Good time to buy a used luxury saloon in Germany

26 August 2021

Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group), discusses the rise in residual values of luxury saloons in Germany because of falling volumes and new models.

With approximately 15-20,000 new registrations and 40-50,000 changes of ownership per year, the luxury class is the smallest passenger-car segment in Germany. For customers and manufacturers alike, however, luxury saloons are a real highlight, not least because of the exclusivity they create in the truest sense of the word. Nevertheless, they remain a playing field for extroverted, wealthy customers – both for new and used cars.

As a rule, each new generation of luxury models can be equipped with virtually everything the supplier industry has to offer in the way of absolute technological innovations, thus becoming a showcase for the technological future of the volume segments, says Geilenbruegge.

This may be one of the reasons why the Mercedes-Benz S-Class, BMW 7-Series, Audi A8 et al remain on the road for an above-average period of time. It could also explain why vehicles more than 20 years old account for about 30% of the vehicle parc, one of the highest shares in a segment comparison.

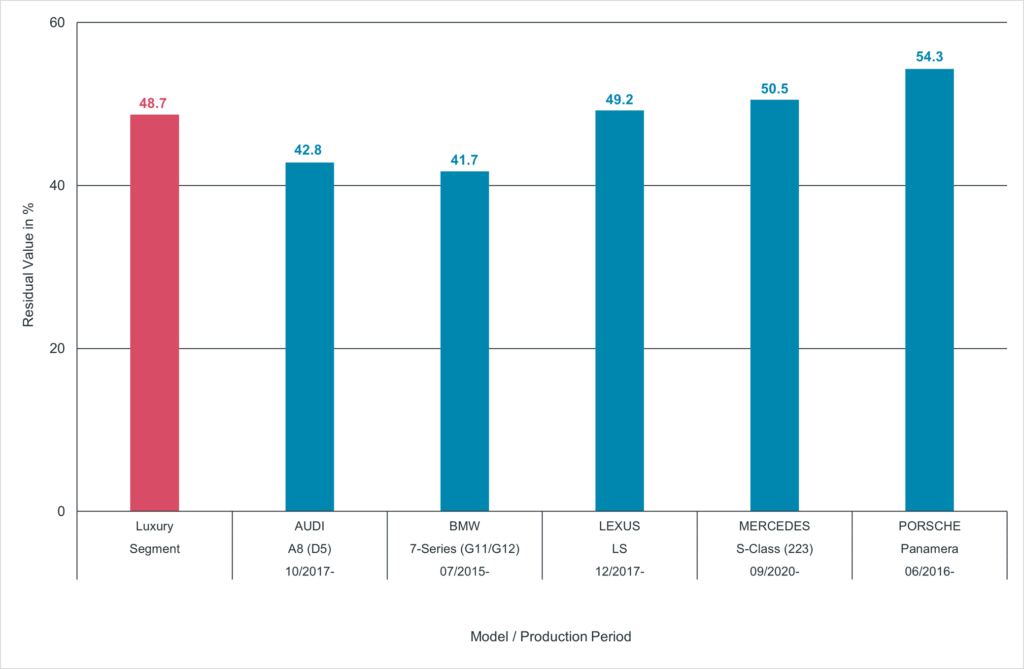

Forecast retail values in %, luxury segment, with segment-specific optional equipment

Source: Schwacke GmbH

With list prices often in the six-digit range nowadays, prospective buyers of new cars may become a little queasy as a result of the loss in value – equivalent to that of a small property. Used-car buyers, on the other hand, are happy about this, even if there is still a hefty sum left to pay. Anyone dreaming of a paradise of cheap, fully-equipped 12-cylinder cars is mistaken. Not only are12 -cylinder and even eight-cylinder engines becoming increasingly rare, but also the 210-250kW mid-range diesel engines of the market-leading S-Class account for more than 40% of new registrations.

Current developments in CO2 emissions are not leaving these heavyweights unscathed. While BMW will introduce a new 7-Series next year, with contemporary engines to accompany the S-Class and the EQS, the Audi A8 will have to hold out for a few more years. Prosperous electric-friendly fans of luxury Audi saloons will either have to switch to the e-Tron GT, or wait until 2025. Only then is the ‘Artemis’ flagship electric-vehicle project – promisingly called the ‘Landjet’ internally – now expected to be launched.

Elsewhere, Jaguar Land Rover (JLR) has unfortunately discontinued development of the next-generation electric-only XJ, which was already well advanced, for cost reasons. As part of the ‘Reimagine’ strategy, presented by CEO Thierry Bolloré in February, the carmaker announced that the replacement of the XJ model will not be pursued. The Lexus LS and Porsche Panamera will not be renewed for a few years and will probably have less and less to do with the current idea of a ‘luxury saloon’ in terms of drive and concept.