European new-car market outlooks stable except for Germany and UK

28 June 2022

Autovista24 has revised its forecasts downwards for the German and UK new-car markets. Senior data journalist Neil King explains why.

Europe’s big five new-car markets performed in line with Autovista24’s expectations in May. However, while the forecasts for France, Spain, and Italy are maintained, the outlooks for the UK and Germany are downgraded this month as supply issues and rising inflation bite.

Autovista24 assumes that the impact caused by the Ukraine war is lessening as alternative sources of raw materials and parts are secured. This was already factored into the outlooks and the assumption holds true. Nevertheless, the ongoing semiconductor shortage is expected to see a large volume of registrations displaced into 2023 due to the associated impact on vehicle supply.

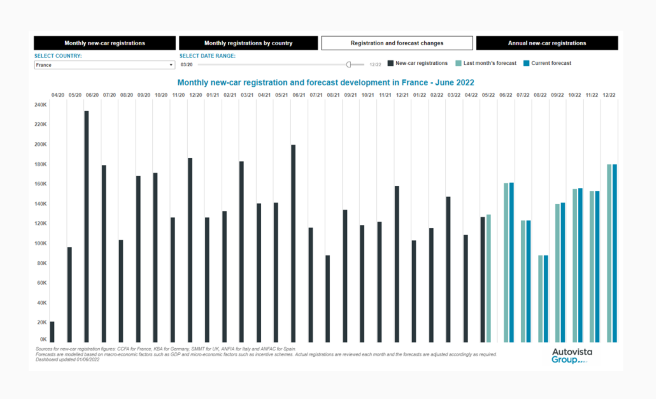

Monthly new-car registrations, France, April 2020 to December 2022

With this displacement, double-digit growth rates are expected in all five key European markets in 2023. In 2024, Autovista24 expects to see a return to a semblance of automotive market normality.

Germany and UK dampen European outlook

The downward trend in the German new-car market continued in May. A shortage of materials is afflicting car production in the country, which is down 6% year on year in the first five months of 2022, according to the German automotive industry association VDA. This will especially impact the domestic market. Furthermore, carmakers are increasing list prices for new cars to offset rising raw-material costs, and the country’s inflation rate is exceeding forecasts.

Against this backdrop, Autovista24 lowered the 2022 outlook to 3.1% growth in its June forecast round. At 2.7 million units, this aligns exactly with the latest forecast issued by the VDA.

There was a notable deterioration in the UK in May, where the seasonally-adjusted annualised rate (SAAR) receded from 1.8 million units to just 1.45 million units. The Consumer Prices Index (CPI) in the UK increased to 9.1% in the 12 months to May 2022 and is likely to exceed 10% in the coming months. Interest rates also rose for the fifth consecutive month in June, with more hikes expected throughout the year.

In conjunction with ongoing supply challenges, Autovista24 has revised its forecast for UK new-car registrations in 2022 downward by 20,000 units, to below 1.71 million. This represents 3.6% growth this year but is 26% below the pre-pandemic level of 2019.

Overall, the combined 2022 forecast for the big five European new-car markets has been lowered from 8.31 million units last month, to 8.26 million units. This marks a reduction of 55,000 units, or a 0.7% downgrade. Moreover, the latest outlook calls for year-on-year growth of only 0.1% in 2022, even after two consecutive annual falls of 25.4% and 2.2%.

Stable outlook for other big markets

France and Italy improved on their registration performance in April and Autovista24 has maintained the forecasts for 2022, with the negligible volume deficits in May simply redistributed into the remaining months of the year.

Spain’s new-car market fared worse when adjusted for the two extra working days last month. However, this was expected following the strong correction in April as vehicle deliveries caught up from the severe impact of the truck drivers’ strike in March. The forecast for this year has been subtly adjusted, by just 5,000 units, to 836,000 new-car registrations.

The new-car markets of France, Spain and Italy are all forecast to contract between 2% and 4% in 2022.

Displacement into 2023

Semiconductor shortages are still expected to persist into 2023 and probably beyond. Nevertheless, as countless new-car registrations will be displaced from this year, double-digit growth rates are expected in all five key European markets next year.

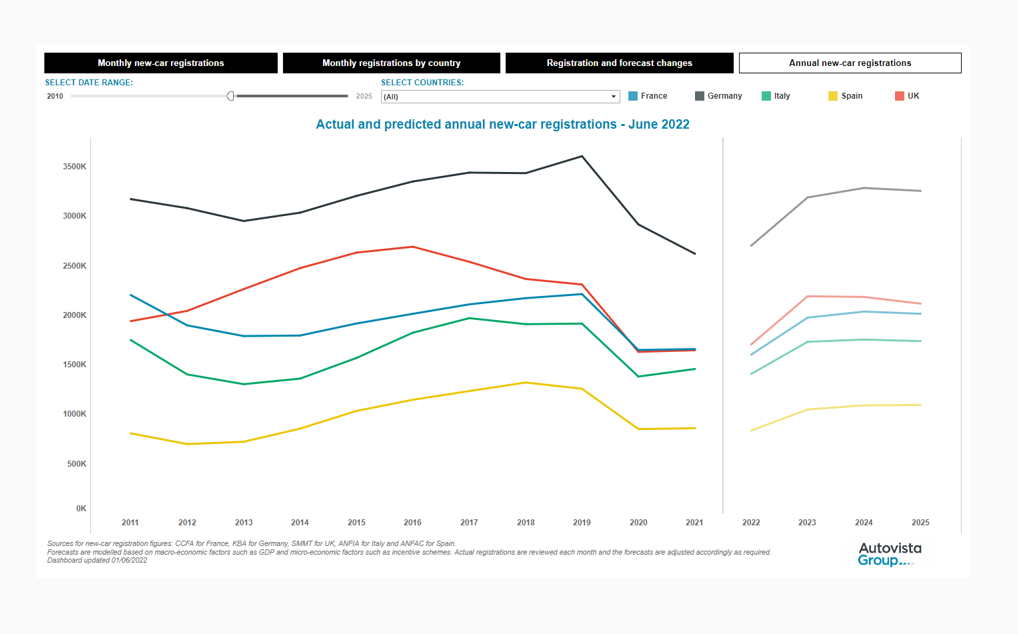

Annual new-car registrations, big five European markets, 2011 to 2025

Autovista24 forecasts that the volume of registrations across the five key Western European new-car markets will rise 22.8% to over 10.1 million units in 2023, but this is still 10.3% lower than in pre-pandemic 2019.

A return to comparative normality is expected in 2024, which is likely to benefit from a pull-forward effect as automotive manufacturers and consumers seek to register cars ahead of the EU Commission’s target of a 55% reduction in CO2 emissions in 2025, compared to 2021 levels.

Autovista24 predicts 2.1% year-on-year growth in 2024 but foresees a modest correction in Europe’s leading new-car markets in 2025, except in Spain where an anticipated slower recovery means the market will be the furthest adrift from pre-pandemic levels in 2024.

The full interactive dashboard presents the latest and previous monthly forecasts for 2022, as well as the annual outlook for the big five European markets to 2025.