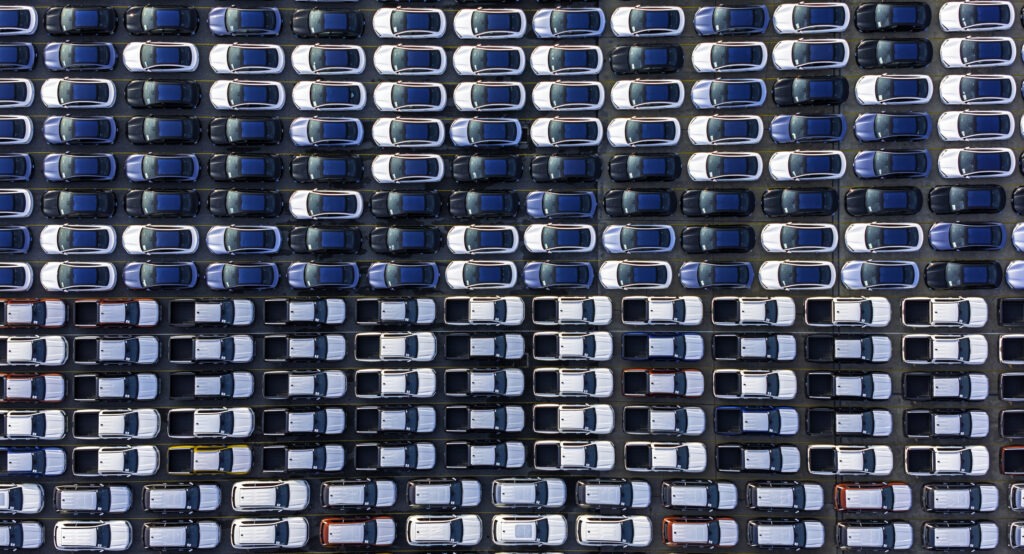

EVs made in China dominate European market in June

15 August 2024

Battery-electric vehicles (BEVs) built in China enjoyed a registration rush in Europe’s electric vehicle (EV) market during June. José Pontes, data director at EV Volumes, analyses the results with Autovista24 journalist Tom Hooker.

A total of 293,588 EVs, consisting of BEVs and plug-in hybrids (PHEVs), took to European roads in June. This equated to a decline of 5% year on year.

BEVs remained stable compared to 12 months ago, reaching 208,622 registrations. Meanwhile, plug-in hybrids plummeted 15%, with 84,966 units. This contrasted with an overall new-car market growth of 4% in the month.

Plug-in models captured 22.4% of Europe’s new-car market in June, including a 15.9% share for BEVs alone.

In the year to date, EV deliveries were up 1%, while BEV volumes improved by 2%. Plug-ins accounted for 21% of new-car deliveries between January and June, with BEVs alone taking a 13.9% share.

Provisional tariff rush

The month’s EV figures were affected by the announcement of provisional tariffs on BEVs made in China. Demand for models, such as the MG4 and Volvo EX30, spiked ahead of the new duties coming into effect.

June’s EV performance was also impacted by Germany’s ongoing BEV slump, after private subsidies stopped abruptly in December 2023. German registrations for the powertrain declined 18% year on year in June. Excluding the country from Europe’s BEV figures, the technology would have grown 5%, outpacing the overall new-car market.

Hybrids, including full and mild versions, emerged as Europe’s fastest-growing technology in June. The segment posted a delivery increase of 24% compared to one year ago, representing 30% of the overall market. This means that 52% of new-car registrations in the month were electrified.

Meanwhile, BEVs made up 71% of the plug-in sector during June, ahead of its 66% EV share in the year to date.

Is Model Y domination ending?

The Tesla Model Y was Europe’s best-selling EV in June, with 23,869 deliveries. However, the crossover is struggling to replicate the volume of previous performances. It appears the market’s natural limits and the impact of new competitors are starting to take effect. It did, however, benefit from Tesla’s traditional quarterly delivery schedule.

The midsize model was also Europe’s most popular D-segment vehicle in the month. The Model Y had strong results in the UK (3,642 units), Germany (3,346 units), Norway (2,324 units), France (2,156 units) and Sweden (2,121 units).

Taking some demand away from first place was the refreshed Tesla Model 3 in second, which reached 20,829 registrations. The sedan’s result was boosted by a pull-forward effect, with deliveries made before provisional tariffs were applied to EU imports.

Volume for the Model 3 was highest in Italy (3,280 units), followed by the UK (3,111 units), France (1,821 units), the Netherlands (1,664 units) and Denmark (1,656 units). The UK’s result is particularly impressive, as it is not applying provisional tariffs to Chinese-built BEVs.

Pull-forward effect

The MG4 took third, with a record 9,877 deliveries. It also benefited from the pull-forward effect ahead of the application of provisional tariffs.

The model outperformed its rivals including the Volkswagen (VW) ID.3 and Renault Megane EV. The crossover saw its best result in Germany (4,492 units), with Norway (1,171 units), France (1,169 units) and the UK (1,024 units).

Fourth place went to the VW ID.3, posting 9,661 registrations. This was its best result in 18 months, as demand recovered due to a recent refresh. The model could reach the top five in 2024. However, this will depend on the performance of Chinese-made BEV models and any impacts of the provisional tariffs.

Germany accounted for most of the ID.3 volume in June, with 6,370 deliveries. Some distance behind was France (1,342 units), the UK (605 units) and Norway (263 units).

The Volvo EX30 finished in fifth, with a record 9,420 registrations. Its delivery ramp-up is now finished, however, June’s result may have been the result of the pull-forward effect.

The brand's smallest and cheapest BEV saw balanced demand across Europe. Germany led the way (1,199 units), followed by the Netherlands (1,172 units), Norway (1,080 units) and the UK (1,075 units).

Year-best results

In the rest of June’s top 20 EV table, multiple models hit year-best and record results, with impressive performances from VW Group. The namesake brand’s ID.4 achieved a year-best total of 6,963 deliveries ahead of its sibling, the Skoda Enyaq. The SUV came in eighth with 5,688 registrations, a record performance for 2024.

The BMW iX1 followed in ninth, reaching 5,210 units. This was a year-best result for the D-segment model.

Rounding out the top 10 was the Volvo XC60 PHEV, posting 4,632 deliveries. The SUV was Europe’s most popular PHEV in June. Meanwhile, the Renault Megane E-Tech scored its highest monthly total in the past year. The compact crossover recorded 4,595 registrations in 11th.

The Cupra Born came 12th, enjoying its best performance of 2024 with 4,389 deliveries. The Spanish brand also saw a record result from its Formentor PHEV in 14th, achieving 4,264 units. The performance was helped by improved technical specifications for the model.

The Polestar 2 finished in 15th, reaching 3,628 registrations, its best tally in 11 months. This model also likely benefitted from a pull forward in deliveries due to the provisional tariffs.

Ioniq revival?

Outside the top 20, the Hyundai Ioniq 5 scored its best result in 10 months (2,737 units). Meanwhile, the Renault Scenic continued its production ramp-up with a record performance (2,260 units). The French model could enter the top 20 soon.

The built-in-China Mini Cooper Electric enjoyed a slight volume increase (2,207 units). Meanwhile, the BMW iX3 produced a year-best result (2,071 units).

The Jeep Avenger also had its highest volume month of 2024 (2,022 units). The MG ZS EV also benefitted from increased deliveries before provisional tariffs were implemented (2,018 units).

Finally, the BMW i5 had a strong June (1,858 units) and is proving to be competitive against its rivals, such as the Mercedes-Benz EQE.

Tesla set for title

Across the first half of 2024, the Tesla Model Y was Europe’s most popular plug-in model. It posted 102,730 deliveries from January to June, accounting for 7.1% of the EV market. The crossover is set to win its third best-seller title in a row this year.

It was over 42,000 units ahead of its sibling in second, the Model 3. The sedan reached 60,403 registrations. The BEV is also comfortable in the runner-up spot, sitting more than 20,000 units ahead of the Volvo EX30 in third (39,652 units). It gained half of this advantage in June alone.

However, there is still a battle for third, with uncertainty on how provisional tariffs will affect the EX30. The Audi Q4 e-Tron (35,863 units) could capitalise on any difficulties for the compact SUV, sitting less than 4,000 units behind it.

The first position change in the first half of the year came from the MG4 in fifth. The crossover recorded 32,645 deliveries, gaining two spots. However, the model may lose ground after the EU’s provisional tariffs take effect.

The VW ID.3 had the biggest improvement in the top 20, jumping five positions into eighth. With 28,982 registrations, it seems the top three are already out of reach despite its rapid recovery. Its sibling, the ID.4, moved up to ninth, posting 28,080 deliveries.

Elsewhere, the BMW iX1 jumped two spots to 11th (25,369 units) and is looking to join the top half of the table. Finally, the Renault Megane E-Tech (19,752 units) benefitted from its recent rise in demand to move into 17th place.