives, like no VAT for home chargers for private buyers, among other charging-infrastructure incentives.

Finally, one indirect driver for change is the zero-emission mandate, set to start in 2030 -except for 4×4 off-road vehicles, demanded by emergency response agencies and inhabitants of the island’s rural areas. All new passenger cars should emit zero emissions, which should be achieved in Iceland around 2027. The Icelandic government has the goal of making the country carbon neutral by 2040, which implies the complete phasing out of fossil fuels in transport.

| Types of incentive | |

| 1 | Purchase tax exemption, purchase incentive, VAT exemption, import tax exemption. |

| 2 | Ownership tax exemption, bus lane use, toll exemption, free parking, free ferries. |

| 3 | VAT exemption, benefit-in-kind tax exemption. |

| 4 | Charging cost deductibility, special license plates, EV charger subsidies. |

The charging-anxiety ratio

Source: ev-volumes.com

EVs do not mean much without charging infrastructure (CI), because for BEV success, three variables should be met:

- Price should be close to internal-combustion engine models;

- Range should be enough for the needs of the buying public, thus avoiding range anxiety;

- Drivers should have enough CI to be able to charge while on the road, avoiding charging anxiety, something that can be as damaging for EV adoption as concerns about range.

CI maintenance is another issue of concern. The official numbers assume that all charging stations are operational, which is not realistic, so the frequency of downtimes should be also considered when designing the CI.

The same logic applies to the EV driver. When preparing for a road trip, drivers need to have a plan B (or even plan C), in case the initial charging station is offline.

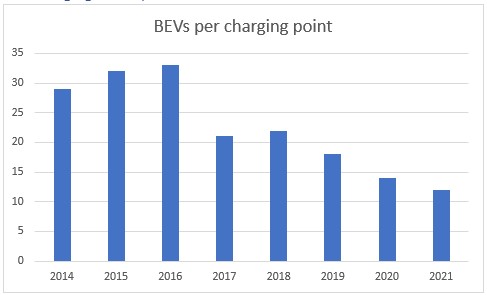

With EV sales starting strong without the corresponding deployment of CI, the number of BEVs per charging point was unusually high, reaching 33 BEVs per point in 2016, which might have drawn many buyers into PHEVs.

Due to an effort to increase the density of charging stations, this ratio has progressively decreased to 12 BEVs per charging point, which is a more manageable number to operate, and below that of Norway (17), which might have been connected to the recent BEV sales surge.

The lack of initial investment in CI might have been a limiting factor in the initial BEV uptake, but once that issue became a priority, these all-electric models experienced accelerated growth.

Targeting private registrations with incentives rather than company-car registrations and including ownership advantages over the lifecycle helps grow the EV market share organically and builds a used-car market at the same speed.