High residual values fail to translate into lower leasing rates

24 June 2022

Despite high residual values (RVs), leasing rates for new cars have not lowered. They have even risen as a percentage of list prices, explains Autovista24 senior data journalist Neil King.

The unprecedented strength of RVs witnessed over the last two years means used cars are depreciating far less than before COVID-19 struck. The natural assumption is that this would lead to a recalculation of leasing offers and lower monthly repayments.

However, this would also require other elements of the leasing equation not to have changed. These include new-car list prices, discounting, and interest rates, for example. ‘Those elements have not stayed the same. In fact, cost new prices have increased every few months and manufacturer support has reduced as they simply do not need to offer it due to the current supply and demand imbalance,’ commented Jayson Whittington, chief editor of Glass’s (part of Autovista Group).

‘We are experiencing an exceptionally turbulent market. As with many other organisations, BVRLA members are facing rising interest rates, high costs for energy, transport and staff, plus constant fluctuations in vehicle prices and long-term uncertainty on future values of electric vehicles,’ explained Toby Poston, director of corporate affairs at the BVRLA (British Vehicle Rental and Leasing Association), in response to Autovista24.

Data prepared within Autovista Group supports Whittington’s view on discounting. Analysis reveals that discounts offered by all brands in Germany are at a lower level than a year ago. Similarly, average discounting was lower in Spain in April 2022 than in September 2021, except for only three brands – Cupra, Mini, and Opel.

In the context of less discounting and other financial pressures, data collated by Autovista Group on leasing offers from both manufacturer websites and third-party portals reveals that leasing rates have not lowered. In fact, the only broadly consistent trend in Europe is that monthly repayments, as a percentage of list prices, are averaging higher in 2022 than in 2021.

‘Leasing companies may gain a higher profit and carmakers too, especially as they can give less discounts to the leasing companies. On the other hand, leasing customers are the unlucky ones in this situation as they are not benefitting from rising RVs,’ commented Christian Schneider, Autovista Group head of analytics.

Fleet management ‘as challenging as ever’

Although leasing companies and carmakers benefit from higher residual values, they face mounting challenges in other areas. Logistics costs, for example, are higher because of rising fuel prices. Alongside interest rates and inflation, these are adding further financial pressure.

‘These factors are on top of reduced vehicle supply and issues with lengthy and unpredictable lead times. One outcome of that is increased used-car prices, which have remained high for a prolonged period and provided a boost to the market. This is helping to bolster cashflow and revenues at a time when companies have large order books curtailed by the supply issues,’ Poston commented.

‘Collectively, this creates a very changeable situation that means members are struggling to manage pricing on quotes and orders. The massive administrative and customer-service implications of vehicle lead times constantly moving, and orders being cancelled with little notice, are leaving members in an almost constant state of flux, making business planning and fleet management as challenging as ever,’ Poston added.

As new-car registrations remain firmly below pre-pandemic levels, any increase in profitability stemming from high residual values is tempered by lower revenues and higher costs. Accordingly, carmakers have become more focused on profitability than chasing volumes and/or market shares as registrations plummeted due to COVID-19.

‘Drivers are extending their current contracts for as long as they possibly can, which is leading to less transactions in the new-car market,’ said Whittington. Pushing new-car sales would reduce profitability and extend delivery delays, which risks creating a vicious circle.

Ultimately, the only real beneficiaries of higher residual values are buyers who purchase a new car outright, either via a single full payment or with financing. Their car is clearly worth more than anticipated when it comes to selling it on or trading it in for a replacement.

Stabilising values

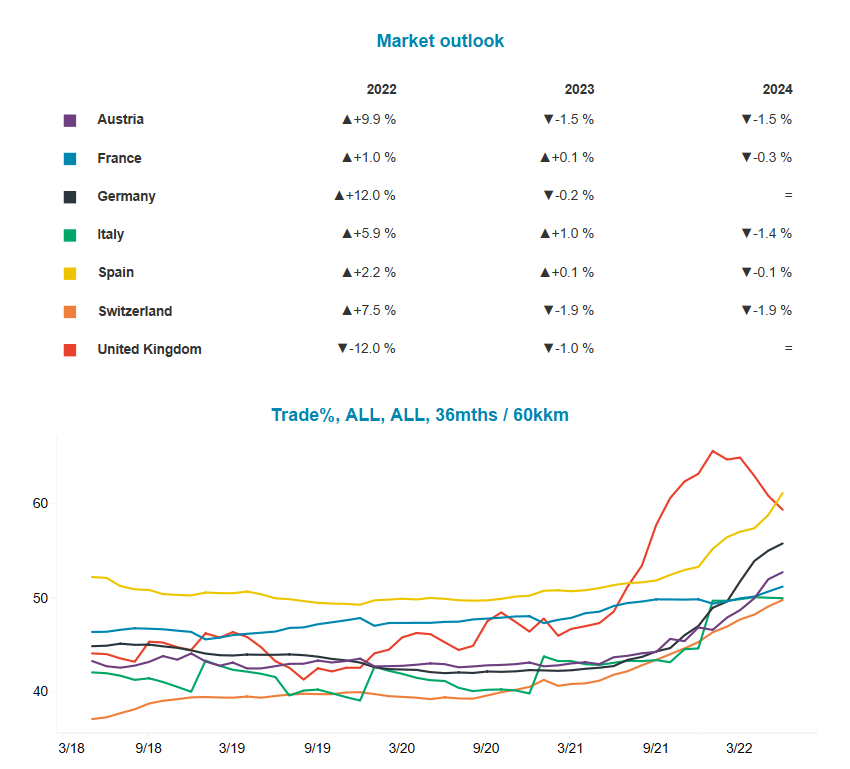

Although residual values remain high, they have stabilised in France and Italy and are showing signs of stabilising elsewhere across Europe. RVs have even been falling in the UK as used-car market activity slows.

Trade %RV, 36 months/60,000km, May 2018 to June 2022 and outlook for 2022-2024

With household budgets squeezed and industry consensus that supply bottlenecks, exacerbated by the war in Ukraine, will ease this year, a recoupling of used-car supply and demand is expected. Accordingly, residual values are forecast to decline in most European markets in 2023. Carmakers and leasing companies are, therefore, even less likely to offer lower leasing rates. The market is competing more on delivering cars, so lowering returns makes no sense while volumes remain low.