Monthly Market Update: Full hybrids fly high across European used-car markets in February

04 March 2024

Enjoying high residual value (RV) rates, full hybrids (HEVs) soared across European used-car markets in February. Experts from across Autovista Group (now part of J.D. Power) unpack the transactional trends for all major powertrains.

In February, HEVs managed to prove their popularity in a changing automotive market. The powertrain managed to retain an impressive percentage of original list price (%RV) after 36 months and 60,000km. The technology exceeded the market-wide average across all powertrains in Austria, Germany, Italy, Spain, Switzerland, and the UK.

The European automotive sector is travelling through a turbulent transitional period. Regulators are looking to lower pollution levels by enforcing clean-air zones while incentivising sales with purchase subsidies.

At the same time, battery-electric vehicles (BEVs) are developing so rapidly that the technology in younger models is ageing quickly. Competitive pricing is also straining RVs, as carmakers look to entice the next wave of consumers into an all-electric car.

This presents an opportunity for transitional technology, as HEVs can fill the gap between internal-combustion engine (ICE) vehicles and BEVs. Purchasers are effectively seeking affordable familiarity while exploring more environmentally-friendly options.

Above average achievements

HEVs achieved a %RV of 65.1% in Spain, ahead of the market average (60.1%) and the next-best powertrain, petrol (60.9%). This was even up on the 64.5% that full hybrids recorded in February 2023. Spain was the only market in which the powertrain saw values rise year on year.

In Germany, HEVs retained 55.2% of their original list price, down from 60.7% at the same point last year. However, this was still up on last month’s market-wide average of 50.8% and the next-best performing powertrain, which was petrol at 52.3%.

Full hybrids recorded a %RV level of 55.7% in Austria, only one percentage point higher than petrol (54.7%). The gap was wider compared to the market average of 52.2%.

In the UK, HEVs held a shorter %RV lead with 54.6%, while petrol managed 54.2% and the wider market average sat at 52.8%. The technology retained 51.8% of its original list price in Switzerland. Then came petrol with 49.1%, while the all-powertrain average was 48.1%.

Italy was the only market where HEVs did not manage a leading %RV level. At 56.1%, the powertrain was behind diesel (58.7%), but still managed to push past the market average of 54.2%.

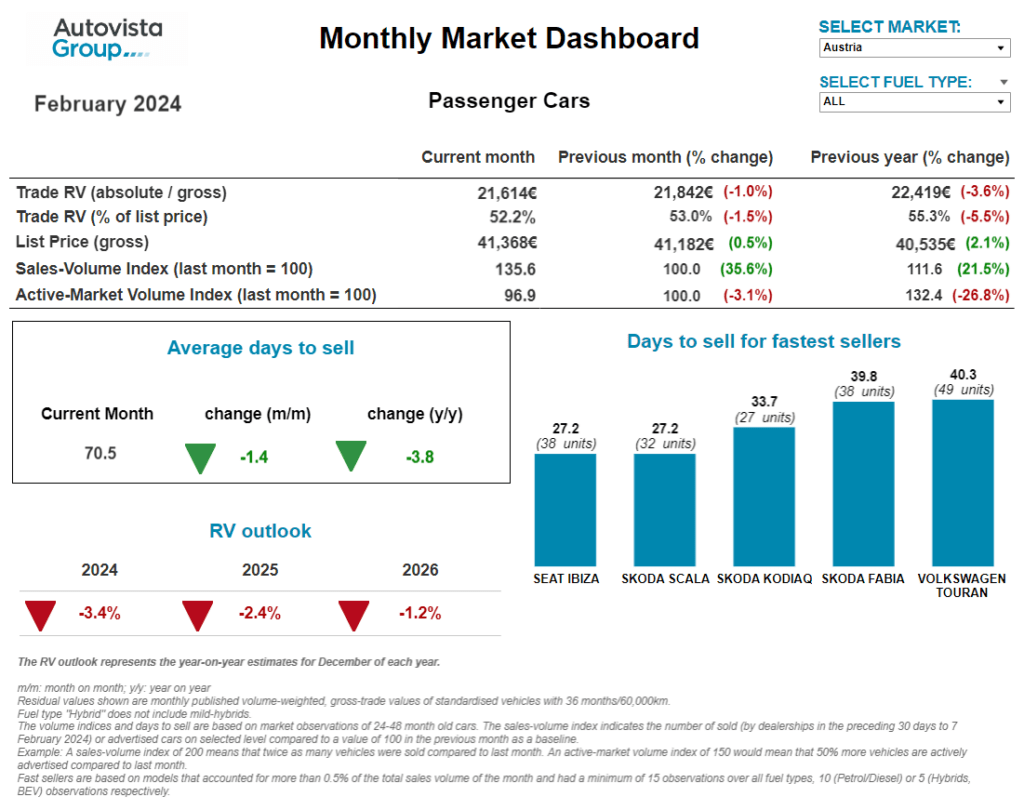

The interactive monthly market dashboard examines passenger-car data by fuel type, for Austria, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

Diesel proves popular in Austria

After two months of very low used-car transactions, the sales-volume index (SVI) showed a healthy month-on-month increase of 35.6% in February and year-on-year growth of 21.5%. At the same time, the supply volume of two-to-four-year-old passenger cars was around 3.1% lower than in January.

The number of days needed to sell a used car fell to 70.5 days on average in February. Diesel-powered cars sold the fastest, averaging 64.8 days, followed by petrol models and plug-in hybrids (PHEVs) at 74.7 and 75.2 days respectively. Both HEVs and BEVs sold more slowly at an average of 82.2 and 83.3 days respectively.

As demand weakened, %RVs of 36-month-old cars at 60,000km dropped month on month to 52.2% on average.

‘This marked a decrease from 55.3% in February 2023 and shows that pressure on RVs is increasing as supply remains stable,’ explained Robert Madas, Eurotax (now part of J.D. Power) regional head of valuations, Austria, Switzerland, and Poland.

In terms of %RVs, HEVs led the way with 55.7% followed by petrol (54.7%), diesel (51.2%) and PHEVs (50.2%). Meanwhile, 36-month-old BEVs retained the lowest value, at 45.9%. However, as demand is expected to weaken, further pressure on RVs can be expected.

The market’s average %RV of a 36-month-old car at 60,000km ended 2023 down 4.6% year on year. Due to weakening demand and unwavering supply, %RVs are expected to decrease further by around 3.4% by the end of 2024. ‘In 2025 and 2026, %RVs are forecast to fall again but at a slower pace,’ Madas said.

Price boost in Germany

‘Used-car asking prices in Germany saw signs of stabilisation in February,’ highlighted Andreas Geilenbruegge, head of valuations and insights at Schwacke (now part of J.D. Power). ‘Dealers are being more resilient when it comes to the prices of older combustion-engine powered models in particular.’

The absolute price level of cars in this age bracket will also have become more interesting to dealers. This is thanks to five-to-six-year-old models remaining at the average price level of a three-year-old car before the COVID-19 pandemic.

Yet BEVs are still coming under volume-related pressure or a mismatch between supply and insufficient demand. Unfortunately, this is unlikely to change in 2024 or 2025. While BEVs, and particularly PHEVs, are finding an increasing number of buyers, there is nowhere near enough interest to absorb the growing supply of models.

However, the supply of very young used PHEVs is now clearly declining following the restriction and cancellation of the environmental bonus last year. This powertrain is also being excluded from an increasing number of company car policies due to costly experiences with real-life consumption.

‘Relatively expensive vehicles are not being met by a sufficient number of potential buyers who are willing and able to purchase these models. However, this is being balanced out as the amount of these cars on offer is not currently increasing any further,’ Geilenbruegge added.

HEVs have also seen an interesting trend. Up to 2023, this powertrain offered the smallest ecological gains and the lowest barrier to electrification. HEVs also managed to capitalise on the supply-chain crisis and reduced levels of supply. A far greater range of brands and models has now led to volume pressure which significantly exceeds demand.

Plug-in struggle for Italy

‘Italy saw %RVs continue to decline in February,’ stated Marco Pasquetti, head of valuations, Autovista Group (now part of J.D. Power) Italy. ‘After 36 months and 60,000km, used cars retained 54.2% of value in the month, down from 55.4% at the same point in 2023.’

While absolute RVs rose by 6.4% year on year, list prices grew even more, up by roughly €3,000 on average, equating to a year-on-year increase of 8.7%. This trend was confirmed by the SVI, which recorded a drop of 11.3% compared with February 2023.

PHEVs and BEVs recorded the greatest year-on-year %RV declines, down 3.1% and 3% respectively. Plug-in cars are clearly still failing to establish themselves in Italy, as these powertrains also recorded a slowdown on the new-car market. As volumes fell sharply, these models recorded their lowest market share in three years.

‘This stagnation is a direct consequence of people waiting for the official announcement of the new 2024 incentive scheme. This can be expected to revitalise interest in electrification,’ Pasquetti commented.

Diesel suffered a very slight %RV decline in February, down 0.4% year on year. Contrary to expectations, this powertrain continues to be very popular with Italian buyers.

On the other hand, HEVs experienced a positive trend, with value retention increasing 3.9% compared with February 2023. Liquid-petroleum gas (LPG) saw the greatest %RV increase, up 5.3% year on year. It was also the only powertrain to see values increase month on month, up 1.8%.

Spain set for strength

‘After a timid start to the year, the Spanish automotive sector looks set to regain some strength in February,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain (now part of J.D. Power). ‘This positivity will be the result of growing demand from the rental channel.’

The new-car market provided a mixture of powertrain performances in January, with both expected and surprising results. Predictably, HEVs continued to be unstoppable while BEVs remained stagnant.

Deliveries of PHEVs improved compared to January 2023, as petrol models saw registrations fall by nearly around 7%. Meanwhile, LPG achieved an increase of 48%, taking a market share of 3.5% in the first month of the year.

‘These powertrain performances are likely to vary throughout 2024, but the results come into sharper focus when also considering the used-car market and RV data,’ Azofra said.

Accounting for more than half of used-vehicle sales in Spain, models equipped with a diesel engine saw demand grow by more than 10%. In line with this greater uptake, diesel was the only powertrain to see both absolute RVs and %RVs increase month on month.

Diesel’s positive performance also explains why the average absolute RV level across all powertrains increased from €19,299 in January to €19,450 in February. The amount of time needed to sell used cars also fell to 67.4 days on average, down 6.4 days on the previous month.

However, the figures are still below those observed in February 2023, with the price trend in Spain’s used-car market remaining negative. The start of the year tends to release pressure on sales and as a result, transaction prices. Almost all powertrains will see pronounced falls in the coming months, apart from HEVs.

Toyota once again had the fastest-selling models in the used-car market. The Toyota C-HR took an average of 26.6 days to sell, followed by the RAV4 at 36.7 days. Despite being at the end of its life cycle, the Audi Q2 came third with an average of 41.5 days to sell.

Switzerland struggles with volume

The active-market volume index (AMVI) for two-to-four-year-old passenger cars decreased by 2.6% from January to February 2024. Year on year, this level dropped by 9.1%. Constrained supply continued for younger models. The SVI significantly increased by 25.9% month on month but was still 7.7% lower year on year.

Relatively steady supply and deteriorating demand resulted in the average %RV of a 36-month-old car falling again. This RV level went from 48.9% in January 2024 to 48.1% in February. The drop was even steeper year on year, descending from 51.7% in February 2023.

‘Considering the different powertrains, HEVs retained the greatest amount of value, with a %RV of 51.8%. Petrol cars came next (49.1%), then diesel models (47.2%), followed by PHEVs with 45.3%,’ stated Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland (now part of J.D. Power). ‘Meanwhile, 36-month-old BEVs retained 44.5% of their original list price.’

Two-to-four-year-old passenger cars sold more slowly in February, remaining in stock for 83.3 days, up 3.3 days from January. HEVs sold the fastest on average after 74.5 days, followed by diesel cars after 82.6 days, then petrol models after 77.1 days. PHEVs took 99.6 days to sell and BEVs needed 109.2 days.

Used-car demand is expected to diminish while supply remains effectively stable. The values of three-year-old cars are forecast to decline from a relatively high level, set against a wider declining trend. The %RV level in Switzerland finished 2023 down 5% on December 2022. In 2024, levels are expected to fall by around 4.5% due to stable supply and lower demand.

Demand boost for UK market

Decent retail demand appears to have returned to the UK used-car market in the 30 days leading up to 7 February. The SVI recorded growth of 13.3% compared to January’s report. Meanwhile, the AMVI revealed that the number of cars advertised for sale in this period declined by 11.4% month on month.

‘This was the result of an increased rate of sales and dealers not having enough fresh stock channelled through the preparation process to replenish forecourts,’ confirmed Jayson Whittington, Glass’s (now part of J.D. Power) chief editor, cars and leisure vehicles. ‘However, with auction activity recently rising significantly, this shortfall in available stock should ease quickly.’

BEVs once again featured in the fastest-selling models list, with the Tesla Model 3 leading the pack. It saw an average of just 22.5 days to sell, over 25 days fewer than the wider market average of 47.7.

The average %RV of a three-year-old car fell from 53.3% in January to 52.8% in February. This rate of depreciation has clearly slowed and reflects a positive change in activity in the used-car market. The extent of the RV drop can be observed in the year-on-year comparison, as values fell to 52.8% from 63.8% in February 2023.