Europe’s used-car markets on track to exceed pre-pandemic level in 2022

16 February 2022

Autovista24 senior data journalist Neil King considers how the big five European used-car markets are expected to exceed pre-pandemic levels in 2022.

New-car registrations in Europe’s big five markets endured double-digit declines in 2021, compared to 2019, as supply constraints especially hampered the recovery in the second half of the year. The volume of used-car transactions was far less affected, with a double-digit fall only reported for Italy. The contractions in Germany, Spain, and the UK were less than 10%, and the French market for second-hand cars even rebounded to surpass its 2019 tally.

Data for January 2022 is only available for Germany and Italy but the year-on-year growth rates, of 5.6% and 34.3% respectively, suggest both used-car markets are on track to exceed pre-pandemic levels in 2022. The same applies to all the major European markets, with Spain and the UK only requiring 5% growth to get ahead this year. Used-car transactions in France would need to contract by 4% to revert to the volume achieved in 2019.

To put this into context, Autovista24 forecasts that all five new-car markets will end 2022 with at least 18% fewer registrations than in 2019. This depends on the extent of the improvement in the supply situation, but the limited availability of new cars and mounting financial pressures for consumers will certainly serve to support used-car demand again in 2022.

This positive development also underpins Autovista Group’s core prediction that car residual values (RVs) will rise further this year in France, Germany, Italy, and Spain. A correction is expected in the UK, albeit largely because of the phenomenal growth in 2021 as opposed to underlying weakness putting prices under pressure.

New record in France

French used-car transactions in 2021 were 3.9% higher than in 2019, according to the automotive data provider AAA Data. This is in sharp contrast to the 25.1% fall in new-car registrations. Moreover, this is the first time more than six million cars changed ownership in a year.

‘Choice, availability and price are all advantages of the used car that have never been truer than in 2021,’ AAA Data commented. The association added that only registrations of young used cars, up to one year of age, are down because of the lack of available vehicles.

Autovista24 sees the upward trend continuing in France in 2022. This is not just because new-car supply remains constrained, but also because the malus (penalty) applies to all cars emitting more than 128g CO2/km since 1 January. Furthermore, for vehicles weighing more than 1.8 tonnes, including a 75kg allowance for the driver, a weight tax is calculated at a rate of €10 for every excess kilogramme. Battery-electric vehicles (BEVs) and hybrids are excluded because of the extra weight of their batteries, on the condition that they have an electric-driving range of at least 50km. The maximum tax liability is limited to €40,000, even if the combined penalty and weight tax exceed this amount.

AAA Data reinforces this view. ‘The second-hand market should still have a good future in 2022. The shortage on the new market is likely to continue until the semiconductor crisis is resolved. In addition, a new reason for turning to second-hand cars has been created by the introduction of the new weight-based tax on new cars over 1.8 tonnes,’ it said.

‘To avoid this, buyers will be able to opt for recent second-hand cars as well as cars over 1.8 tonnes that were imported and registered in their country of origin before 2022, which are also not subject to the new weight-based tax.’

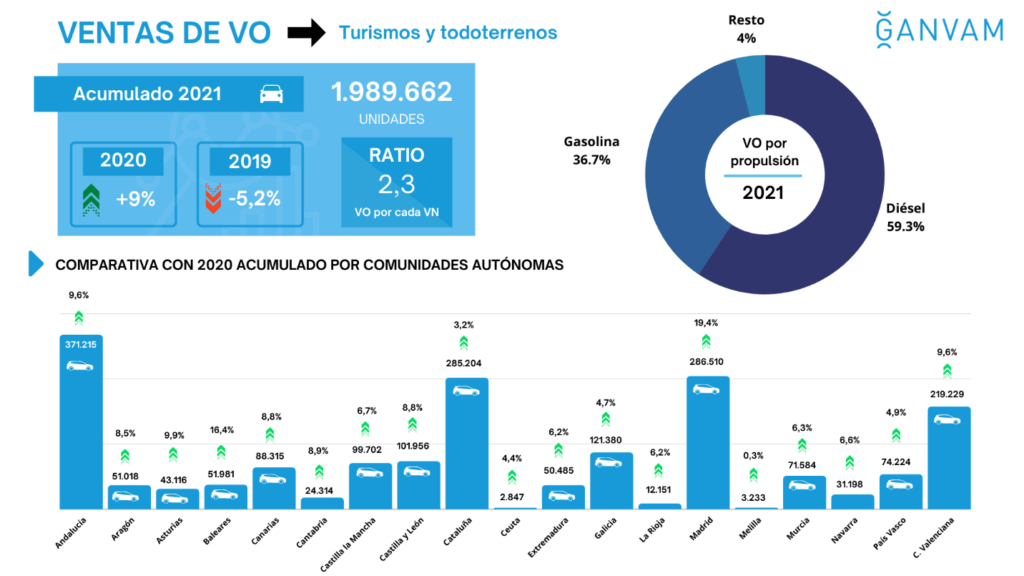

Used-car transactions lead the way in Spain

In contrast to the dramatic 31.7% decline in new-car registrations in Spain in 2021, compared to two years earlier, the volume of used-car transactions only fell by 5.2%, according to GANVAM, the Spanish dealers’ association. With a total of 1,989,662 vehicles changing ownership, ‘these data show that for every new vehicle, 2.3 second-hand vehicles were sold,’ the association emphasised.

‘In an analysis by age bracket, transactions of used vehicles between five and eight years old were the ones that grew the most last year, with an increase of 24.5% compared to 2019. For their part, transfers of models over 15 years old, the main driver of private-to-private transactions, accounted for 34% of the market, in line with 2019,’ GANVAM added.

In addition to the economic pressures and new-car supply shortages, registration taxes have also increased in Spain since 1 January. This will support the used-car market again in 2022, which Autovista24 predicts will grow sufficiently to return to the pre-pandemic level of 2019. Although the year-on-year growth rate is expected to be higher in the new-car market, Autovista24 forecasts that 29% fewer new cars will be registered than in 2019.

‘There is no doubt that the Spanish market has the capacity to sell more than two million used cars per year, a figure that will be exceeded as the fleet is rejuvenated and the "used-vehicle factories" (renewal of car-rental fleets, leasing, higher turnover in private vehicles, etc.) can generate a supply of young cars to cover the market niche that is so much in demand and so little offered today, i.e. models between three and five years of age,’ commented Tania Puche, GANVAM's director of communications.

‘Best Q2 on record' in the UK

The UK’s used-car market has suffered a similar fate as in Spain, with 5.1% fewer transactions last year than in 2019, according to the UK Society of Motor Manufacturers and Traders (SMMT). Again, this compares favourably to the new-car market, which contracted by 29.3%, as it was more adversely affected by the closure of dealers until 12 April.

‘Quarter four rounded off a volatile year for the market, with transactions falling to just over 1.6 million, as semiconductor shortages impacting new-car sales in the second half of the year squeezed supply of stock into the used market. The second quarter was, in fact, the best on record and, with 2.1 million transactions, the busiest period of the year as the UK emerged from renewed lockdowns. May was the highpoint with 769,782 cars finding new keepers in the month,’ the organisation stated.

Autovista24 forecasts that the volume of used-car transactions in 2022 will exceed that of 2019. The 15% year-on-year growth forecast for the new-car market is far greater, but also essential to improve availability in the used-car market, especially of the latest generation of low-emission vehicles.

SMMT chief executive Mike Hawes added: ‘With the global shortage of semiconductors set to ease later this year, releasing the squeeze on new-car supply, we expect more of the latest, cleanest and zero emission models to become available for second owners. The demand for personal mobility has undoubtedly increased during the pandemic, so it is vital we have healthy new-car sales to drive fleet renewal and the used-car market if we are to improve air quality and address climate change.’

Weaker performance in Germany and Italy

In Germany, the used-car market contracted by 6.8% in 2021, according to the motor-vehicle authority KBA. Dealerships in the country could only reopen, conditionally, from 8 March last year. This naturally impacted the new-car sector far more, with registrations down 27.3% compared to two years earlier.

The 5.6% year-on-year growth in used-car transactions last month is slightly lower than the 6.8% downturn in 2021, versus 2019. Nevertheless, Autovista24 is confident that the market will return to, or at least nudge, pre-pandemic levels this year, supported by 10% growth in the new-car market improving stocks of used cars.

The poorest performance among Europe’s used-car markets in 2021 was in Italy, where 17.5% fewer cars changed ownership than in 2019, according to trade body ANFIA. However, even this was a less dramatic downturn than the 23.9% decline in the new-car market.

Italy faces the same challenges as other countries in 2022, including supply constraints, rising raw-material costs and surging energy prices. Additionally, the purchase incentives for electric vehicles (EVs) were exhausted in November and are not expected to return. These factors will likely propel the used-car market back to pre-pandemic levels this year, as evidenced by the phenomenal 34.3% year-on-year growth in January.

Residual values continue to grow

Autovista Group’s latest monthly market update reveals that the strength of Europe’s used-car markets resulted in further growth of residual values (RVs) of three-year-old models last month. RVs remain firmly higher than a year ago in all countries covered.

In addition to the Europe-wide shortage of supply, the revised registration taxes in France and Spain mean that list prices of many new cars have artificially increased too. Furthermore, OEMs are offering new cars with a lack of options due to the semiconductor crisis, which is also deterring customers from buying, even when the car itself is available.

The upward trend in RVs of cars with internal-combustion engines (ICE), and hybrid-electric vehicles (HEVs), is forecast to continue across most of Europe in 2022. The exception is the UK, where Glass’s expects values to lose some of the impressive gains made in 2021, albeit only falling by around 3-4%. Nevertheless, even the outlook for the UK is healthy by historic standards as ongoing supply issues are expected to give vendors the confidence to hold out for strong reserve prices.

The outlook also points to ongoing RV rises for plug-in hybrids (PHEVs), except in France and the UK, as they make up for the lack of ICE cars and HEVs. However, transaction prices of BEVs, especially those with a limited range, will continue to struggle as there is not enough demand from private used-car buyers to absorb the growing supply.