COVID-19, rising costs and supply shortages cripple UK new-car market in September

05 October 2021

The UK new-car market was crippled by the persistence of COVID-19 and semiconductor shortages, as well as rising costs, in September. Autovista24 senior data journalist Neil King explores the latest figures and factors.

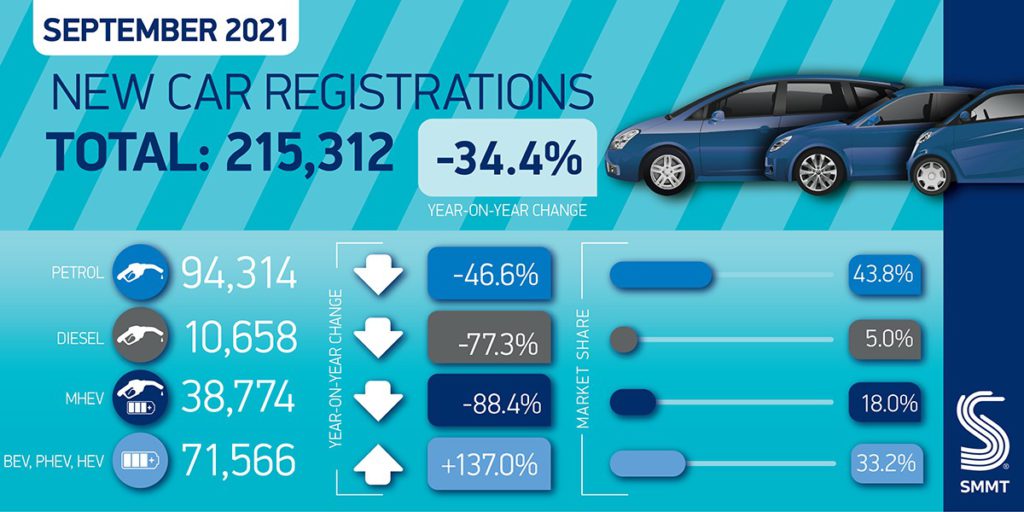

In total, 215,312 new cars were registered in the UK last month, according to data released by the Society of Motor Manufacturers and Traders (SMMT). This is 44.7% lower than the 10-year monthly average (between 2010 and 2019) of almost 390,000 registrations. Furthermore, the SMMT reports that ‘the UK new-car market has recorded its weakest September since 1998 – ahead of the introduction of the two-plate system in 1999.’

As UK dealers endured lockdowns and subsequent releases of pent-up demand, year-on-year comparisons with 2020 are meaningless. Therefore, comparisons are made against 2019, which better represent the true performance of the country’s new-car market.

The 37.3% contraction last month is a significant deterioration from the 26.5% decline in August. Moreover, there was one more working day in September this year than in 2019 and, on an adjusted basis, Autovista24 calculates that the market plummeted by 40.1%.

‘This is a desperately disappointing September and further evidence of the ongoing impact of the Covid pandemic on the sector. Despite strong demand for new vehicles over the summer, three successive months have been hit by stalled supply due to reduced semiconductor availability, especially from Asia. Nevertheless, manufacturers are taking every measure possible to maintain deliveries, and customers can expect attractive offers on a range of new vehicles,’ said SMMT chief executive Mike Hawes.

Unique circumstances in the UK

This latest development in the UK contrasts with the performance of major EU new-car markets, where the downturns were less severe than in August. All European countries are contending with semiconductor shortages and inflationary pressure, especially from rising energy costs, but there are two additional phenomena that are specific to the UK.

First, as a right-hand drive market, the semiconductor shortage is undoubtedly having a greater adverse impact on deliveries, which were already subject to more significant delays in the wake of Brexit.

Second, the UK has suffered from disruption to the delivery of fuel supplies due to a shortage of truck drivers. This has resulted in long queues at petrol stations but, moreover, a spike in prices at the pump. According to the RAC Foundation, the per-litre cost of petrol and diesel on 1 October was at it its highest level since late 2013. This is further squeezing household budgets and while it has not had an impact on September registration figures, does not bode well for an improvement in demand for new cars.

Downward forecast revision

In the first three quarters of this year, the UK market has contracted by 29.3% compared to the same period in 2019. Given the disappointing September result, the persistent supply shortages, and the mounting pressure on household budgets, including rising energy costs and the recent hike in fuel prices, Autovista24 has downgraded its 2021 forecast to 1.71 million units, equating to 5% year-on-year growth and a fall of 25.9% against two years ago.

In its last quarterly forecast update, the SMMT predicted 1.82 million registrations in 2021. A downward revision to this forecast is expected in the association’s November update.

Although the UK market is contending with supply shortages, registrations of electrically-chargeable vehicles (EVs) continue to surge.

‘September was the best month ever for new battery-electric vehicle (BEV) uptake. With a market share of 15.2%, 32,721 BEVs joined the road in the month, reflecting the wide range of models now available and growing consumer appetite. Indeed, the September performance was just over 5,000 shy of the total number registered during the whole of 2019,’ the SMMT noted. The share of plug-in hybrids (PHEVs) also grew, to 6.4%. The combined 21.6% share of EVs was more than double that of diesel cars, including mild-hybrid diesels, which gained 10.3%.

In the first three quarters of 2021, BEVs and PHEVs captured 9.5% and 6.6% market share respectively. Combined, the 16.1% share of EVs has overtaken the diesel share, 15.4%, for the first time in the year-to-date.

Fuel crisis drives EV demand

There has been widespread media coverage of the fuel shortages in the UK since 23 September. ‘In reality, it will not have had any impact on new-car registrations in September. To have had a car available in September, the likelihood is that it would have needed to have been ordered several weeks or even months before the crisis happened,’ said Jayson Whittington, Glass’s chief editor, cars and leisure vehicles.

Nevertheless, any increase in EV sales orders will translate into registrations in the coming weeks, vehicle deliveries permitting. Whether the current high demand for EVs is maintained, or even gathers pace, depends partly on the speed and longevity of the fuel-crisis resolution. Even if it is only a short-term issue, the SMMT will likely have to increase its forecast that BEVs and PHEVs will account for 9.5% and 6.5% of registrations respectively in 2021. This has already been surpassed.

‘The rocketing uptake of plug-in vehicles, especially battery-electric cars, demonstrates the increasing demand for these new technologies. However, to meet our collective decarbonisation ambitions, we need to ensure all drivers can make the switch – not just those with private driveways – requiring a massive investment in public recharging infrastructure. Charge point roll-out must keep pace with the acceleration in plug-in vehicle registrations,’ Hawes cautioned.