Cautious start to 2024 for car registrations and transactions in Switzerland

23 April 2024

New-car registrations and used-car transactions in Switzerland recorded a cautious start to the year. Hans-Peter Annen, head of valuations and insights at Eurotax Switzerland (part of J.D. Power), reviews the first quarter of 2024 with Autovista24 editor Tom Geggus.

After a positive 2023 for new-car registrations, the start to 2024 in Switzerland and Liechtenstein was subdued. The first quarter of the year saw deliveries total 57,224 units, a decline of 2.7% against the same period in 2023.

Compared with the first quarter of 2019, prior to the COVID-19 pandemic and supply-chain disruptions, registrations were down by more than 20%. However, despite the industry having recovered and order backlogs cleared, ongoing conflicts have led to reluctance from buyers.

Totalling 23,467 registrations, 6.8% fewer new passenger cars were delivered in March 2024 than in the same month last year. With five weekends in the month and the early Easter period, March was heavily impacted by fewer working days.

Hopes for the coming months rest on the market’s Spring performance, which should reverse the current trend and lead back towards positive figures. The focus is likely to be on the weaker electric-vehicle market.

Compared with March 2019, 19% fewer cars took to the country’s roads last month. The new-car market results recorded before the pandemic are, therefore, likely to remain unattainable for the foreseeable future.

Slight electric growth

Electrified models, including battery-electric vehicles (BEVs), plug-in hybrids (PHEVs), full (HEVs) and mild hybrids (MHEVs), saw 14,036 registrations in March. This was only up 1.1% compared to March 2023, and equated to a market share of 59.8%, up from 55.1% a year earlier.

While enjoying an improved market share of 20.3%, up from 19.1% in March 2023, BEV registrations fell to 4,765 units, down 1% year on year. PHEVs performed worse, with 1,994 deliveries, down 6.4%. Petrol cars recorded a drop of 17.6% to 7,382 units, while diesel models fell by 12.6% to 2,048 units.

The only powertrain category to record growth was that of hybrid vehicles, which combines both MHEVs and HEVs. These vehicles saw registration growth of 5.2%, up to 7,277 units.

Weak March impacts transactions

The first two months of 2024 were marked by positive used-car transaction results. However, the first quarter of 2024 saw a significant decline overall, due to an extremely weak March. A total of 178,800 car-ownership changes were recorded in the first three months of the year, down 7% compared to the first quarter of 2023.

Transactions fell by 30.8% to 48,208 units last month. However, as with new-car registrations, this was likely due in part to fewer working days in the month. Therefore, these figures are expected to rise again in the coming months, with March’s figures considered an anomaly.

Persistent price drops

Since the beginning of 2023, the number of used cars on offer has recovered and returned to the pre-pandemic level. Cars up to two years old are the only age group to see low supply, down by around 20% compared to the beginning of 2020. Meanwhile, most other age groups are seeing higher supply.

This overall positive supply level continues to contrast with subdued demand. This means prices on the used-car market have been under pressure since 2023 and into 2024. High offer prices continued to fall in the first quarter of this year.

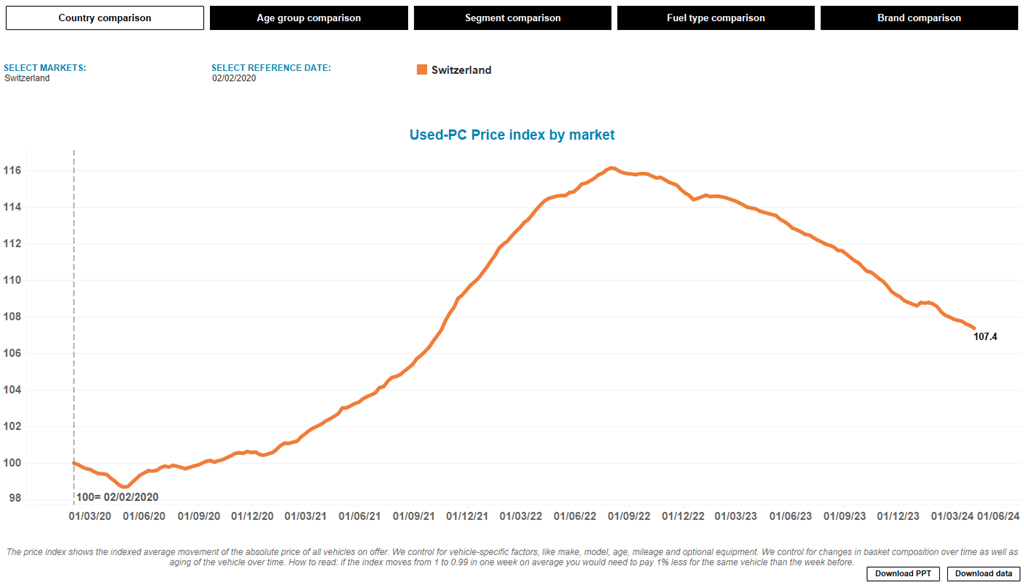

Compared to the level recorded at the beginning of February 2020, the Eurotax asking-price index is currently 7.4% higher than before COVID-19. This is down on 2022, when the index climbed to 16%.

All powertrain types and age categories saw the impact of the exceptional market situations until the end of 2022. Since then, asking prices have fallen significantly. One exception is HEVs, which have seen results weaken far less.

BEVs, on the other hand, reported a temporary increase across all age groups in 2022, starting from the lowest level of all powertrains. However, these vehicles have now seen list prices weaken the most since the end of 2023.

Residual values to fall

The new-car market and supply situation, in conjunction with consumer sentiment and demand, are decisive for the used-car market’s development. Higher inflation, increased energy costs and global conflicts have seen consumer sentiment weaken.

This is offset by the high availability of new cars and large range of used cars. The increasing new-car price war and high used-car supply are meeting restrained demand. This is likely to lead to a further decline in residual values in 2024.

*Since the beginning of 2022, the Federal Roads Office, ASTRA, has provided figures for changes of ownership. Before that, up to and including June 2022, ASTRA supplied raw data with all changes in the Swiss vehicle stock. The analysis of changes of ownership was carried out by Eurotax, partly with assumptions. The figures calculated in this way were approximately 3% higher than the values according to ASTRA’s evaluations from 2022 onwards. Therefore, the figures for 2022 are based on ASTRA data. The values up to and including 2021 are shown according to the previous method. This must be taken into account when comparing the figures for 2022 with previous years. Comparisons are therefore only possible to a very limited extent, if at all.