Monthly Market Update: Petrol and diesel RVs resume rise in September but prices approaching peak

28 September 2021

Despite a slowdown in the active-market-volume index across Europe’s used-car markets due to supply shortages, sales volumes remained buoyant in September. Accordingly, residual values (RVs) have resumed their rise after the seasonal hiatus in August, and the 2021 RV outlook has been upgraded in Italy, Spain, Switzerland, and the UK.

Autovista24 has recently extended its coverage of used-car markets in the dashboard to include Austria and Switzerland. It also includes a breakdown of key performance indicators by fuel type, average new-car list prices and sales-volume and active-market-volume indices.

Whereas RVs of petrol and diesel cars are rising again, electrified vehicles, including standard hybrid (HEVs), plug-in hybrid (PHEVs) and battery-electric vehicles (BEVs), struggle to find used buyers. However, there are early signs that asking prices for internal-combustion engine (ICE) cars are approaching their peak, and stock days and values of electrified vehicles are stabilising – at least in some markets.

Since the beginning of the year, the Austrian used-car market has been characterised by stable demand and continued low supply, explains Robert Madas, Eurotax (part of Autovista Group) valuations and insights manager, Austria and Switzerland.

On average, across all passenger cars aged two to four years, the supply volume in September was 11.5% lower than at the beginning of 2020. Diesel vehicles are especially missing from the market, with a drop of 19.4% in the active-market volume index compared to the start of last year. Nevertheless, sales activity for diesel cars in September was 20.9% higher than in January 2020.

Average days to sell have slightly increased, by 1.5 days, compared to August. However, this is still way below the figures from last year. On average, a two to four-year-old car is currently on offer for 57.3 days, down from 63 days a year ago. Diesel cars are selling the fastest, averaging 55.7 days.

This market environment has led to a further increase in the values of 36-month-old cars. RVs have risen by 3.3% year on year to retain 44.3% of their value. HEVs, in particular, have made strong gains (to 46.7%) and are now followed by petrol cars (45.4%) and diesel cars (43.9%). In contrast, RVs of three-year-old BEVs have declined significantly and stand at 36.8% (down 7.2% year on year). ‘The reasons for this, apart from the significantly higher supply volumes, are the faster technology ageing of older BEVs as well as the attractive subsidies available on the new-car market,’ Madas explains.

Austria values pressure free – for now

Madas assumes that the market parameters will not change in the medium term, so that RVs for three-year-old passenger cars will probably continue to rise this year and next. Only when the new-car market picks up significantly, and thus volumes on the used-car market also increase, are values likely to come under pressure. This will probably not be the case before 2023, he concludes.

Meantime, for those who earn their money in the used-car business, a ‘gold-rush’ mood is probably spreading across Germany – at least in terms of prices. And although the year-end push to sell stock has begun, the outlook for the overall market remains clear, says Andreas Geilenbruegge, head of valuations and insights at Schwacke.

Supplies scarce in Germany

Supplies in all age clusters are scarce in the country, and people are no longer afraid to increase existing offer prices instead of simply pricing new stock higher than before. After all, used cars are leaving forecourts more and more quickly, and sources of new vehicles are becoming less and less productive. ‘As an overall market description, the term “seller’s market” is appropriate’, comments Geilenbruegge.

Looking in more detail, however, there are differences. In terms of age groups, for example, the older the vehicle, the stronger the percentage price increase – but this also means lower growth in absolute value and earnings.

Overall, sales of three-year-old diesels are still relatively stable in terms of volume, even though the observed daily supply volume has decreased by about 25,000 vehicles, or almost 40%, compared to before the pandemic and the semiconductor crisis. In the case of young used cars aged six to 18 months, petrol models are faring better than diesel in terms of price development, but they also remain on the market for 15-20 days longer on average.

The situation remains difficult for electrified powertrains, which still account for a conspicuously small share of the used-car market across all ages. However, stock days of BEVs are lowering, and prices appear to be stabilising. Both PHEVs and HEVs are increasingly substituting for the lack of combustion-engine supply and are stable in price, even compared to a year ago. Nevertheless, young HEVs have overtaken BEVs to have the highest number of stock days this year, which gives an indication of their future price development, Geilenbruegge adds.

New-car delays drive Italy’s used-car demand

The latest used-car market observations confirm the recent trend observed in Italy: RVs are rising sharply and after an average of 61 days, a car is now sold five days faster than a year ago. Delays in the delivery of new vehicles have shifted some purchases to used cars, with the sales-volume index showing a 37.5% increase compared to January 2020. A 45% reduction in self-registrations and a 52% decline in sales to the short-term rental channel, compared to 2019, certainly help explain this phenomenon, says Marco Pasquetti, forecast and data specialist, Autovista Group Italy.

However, it is important to highlight that the rise in RVs is related to ICE vehicles, thanks to demand exceeding supply, Pasquetti explains. This is especially clear in the case of diesel cars, which are still very strong on the used-car market as restrictions or bans are mainly only in place in large cities. There were 10.7% more sales for this fuel type in September, but 15.8% fewer adverts than in January 2020.

The situation is different for RVs of hybrid and electrically-chargeable vehicles (EVs), with BEVs falling especially sharply compared to a year ago, down 30%. The market share of used BEVs is still very low, but they still take more than 100 days to sell. This is an increase of almost three days compared to last month and about 40 days more than the average selling time.

Shortages in Spain

Used-car sales figures in Spain are currently well above 2020 levels and are almost in line with 2019. However, their ability to grow is limited by the shortage of product, with a drastic drop in stock volumes in recent months, says Ana Azofra, Autovista Group head of valuations and insights, Spain.

The semiconductor crisis has slowed down sales of new vehicles, limiting the entry of young used cars into the market, which was already suffering the consequences of the drop in new-car sales since 2020. This is in addition to the shortage of product, caused by a lack of car-rental activity and the extension of leasing contracts. Conversely, demand for used cars is growing, with the economic crisis and product shortages in the new-car market pushing more consumers to buy used.

This imbalance is intensifying the upward trend, already seen in recent months, in the transaction prices of used petrol and diesel cars. Azofra expects this upward trend to continue over time as ‘there is no sign of stabilisation, and nor will there be until the semiconductor crisis begins to be resolved and production gathers pace.’

In addition, the shortage of new product has allowed discounting to be set aside, both for new and used cars, which will help the positive RV trend to be better sustained over time. In this scenario, only BEVs and PHEVs show a negative trend due to their persistently high prices and the pressure being exerted by the incentives offered under the MOVES plan.

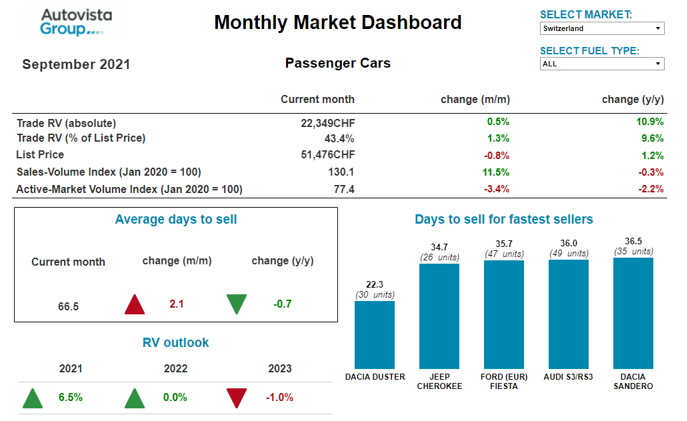

Asking prices peaking in Switzerland

As in Austria, the Swiss used-car market continues to be characterised by stable demand and low supply, says Madas. On average, across all two to four-year-old passenger cars, the supply volume in September was 22.6% below the level at the beginning of 2020. Diesel cars are particularly missing on the market, with supply 36.5% down compared to the beginning of 2020, whereas sales remain at a similar level. Petrol cars show a similar dynamic, albeit more pronounced: the sales-volume index is around 45% higher than at the beginning of last year, and supply has fallen by around 17%.

After a decline in the past few months, the average days to sell have risen slightly since August: a passenger car aged two to four years is currently in stock for 66.5 days. Petrol cars are selling especially quickly, after an average of 63.8 days. ‘Rising days to sell with tight supply sounds contradictory, but it could be a sign that the good offers are now sold and that the high asking prices are slowly reaching their peak,’ explains Madas.

This market environment has led to a further increase in the average residual-value percentage (%RV) of 36-month-old passenger cars to 43.4% (+9.6% compared to September 2020). Petrol cars posted strong year-on-year gains of 10%, to 44.5%, as too did diesel cars (up 9% to 41.7%).

Regarding the future development of RVs, supply will be decisive. As cumulative new-car registrations are markedly lower than before the crisis (down 20.6% compared to 2019), Madas assumes that the market parameters will not change in the medium term. RVs for three-year-old used cars will probably continue to rise this year, and at the beginning of next year, before stabilising over the course of 2022, he concludes.

No slowdown in the UK

Activity in the UK’s used-car market shows no sign of slowing down. In fact, sale prices at auctions continue to exceed Glass’s trade values despite month-on-month increases, says Jayson Whittington, Glass’s chief editor, cars and leisure vehicles. In September, RVs rose a further 7.7%, bringing the year-on-year movement to 22.2%.

There has been a rapid move away from diesel-powered cars in the new-car market due to a combination of unfavourable taxation for company-car drivers and negative press reporting in the wake of the ‘Dieselgate’ scandal. Consequently, fewer diesel cars are now entering the used-car market. This is highlighted by the active-market index, which shows a 39.4% year-on-year fall at a time when demand remains strong.

Although the general used-car market is clearly performing well, this month’s dashboard shows that diesel RVs have increased even more, rising 35.8% compared to September 2020. Underlining the continued popularity of diesel is the average number of days it took a dealer to retail a unit in September, which, at 33.7, was 1.3 days fewer than the average of all fuel types.

With new-car supply issues expected to continue for the rest of the year, Glass’s does not expect an increase in the volume of part-exchanges and contract hire de-fleets entering the used-car market. Whittington does therefore not foresee ‘an end to the incredibly buoyant wholesale market, and values could even carry on rising’.

View the September 2021 monthly market dashboard for the latest pricing, volume and stock-days data.