C-SUV EVs offer compelling total-cost-of-ownership advantages over hybrid and ICE models

08 July 2021

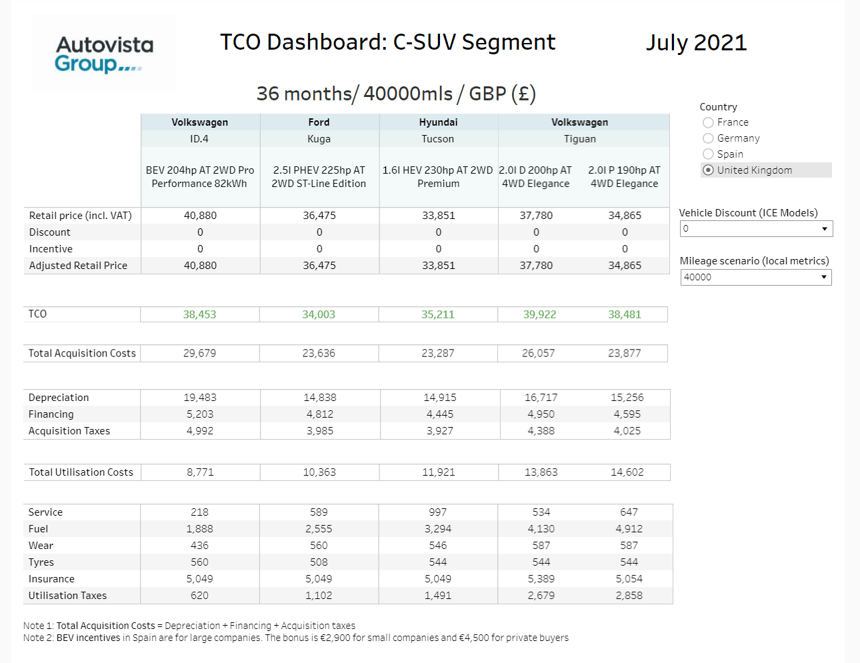

In the latest update on total cost of ownership (TCO), we compare retail prices (including taxes) and TCO of leading battery-electric vehicles (BEVs), plug-in hybrids (PHEVs), standard hybrids (HEVs) and petrol and diesel cars in the C-SUV segment in France, Germany, Spain and the UK. Autovista24 senior data journalist Neil King discusses the findings.

Analysis reveals that electrically-chargeable vehicles (EVs) offer a significant TCO advantage, of at least €10,000, over HEV and internal-combustion engine (ICE) rivals in Germany. This is due to the generous purchase incentives available in the country. However, the Volkswagen (VW) ID.4 BEV and Ford Kuga PHEV are also attractive propositions from a TCO perspective in France and Spain, despite the reduced government subsidies.

The exception is the UK, where the VW and Ford EVs are not eligible for incentives. Nevertheless, the two models, as well as the Hyundai Tucson HEV, have a lower TCO than the comparable petrol and diesel variants of the VW Tiguan. Furthermore, all three electrified offerings have a higher power output than their ICE competitors.

France lowered their incentives for BEVs costing less than €45,000 (including VAT) by €1,000 on 1 July. For cars priced between €45,000 and €60,000, such as the ID.4 under review, the subsidy for both private and company buyers is just €2,000. For PHEVs with CO2 emissions of between 21g and 50g/km and with a retail price less than €50,000, such as the Kuga, the incentive is only €1,000. Similarly, in Spain, the incentives for large companies buying BEVs and PHEVs with a range of greater than or equal to 90km reduced to €2,200 with the introduction of the MOVES III scheme.

Discounts

Pricing data is provided in the local currency for the same five models in each market, encompassing retail list prices (including taxes), incentives, and a final adjusted retail price. The TCO is calculated as the sum of total acquisition and utilisation costs in both the 36-month/45,000km and 36-month/60,000km scenarios. Acquisition costs cover depreciation, financing and acquisition taxes. Total utilisation costs consist of servicing, fuel, wear, tyres, insurance, and utilisation taxes.

These standard TCO results do not factor in discounts that buyers may negotiate on petrol or diesel cars. For this reason, TCO calculations are also provided with discounts of 10% and 20% applied to the two ICE variants of the VW Tiguan featured in this analysis.

Even if buyers could secure a 20% discount on the ICE versions of the Tiguan, the ID.4 BEV and Kuga PHEV still offer a competitive TCO in France, Germany and Spain. Even in the UK, the two EVs still offer a competitive TCO when a 10% discount is applied to the Tiguan ICE pair.

Supporting emissions reduction

There is, therefore, a compelling argument for consumers to switch to C-SUV EVs across Europe. These market forces also explain the early sales success of the VW ID.4. This will spur other carmakers to roll out competitor models in the segment to drive down their fleet-average emissions further.

Although most met their 2020 emissions targets, whether pooling or going it alone, the highest-polluting 5% of new cars registered last year were excluded from the fines calculations, which serves as a transitional phase for carmakers. Nevertheless, even with this concession, VW Group and Jaguar Land Rover did not meet their respective targets. Manufacturers face greater challenges going forward as full compliance is required in 2022, i.e. new cars registered in 2021 onwards, and the targets will be reduced in 2025 and again in 2030.

Whereas B-segment and C-segment BEVs offer competitive TCO, albeit only because of incentives, affordable electromobility is even more important for larger cars and SUVs. As governments and carmakers alike seek to reduce pollution levels, higher incentives across Europe, especially in Spain and the UK, would provide a much-needed boost. Lower prices and incentive ceilings would also offer relief from the fallout from the COVID-19 pandemic.

However, many consumers still need to be convinced about the range of EVs, especially BEVs as they do not have a fossil-fuel engine as back-up, as well as the availability of operational charging points and manageable charging times.

Click here or on the screenshot above to view the pricing and TCO dashboard for the C-SUV segment models under review in France, Germany, Spain and the UK. We have previously published dashboards analysing the TCO of BEV, hybrid and petrol models in the B-segment, C-segment and D-segment, as well as D-SUVs.

Do you think TCO alone is compelling enough for consumers to make the switch to electromobility or are range and charging still barriers to adoption? Follow us on Twitter @autovista24 and comment on our post with your views.