Electric cars buck trend and gain 18% share of 2021 EU new-car market

03 February 2022

The uptake of electrically-chargeable vehicles (EVs) gathered pace in Europe in the fourth quarter of 2021. This year-end push culminated in EVs accounting for 18% of all new passenger cars registered in the EU last year, up from 10.5% in 2020, according to the European Automobile Manufacturers’ Association (ACEA). Autovista24 envisages that with this growth set to continue, EVs will account for one in four new-car registrations in Europe by 2023, one in three by 2026, and one in two by 2030.

In the fourth quarter alone, battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) accounted for 14.2% and 10.3% of EU new-car registrations, respectively. Accordingly, almost one in four new cars registered in the period were EVs, up from 19% in the third quarter.

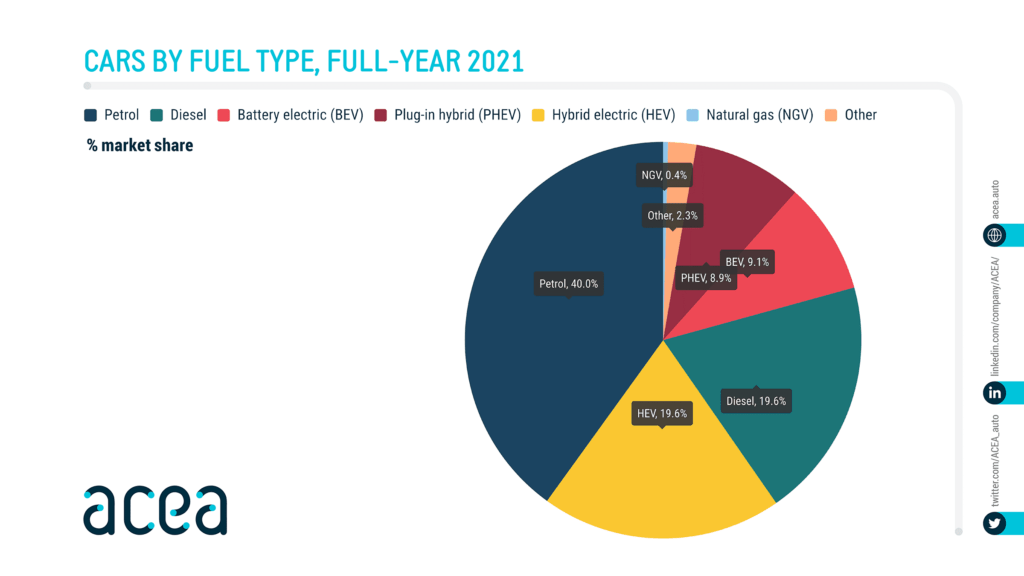

Despite the overall decline in EU new-car registrations in 2021, even after the COVID-19 pandemic decimated the market in 2020, BEV and PHEV volumes increased by 63.1% and 70.7% year on year respectively. This expanded their market shares to 9.1% and 8.9%, up from 5.4% and 5.1% in 2020.

Hybrid-electric vehicles (HEVs) also enjoyed phenomenal year-on-year growth, of 60.5%, to gain a market share of 19.6% in 2021, up from 11.9% a year earlier.

Registrations of petrol cars in the EU declined by 17.8% year on year in 2021. However, the fuel type remained the most dominant, accounting for 40% of the new-car market, albeit down from 47.5% in 2020. Diesel cars fared even worse last year, with registrations 31.5% lower than in 2020. Moreover, fewer diesel cars were registered in 2021 than HEVs. Although the difference was a mere 39 units, 2021 marks a historic landmark for HEVs becoming the second-most popular fuel type in the EU.

‘The overall contraction of the EU car market affected both diesel- and petrol-powered vehicles negatively. Nevertheless, conventional fuel types still dominated EU car sales in terms of market share in 2021, accounting for 59.6% of all new registrations,’ ACEA commented.

The diesel market has been in decline for a number of years, with buyers put off by demonisation of the fuel type. However, until last year, it held on to its position as ‘best of the rest’ when it comes to drivetrain technology in the EU. While the internal-combustion engine (IVE) continued to dominate, the shift in market position, with HEVs overtaking diesel, and EVs taking share away from petrol models, is a sign of things to come.

Higher EV uptake Europe-wide

The EV share achieved in the non-EU car markets of Iceland, Norway, Switzerland, and the UK was higher in 2021 than the EU average. Accordingly, EV uptake across the wider European region stood at 19.2%, up from 11.4% in 2020.

Norway and Iceland have the greatest prevalence of EVs across Europe, with respective shares of 86.2% and 54.7% in 2021. Within the EU, Sweden leads the ranking, with EVs accounting for 45% of passenger-car registrations in the country last year.

One in four

The EV share increased in 2021 in all 30 European markets tracked by ACEA, with 15 markets in double digits. Among the big five European markets – France, Germany, Italy, Spain, and the UK – Germany leads the way in terms of both EV penetration and market-share growth in 2021. More than one in four new cars registered in the country last year was an EV, up from 13.5% in 2020.

Italy and Spain lag far behind, with market shares remaining in single digits in 2021, at 9.4% and 7.8% respectively. The improvement was significant in Italy, which had a lower EV share than Spain in 2020 but gained by more than five percentage points in 2021. This compares to growth of less than three percentage points in Spain.

Italy is a market of concern however, as the EV incentives were exhausted in the country in November and there are no plans to resurrect them, despite industry pressure.

Upward trend assured

Hardly a day goes by without a carmaker announcing EV-battery development and/or production plans in Europe to meet the rising demand. As more EVs are launched on the market and consumer acceptance improves, an ongoing upward trend in EV uptake across Europe is assured.

Just this week for example, Volkswagen (VW) Group has announced that Zwickau has become the first large-scale plant worldwide to switch over all production from ICE vehicles to their electric counterparts. And Jaguar Land Rover (JLR) has secured a £625 million (€749 million) loan to support the research, development, and export of BEVs.

Governments have to meet strict CO2 emissions targets, which will ultimately result in the end of sales of ICE cars by 2035, including HEVs and PHEVs. Although these vehicles will not suddenly disappear from the roads, this does mean that new cars will either be BEVs or hydrogen fuel-cell vehicles (FCHVs).